Crypto Market Commentary

30 December 2019

Doc's Daily Commentary

The 12/11 ReadySetLive session with Doc is listed below.

Mind Of Mav

Bitcoin’s Inflection Point Ending 2019

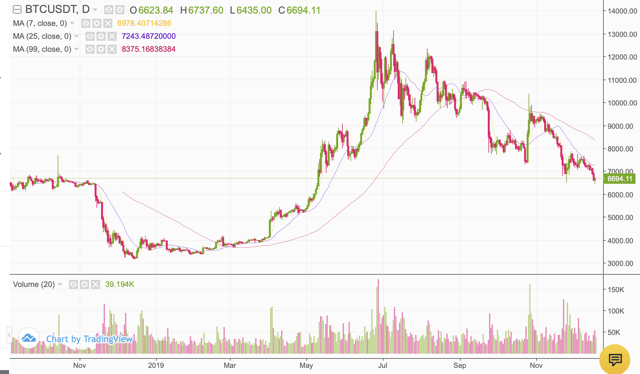

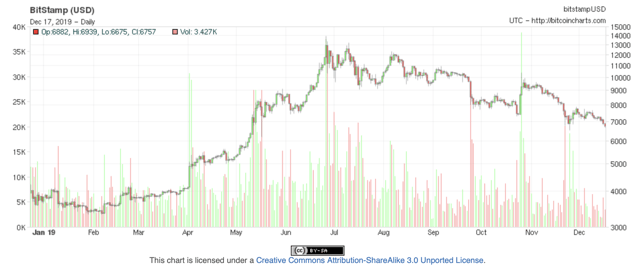

Bitcoin is at a crucial inflection point. Bitcoin and the cryptocurrency market in general have been in a slow-motion meltdown mode after Bitcoin hit a high of roughly $14,000 in late June. Since then, Bitcoin has lost more than 50% of its value and may be headed even lower if this critical level of support at $6,500 fails.

Source: Binance.com

Nevertheless, despite the recent volatility, Bitcoin and other systemically important digital assets have a strong probability of recovering from current levels, likely have very limited downside from here, and should appreciate significantly in future years.

Technically speaking, Bitcoin’s short-term image does not look particularly encouraging, as we see Bitcoin making a series of lower lows and lower highs following the summer’s top-off at $14K. The good news is that Bitcoin has deflated from an extremely overbought level and is now trading around critical support of $6,500. The bad news is that if the $6,500-$6,000 support level fails, Bitcoin could plausibly fall through to $5K or lower. Nevertheless, I see a stronger possibility of Bitcoin stabilizing and bouncing off from current levels. Thus, a trend reversal from current levels appears likely in my view.

So, what is going on? Why is Bitcoin seemingly moving perpetually lower in recent months?

Several elements appear to be in play here, but one of the primary reasons appears to be that Bitcoin may be losing its “popularity”. While this is a temporary phenomenon in my view, it is leading to decreased volume and lower prices.

So, why is Bitcoin “losing its popularity?”

One of the reasons is that there is limited access to Bitcoin in that it can only be purchased directly through cryptocurrency exchanges. Market participants can trade Bitcoin futures contracts, or get access through the Grayscale Bitcoin Trust (GBTC). However, the last two options are not the same as owning Bitcoin.

First, a large portion of the population probably does not fully understand what Bitcoin is, how it works and what prospects it represents for the future of the global financial system. Second, a relatively small portion of the population uses actual cryptocurrency exchanges to purchase BTC. Third, Bitcoin futures trade at very low volume compared to other major commodities. Fourth, the SEC keeps delaying its decision on Bitcoin ETFs, or denies applications.

The bottom line is that many market participants have limited access to owning Bitcoin and other digital assets, and this is partially why we’ve seen prices slide lately. Exchanges are being increasingly regulated across the globe, the IRS and other tax agencies want their cut, and this is also likely pushing some market participants away for now.

Yet, another reason is that Bitcoin and other coins got substantially overbought going into the summer due to the initial Libra news and other factors which made it appear like the Bitcoins and Litecoins of this world were getting ready to be integrated into the global financial order. Since then, we’ve seen Facebook and its idea of creating a digital token come under serious scrutiny from the U.S. government, the Federal Reserve and banks in general.

This is logical of course as the major banks along with the Federal Reserve, backed by the U.S. government have a monopoly concerning USD creation and thus exercise enormous control and influence over the global financial system. Competing currencies like the Libra, which would likely make true digital assets like Bitcoin and others more popular could take away market share from the current status quo, and this is something the authorities clearly do not want.

The Fed Connection

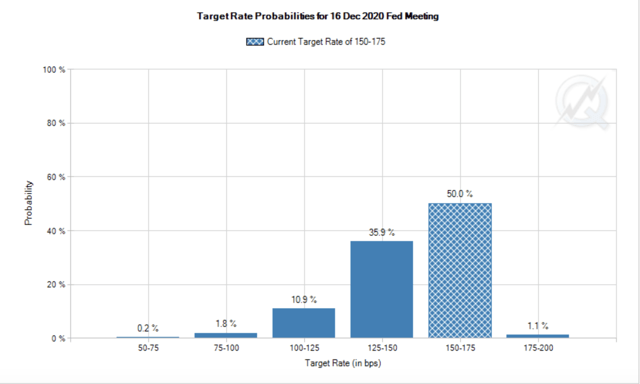

Another factor to consider is that the Fed has stopped easing for now. In fact, there is only about a 50% probability that there will be another rate cut at all in 2020. This essentially means that the monetary base is not projected to expand as rapidly as it was perceived to months ago.

Source: CMEGroup.com

Bitcoin is much like gold in the respect that it is a hedge against inflation, devaluation, excess money printing, irresponsible monetary policy, etc. There are only 21 million Bitcoins that can ever be mined, yet there is an unlimited number of dollars, euros, and yens that can be printed.

The Bottom Line: Near and Long-Term Outlook

In the near term, there aren’t that many positive factors that are likely to attract a substantial number of new buyers and drive prices notably higher. On the other hand, prices in Bitcoin and other major coins have cratered by significant amounts and are likely on “sale” now, representing good long-term buying opportunities.

Furthermore, the number of blockchain wallets keeps increasing, as there are now about 45 million blockchain wallets online. Thus, the infrastructure is there, the network effect is present, and it is likely only a matter of time until the next wave of popularity and demand drives Bitcoin and other digital asset prices much higher.

Source: Statista.com

If we look at a long-term chart, we see that Bitcoin moves in waves. Moreover, we see that each consecutive wave typically takes longer to go from peak to peak and the price perpetually goes higher from peak to peak. Thus, we are still likely in the relatively early stages of the current wave and prices are likely to appreciate significantly higher over the next several years.

As far as the extraordinary number of cryptocurrencies coming online, we can see that the number of different tokens essentially increased by around 150% in about two years. Yet most of the new coins introduced are essentially worthless, and are likely to remain largely worthless going forward. Most of the coins that had the largest market caps and market share 2 years ago remain in their market leading positions today. This trend is likely to continue as they have the best and most trusted networks coupled with brand names that have been around for years now.

Therefore, I would not look at the new coins coming online as a threat to current market leaders. The new tokens will likely either remain largely worthless, will fill niche positions in the market, and some (very few) may appreciate greatly for various reasons. However, the main takeaway is that the leading coins of today should remain the leading coins of tomorrow and the leading coins of the next decades as well.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)