Doc's Daily Commentary

Mind Of Mav

The Case For A Million Dollar Bitcoin

January 3rd 2021 was the 12th birthday of Bitcoin since the inception of the genesis block — and there are good reasons to celebrate. The news of Bitcoin constantly breaching new highs is a welcoming narrative by all HODLers and bulls alike. While the price is still going parabolic as we speak, the million-dollar question is now again on the table — how likely is it for Bitcoin to add six zeros in its value?

I posted this question on Reddit mid-December and has since gathered more than 50 opinions in the discussion thread. I studied and compiled the opinions and analyzed the rationales behind them.

The Probability

From single-digit to double-digit probabilities, most certainly a non zero chance.

Most arguments seem to align with the narrative that Bitcoin will continue to raise its prominence as the preferred store-of-value asset, outpacing the flow of capital into bank savings, pension funds, and even gold.

When we look at the numbers, for Bitcoin to worth a million bucks a piece, the entire market cap has to reach a staggering 20 trillion dollars, which is about 28 times of its current market cap (around 8 billion dollars at the time of writing) and twice as big than that of gold’s.

Why comparing against the gold you ask? Gold has largely played an important role in human history as a reliable store of value for more than 2000 years (~550BC to 2021). In response to Nixon shock in 1971, gold has decoupled itself as a medium of exchange against the dollar, effectively paving its new role as a deflationary asset. Ever since gold has appreciated from roughly $30 an ounce to $1,900 today, a 60x gain over half a century as monetary inflation occurred. Bitcoin, which is still relatively juvenile in comparison, exploded from less than a penny a decade ago to almost 40 thousand dollars on January 10 2021. Certainly, if history rhymes, both gold, and bitcoin will continue to appreciate against fiat currencies but given the magnitude, Bitcoin will certainly outpace gold given its stronger momentum of growth.

In another perspective, there are approximately $1.2 quadrillion dollars in all investments, derivatives, and cryptocurrencies. All we need is 1.75% of that and we hit $1 million per bitcoin. Put simply, if everybody put 1.75% of their investments into Bitcoin, we would have landed on the moon. That doesn’t seem that far fetched anyway.

The Timing

Not if but when.

The conservative answer would predict this likely scenario to happen sometime 10–20 years from now. Well-known investor Chamath Palihapitiya, one of the earliest bitcoin evangelists and a former Facebook executive has made the case for a million-dollar bitcoin in the next 20 years. However, in a slightly more (cautiously) optimistic case, the most common answer is approximately 5 years. This is aligned with what Raoul Pal, a former Goldman Sachs hedge-fund chief has recently said in an interview.

Statistically, when the functional relationship can be established between a relative change in one quantity in affecting the proportional relative change in the other quantity, it’s attributed as the power law. By modeling Bitcoin’s historical price using power law, it’s not difficult to spot that the price development falls within the corridor of the defined power-law. Harold Burger, an AI lead at Selligent Cortex has concluded in his article that the price will reach $ 1,000, 000 per bitcoin no earlier than 2028 and no later than 2037.

