Premium Daily Crypto Newsletter

July 2, 2018Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

The Good

- Market Continues Rally With 6% Upside

- Major Short Sqeeuze

- Coinbase Custody opens, allowing for institutional investment

The Bad

- Korean authorities probe exchanges’ handling of personal data

The Ugly

- Bank of Finland calls cryptocurrency a ‘fallacy’

Markets Finally Green

Is This The Real Life? Is This Just Fantasy?

Today was certainly reassuring as we saw green across the board. The market had a nice 5.6% pop adding to the 10% spike we saw on Friday, leaving us up comfortably positive for the week for the first time in a month.

There were a number of factors at play.

For one, the bounce today correlated nearly perfectly with a short squeeze.

There was even a very impressive $10 Million USD short squeezed out.

Elsewhere, the biggest news today centered around Coinbase and their custodial program.

While we’ve known about ‘Coinbase Custody’ since late 2017, today the custodian solution for institutional investors is now launched.

What Coinbase made apparent in their announcement was that while they’ve been storing over 20 Billion in clients’ crypto assets over the course of their six year operation, their new custody offering will be secured through an SEC-compliant and FINRA-member independent broker-dealer, Electronic Transaction Clearing (ETC).

They’ve made security a very apparent focus of this initiative, claiming they will employ a range of security measures, including “on-chain segregation of crypto assets,” “offline, multi-sig and geographically distributed transaction protection” as well as “robust cold storage auditing and reporting.” Pending regulatory notifications, they also plan to add “secure, segregated hot wallets” and scheduled withdrawals to increase flexibility.

What this essentially means in regular language is that they’re not allowing assets to be vulnerable due to a single point of failure. There will be multiple failsafes to ensure that Coinbase can’t be comprised in the same way we’ve seen other crypto exchanges have. While no security measure is perfect, having overlapping countermeasures ensures a degree of integrity that centralized systems often lack.

Why this is important becomes apparent when it’s clear who is going to be storing money with Coinbase: Institutions from both the US and Europe can now store their crypto assets with Coinbase Custody, though the company hopes to expand its offering into Asian markets as well.

Moreover, this means that banks and other financial institutions wanting to invest their money or their clients’ money into crypto now have the option to do so without having to risk actually managing the assets. It’s conceivable that your average bank customer could be investing a portion of their portfolio into crypto through their bank.

Now, it’s important to stress that this opens the door for institutional investors, but the door is not even close to being all the way open. For many mutual funds and other institutions, strict rules regarding custodianship have barred their way without solutions such as this, so in that regard this is a huge win for the space. On the other hand, the liquidity and volatility issues may still serve as major barriers that will have to be reconciled over time.

In no way do we anticipate a “flood” of institutional money entering the space all at once, but this is a very big domino that will lead to many more important milestones.

Companies like Coinbase are cognizant of the real challenges and obstacles in our way, but at the same time the massive opportunities that await if this becomes a recognized asset class and legally tradable market, as we anticipate it will.

To that end, today the EU Parliament published a new report, “Virtual currencies and central banks monetary policy: challenges ahead”. It painted the picture of things to come similar to our own rhetoric, going so far as to say that “their global transaction networks are relatively safe, transparent, and fast” and that “this gives them good prospects for further development.”

The report does not believe that Bitcoin itself will replace global currencies, instead saying that they “remain unlikely to challenge the dominant position of sovereign currencies and central banks, especially those in major currency areas.”

One interesting takeaway we had was that it echoes what we’ve been saying about market bears and crypto critics: that cryptocurrency is used only for illicit purposes. To refute that, the Foundation for the Defense of Democracies conducted research and reported that less than 1% of Bitcoin is used for money laundering, similar to the numbers we see for fiat currencies.

While there were many challenges and roadblocks highlighted in the report, this report shows that regulators are willing to consider the legitimacy and the case-use benefits of cryptocurrencies.

We think that’s the shifting tide we’ll see more and more as governments begin to see the potential use cases over the potential illicit purposes.

If you were not able to join us for the recent webinar “Ten Steps to Building Your Portfolio” webinar, the replay is available here.

We’ve started to produce episodes for The ReadySetCrypto Podcast; episode one, two and three are listed below (and on iTunes) and episode four is now available. Episode Four is about the portfolio rebalancing tool “Shrimpy”.. Look for more episodes shortly as we comb the crypto space for valuable interviews, and create valuable content to keep you in the loop!

