Doc's Daily Commentary and Watchlist

Mind Of Mav

The Lehman Brothers Of Crypto; Three Arrows Capital Explained

The fear is palpable. The dominos are falling. Is this the beginning of a true reckoning?

Six weeks after Terra collapsed and one week after Celsius suspended withdrawals, investors are now anxiously watching what was once a top crypto hedge fund, Three Arrows Capital, circling the drain and potentially about to bring more companies down with it.

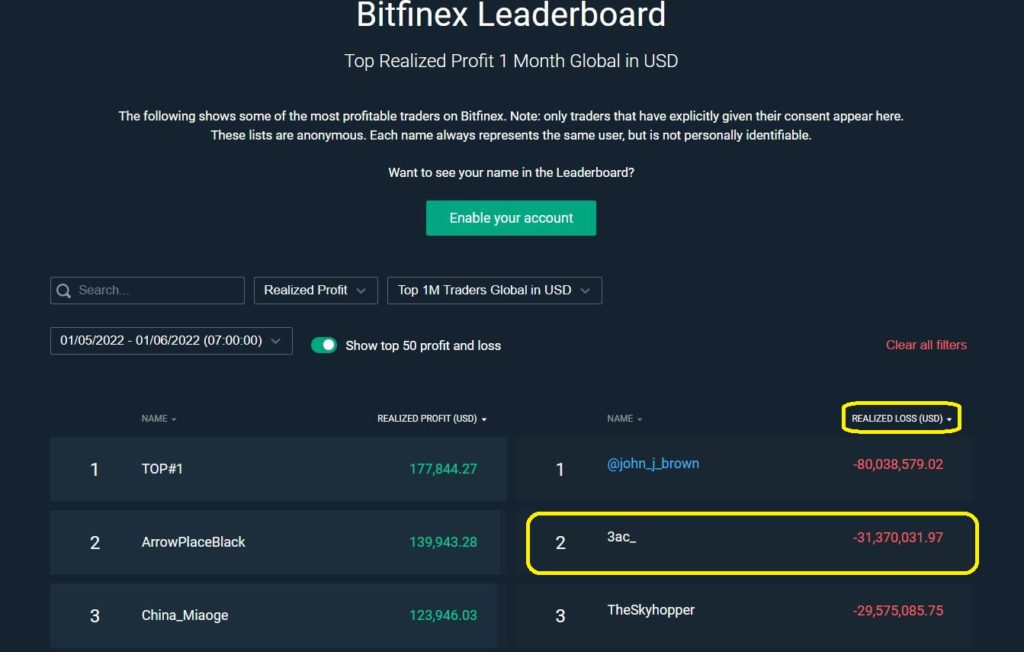

Three Arrows Capital is sitting on what are believed to be billions of dollars worth loans secured by cryptocurrencies. With the market down 56% this year in its worst bear market since 2018, investors believe the collateral no longer supports the loans. Now the fund is on the hook to start paying them back, and everyone is wondering whether it will default.

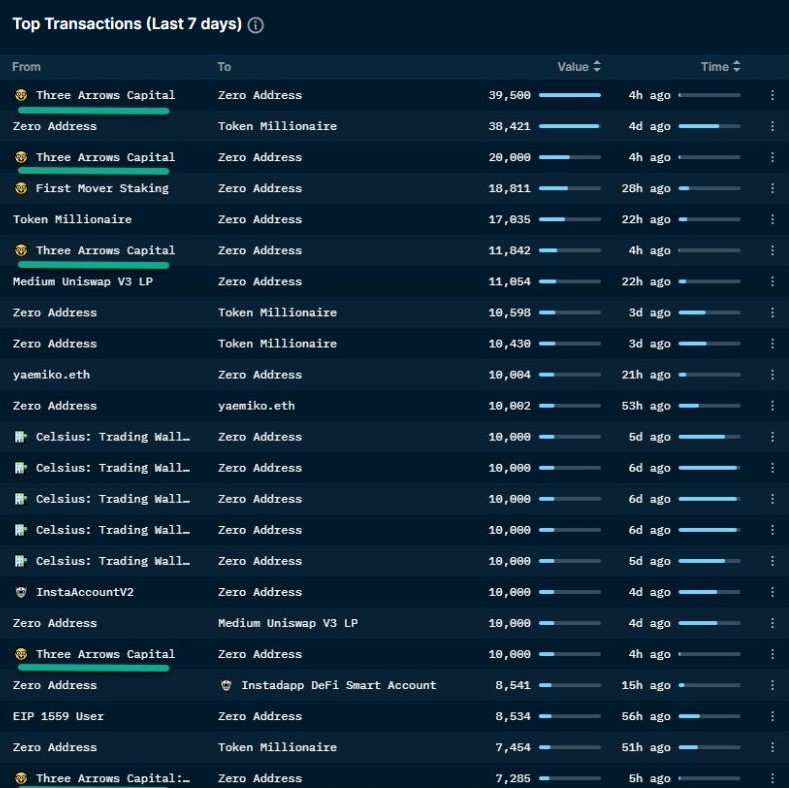

As one indicator of this, 3AC may have transferred 30,000 stETH — they have used this to pay off the Aave debt they incurred following liquidations.

stETH is Lido Staked Ethereum. You lock the Ethereum in Lido but receive the stETH token in return, and you’ll be able to swap this stETH 1:1 for ETH once the Merge takes place. However,

A month ago, 1 ETH could be exchanged for 1.0248 stETH through the Curve protocol, meaning it traded at a 3% discount relative to Ethereum — a very nice boost in capital for an organization who needs it as badly as 3AC does. The stETH price surged as people who had staked it in the Anchor lending protocol, which runs on the all-but-defunct Terra blockchain, rushed to retrieve it. Since then, however, stETH de-pegged from ETH. and is around 6-7% short of the ETH price.

