Doc's Daily Commentary

Mind Of Mav

Looking Ahead To The Rest Of 2021

The past week has probably been one of the most eventful in markets in recent memory. The same has been true for the crypto space. We’ve discussed the recent events in length here, but I feel we must also look to the larger trends at play.

After all, trends in Blockchain and Cryptocurrencies are changing incredibly fast. Every year there is some new thing: 2017 – ICO, 2018 – IEO, 2019 – Stablecoins, 2020 – DeFi.

To keep up-to-date with all that variety, I want to share my opinion on what’s worth paying attention to in 2021:

1. CBDC

Since 2016 there have been rumors and opinions that many states will start switching to CBDCs (central bank digital currencies) soon.

However, it was not until 2020 that it became clear that we were closer than ever. China has already begun testing its e-currency with the general public, and in response, many countries have announced their own public e-money developments.

In 2021 that race will continue with renewed vigor, and the implications of such will soon be made evident.

2. Conferences

The year 2020 is remembered for the cancellation and postponement of most cryptocurrency events and conferences due to the pandemic. Some of them went online, but it’s an entirely different experience not capable of conveying the full range of offline event opportunities.

I see people’s great desire for events. e.g., in 2020, a Blockchain Life forum was held in Moscow during the gap between the coronavirus’s first and second waves. More than 3,000 people attended, clearly showing people’s desire to attend conferences again despite all the fears.

