Doc's Daily Commentary

Mind Of Mav

Why The Macro Case For Crypto Is So Strong

A year-end rally in crypto appears to have fizzled today, with Bitcoin and Ether both falling more than 7%. The rest of the crypto market is similarly red. Despite this, most crypto investors remain in good spirits, with the crypto market fear / greed index only slightly leaning into ‘fearful’ today.

Why is that?

No, seriously, ask yourself this question: why are long-term crypto investors and supporters generally so unphased by massive market moves that would send your typical equities market trader into a panic attack? Sure, “crypto being volatile is a feature of a free market, not a bug, bro” and “just HODL, bro” and “BTFD, bro”, etc., but when you boil it down, there’s something more to the unwavering, almost blind, devotion that a real crypto supporter exhibits. Part of that surely comes from the culture of the crypto markets, which encourage this behaviour, but there’s definitely something more to it. In a sense, crypto investors have faith in the longevity of crypto because crypto has invariably been linked to the macro trends and markets. Let’s dig further.

Without the existence of crypto assets, what would be the macroeconomic megatrend defining markets? Ray Dalio hinted at it in his article entitled, Paradigm Shifts. The global economy has shifted from credit-based easing to devaluation-based easing. So, let’s examine this tectonic shift and its implications.

Simultaneously, Bitcoin signaled the discovery of digital scarcity through cryptography. Crypto is a new asset class that will reap the benefits of a macroeconomic paradigm that favors scarce assets. At best, crypto is an alternate monetary and financial system that will witness continued migration in the face of an atrophying monetary system built from the original sin of severing savings from credit in 1914. With this lens in mind, the study of growth and interest rates or the prospects of equities, bonds, and real estate pale in comparison.

How We Got Here

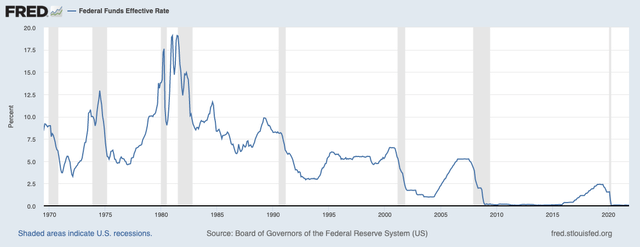

Without the threat of inflation following the end of the demographic bulge of baby boomers entering the work force in the 1970s, the Fed could rely on credit manipulation as a tool to prevent solvency and stave off asset price depreciation. The Fed slashed rates during the 1980s recession, 1984 economic slowdown, Black Monday of 1987, 2000 stock market crash, global financial crisis of 2008, and coronavirus shutdown of 2020. Below is the precipitous march down in interest rates since 1980.

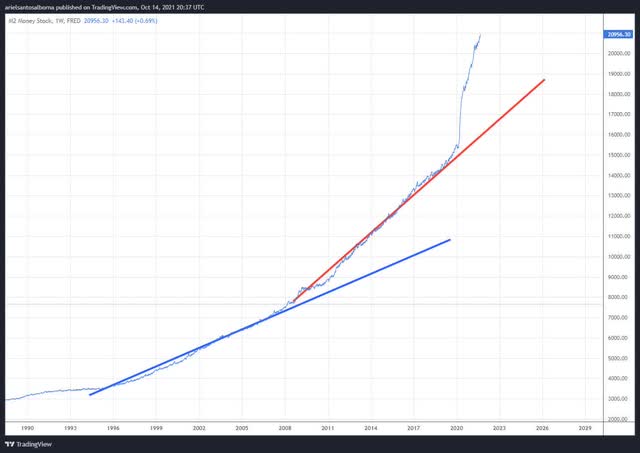

Slashing interest rates provides short term stability at the expense of long-term economic dynamism. It allows failing companies to shore up their balance sheets by refinancing their debt at lower rates. However, it also incentivizes more debt and more reckless behavior that led to the credit boom and bust in the first place. When rates reach zero as they did in 2008, monetary authorities can no longer use the interest rate policy tool. They transition from credit-based easing to devaluation-based easing. 2008 introduced quantitative easing (QE) and 2020 witnessed monetary debasement enter hyper speed as shown below in the M2 growth rate below.

