Premium Daily Crypto Newsletter

February 7, 2018

Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

I’m givin’ her all she’s got, captain!

Powerful rally stalls and goes sideways — More pain incoming

Want to have more input into what we’re doing and how we’re providing value to you? Please take two minutes to fill in our survey and let us know how we can add to our service!

It’s something amazing to watch how quickly the market sentiments can switch from absolute despair. As we pulled ourselves from the yearly all time low, it’s important to keep in mind what Doc talked about on our free webinar on Monday — the principle of maximum adversity and how this market will not pull itself from the depths until we reach that point. One of the best ways to reach that is a bull trap that we are likely seeing now. If you can convince enough weak hands that the market is rebounding, after which it plummets once more, that can be enough to inspire weak hands to finally call it quits. It’s human psychology.

Think about watching a sports game for you favorite team. Would you rather lose outright, or watch your team be down the whole game, see them make a comeback, and then blow it in the last minute? Some people might answer that at least the latter is more exciting and therefore preferable, even if the outcome is more disappointing, but that’s the point. More emotions are involved in the second scenario. One of the principle things you must learn as either a trader or investor is that money (even crypto money!) and emotions do not mix if you want to be smart money. If you want to combine emotions and money, go to a casino. Otherwise, and we’re going to pound you over the head with this, trade logically and make calculated, rational decisions. If you’re making trades because you’re angry or sad or desperate or trying to get revenge for a bad trade, you need to stop and walk away. If a trade goes poorly, learn from it.

To all of those new to cryptocurrency and who have never encountered a bear market before, you’re being baptized for the greater good. We wanted to see another drop to around $5,000 / BTC, but we may need more time to shake off weak hands. One thing’s for sure: no one knows when the bear will end, but we know the bull will return, and all of this miasma we’ve been in for the better part of a month will clear. This is the way things operate, and now that you’ve been through your first bear market, next time we have one you will hardly react to it. Once the FOMO cycle begins anew, people on the sidelines will get back in as if there was never a problem.

As we’ve said in the past, this bear market has been extremely healthy for the greater crypto market. While we can’t just magically make every negative factor facing crypto go away, the bear has given people perspective that was lost in the midst of panicked buying. As it stands, crypto is 90% speculation, so moves like these are going to be normal for some time until we make more a switch to utility value and regulations are in place. Anyone who has been in crypto for some time has no doubt that this space will be worth trillions one day. The journey up the mountain may be one of adversity and challenge, but the view from the top is worth every step.

If you missed our class “Introduction to Cryptocurrency Trading” that we held on last weekend, it’s available now in our Premium Member’s Home as an archived class for those that purchase it. You can view more about it and watch the class today by visiting this link here.

Watching on Mobile? Click this link to watch in HD

Click here for audio link of today’s video

Offense – Adding Trades

Offensive Actions for the next trading day:

- No specific actions.

Defense – Managing Risk

Defensive Actions for the next trading day:

- No specific actions.

