Premium Daily Crypto Newsletter

February 12, 2018

Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

The Market Is Green On A Monday?

The Bulls And Bears’ Tug Of War Continues

Yesterday we put out a video detailing the need to move funds off exchanges if you are at all serious about their security.

It may seem like we’re on a warpath recently, but our intentions are to help you navigate away from the spike pits and quicksand in crypto.

For those keeping score, we recommend staying away from the following exchanges:

Bitgrail

Bitfinex

Yobit

Next up on our blacklist:

HitBTC

Mercatox

HitBTC has been locking people out of their funds for several months now, using various techniques. While nothing is definitive at this point, locking accounts and delaying fund withdrawal is a bad sign and could point toward a hack and subsequent insolvency.

The same thing seems to be happening over at Mercatox, where users are unable to withdraw their funds, and there has been radio silence from the owners. Couple this with the fact that millions of the stolen Nano from Bitgrail was sent to an account on Mercatox and it seems there are some very suspicious actions and inactions afoot.

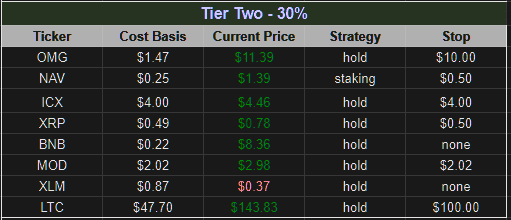

Again, storing your crypto, especially on smaller exchanges, is not an idea congruent to crypto security. Just like with fiat, you can have trading accessibility, or you can have security, but you cannot have both (currently). If you want to keep your T3 and T4 positions on exchanges because there isn’t adequate wallet support or the position is small enough that you’re OK losing it, that’s an acceptable plan so long as you understand the risks. As far as we’re concerned, every one of our T1 and T2 coins are safely locked up, especially the coins that earn us staking dividends as incentive for doing so.

As far as which exchanges we trust (the word “trust” being used loosely), we have had very positive experiences on the following:

Binance

Bittrex

Gemini

Kucoin

IDEX (decentralized exchange)

And we’ve had neutral to negative responses to these exchanges:

Coinbase / GDAX

Poloniex

Kraken

Cryptopia

Liqui

EtherDelta (decentralized exchange)

Changelly

As far as where to store your crypto, we like multi-coin wallets such as Exodus, Enjin, Jaxx, and the mobile app Coinomi. We like Myetherwallet.com for Ethereum and ERC20 coins (https://eidoo.io/erc20-tokens-list/) despite the recent drama regarding their owners. Additionally, hardware wallets currently support a small number of coins, but we see them as the most secure form of storing crypto, outside of writing down your private key on a piece of paper.

While the market seems to have collected itself after our yearly all time low last week, what we’re seeing today is a new record low for 24 hour trading volume this year, indicating to us the market has become “quiet” as both the bull and bears are waiting in anticipation for the next bell toll. Last week’s news regarding the CFTC / SEC session has mostly quieted the chatter and FUD regarding regulations — they’re the ever-present boon or doom of crypto, and most inexperienced traders panic at the notion that crypto will be “banned”.

Given the normal volatility of crypto, it’s easy to think of times like these as the “calm before the storm”, but really these moments should be where you can do your best research and strategy. Peaceful moments are rare in crypto, so enjoy this moment of brevity while we all collect ourselves.

If you missed our class “Introduction to Cryptocurrency Trading” that we held on last weekend, it’s available now in our Premium Member’s Home as an archived class for those that purchase it. You can view more about it and watch the class today by visiting this link here.

Watching on Mobile? Click this link to watch in HD

Click here for audio link of today’s video

Offense – Adding Trades

Offensive Actions for the next trading day:

- Added TRAC position

- Added NANO position

- Added LOCI position

Defense – Managing Risk

Defensive Actions for the next trading day:

- Removed DCA Acquire strategies as the market is going up

Current Portfolio

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

Tier 3

NANO

Nano uses a technology called DAG ( Directed Acyclic Graph )

Nano offers us an alternative to bitcoin as it solves two of the big problems that BTC has

Slow transactions

High commissions

Nano offers us the solution that being a currency that does NOT depend on MINERS, its ecological impact is less, since by not promoting mining the energy consumption is enormously low compared to the cryptocurrencies that use the miners for the creation of coins and the confirmation of transactions, and by not depending on miners for the confirmation of transactions, they are free of any commission.

