Premium Daily Crypto Newsletter

January 28, 2018

Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

Week In Review

Net Neutral?

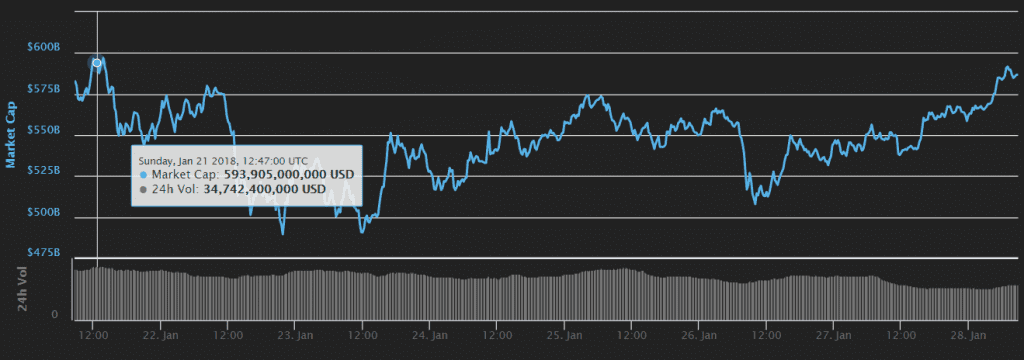

The market was generally choppy throughout the week but edged up towards the end. In terms of the entire cryptocurrency network value, it remained unchanged at $590 billion. Boring.

Thankfully, this is a respite from the previous week where things were a lot scarier for a couple days. That said the outlook is much more positive after the already deep correction and most of the large caps are nearing oversold territory. The Coincheck hack also drove market lower. The hack only involved NEM ($XEM). No other cryptocurrencies were stolen. Seemingly sick of negative news at this point and seeing that the impact was isolated, the market quickly shrugged it off. This was further evident after it was announced that:

- Coincheck says it will compensate all losses to its NEM holders at a rate of 88.549 JPY ($0.81) per each coin. Says it is using its own capital to reimburse clients. Exact date of reimbursement not yet decided.

- The NEM that was hacked is being tracked so the hacker will have a hard time moving it around. The NEM development team created an automated tagging system to ensure that all funds stolen from Coincheck are traced. By tagging stolen funds as tainted funds, cryptocurrency exchanges can now easily verify if stolen NEM funds are withdrawn or deposited to regulated trading platforms.

“NEM is creating an automated tagging system that will be ready in 24-48 hours. This automated system will follow the money and tag any account that receives tainted money. NEM has already shown exchanges how to check if an account has been tagged. So the good news is that the money that was hacked via exchanges can’t leave,” said a NEM spokesperson.

At a macro level, some good PR for crypto seems to be percolating. Starbucks Chairman Howard Schultz expressed optimism towards cryptocurrency. Robinhood, the US based app that offers commission free stock trading, revealed that it will add cryptocurrency (Bitcoin and Ether) trading in five selected states. The waitlist quickly grew to 900,000 less than three days after the announcement. As we mentioned in our last daily newsletter, this is a very good sign because it shows that a platform can have stock and cryptos coexisting, and that people want solutions outside of Coinbase to buy and sell crypto. After the discussions at the World Economic Forum in Davos, the world leaders are getting ready to deliberate on cryptocurrencies in the forthcoming G20 summit in March. Many leaders may seek to regulate cryptocurrencies, but if we study the consequences of the Chinese regulations, we find that they have been ineffective. As evidence, traders based in China are using cryptocurrency exchanges in Hong Kong. The Chinese government has only increased the risk for their traders because now they are forced to buy Bitcoin at a premium of about $1,200 compared to other mainstream exchanges. The leaders and central banks, instead of blindly opposing cryptocurrencies should chalk out a strategy to embrace them after discussing with the crypto stalwarts. We believe this is the optimal path forward for sovereign nations and crypto. We’ll see what the results of this discussion are. Have a great rest of your weekend!

If you missed our class “Introduction to Cryptocurrency Trading” that we held on Saturday, it’s available now in our Premium Member’s Home as an archived class for those that purchase it. You can view more about it and watch the class today by visiting this link here.

Download the Audio Only version of our Premium Newsletter Video Here

Offense – Adding Trades

Offensive Actions for the next trading day:

- Expanded OMG position.

- Entered TRAC position.

Defense – Managing Risk

Defensive Actions for the next trading day:

- Nothing specific for early this week; please see comments in holdings below.