Please be aware that we will be taking off Wednesday July 4th in observance of US Independence Day; there will be no newsletter produced that evening. Trading volumes will be light on Wednesday as well.

See you tomorrow.

New to Cryptocurrencies? Check out our archived classes “Intro to Cryptocurrency Trading”, “How to Find Your Next Big Cryptocurrency: Intro to Fundamental Analysis,” Mav’s class on “Security and Wallets” and Doc’s classes, “Introduction to Technical Analysis” and “Short Term Trading Strategies” which are now all available for immediate purchase in our Store, and seconds away from viewing in the Premium Member’s Home. View more about them at our online store by CLICKING HERE.

Didn’t catch our Portfolio Webinar from last week? Listen here.

Sign up for our NEW Telegram channel by clicking here!

Watching on Mobile? Click this link to watch in HD

Listen to Episode One of the ReadySetCrypto podcast

Listen to Episode Two of the ReadySetCrypto podcast

Listen to Episode Three of the ReadySetCrypto podcast

If you go to buy any of our courses at our online “store” you can receive $10 off the street price with your member’s “coupon code” of member18crypto

Offense – Adding Trades

Offensive Actions for the next trading day:

- None.

Defense – Managing Risk

Defensive Actions for the next trading day:

- None.

Current Portfolio

Desired Holdings

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

Tier 4

ZIL

IAM

FT

DATA

ELEC

None.

Tier 2

MOD

Tier 3

REQ

SUB

LINK

NANO

KNC

Tier 4

BNTY

TAU

WISH

PHR

LOCI

XBY

ELA

ECC

POE

HPB

BIX

EVE

XVG

NULS

DNA

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Fundamental Currency Research

Daox

For flipping Good.

For long-term holding Good.

What is it?

What is our verdict?

What we like: Well organized marketing, a good approach to DAOs, MVP is decent.

What we don’t like: Many similar projects. Team feels weak comparatively.

PREICO 33 days ICO Starts in 34 days Token DXC PreICO Price 1 DXC = 0.20 USD Price 1 DXC = 0.000387 ETH Bonus Available Bounty Available MVP/Prototype Available Platform Ethereum Accepting ETH Soft cap 4,500,000 USD Hard cap 300,000,000 DXC Country UAE, Spain, Russia Whitelist/KYC KYC & Whitelist Restricted areas USA, Canada

Website: https://daox.org/

Whitepaper: https://daox.org/daox-whitepaper-eng.pdf

Tuesday 6/26

Wednesday 6/20

https://medium.com/helloiconworld/icx-token-swap-schedule-announcement-10238888a50d

[Token Swap process]

The ERC20 ICX tokens will be swapped to mainnet ICX coins with a 1:1 swap exchange rate (1 ERC20 ICX token = 1 mainnet ICX coin). Please be aware that once the token swap is made, you cannot convert them back to ERC20 ICX tokens.

Token Swap schedule

1. Exchanges: Deposit your ERC20 ICX tokens to the exchange until; – Binance: 2018.6.20 (09:00,UTC+9) (For details, click here) – Upbit: 2018.6.20 (22:00,UTC+9) (For details, click here) – Bithumb: 2018.6.21 (22:00,UTC+9)(For details, click here) 2. ICONex: You can swap your ERC20 ICX tokens to mainnet ICX coins using the token swap feature of ICONex starting from 2018.06.25(13:00,UTC+9) until 2018.09.25(13:00,UTC+9)

* Important notice

1. (As of June 18th) Only Binance, Upbit and Bithumb are the official exchanges that have agreed with ICON for the token swap support. Please beware of other exchanges or third-parties claiming that they support ICX token swap. The list of exchanges will be updated.

2. ERC20 ICX tokens must be received by the exchanges before their deadlines for the token swap to be made.

3. All ICX deposits and withdrawals from the exchanges will be suspended until the token swap process of the exchanges are finished. For details, please refer to the exchange announcements.

Token Swap procedure (Using Exchanges)

- Deposit your ERC20 ICX tokens to the exchange before 1) Binance: June 20th, 2018 (09:00,UTC+9) 2) Upbit: June 20th, 2018 (22:00,UTC+9) 3) Bithumb: June 21st, 2018 (22:00,UTC+9)

- The exchanges will automatically make the token swap process without any additional submission or waiting period.