3. DeFi

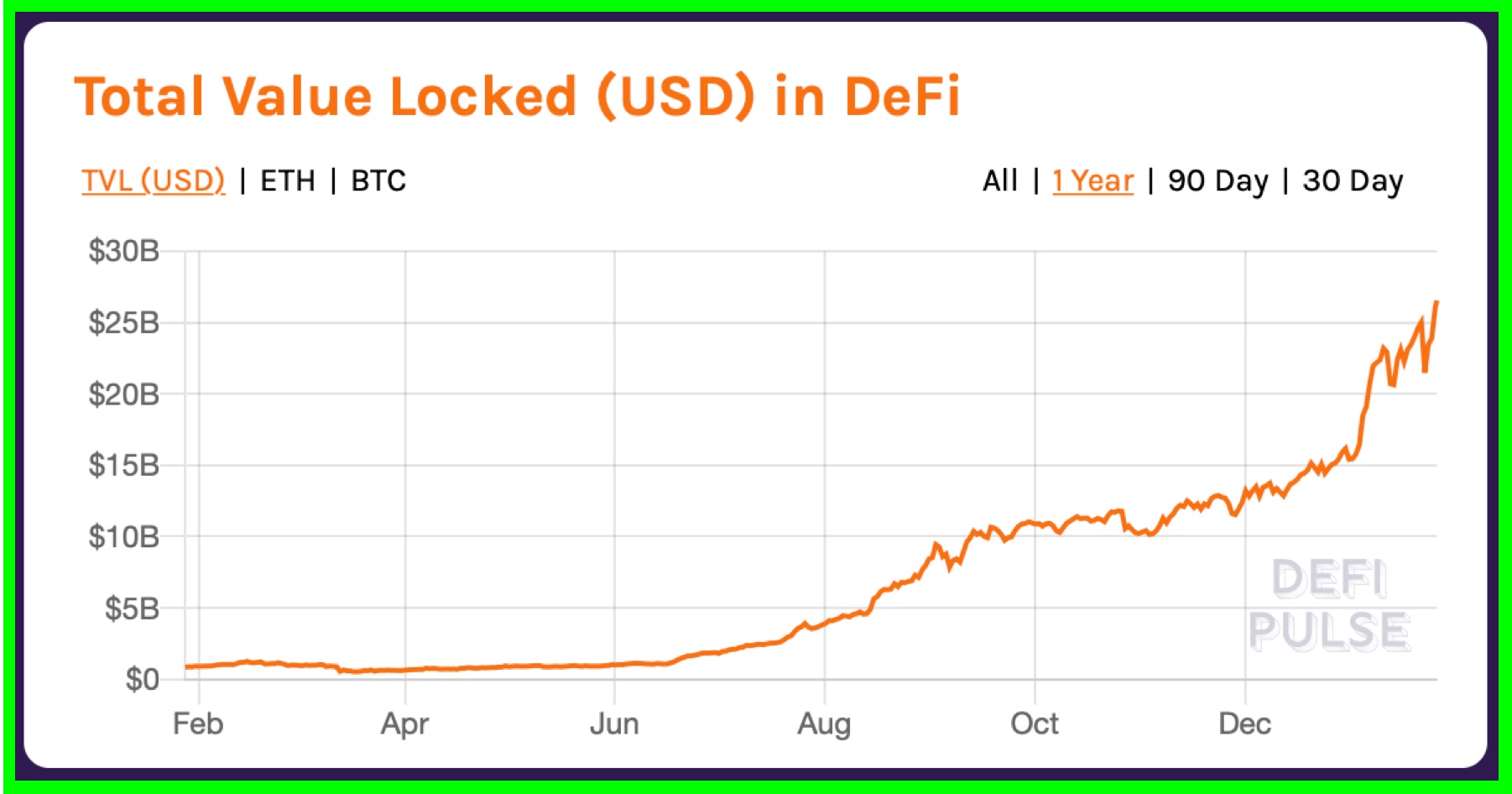

2020 was an incredible year for the DeFi industry.

In just one year, there was an unprecedented growth of popularity and funds (about $25 billion), mechanisms of staking and farming became explosively popular, and governance tokens and flash loans became the development of decentralization ideas.

2021 will bring even more attention (and funds) to the DeFi market.