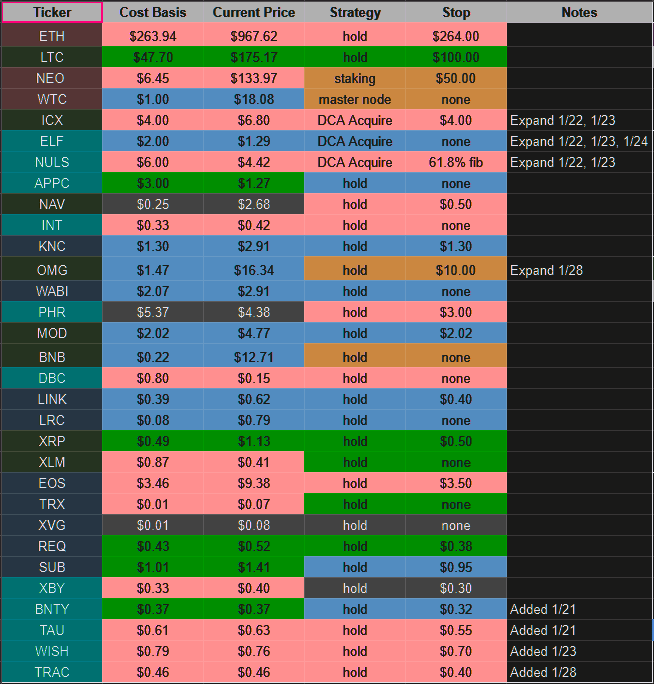

Current Portfolio

How to read this portfolio: Ticker: Contains the ticker code for the coin. You can search this ticker in Coinmarketcap to learn more about the coin. The color denotes the risk tier by our evaluation. Dark Red = T1, Dark Green = T2, Dark Blue = T3, Light Blue = T4 (Colors in the Ticker column do not interact with the colors in the other columns) Cost Basis = Our average purchase price for this coin. Current price = The average price of the coin based on the exchanges it is listed on. Strategy = What we plan to do with this coin. Staking is receiving dividends for that coin. Master node is also staking, but with a higher return rate for having a (large) number of that coin. Stop = Our exit point, if it exists What do the colors mean? The colors in the ticker column represent the risk profile of that coin. The colors in the other columns reflect what sector(s) that coin belongs to. Some coins belong to multiple sectors, which is indicated by multiple colors. The colors correspond to our 7 categories in the graphic below.

Tier 4

OriginTrail (added 1/23)

First Purpose-built Protocol for Supply Chains Based on Blockchain

MyWish (added 1/23)

MyWish platform is an ecosystem of smart contracts accumulating a complex of blockchain solutions designed to integrate high technologies into the real sector.

TAU (added 1/21)

Lamden is a suite of developer tools that speed up the process of creating new and custom blockchains and apps. The Lamden Tau token connects these new projects together and with mainchain cryptocurrencies.

BNTY (added 1/21)

A decentralized bounty hunting platform enabling anyone to manage bounty programs, and bounty hunters to receive payment for completing bounty tasks.

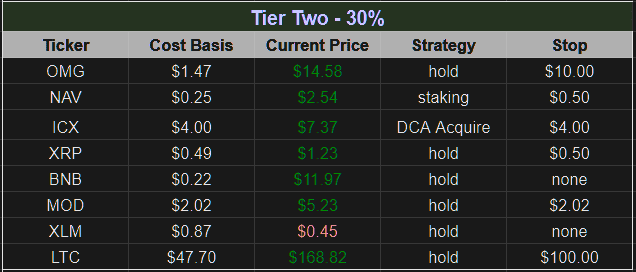

Tier 2

OMG

OmiseGO is a public Ethereum-based financial technology for use in mainstream digital wallets, that enables real-time, peer-to-peer value exchange and payment services agnostically across jurisdictions and organizational silos, and across both fiat money and decentralized currencies. Designed to enable financial inclusion and disrupt existing institutions, access will be made available to everyone via the OmiseGO network and digital wallet framework.

ELF

Based in Singapore, aelf is a crosschain blockchain protocol that intends to become the new internet infrastructure to support the next generation of digital businesses. The team and its advisors have been advising numerous blockchain projects in the past and they see a few industries who could be the early adopters of aelf: financial services, insurance, digital identity and IPs, smart city, and internet of things. Aelf will actively identify new business opportunities and dApps to be part of the aelf ecosystem. Below are some of the things that they are planning to do: Interoperate with existing dApps on existing chains Nurture new start-ups ideas Educate and transform established companies to be blockchain savvy As a “third generation” blockchain, aelf strives to provide a breakthrough in 3 areas: performance, resource segregation, and governance structure. We will explore these features in more detail below.

ReadySetCrypto’s 7 Categories Of CryptoCurrency

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

Fundamental Currency Research

Another question we’ve been asked a lot frequently is why we don’t have any Bitcoin. While we do believe that Bitcoin is due for a rebound, it is old news in cryptocurrency. As an example, Ethereum has been a much better performer over the past month than Bitcoin. Now, Bitcoin being the biggest and most well known means people are not going to stop investing into it anytime soon, and as such it represents “stability” or at least the illusion of stability in a very volatile market. In a single sentence, we simply believe there are better investments out there. Here’s some of the top stories we saw this week:

Robinhood add BTC/ETH trading in 5 states in February: https://crypto.robinhood.com/

South Korea Reveals Deadline for Anonymous Crypto Trading Halt: https://www.coindesk.com/south-korea-announces-deadline-for-halt-of-anonymous-crypto-trading/