- All ICX deposits and withdrawals from the exchanges will be suspended until the token swap process of the exchanges are finished.

- To find out more about the exchange schedules, please see the following 1) Binance: Official announcement 2) Upbit: Official announcement 3) Bithumb: Official announcement

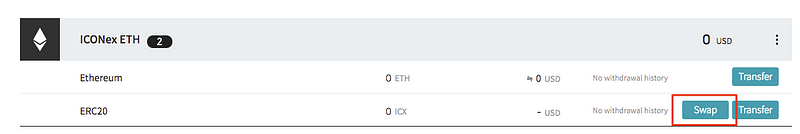

Token Swap procedure (Using ICONex: Detailed guide – Click here)

- Create an ICONex ETH wallet and send your ERC20 ICX tokens to the ICONex ETH wallet (Guide to creating your wallet) * Please check you create an ICONex ETH wallet(address starts with “0x”)

- Add ICX custom token to activate the token swap feature.

- Follow the instructions and complete the token swap submission 1) Your ICONex ICX wallet will be created automatically and the same amount of ICX that you have swapped will be distributed to your ICX wallet. 2) You will need a small amount of ETH balance for the token swap.

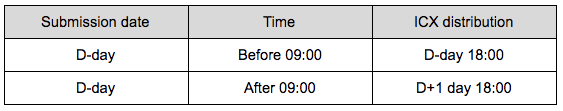

- Mainnet ICX coins will be distributed once per day(except weekends). (Token swap submission available at all times)

- Token swap submission received before 09:00(UTC+9) will be processed and distributed on the same day at 18:00(UTC+9). Submission received after 09:00(UTC+9) will be processed the next day. (No distribution on weekends or holidays)

* Important notice

1. Mainnet ICX coins will only be available for trade in exchanges that support Mainnet ICX.

2. Mainnet ICX coins that are swapped using ICONex cannot be traded right away in Binance, Upbit and Bithumb as they will suspend ICX deposits during the exchanges’ token swap processing period. (ICONex token swap(25th) feature will be open after the exchange deposit deadline(20th~21st))

3. If you wish to trade your mainnet ICX coins without waiting, please use Binance, Upbit or Bithumb for the token swap.

Monday 6/18

Tuesday 6/5

We’ve expanded our WTC and XRP postions due to the news stories we discussed today. We see both of these as solid long-term plays with excellent horizons ahead.

Tuesday 5/29

Thursday 5/24

Please note that you need to register your EOS if you haven’t done so already. There’s several methods, and this website is a good starting point for information: https://eosauthority.com/genesis Probably the easiest method I’ve been pointing people to is using Exodus: https://support.exodus.io/article/690-how-do-i-register-my-eos-address-inside-exodus Hopefully, that should get you started! Alternatively, if you don’t feel like going through this you can just sell right before the mainnet launch and re-buy the new tokens afterwards. … We were recently asked if we’d invest in TRAC or EVE, two supply chain projects that are competing for realtively the same space. Without getting too deep into EVE vs. TRAC today, what you should instead be focused on is which one is best long term. If you can’t adequately make that determination, which is fair given they’re both very new, then there’s no shame in holding both. After all, I guarantee you if you go all-in on one of these projects, and the other takes off, it’s going to hurt a lot more than if you split your holdings and only received a bump in half your portfolio. I’d rather take a 50% shot over a 0% shot any day. When it comes down to it, I think they both have potential and it’s just too early to know which is better long-term. Having two competing projects, it’s wise to invest in both instead of trying to decide which is better. I’d advise anyone the same way if they asked me WTC vs. VEN, or NEO vs. ETH, or ICX vs. ARK, etc. This space is so immature that you’re playing to lose if you go all-in on one project. Diversify is the name of the game. We don’t currently own EVE as we feel the project has received a l9ot of attention recently and we’d like a better buy-in price.