Tier 4

OriginTrail

OriginTrail enables seamless data sharing along any supply chain. The decentralized, blockchain-supported network protocol ensures trust, transparency, and security. It helps companies exchange relevant data seamlessly and in a secure way to build accountability, protect their brands and increase efficiencies.

LociCoin

Currently the inventing process is convoluted, expensive, and stifles progress. In short, the process is broken forcing many inventors to go straight to market with their idea or never follow through. InnVenn is designed to reform the inventing process through simplifying the process and making it efficient, thereby increasing the possibility of new inventions, innovations, and inspiring the next big idea.

Loci holds numerous patents to protect our IP, but our InnVenn product development has been guided by the main patent “System and method for fuzzy concept mapping, voting ontology crowd sourcing, and technology prediction.” The ideas covered in this patent have been researched and developed since 2008 and is the bedrock of what we are doing at Loci.

Tier 3

REQ

SUB

LINK

Tier 4

XBY

BNTY

TAU

WISH

TRAC

PHR

ReadySetCrypto’s 7 Categories Of CryptoCurrency

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

Fundamental Currency Research

“It’s clearly a domain where we need international regulation and proper supervision,” she continued.

She of course joins a long list of regulators who have surmised as much, and have been able to do little. The fact remains that cryptocurrencies, being decentralized, are under no one countries’ jurisdiction. Getting all the countries of the world to agree on something, especially something that is currently as much as a niche as cryptocurrency, is frankly folly. This is the IMF chair speaking to the status quo, not the future.

Further warnings came from the European Supervisory Authorities (ESAs), who warned that cryptocurrencies are “highly risky” assets that show “clear signs of a pricing bubble.”

“The ESAs warn consumers that VCs (virtual currencies) are highly risky and unregulated products and are unsuitable as investment, savings or retirement planning products.”

Of course, this comes right after the European Central Bank told CNBC on Feb. 7 that crypto regulation is “not high on the to-do list.” Clearly, European authorities are taking the same approach that many around the world are: wait and see, stop illicit activities, and pay little attention to the growing tide.

Watch our video on why you should move your crypto off exchanges here:

We find that to be exciting news, especially for Loci, who we’ve decided to open a position with. They only recently were listed on Kucoin and have not been advertising their solution in the slightest. We expect good price movement once they are listed on larger exchanges and announce partnerships with universities for their IP.

It was hinted that IBM would be introducing central banks to Stellar Lumens ($XLM), whom they have a partnership with, to gain a first mover advantage with the largest financial institutions of the world. The rumor was based on this report which unfortunately has no mention of Stellar, but it is not a large reach that IBM, being partnered with them, would use Stellar as a chief example. It should be important to note that we say chief example, and not chief solution, because it’s very possible, if not probable, that central banks would develop their own cryptocurrency.

Gems

For flipping Neutral.

For long-term holding Good. The gig economy will be a developing nice in crypto.

What is it?

Gems is a protocol for contracting workers to perform micro tasks. Workers stake tokens in order to prove validity of their tasks and earn

a reusable computed trust score, enhancing the cost-efficiency of the network while democratizing access to scalable micro task workers.

What is our verdict?

What we like: Similar “mechanical turk” services are very greedy, leading to disruption potential.

What we don’t like: Very competitive area to tackle.

Website: https://gems.org/

Whitepaper: https://gems.org/whitepaper.pdf

Technical Analysis Research

I did see some signs of life in SOME of tonight’s charts; high-volume bounces, and some constructive price action showing potential “higher lows” setting up. My hope is that these do not turn into larger-timeframe lower highs, which means that there is more corrective price to come.

We held an excellent class recently, Introduction to CryptoCurrency Trading. (Click here for more information and to sign up) This class is really targeted at the Crypto investor who wants to get moving but is somewhat uncertain about what they should do, and how to go about it. Another great candidate would be the recent investor who bought in at the top and is unsure of their actions. While you can’t attend the live class and the Q&A any more, the content is all there and we give you the slide download as well. If you go to buy the course at our online “store” you can receive $10 off the $59 street price with your member’s “coupon code” of member18crypto…or you can simply use the link above but that does not offer paypal.

In the meantime, however, a rising tide lifts all boats and this is what I would expect in the near-term. This market is still working off the huge December-January move and might take more consolidation before the next leg kicks in. Equity bear markets last 12-18 months so we can hope that the crypto market doesn’t have the same supply/demand structure. (so far that hasn’t been the case)

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.