Coinbase Overshoots 2017 Revenue Goal By 66% Making $1 Bln, Rejects Further VC Funding: https://cointelegraph.com/news/coinbase-overshoots-2017-revenue-goal-by-66-making-1-bln-rejects-further-vc-funding

Stripe is ending support for bitcoin payments on April 23: https://techcrunch.com/2018/01/23/stripe-is-ending-support-for-bitcoin-payments-on-april-23/

Starbucks’ Howard Schultz: A ‘trusted’ digital currency is coming, but it won’t be bitcoin: https://www.cnbc.com/2018/01/26/starbucks-schultz-a-digital-currency-is-coming-but-wont-be-bitcoin.html

50 Cent forgot he had a stash of Bitcoin now worth $8m: http://www.bbc.com/news/business-42820246

Japanese cryptocurrency exchange loses more than $500 million to hackers: https://www.cnbc.com/2018/01/26/japanese-cryptocurrency-exchange-loses-more-than-500-million-to-hackers.html

$530 Mln in XEM Stolen From Coincheck Can Be Traced, NEM Team Confirms: https://cointelegraph.com/news/530-million-in-xem-stolen-from-coincheck-can-be-traced-nem-team-confirms

Coincheck To Refund All Customers Affected By Hack: https://cointelegraph.com/news/coincheck-to-refund-all-customers-affected-by-hack-faced-by-community-support

WaltonChain ($WTC) had their conference today. Here’s what came out of it:

- Walton’s new logo

- They said they’re doing 6 child chains now instead of 3

- China Mobile manager said Walton will be the next Alibaba

- Coinnest CEO said out of the 30+ companies they talked to, Walton was the best, and their hardware was incomparable

- GlaxoSmithKline came to THEM, and they are in talks with Walton

- In talks with either H&M (clothing retailer) or HNM (global logistics). Yet to be confirmed.

- Walton said they have something so innovative that it’s going to turn blockchain on its head, and this application for blockchain has never been conceived before, but it’s under NDA so they can’t reveal.

- They confirmed mass production of their chips in Q4 2018

- They said Walton will be in 11 different INDUSTRIES in 2018

- They said that Walton will be in mobile phones in 2019

We remain extremely excited for the direction of this project and all the good news coming out of it. Don’t forget the ICON ($ICX) summit is on Wednesday and we will see price action surrounding it.

In this section we’ll feature a daily ICO or new coin we think you should check out. Based on your country, you may not be able to participate in the ICO, but you will be able to trade the coin once it is listed on an exchange following its ICO (usually only a couple of weeks). ICOs are where a lot of money in crypto is made. Here’s proof. That said, we should warn you: ICOs are highly risky endeavours and you need to mitigate any potential losses. Treat it as money you’ve lost the moment you contribute to the ICO. We are not responsible for the ICO’s performance. Today’s featured ICO / New Coin is:

Coinmetro

A one-size-fits-all fintech platform fueling the future of blockchain innovation

Overall, we like both the flipping and long-term potential for this ICO. Our thoughts on buying the tokens for flipping and investing for the long term are as follows: For flipping Good. The project has a promising idea that could see mass market appeal. For long-term holding Good. CoinMetro have some extremely interesting and unique features.

When – Pre Sale running now. The ICO starts February 21st, 2018 and runs until March 23rd, 2018

Token – COIN

Supply – A total supply of 500 Million COIN tokens will be created, with a maximum number of 300 Million COIN tokens to be sold

Price – Starts at 0.03 EUR. The price will increase by 0.02 after every 12,500,00th COIN is sold

Platform- NEM

Accepting – ETH, BTC, LTC and BCH

Hard cap – 300 million COIN

Link to the CoinMetro whitepaper

Where to participate in the CoinMetro ICO

Technical Analysis Research

- Bitcoin

- Ethereum

- Ripple

- Bitcoin Cash

- Cardano

- XLM

- Litecoin

- NEM

- NEO

- EOS

A hopeful bounce in the last 24 hours but I’m not impressed yet. I cut my teeth on bear markets in the 2008 financial crisis where I woke up every day wondering if the world would still be there when the sun came up. I know that this sounds dramatic but it literally was that bad, yet I feel nothing with this current crypto Bear. Perhaps that was because I sold several assets into the December peak. But what sticks with me was how negative and oppressive that the true “bottom” was, and I just don’t feel that way about this current crypto bottom yet. I’ve been saying that the strength of the eventual rally is in direct correlation to the negativity expressed at the bottom, and that only means that that any bounce will be tepid and a potential bull trap. Because of this I’m not really interested in picking up any large “dip” positions yet. There are some coins, however, that are bucking the “Bitcoin” trend and are either setting up excellent bases, or are starting to break higher already; I’ve covered them in this weekend’s “top 10 coin” report. We had an excellent class this weekend, Introduction to CryptoCurrency Trading. (Click here for more information and to sign up) This class is really targeted at the Crypto investor who wants to get moving but is somewhat uncertain about what they should do, and how to go about it. Another great candidate would be the recent investor who bought in at the top and is unsure of their actions. While you can’t attend the live class and the Q&A any more, the content is all there and we give you the slide download as well.

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.