Wednesday 5/23

We made a number of acquisitions today in response to a perceived market drop. Zilliqa: The practical byzantine fault tolerance algorithm (PBFT), which is used to establish consensus in blockchain systems, is only one of those potential solutions. Three examples of blockchains that rely on the PBFT for conses are Hyperledger, Stellar, and Ripple. Zilliqa will likely be the first blockchain with live on-chain transaction sharding, which gives them a high, near linearly increasing, throughput: 2488 tx/s in their internal testnet. Additionally, Zilliqa uses the smart contract language “Scilla”, which is similar to Solidity, but safer, e.g. things like the parity hack would’ve been prevented when using Scilla. Is it Ethereum with already implemented sharding? Like Ethereum, it is a blockchain on which you can run smart contracts. However, it is designed in such a way, that it is linearly scalable with the number of nodes of the network. I. e., the more Zilliqa nodes there are, the faster the blockchain gets. With the number of nodes Ethereum has at the moment Zilliqa would be able to process 15 000 tx/s! In the long-run they will focus on blockchain interoperability and privacy as well. The project that can break through VISA’s 24,000 TPS limit will certainly draw a lot of attention inside and outside of the crypto community. Are they near that objective or is it still theoritical? They are near their objective. As mentioned previously they had already 2488 tx/s in their internal testnet. This month the public testnet will be launched. The mainnet is due in Q3 of this year Streamr: From Coindesk: Blockchain data platform Streamr is partnering with Finnish telecom giant Nokia and California software company OSIsoft to allow mobile customers to monetize their user data and make purchases. Chief executive Henri Pihkala announced the partnerships at CoinDesk’s Consensus 2018 conference Wednesday, while also conducting a live launch of its real-time data marketplace, through which users can provide and subscribe to real-time data streams. He said in a statement that “today marks a hugely significant day in Streamr’s history, not only showcasing our platform to the world on-stage at Consensus but announcing two stellar partnerships.” The partnership with Nokia will see Nokia’s Kuha base stations integrate with Streamr’s data marketplace, allowing Nokia customers to both monetize their user data and purchase streams from Internet of Things devices. “We recognize a growing movement of empowered mobile customers who want to control and monetize their own data,” Nokia’s radio system evolution lead Martti Ylikoski, said in a statement, adding, “our partnership with Streamr reflects our firm belief in the platform.” Participants buy and sell real-time data streams through ethereum smart contracts. Buyers and sellers use an ERC-20 token called DATAcoin. The partnership with OSIsoft will see the firm’s enterprise customers gain the ability to earn money for their operations data. Ealier in May, Streamr announced another partnership, with Hewlett Packard Enterprise, to use the Streamr Engine – a data aggregator and analytics tool – to collect data feeds from an Audi Q2″ Bridge Protocol: Bridge interfaces with NEO framework and allows users to manage, protect and utilize sensitive information in new ways. The Protocol offers a new standard for whitelists and allows participation in multiple ICOs. Bridge Certificates build trust so users can transact with confidence. Digital identity is a big part of why NEO will succeed in China, and Bridge or the THEKEY are potentially a big piece of that. Fabric Token: The Fabric Token (FT) ecosystem aims to empower individuals and businesses with easy access to blockchain technology and smart contracts by providing a bundle of user-friendly software. The products within the FT ecosystem will focus primarily on helping people of any background to create and deploy their decentralized application (DApp), without the specialized computer programming knowledge that they would usually need.

Tuesday 5/22

We exited our position in ELEC after we hit our stop loss. This was always a risky position as the Power Blockchain space is competitive and has a lot to prove over existing systems. We’ll consider re-entering this position as it continues to fall.

Tuesday 5/15

Norway-based registrar organization DNV GL has invested in blockchain startup VeChain. VeChain CEO Sunny Lu told CoinDesk that the companies would continue their partnership.  “We are able to provide with VeChain a solution that balances safety and [speed],” Luca Crisciotti, chief executive of DNV, explained, adding: “Our mission is the ability to make sure that product is reaching the shelves, that it’s ultimately reaching the consumer … What we are providing to our customers is commitment.” Meanwhile, ICON also had a large partnership announcement today.

“We are able to provide with VeChain a solution that balances safety and [speed],” Luca Crisciotti, chief executive of DNV, explained, adding: “Our mission is the ability to make sure that product is reaching the shelves, that it’s ultimately reaching the consumer … What we are providing to our customers is commitment.” Meanwhile, ICON also had a large partnership announcement today.