Not surprisingly, this doesn’t help 3AC.

It also doesn’t take the calculation into account that both ETH and stETH dropped in price. They’re down 41% over the last 30 days, according to CoinGecko. Yesterday Three Arrows sold at least $40M worth of staked Ether as part of an apparent liquidation.

This also doesn’t help 3AC.

Aggressive Leverage

So, how did they get here?

3AC’s strategy was simple: go big, then go bigger. Leverage, then leverage bigger. They seemed unstoppable in their rise during the 2021 bull market, becoming the largest holder of GBTC — then the Fed’s free money faucet turned off and very quickly their luck turned to liquidations.

Here’s why that matters: If 3AC were to become insolvent, it would be catastrophic for the industry due to their roots stretching far and wide — you can think of them like the hedge fund version of Tether; ubiquitous and yet rotten to the core.

The mastermind of this insanity was co-founder Su Zhu, who has been aggressive in using leverage to maximize his potential investment returns.

Zhu believed in the super cycle and used a ton of leverage to increase their position size.If the firm cannot pay off its positions, it’ll force more liquidations.”

On June 15, Zhu alluded to the fund’s troubles in a tweet:

“We are in the process of communicating with relevant parties and fully committed to working this out,” he said.

In the meantime, crypto players have been poring over blockchain data and analysis to garner some sense of Three Arrows exposure, and what might happen next.

Getting Margin-Called

On June 15, Danny Yuan, Head of Trading at 8 Blocks Capital, tweeted that Three Arrows removed nearly $1M from his firm’s trading account. Effectively, 3AC stole a million dollars to help cover their debts.

The two companies worked together for 1.5 years, but Yuan explained that when his team tried calling 3AC’s Operations Team about the $1M withdrawal, they ignored their calls.

“What we learned is that they were leveraged long everywhere and were getting margin-called,” Yuan tweeted. “Instead of answering the margin calls, they ghosted everyone. The platforms had no choice but to liquidate their positions, causing the markets to further dump.”

“What we learned is that they were leveraged long everywhere and were getting margin-called.”

Danny Yuan

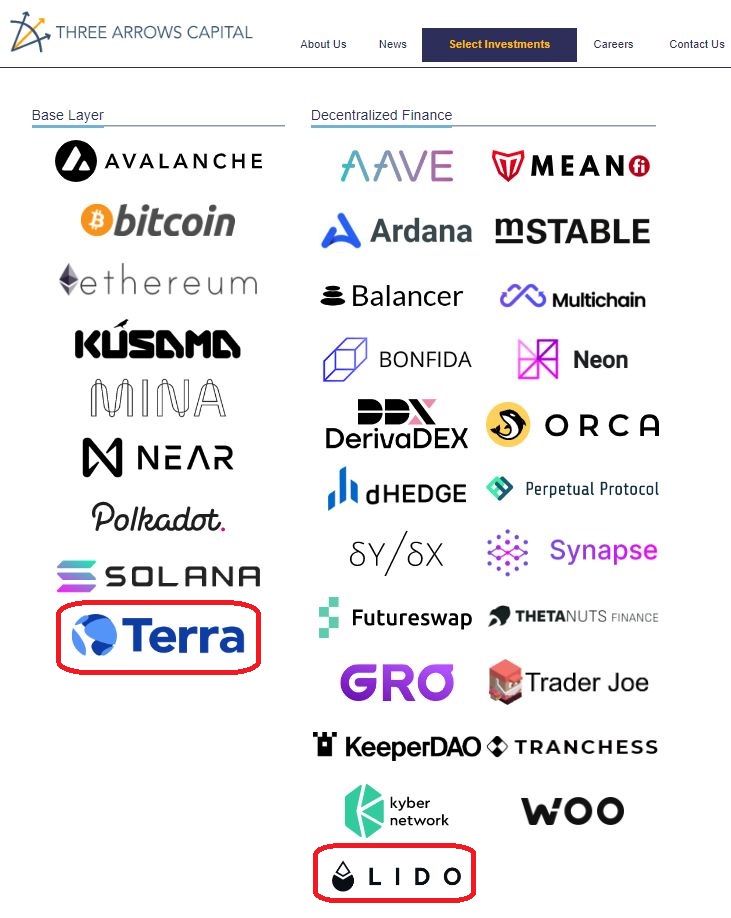

Three Arrows, which is based in Singapore, has become a force in DeFi by backing some of its most important platforms. It’s invested in Solana, Avalanche, Aave and Terra, as well as GameFi names such as Axie Infinity and NFTs.

Zhu made his name as a crypto bull championing the idea of a “super-cycle” in which Bitcoin would hit $2.5M and become a new form of gold. He believed the digital assets market would sidestep a bearish turn thanks to blockchain innovation.

On May 27, with the market cratering after Terra’s stablecoin, UST, lost its peg, Zhu admitted he was wrong. “Supercycle price thesis regrettably wrong,” he tweeted. “But crypto will still thrive and change the world everyday.”

Inner Workings

Now investors are wondering, and hoping, that Three Arrows survives. If it can’t service its debts that would be a severe blow to a market already struggling to find its footing. Yet it’s hard to get a bead on precisely what’s going on inside the firm.

Just like TradFi hedge funds, Three Arrows doesn’t share much about its inner workings. What is certain is the domino effect of fear it is causing in the marketplace.

When everyone’s rushing for the most liquid thing in the room, the leverage gets unwound and just triggers the next domino.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.