Doc's Daily Commentary

Mind Of Mav

Crypto In 2022; No Longer About ‘HODL’ing Coins

You’ve heard the term passive investing and active investing. Passive investing is where you buy an asset and wait over a long period of time. Active is when you are actively trading it, such as buying low and selling high, to buy low again.

You might have also read somewhere that passive investing > active investing. The quote that says, “time in the market is better than timing the market.” Well, that statement might be true in the realm of traditional finance.

Here in crypto, we don’t go passive like in stocks. There are some reasons for that.

The newness requires special attention

It’s not about the volatility, but rather the fact that the cryptocurrency industry is nascent. It evolves fast. Investors sitting inactive is the definition of ngmi (not gonna make it.)

The coins that were popular in 2014, few of them made it to 2022. There were top coins too in 2017–2018 that failed to reach broader adoption (and an all-time high, price-wise) in the current bull market cycle.

There are OG investors that are still stuck in their 2017 and beyond mindset. They missed a lot of things, and become the boomer in the industry. Their knowledge is obsolete, they like the status quo, they become lazy and not updated, and we don’t refer to them for alphas — or basically anything.

Nothing is permanent in a new industry that’s constantly evolving. We have to follow where the direction of the tech — and the market — is going. Those who can’t keep up won’t be able to make it.

Using DeFi is the equivalent of getting the front seat at a concert. You get to watch how the event unravels in close proximity.

Investing in crypto is similar to investing in companies. The only way you can know something is good or bad is by actually using the products/services. That’s how you build conviction. Skin in the game results in convictions.

Conviction is #1 weapon in successful investing. It’s when you are so sure that the asset you hold is the real gem. You understand its strengths and challenges. You know its hidden real potentials.

That way, it’s time to withdraw to a private wallet and start exploring dApps (Decentralized Apps.)

Don’t become exit liquidity

Something that is an open secret in the crypto community, but most new entrants probably don’t know. It’s that by the time a token is listed on a centralized exchange (CEXs), you are too late.

You won’t be an early investor anymore. In fact, CEX listing is when super early investors exiting — selling their tokens. The listing provides them with the liquidity required to cash out big amounts. Yes, in harsher words, they are dumping on you.

This is even more applicable for altcoins in the category of “shitcoins” and “memecoins.” Even good projects still suffer from such treatments. No project is immune to paper hand whales and VCs.

This particular point is the biggest reason why you should DeFi. It’s where you can find a project with a small market cap and big potential upside. It is where you can spot early projects beginning to gain some traction. It’s where you can support and contribute to a project whose Twitter followers are still under 1000.

DeFi is how you are “early.”

Opportunities abound

This is where we finally get to that “buy and hold” point as I mentioned in the title.

The time to get rich holding bitcoin has long passed. BTC is the boomercoin now, being one of the most underperforming cryptocurrencies in 2021.

It’s time for Decentralized Finance.

Once you learned about DeFi, you’ll find out that there’s more to crypto than to hold tokens.

You’ll learn about additional profit through staking and yield farming. You’ve probably have heard about airdrops — when users are given cryptocurrency for free just because they use certain DeFi protocols.

You’ll also learn that you can make your fiat, converted into stablecoins, to work for you, giving you double-digit yield annually.

There’s so much to explore in the world of blockchain. Opportunities available for everyone regardless of:

1- Privilege (or lack thereof.) You can participate regardless of your race or nationality. As long as you have a wallet, all you have to do is to click “connect”. No gatekeeping. No one can stop you.

2- Passion. Crypto has various sub-niche you can be part of. Gaming through the metaverse? Creative arts through the NFT? DeFi for the more mathematically nerds? Find your folk.

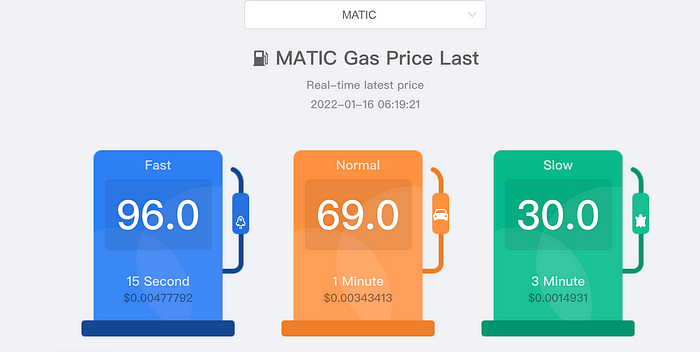

3- Financial situation. You don’t have to be rich to get started in DeFi. Yes, you may have heard about Ethereum and its notorious high gas fee problem. But Ethereum is practically the only smart contract platform to exclude low-budget users due to high gas fees. Others, like Polygon, Fantom, and Harmony, they cost pennies in gas fees.

Don’t be scared about the rite of passage

But, what about scams? What if I lose my money?

Plenty of scams in the space, I know. But you won’t ever learn if you don’t try. How to separate gems and trash without diving into the environment head first?

People who are successful in crypto now, all went through the same rite of passage. They came into the space green and hopeful, not knowing anything. Then come the challenges, confusion, hacks, rugpull, and bear markets. But through all those challenges they become wiser, savvier, cleverer, and battle-hardened. Portfolio performance goes up in line with experiences collected.

Everyone has to start at some point. Like with everything, the most important thing — and the hardest — is to begin. If not now, then when?

Especially now that plenty of people that came before you, happily share their experience. That way you can learn things, what to do and what’s not. How to minimize risk. How to differentiate scams and legits. You’re lucky that there were trailblazers that were there before you.

Contribute the other way

Over time, you’ll realize how vast the blockchain industry is after you start exploring it. And you will also realize the space has so much to offer. You’ll see opportunities beyond just investing.

The blockchain space is a thriving new space. It needs skilled people from various walks of life. Not just people with tech backgrounds, but other areas like marketing, design, public relation, media, even accounting (taxes.)

There’s something for everyone.

You’ll see this space differently. You’ll see it as a community movement. You recognize that it’s the future. Be prepared to be smitten.

Yes. I know. All this sounds overwhelming. But trust me, once you rolled into DeFi, it will get easier. And then you feel that there’s no going back — to traditional finance. You don’t just look at the cryptocurrency space in a different way. Crypto will change how you look at the world — and yourself — too. You’ll recognize how inefficient is Traditional Finance. You will be excited about the indiscriminate opportunities crypto offers. You feel powerful and in control because you self-custody.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.