“Unchain will create a blockchain ecosystem fueled by a token economy, where the users are rewarded for their contributions to the network. DApp services discovered through ICON and Unblock, a subsidiary of LINE dedicated to blockchain research and to accelerate DApp projects, will be integrated with Unchain. This joint venture takes blockchain and decentralization another step closer to being a part of our everyday lives.” We found the following video to be a great summary of where we are with Blockchain today:

Monday 5/14

The Ontology Foundation and the NEO Foundation signed a memorandum of understanding on May 14th, 2018, concerning strategy and technology integration:

Whereas: Ontology is a distributed trust network that focuses on digital identity, data exchange and other trust collaboration scenarios. NEO is dedicated to realizing a distributed network that serves the smart economy. Both Ontology and NEO share a common technical understanding and vision, and both wish to promote blockchain technology and its applications.

Purpose: Ontology and NEO together provide compliance-ready, regulatable protocols to global developers. These protocols are supported by NeoVM with exceptional finality and a smart contract system with a robust and stable infrastructure-level network.

As such, the Ontology Foundation and the NEO Foundation have agreed to cooperate as follows:

Key Cooperation Areas

1. Ontology will provide digital identity, data exchange services and other customized services. NEO brings a mature and complete smart contract platform as well as distributed network infrastructure services to the table.

2. Smart Contracts: Ontology and NEO will work together to build a smart contract ecosystem, fully support the development and adoption of NeoVM and NeoContract, and collaborate on developing smart contract open standards.

3. Data Integration: Both parties will provide standardized technology interfaces (APIs, SDKs, etc.), and share and communicate development achievements and research results.

4. Cross-chain: Both parties will push forward with cross-chain research, with the eventual goal of producing integrable mainnets.

… We see this as an extremely promising step forward for both projects, and for the larger NEP5 ecosystem. The system of cooperation is one way this space moves forward, and we see NEO’s smart economy as a big part of that.

Technical Analysis Research

The bounce continues, terrific relief after two straight months of constant bear flags. Folks, I do not believe that this is THE bottom, but rather it is A bottom for now, until the weekly chart can start to turn. I’ll change my mind if we’re able to see the price break first 7800 and then 10,000. Until then, let’s see if we can find some swings to play. In tonight’s video I discuss 0X as a potential swing to the upside, but don’t enter just yet.

Here are the recent swings that we’re tracking in the portfolio below; :

- WTC/BTC – Long @ .00155980BTC (4/23). My target exit is at .002BTC.

- ADA/BTC – Long @ .00003931BTC (5/1) My target exit is at .00005BTC.

- ONT/BTC – long @ .0008905 (5/20) My target is .0013BTC.

- BTC/USD – long @ 6320 (6/30) Target is $7000.

Please keep in mind that if you want to follow these trades, I am using FIXED RISK POSITION SIZING. This means that I am using a fixed amount of risk capital that is based on my account size, like 2%. I am assuming that the trade will burn to the ground and that I will lose that entire capital position! Only in this manner can one effectively manage a position the way that you have to. If you’ve every checked your blockfolio nervously every 5 minutes when you’re underwater, this will prevent that. I will track these positions in this area and not in the main portfolio section. I will use a public portfolio tool to do so, which you can access by clicking below:

Public Swing Portfolio Link

I hope you all got a chance to catch my webinar class last week; if not, the replay is available here. If you missed my earlier webinar, “More Profits in 2018; Ten Ways to Chart Like a Pro.” then you can catch the replay here. My new class “Introduction to Technical Analysis” is now available via our online store.

If you go to buy any of our courses at our online “store” you can receive $10 off the street price with your member’s “coupon code” of member18crypto..

We’ve started to do some swing trades on alts, tracked in the previous section. I am mostly focusing on the top 10-20 coins for now until we confirm that we’re back into an overall bull market.

I am doing the majority of my Technical Analysis work on TradingView, and I have a BitFinex app on both my iPad and Android smartphone. All of these charting platforms call a TradingView API. TradingView is the 800 lb. gorilla in the Crypto charting space until the “established” players want to make a go at Crypto, like Ninjatrader, Tradestation, eSignal, Sierra charts, etc. My sense is that TradingView has such a head start that it will be very difficult for the big boys to make a dent in this space for a while. Until that point, TradingView has almost a monopoly in this space. If you have a particular tool that you think is superior, please let me know. You can access the BitFinex and TradingView platforms for free, however there are some paid features that you might want to consider depending on your needs, such as expanded watchlists, different study sets, account alerts, etc.

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio and/or Delta to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

I am also trialing the Profit Trailer and CryptoHopper trading apps which are working well in this choppy market.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.