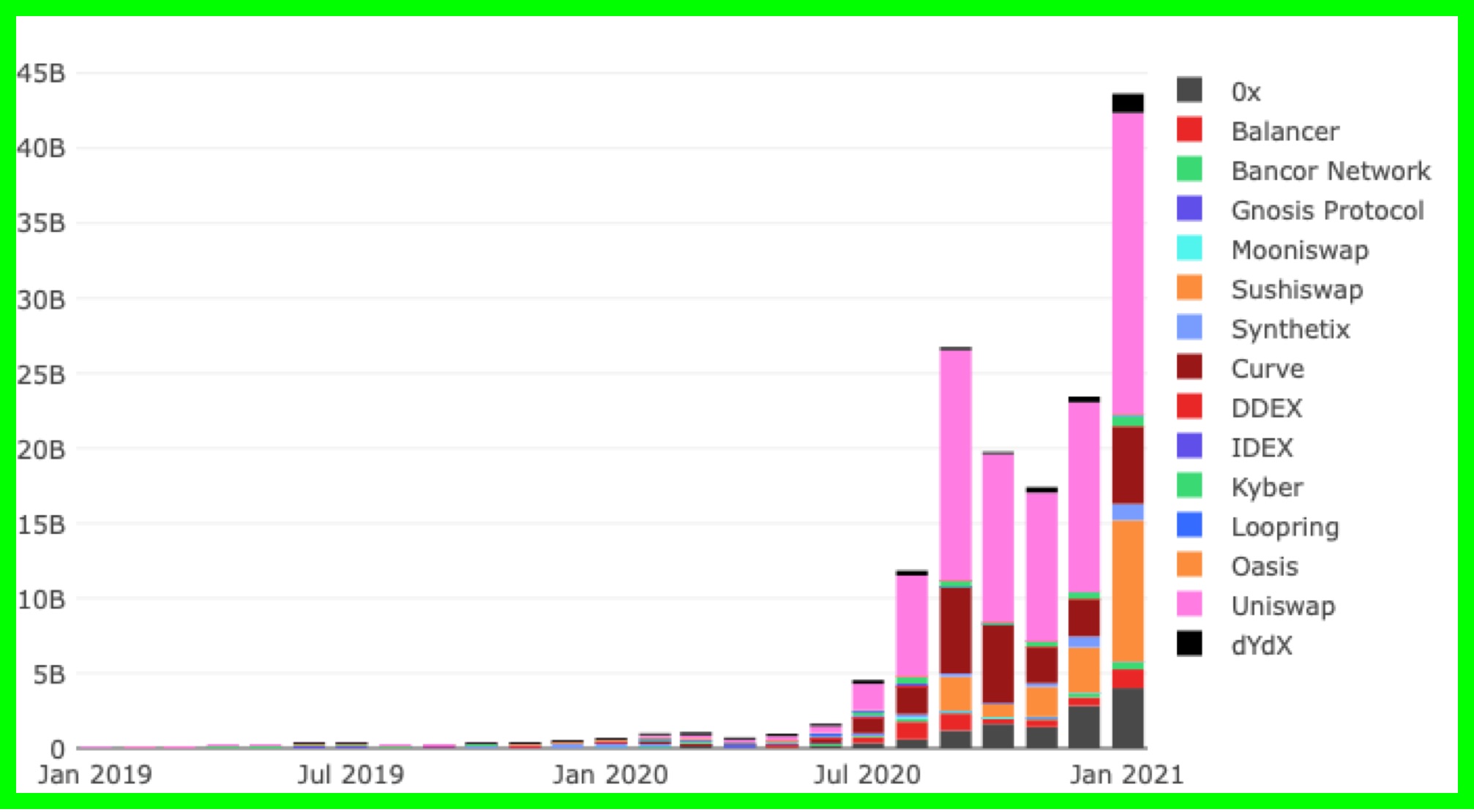

4. DEX

Decentralized exchanges (DEX) are an essential part of the DeFi market and the larger crypto initiative.

2020 was a real breakthrough for them as well with the rise in popularity of Uniswap, 1inch, and other projects.

The trend is only getting stronger: 2021 intrigues with a possible breakthrough in the development of such exchanges through the prism of Ethereum 2.0 and possible alternatives from other blockchains, as well as the birth of the IDO (Initial DEX Offering) trend.

5. NFT

NFTs (Non-fungible tokens) are relatively new types of digital assets that are designed to represent ownership of something that is unique and scarce, whether that be tokenized physical assets, rare digital resources, shares, or practically anything else.

The beginning of 2021 has brought some attention-grabbing headlines surrounding NFTs, e.g., the creator of “Rick and Morty” sold paintings for $1.65 million in Ethereum, and a rarity cryptopunk sold for $762,000.

I also see a fascinating parallel between the popularity of DeFi and NFTs, and how the two come together to make each other better. For example, it’s possible to farm and fractionalize NFT tokens, then use them as collateral, etc. NFT tokens could become the tokens we’re used to seeing over the next couple of years as their potential continues to be built out and explored.

6. SoFi

The concept of “Social Tokens” or “Social Finance” (SoFi) embraces some of the most popular aspects of decentralization, such as tokenization, digital reputation, and decentralized social networks. This market segment is very new but is already attracting a healthy amount of attention. We could, for example, see SoFi expressed through independent content ownership, new community motivation systems, digital avatars, or NFT merchandise, just to name a few.

With the recent social media crackdowns and the desire for expressions of free speech growing, we will certainly see new social networks based on blockchain, open-source and transparent algorithms, and governance models akin to DeFi projects.

7. Legislative regulation of blockchain and cryptocurrencies

The year 2021 has already been marked by several events related to legislative regulation in the US. For example, the Office of the Comptroller of the Currency (OCC) within the U.S. Treasury Department allowed national banks and federal savings associations to use public blockchains and stablecoins.

Furthermore, U.S. President Joe Biden declined FinCEN’s proposed rules for regulating the cryptocurrency industry.

In many ways, the coming months will provide insight into the new White House administration’s cryptocurrency policies and prejudices.

Additionally, the evolving views on digital assets held by regulators in major economies, such as Russia, China, India, Japan, and the EU, remains very important. It remains to be seen how the legacy legislative and banking system will respond to new challenges of authority posed by the maturing cryptocurrency industry.

As always, we will be watching, and we will be vigilant.

After all, the tenets of blockchain are needed now more than ever.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.