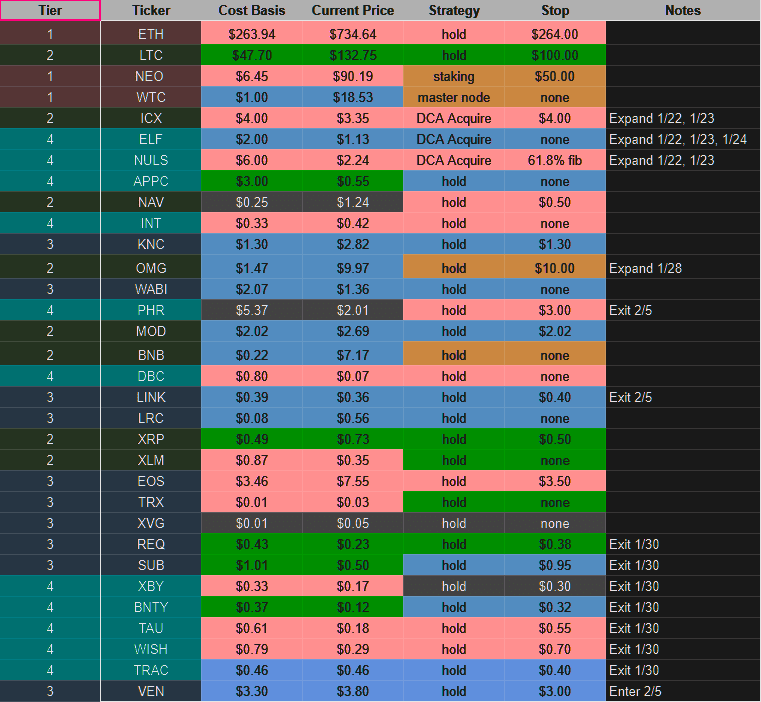

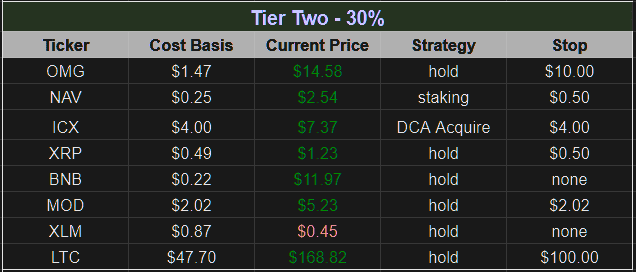

Current Portfolio

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

Tier 3

Vechain

VeChain is a global leading blockchain platform for products and information. VeChain is the world’s leading Enterprise-focused dApp/ICO platform for products and information. It aims to connect blockchain technology to the real world by providing robust infrastructure as well as IOT integration, with scalability up to 10,000 tx/s and pioneering in building real world applications. This is being achieved through partnerships and collaborations with innovative brands and industries. As of today, VeChain has established partnerships with PricewaterhouseCoopers, DNV GL, Renault Group, KUEHNE+NAGEL, D.I.G., China Unicom, etc., and accumulated extensive experience in an ever expanding list of industries including pharmaceuticals, liquor, auto, luxury goods, retail, logistics, supply chain,food and cold storage and more.

Tier 3

REQ

SUB

LINK

Tier 4

XBY

BNTY

TAU

WISH

TRAC

PHR

ReadySetCrypto’s 7 Categories Of CryptoCurrency

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

Fundamental Currency Research

In it, Coindesk breaks down everything from the growth in public blockchains, to the different volumes, transactions, and fees for the largest cryptocurrencies. It’s a very comprehensive study that’s certainly worth your time should you find the data interesting at all.

Here’s some highlights from the report and the accompanying article.

The overall summary. These metrics truly put into perspective what a watershed year for crypto 2017 was.

Another slide that highlighted what was probably obvious without the data: cryptoassets have been absolute monsters of returns compared to traditional assets. Don’t expect this to be the norm forever, but for now it’s incredibly exciting to be a part of.

The rise in valuations has attracted many new users to the space. As such, the transaction volumes have spiked for all the major cryptocurrencies. Of particular note is how Ethereum is now processing more volume than all the other major cryptos combined.

Lastly, that increased volume has led to a spike in transaction fees. This became the prevalent story about Bitcoin in late 2017, and still remains an issue today.

Coindesk had their own conclusions:

- This is not your father’s investment bubble

“ . . . In short, bitcoin has made it this far without help from Wall Street or banks (unless you count the wholesale closing of accounts to certain industries and geographies by risk-averse financial institutions, which may inadvertently drive those de-banked users to use a permissionless system).

This marks the first time in recent memory average people have been ahead of the so-called “smart money” – another chapter in the ongoing narrative that bitcoin and cryptocurrencies are the most interesting story worldwide in finance and economics.”

- The market has significantly diversified

“In January 2017, bitcoin’s value represented over 90 percent of the cryptocurrency market. Ethereum had a huge developer following, but its trade volumes were still quite small. But when its first “killer app,” the ERC-20 smart contract to generate tokens and ICOs, began to gain traction in Q2 2017, the whole story changed.

Demand for ether (generally needed to participate in many ICOs) grew, and so did the ability to finance and create new blockchains. This chipped away at bitcoin’s dominance in the market until Q3, when bitcoin reversed the downtrend.

The timing of that shift appears to line up with bitcoin’s adoption of Segregated Witness and the end of confusion around the bitcoin cash fork. While bitcoin steadily won back its dominance score, it waned again in December as ethereum had its best month of the year, driven by the ICO boom.”

- Ethereum continues to set all-time transaction records

“ICOs helped push demand for ethereum in 2017, but they weren’t the only app that made news.

CryptoKitties took the world by storm in December, adding another interesting wrinkle to ethereum’s magic year. While many criticized the silliness of the Kitties, the novel blockchain use case nevertheless made its mark.

While ethereum had already broken its transaction records in the third quarter, the digital collectibles app, along with the upgrades from the Byzantium hard fork, helped ethereum nearly double the volumes achieved just a few months earlier.”

- Korea fills the void left by China

“ . . . In short, it seemed no one cared that China was out. Rather, it was an opportunity for new players.

South Korea, for one, became an important cryptocurrency trading hub in Q3 and Q4 – taking up much of the void left by China. The Korean won became one of the highest-volume paired currencies in the industry, with particularly high XRP and ETH volumes.”

