Doc's Daily Commentary

Mind Of Mav

Where Is The NFT Market Going From Here?

I have been thinking a lot recently about how NFT marketplaces will evolve, especially as it feels like every other deck I see is some form of marketplace.

Then today I saw a debate between two very intelligent people in the space, whose opinions I have grown to respect.

I wanted to share my thoughts.

I don’t currently have a conclusion but this is how I am viewing the different options and issues facing the NFT Marketplace space.

Problem – There are SO many marketplaces

The buzz around NFTs has been awesome, but that has meant there is a proliferation of marketplaces, some are similar (i.e Opensea and LooksRare) and others offer more specialised services such as curated content, ‘fine’ art, liquidity pools or fractionalised pieces: SuperRare, Rarible, Foundation, NFTX and Fractional come to mind.

Speaking of, as I type this, I just found out at x2y2.io…

Then you also have L2 marketplaces emerging on Arbitrum (i.e. Agora)and Optimism (Quixotic) and other L2’s such as Immutable X.

Don’t forget to go cross-chain if you are a real collectooooor- maybe you are looking on Solana at: Solsea, Magic Eden, Metaplex etc or Avalanche with YetiSwap or Tezos with OBJKT & Hic Et Nunc. Oh and NEAR with… well you get the point.

So the question is what happens? Does it all move to aggregators? Does it all become centralised or do we have individuation and different platforms compete in the open market and offer different benefits.

Let’s examine a few of the options and some pros/cons:

