Doc's Daily Commentary and Watchlist

Mind Of Mav

“We’ll Never See $20k BTC Again”

The unthinkable has just happened!

The price of Bitcoin has just dropped below $20K again.

For some, this prospect was impossible. Bitcoin had entered a world of its own in 2021, and to see Bitcoin fall below $20K again was impossible to listen to. Since analysts with a large Twitter following were telling you this, it must have been true:

At the time, I was already circumspect to see analysts or influencers so categorical. No one can predict the future. Therefore, no one can predict the price of Bitcoin. So no one can tell you that. This is just one opinion among many. It’s not guaranteed because the person delivering it has over 100K followers on Twitter or YouTube.

At the end of the day, these opinions are just opinions. You’re going to have to learn to incorporate them into your thought process, but not follow them blindly. Unfortunately, too many people follow them blindly. The same people took the S2F model for granted. This model was just one of many. It proved to be true for a while before it was proven invalid.

The price of Bitcoin should be above $100K if this model were correct. However, the price of Bitcoin has just hit a low of $17.7K. And it could go even lower, no one can guarantee you otherwise.

It’s simply because Bitcoin is a free market, and these crashes are logical. I don’t expect anything in particular in the short term, but I am prepared for everything.

People who bought Bitcoin by following Bitcoin influencers or analysts, or the S2F Model, are now at a loss. Since these people do not believe in Bitcoin, they are panicking:

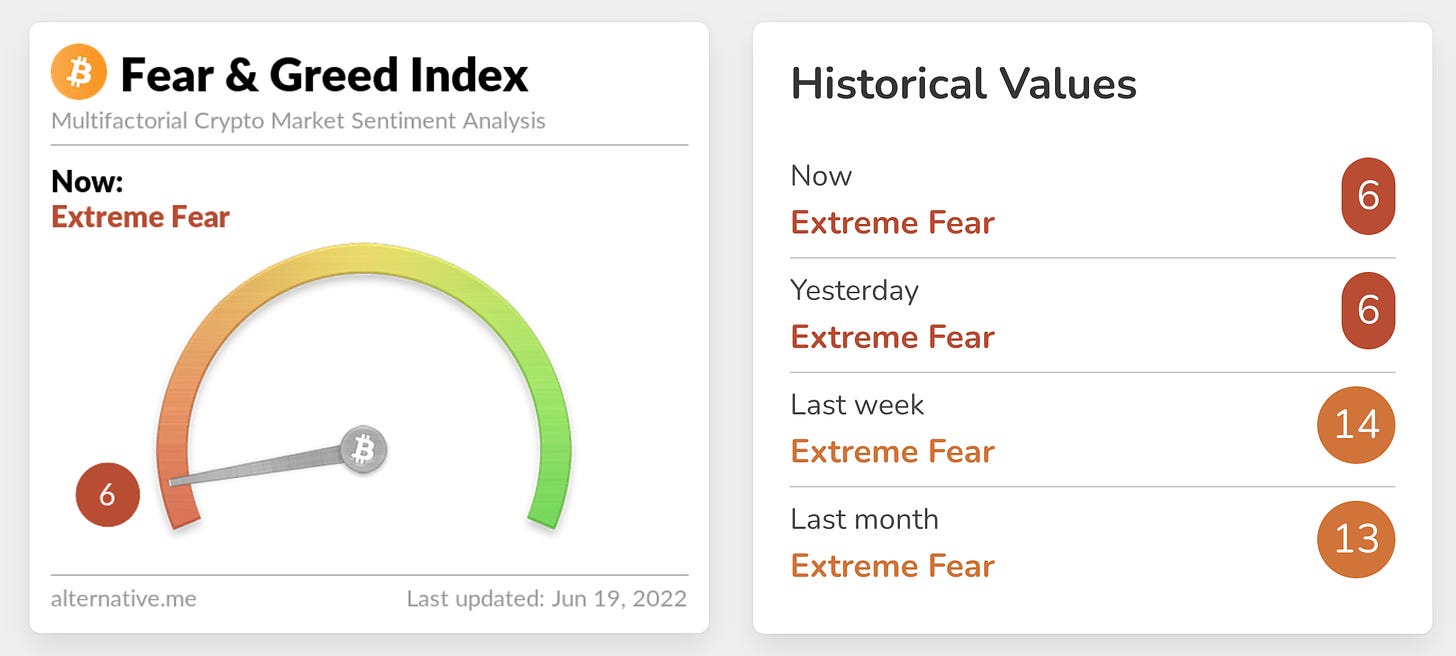

The Bitcoin Fear & Greed Index just hit a low of 6. The last time this index hit 6 was in 2018 when the Bitcoin price was around $3.2K. Bitcoin’s price is still 5 times higher, but some people have short memories. What Bitcoin has achieved in the last few years is huge. Yet, you are watching the same pattern happen all over again:

At every ATH of the Bitcoin price, you have naysayers who keep telling you that Bitcoin is a bubble. And then, when the speculative bubble around the price of Bitcoin deflates, these people tell you that Bitcoin is dead.

Bitcoin is not a bubble. It is a unique system that will change the world of the future for the better by giving the people back the power over money. However, bubbles can be created around the price of Bitcoin. They burst for whatever reason.

Then, once the market is purged, the price of Bitcoin will rise again. That’s the way it’s always been, and I’m sure it will be again. I’m not giving you any guarantees, as you’ll understand, just my opinion. The opinion of someone who has been in this market for several years and who has understood the reason for Bitcoin. Or at least who is constantly studying it daily while trying to better measure the impacts that such a monetary revolution will have on the world of the future.

While some are panicking, the fundamentals of Bitcoin are getting stronger. And that’s what interests me. Bitcoin’s Hash Rate continues to make Bitcoin the most secure decentralized network in the world. The promise of Bitcoin has never been misused. Nor has the Bitcoin protocol ever been hacked. All is well with the Bitcoin revolution.

Final Thoughts

As usual, this crash will pass. It will take time, but Bitcoin will rise stronger. How long will it take? Unfortunately, I can’t promise you anything, because no one can do it as you see it.

My opinion is that as long as the macroeconomic environment is what it is now, retail investors will not come back to the Bitcoin market en masse. Therefore, its price will not resume its rise. Patience is the key. To give you a note of hope, the next Halving will take place in early 2024. By then, the world economy could be out of the current situation, and the war in Ukraine could be over. Bitcoin will then enter a new 4-year market cycle, with the prospect of profiting from the decisions you make today amid the storm.

Finally, keep in mind that while you are selling your Bitcoin at a loss or hesitating to accumulate more, others are doing it for you. Those HODLers who take the long view and continue to send their Bitcoin into cold storage, which is why BTC reserves on exchange platforms remain at very low levels despite everything.

It’s up to you to be on the right side of history.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.