- ICOs were big, but forks and airdrops were much bigger

“While the entire early-stage financing industry heard the call of ICOs in 2017, they were a blip when compared to other token-generating events.

Forks and airdrops come with a built-in user base (generally bitcoin HODLers) and were much more significant to the overall market cap in cryptocurrencies.

The bitcoin cash fork was the first to surprise the industry with the interest it generated, catching several exchanges flat-footed when users demanded their inherited property. Stellar too offered airdrops of its native currency, lumens, to bitcoin holders, leading some to believe this will be a more widely used strategy going forward.”

There was an (arguably silly) article published by CNBC today that claims that crypto will hit a total market cap of 1 Trillion this year with Bitcoin hitting 50,000. While articles such as these are fun to dismiss or fantasize about, we want to make it clear that no one knows the future (even us!) and just because someone is a “hedge fund manager” or “expert” does not mean they have a crystal ball that lets them have insight on some arbitrary valuation. While this prediction is in the realm of possibility, understand that there are infinite possibilities. Personally we believe that crypto will hit 1 trillion and Bitcoin will hit 50,000 one day, but we’re not about to make asinine open-ended predictions about when that will happen. People who do that are simply guessing, even if they’re making an educated guess.

If you really want to go down the rabbit hole, look into Monte Carlo simulations of crypto prices. As you can see from the price of Bitcoin alone, the standard deviation is quite expansive which highlights a degree of uncertainty and the underlying volatility of the asset. Basically, it’s only a little better than throwing darts at a board.

As a summary of Monday’s free Webinar, with some additional info added, check out our video on bear markets. Alternatively, you can watch the free webinar recording the in the archive in your member home.

We also summarized the points we made regarding yesterday’s SEC/CFTC hearing in this video. We suggest you check it out if you want to learn more about the future the US government is trying to make for crypto.

In this section we’ll feature a daily ICO or new coin we think you should check out. Based on your country, you may not be able to participate in the ICO, but you will be able to trade the coin once it is listed on an exchange following its ICO (usually only a couple of weeks). ICOs are where a lot of money in crypto is made. Here’s proof. That said, we should warn you: ICOs are highly risky endeavours and you need to mitigate any potential losses. Treat it as money you’ve lost the moment you contribute to the ICO. We are not responsible for the ICO’s performance. Today’s featured ICO / New Coin is:

Sapien

Take back control over your Social Experience

For flipping Neutral.

For long-term holding Neutral. Social media is a fickle area that relies heavily on the network effect — The biggest networks get bigger.

What is it?

Sapien is a highly customizable, democratized social news platform capable of rewarding millions of content creators and curators without any centralized intermediaries.

From their whitepaper: “A multitude of theories behind human intelligence suggest how fundamental social networks have been to the evolution of our species, Homo Sapiens. Whereas thousands of years ago the primary objective of interaction was survival, we now interact for numerous reasons, ranging from business to pleasure. Companies like Reddit and Facebook have enabled us to continue this ancient practice of socializing, while simultaneously driving open-source innovations like React.js and GraphQL. Another example of the earliest social activity is payments. Bitcoin is the first successful implementation of a borderless, cryptographical store of value enabling us to discreetly send funds to another person. Yet it was Satoshi Nakamoto’s brilliant idea behind the coin, the Blockchain, that has opened the floodgates of innovation. Immutable, hashed data is stored in blocks that are chained together to create a distributed database, secured with cryptography. This new technology has begun to disrupt everything from healthcare to banking to consumer apps. It is quite likely that we are witnessing the early stages of Web 3.0. Our team believes it is now feasible to combine the innate human desire for social networks with the immense power of the Blockchain to give each individual unprecedented control over their online social experience. We intend to build a democratized social platform that truly serves its users, fueled by a flexible cryptocurrency, SPN, built on the Ethereum Blockchain.”

What is our verdict?

What we like: Very clear passion and vision from the team. Idea has merit, even if it needs a lot of adoption to grow.

What we don’t like: Young team with little experience.

Website: https://www.sapien.network/

Whitepaper: https://www.sapien.network/assets/SPNv1_0.pdf

Technical Analysis Research

If you are an Investor (with a capital “I”) then proceed as normal, especially if you are dollar-cost averaging on the way down. My preference (as a Trader) is to buy assets that are being accumulated, not distributed. Charts can help identify the direction.

We had an excellent class last weekend, Introduction to CryptoCurrency Trading. (Click here for more information and to sign up) This class is really targeted at the Crypto investor who wants to get moving but is somewhat uncertain about what they should do, and how to go about it. Another great candidate would be the recent investor who bought in at the top and is unsure of their actions. While you can’t attend the live class and the Q&A any more, the content is all there and we give you the slide download as well.

Want to help us build a better service? Please take our survey.

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.