The Fundamentals

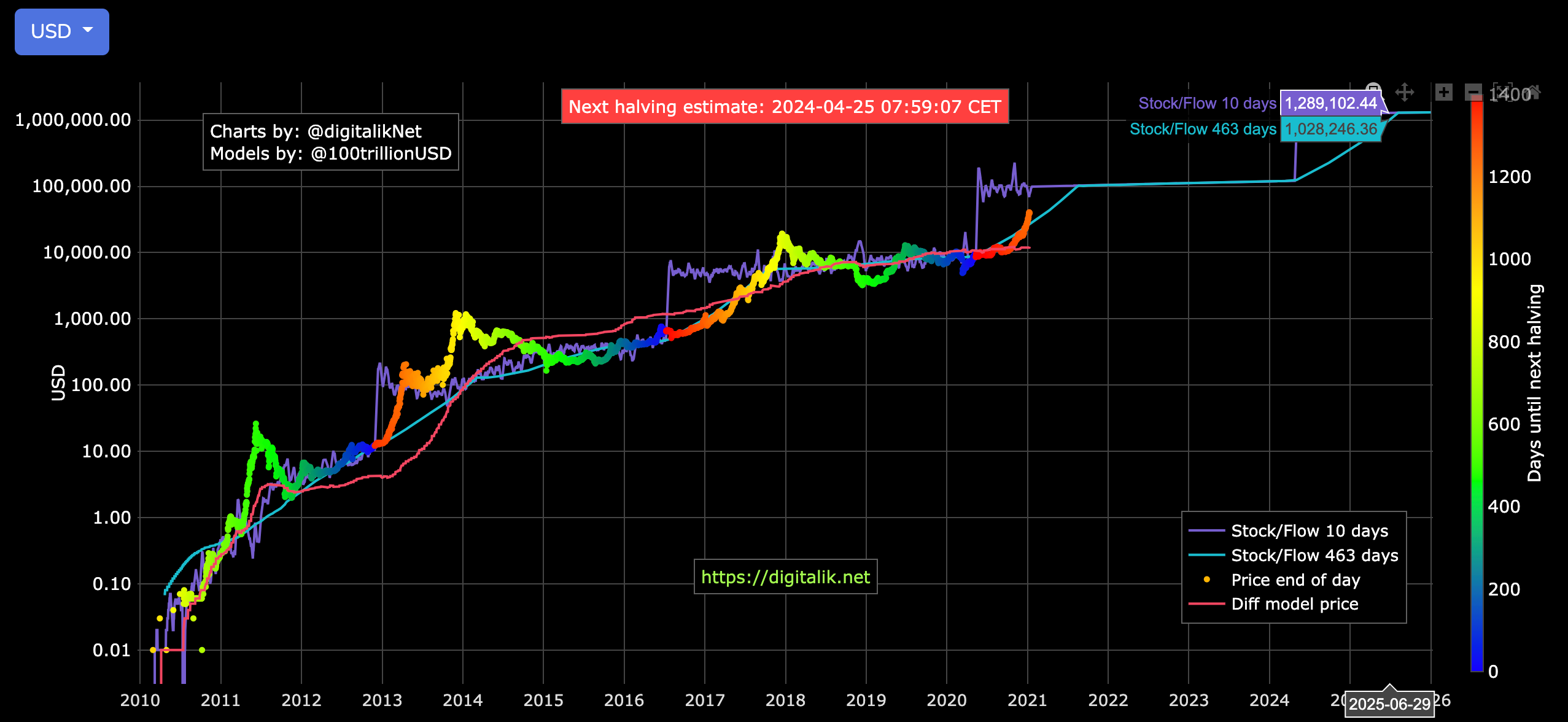

s2f aka Stock-to-Flow Model by Plan B.

Apart from the power law, the stock-to-flow model is perhaps the most widely discussed and contentious fundamentals in modeling bitcoin’s price development. Stock-to-flow model is based on the ratio for a commodity annual inventory or reserves in relative to its annual supply and is one of the significant reasons that back gold’s monetary importance. Bitcoin shares a similar feature as gold for being scarce, and thus its stock-to-flow ratio can be interpreted as the current number of bitcoins in circulation against the number of coins mined in a year.

Plan B’s first article argues that bitcoin’s price can be modeled by quantifying the scarcity using stock-to-flow. While gold’s total supply is unknown, bitcoin’s total supply is capped at 21 million coins and its production rate is subject to the halving event which happens on average every four years. Thus, by plotting a linear regression of bitcoin’s stock-to-flow value against its market value on a logarithmic scale, it has an R2 of 95%. The model predicts that the market value for bitcoin after May 2020 halving is $1trn, which translates into a bitcoin price of $55,000. Bitcoin’s price currently hovers around the $40,000 mark, some 6 months after the halving. If this projection holds true for the next halving, which is expected to happen in 2024, the price will hit the $1 million mark in 2025, about one year after the halving.

Takeaways

“History doesn’t repeat itself, but it does rhyme.”

As coined by Mark Twain, this aphorism applies with recognizable patterns resembling not just to economic history but extends well into the financial markets. In such cases, there’s an inclination that future project developments try to follow along the lines of the historical “pattern” — until that no longer works. In the last two rounds of bitcoin’s meteoric bull runs, the exponential growth of the price tends to correlate with the halving events, albeit with a time lag from a couple of months to almost two years.

However, given the novelty of bitcoin and its infamous volatility in price, there is not enough historical knowledge to truly understand the macroeconomics of the cryptocurrency. The current narratives mostly mimic that of precious metals, especially— gold. Thus bitcoin is also sometimes dubbed as “digital gold” given its similar deflationary nature and scarce supply.

While we continue to debate on which direction the price is going, what we really should be asking is how long until we no longer compare the value of bitcoin to that of fiat currencies. According to Satoshi Nakamoto, bitcoin was originally envisioned as the first independent electronic cash, free from interference from any governments or financial institutions. The reason why we are so enthralled by the price of bitcoin is none other than to get rich, so we can all one day cash out in fiat money to buy that Lamborghini. What if I tell you that one day you can drive home your dream Lamborghini with just bitcoin? No more exchange or swaps that stands in the way anymore. But until then, governments and central banks have to give in and yield their control on the money supply and let the free market dictate its own currency. Or perhaps cryptocurrencies will co-exist with fiat money under new regulations? Either way, we are definitely living in an exciting time of monetary evolution, and bitcoin is just a proof-of-concept, not any kind but most certainly a successful one.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.