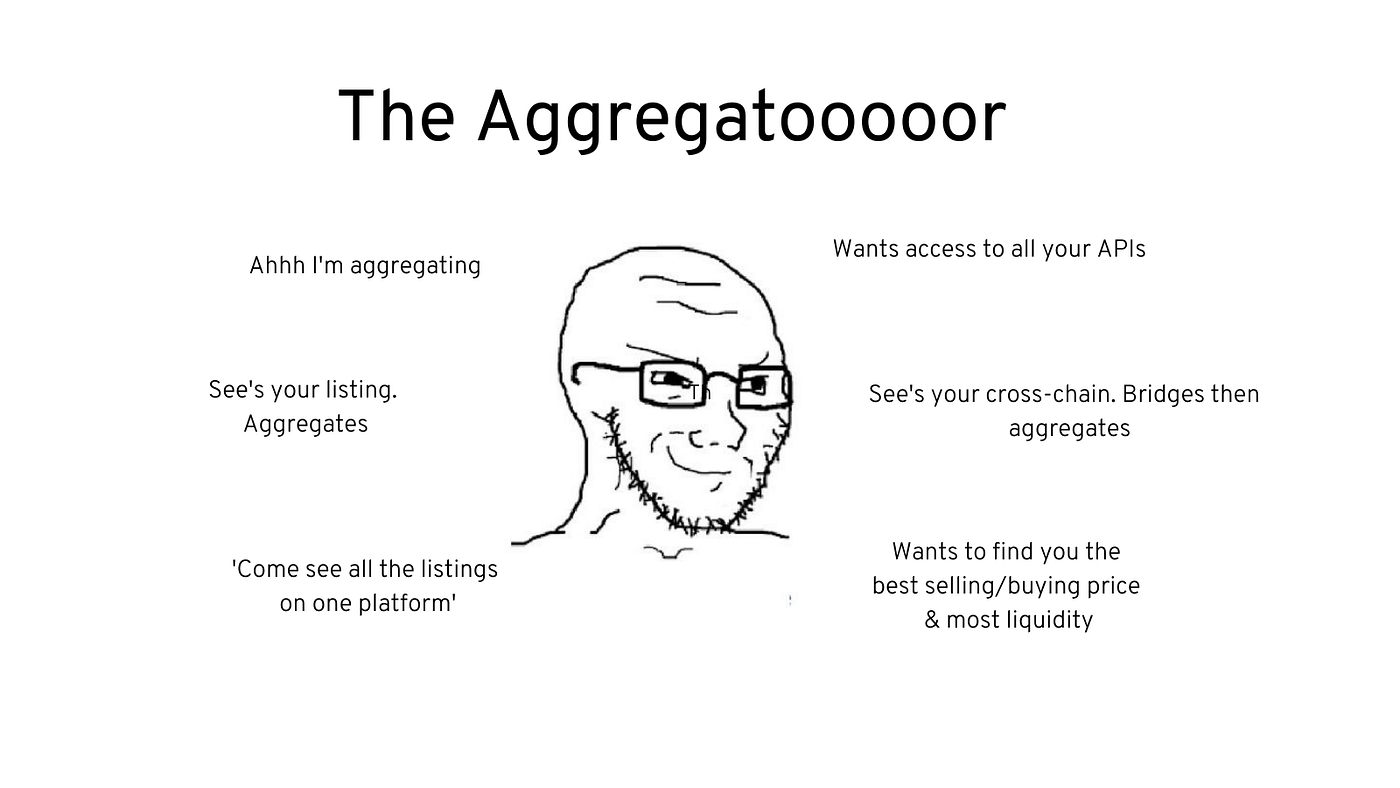

Aggregators:

We haven’t seen much in this space yet for NFT Marketplaces, there are some but they haven’t captured meaningful volume yet. Gem.xyz is one I was just introduced to.

The basic premise is they plugin to different marketplaces and show you a fuller picture of the marketplace.

In the Defi world we have already seen the popularity of these DEX aggregators like 1inch and Matcha, with rising volume.

Why could aggregators become popular?:

With an easy UX people will get access to the widest market options, if you provide depth of liquidity

NFTs aren’t physical products and so the moat around stock is not the same as physical products

There are so many exchanges now, it is extremely challenging to keep up with where the best buy/sell price is available.

You could incentivise use with tokenomics and partnerships beneficial to the platforms too.

And why wouldn’t this work? :

Network effects, if someone like Opensea builds up a meaningful moat if can be extremely hard to displace them. The example I saw used in the debate was Ebay. Ebay isn’t a great experience for buyers/sellers but people know it is where the most buyers/sellers are which reinforces their advantage.

We have seen a few failed attempts to take volume from OS — for example, Infinity.xyz, which didn’t make a dent. The closest so far has been LooksRare and I will be interested to see how that unfolds.

Security issues — we have already seen issues and exploits on Opensea and other platforms on other chains. If you can’t guarantee the safety of an individual platform, would you want to expose your wallet and sign approvals to an aggregator connected to multiple platforms?

Technical issues like sorting royalty payments, transaction fees, allowing cross-chain purchases etc

I have been thinking about aggregators in Web 2 as an analogy. Property is non-fungible, and agents all have their own websites and listings, but they also all list on aggregators like Zoopla and OnTheMarket, or Zillow in the US.

1. Centralisation wins

‘Nooooooooo’ to centralisation, that is against out ethos right? Well it could happen. Opensea is the easy example, but look at platforms like Coinbase launching its NFT market. They have access to millions of users, your average retail user ‘trusts’ them and doesn’t care about decentralisation.

If they end up having the most buyers and sellers, we are back to the marketplace issue- why would you go anywhere else? You can get the best price and sell or buy quickly.

I’d argue, on ETH at least, right now that the NFT market is largely centralised around Opensea anyway and we can see how hard it has been to unseat them. So perhaps they, or someone like Coinbase, becomes the leviathan that dominates like eBay and is nigh-on impossible to beat.

Generally it is a lot easier to build a really quality UI on a centralised platform too, which makes the user experience so much cleaner and them less likely to use other platforms. (Opensea isn’t doing much to make this case convincing though…)

Bear in mind here, centralisation doesn’t necessarily mean a centralised platform it can also just mean a decentralised platform that dominates the market. for example Universe.xyz launches and takes 95% of the market.

2. Individuation

One thing that is interesting in the NFT space is the variation, both in the offerings of NFTs and also in how they can be packaged.

I wonder whether you will end up with ‘niche’ markets and marketplaces. The opposite of ‘the everything store’.

We have seen a bit of this already with platforms alluded to earlier. You could see platforms appealing to smaller markets such as: 1/1 pieces, small editions, gaming NFTs, curated artists, decentralised platforms, fractionalisation, liquidity providers, index investments etc.

People can go to different places to service their specific goals and each platform can incentivise users to use them individually (different reward systems).

Platforms here include one previously alluded to: Foundation, Superare, Rarible, Universe.xyz, NFTX, Immutable X.

I don’t have a conclusion on how this battle with play out right now but interested to hear other peoples thoughts or if there are options that I have missed here.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.