Doc's Daily Commentary

Mind Of Mav

Modern Debt Examined

According to the Government, there are two certainties in life:

Debt, and taxes.

Oh sure, death is a certainty too, but you certainly won’t escape debts owed nor stop paying taxes just because you conveniently decided to stop breathing.

Satire aside, this does highlight something pervasive about modern society — a silent shadow that cripples lives, topples businesses, and absolutely will haunt many people to their grave.

And yet, despite the scale of malignant prominence ruling over so many, what is baffling is that so few choose to openly about it or find the courage to address it for the cancerous dirge it plainly is.

Of course, I’m talking about debt.

The private debt that many people are increasingly saddled with — student, home, car, credit card, medical, etc. — can and will prevent them from moving vertically.

That crazy part is that this ball and shackle, a willingly accepted lifetime of debt, is seen as a necessary evil in order to taste the finer fruits of this society. What a beautiful, yet terrifying, concept to indoctrinate people with: using their hopes and dreams against them while making them believe their big break will come soon . . . so long as they keep working a meaningless job to pay off meaningless debts.

“The poor see themselves not as an exploited proletariat but as temporarily embarrassed millionaires.”

In other words, the rat race so many are stuck in is fueled by this obsession with more and more private debt — and it’s no wonder why. Dopamine can be used for both celebrating and coping. It is easy to forget the prison walls so long as you have a window to look out of.

In a true display of warped reality, our race-to-the-bottom debt-laden society is increasingly obsessed with making the impression of being rich — no matter how false that façade, no matter how deep the debt.

“We buy things we don’t need with money we don’t have to impress people we don’t like.”

But here’s the real kicker:

This incognizant comporting, this blind belief in what was once a dream and now only detritus remains, applies to the debt of individuals.

And here we have one of the greatest disconnects of the modern era:

Overwhelming debt, which acts as a boot on the throat of so many people, instead liberates the state to act with impunity.

In 2020 this could not be clearer. Let’s dig into it.

In the US, it has become the norm for the federal government to spend more than it takes in in the form of taxes. This excess is called the “fiscal deficit”. Collectively, the deficits form US debt. The US Debt Clock indicates the current debt is sitting right around $26 trillion — and growing quickly as the US injects fiscal stimulus to combat the recent economic downturn.

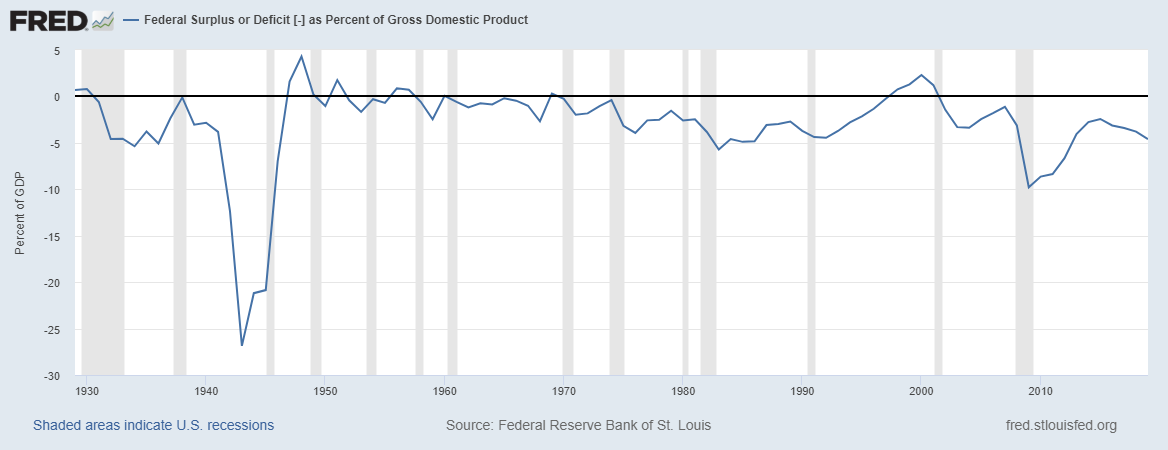

This might seem like it’s a large amount — and without question, it is. The US debt has also been increasing for many years. For most of the last 70 years, the US has run a fiscal deficit:

In 2019, the US ran a deficit of 4.6% of GDP despite unemployment below 4%. The fiscal deficit for 2020 is set to be much larger.

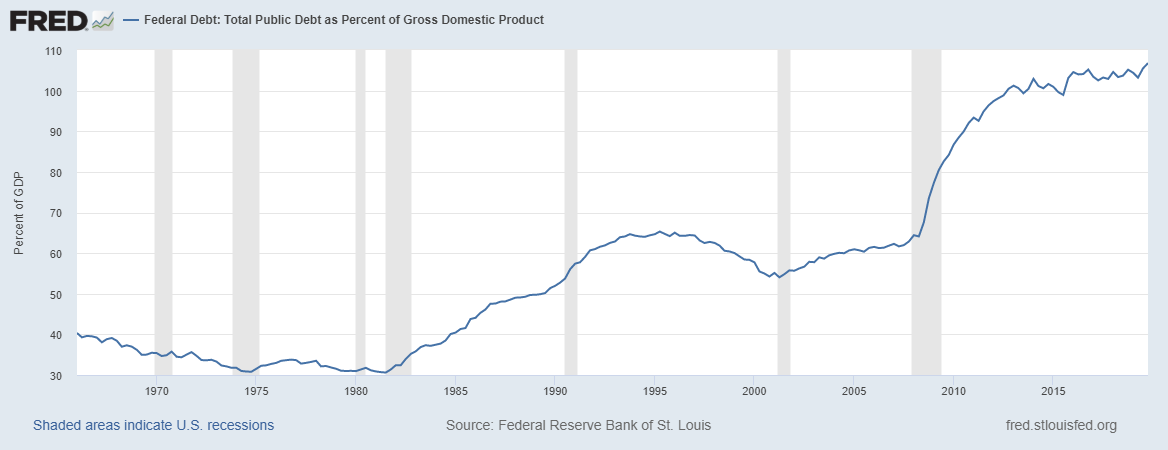

When measuring debt, we typically measure it as a ratio to GDP, since this represents a country’s ability to pay that debt. By this metric, the US has seen an ever-climbing national debt:

The national debt currently sits at a record high of almost 107% of GDP. With the economy struggling, this debt is set to rise quickly. Is this debt sustainable? And should the government act with restraint when considering fiscal stimulus?

Cross-Country Comparison

Compared to other OECD countries, the US carries a relatively high level of debt. Only a handful of countries have more:

However, there are countries that carry a higher debt — in particular, Japan has a debt approximately twice that of the US. Japan still receives relatively affordable lending costs, and has a respectable A+ rating from Standard & Poor’s. Meanwhile, countries like France and the UK both have debt levels only slightly lower than that of the US.

This raises the possibility that some countries may be able to carry larger debt than others. In particular, the US dollar’s status as the global reserve currency generally allows for low borrowing costs, and lets the US run large fiscal deficits.

What Exactly are the Consequences of Debt?

Ultimately, debt has two potential consequences which we must pay attention to:

It can leave a rising fiscal burden for future generations

It can crowd out private investment

We will analyze these two factors individually tomorrow.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.