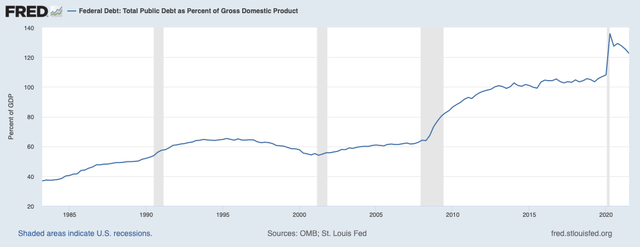

Forty years of kicking the can down the road has left the economy and markets in a precarious position. No more stimulus in the form of raising rates or halting QE will lead to an unwind of forty years, and arguably a century, of capital misallocation. There is no putting the toothpaste back in the tube. The Fed can never normalize the balance sheet. Additionally, as the chart below shows, a year of high inflation has succeeded in moving the needle on U.S. debt to GDP from 135% to 122%. “Inflating the debt away” will not occur overnight if at all.

Scarce Assets and Risk

Whereas financial assets such as stocks and bonds were the best manner to capitalize on the forty-year march down in interest rates, scarce assets are the best way to capitalize on skyrocketing M2. This paradigm shift occurred in 2008. However, it did not become obvious until 2020. Real estate was also a great play in the post-2008 world of cheap credit and high devaluation. Fixed debt service payments become cheaper overtime as they are paid in a devaluing currency. The asset also becomes more valuable over time due to its scarcity premium. This is the framework to understand the MicroStrategy playbook of tapping into credit markets to purchase Bitcoin.

This shift has other unintended consequences such as making asset owners richer and inadvertently pushing investors further and further out into the risk spectrum. The year-over-year M2 growth rate is currently 13%. What that means is that 13% more dollars vs. one year ago equals your dollar has devalued by 13%. It also means that 13% is the real hurdle rate. If you aren’t beating that with your annual investment returns and your yearly raise, then you’re losing money and you’re taking a pay cut.

One would be lucky to find an asset class that breaks even in such an environment.

Enter Crypto

A new asset class that values itself on scarcity and technological innovation is discovered just as the paradigm shift to devaluation-based easing puts a premium on all things scarce. There is nothing more macro than this. Crypto has aspects of network-based technology stocks, monetary assets such as gold, real assets in that protocol investors own a piece of the network, venture capital in that it democratizes early-stage investing with real-time pricing, and behavioral incentives for network owners to participate and protect the network. With an average return of 200% per year for the last decade in Bitcoin, this asset class flew under the radar as traditional investors focused on atrophying financial classes; many of which are guaranteed to lose money on a real basis.

Bitcoin or Crypto?

Bitcoin only does one thing, and it does it well. It is a decentralized, autonomous ledger governed by protocol rules. There exists a fixed inflation rate tied to energy expenditure and a supply cap of 21 million. Ownership and peer-to-peer token transfers are recorded on the ledger. It is incorruptible money, and a savings vehicle outside of equities and housing that monetary policy currently denies fiat users.

Similar to software companies, most other blockchain protocols abide by the mantra of “move fast and break things.” If a protocol is not moving fast enough, such as Ethereum’s transition to ETH2, another one will come to challenge it-such as Solana, Terra, or Cardano. Smart contract protocols disintermediate banks, trading platforms, money transfer companies, and more. Other protocols such as utility tokens serve a specific function within the blockchain ecosystem or disrupt previously established industries in gaming, logistics, etc. Most importantly, they do so through scarce network tokens equivalent to owning a piece of the internet as opposed to a share in a centralized company.

Conclusion

The logic here is as follows:

1) scarce assets win as we transition to devaluation-based easing.

2) Crypto is the discovery of digital scarcity that benefits from this. On this basis alone, it deserves a role in the portfolio.

3) Moreover, crypto is creating an alternate monetary system that users may migrate to as it solves the issues of a monetary operating system that made its users 13% poorer this year alone. It also creates a peer-to-peer financial system that avoids the time and fees of banks.

On a macro basis, no other asset class provides such a skewed risk-reward ratio.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.