Doc's Daily Commentary and Watchlist

Mind Of Mav

Leverage: Why The Crypto Market Crashed

The last few weeks have been brutal for crypto. Two of the biggest names in crypto, Celsius and 3AC, nearly collapsed.

In this deep-dive, we’re going to dig into why this happened, where this leaves us and what we can takeaway from this.

Let’s start with two concepts that are critical for this deep-dive.

Debt & margin calls

Traders used debt to increase their potential for profits by borrowing money. To do this, they need to put up an asset as collateral. This is equivalent to taking out a mortgage for your new house. Your new house is the collateral. If you don’t pay up, the bank will seize your house.

If the price of your collateral falls below a certain price, the lender asks for more collateral or for the borrower to pay back some of the debt. This is called a margin call. If the borrower can’t do either, the lender sells the underlying asset and takes what they can.

Debt and margin calls work on the same way in crypto, with two important differences:

1. It is over-collateralized. The collateral you need for a loan is much higher than traditional finance. This is because crypto assets are far more volatile.

2. It does not have a fixed term. In traditional finance, leverages comes with a fixed term, i.e. I lend you $1 million and you need to pay it back in 3 years. In crypto, it’s not fixed — I lend you $1 million indefinitely. I expect you to pay me 5% every year. If the price of your collateral falls below $120, you need to pay me back.

Staking

Staking is like earning interest on your crypto. Here’s how it works with Ethereum.

Ethereum is the second biggest cryptocurrency in the world. It’s moving from proof-of-work (PoW) to proof-of-stake (PoS) later this year.

With PoS, people can deposit a ‘stake’ to help validate transactions. In return, they earn yield. The change is scheduled to take place this year, but staking has been available for a while. Read this for more information.

The main drawback of staking directly on the Ethereum network is that: a) the ETH cannot be withdrawn until a later date (which is currently unknown), and b) you need a minimum of 32 ETH to stake.

Lido.finance launched in December 2020 to solve these pain points. It lets you stake as little as you like, earn interest and offers liquidity.

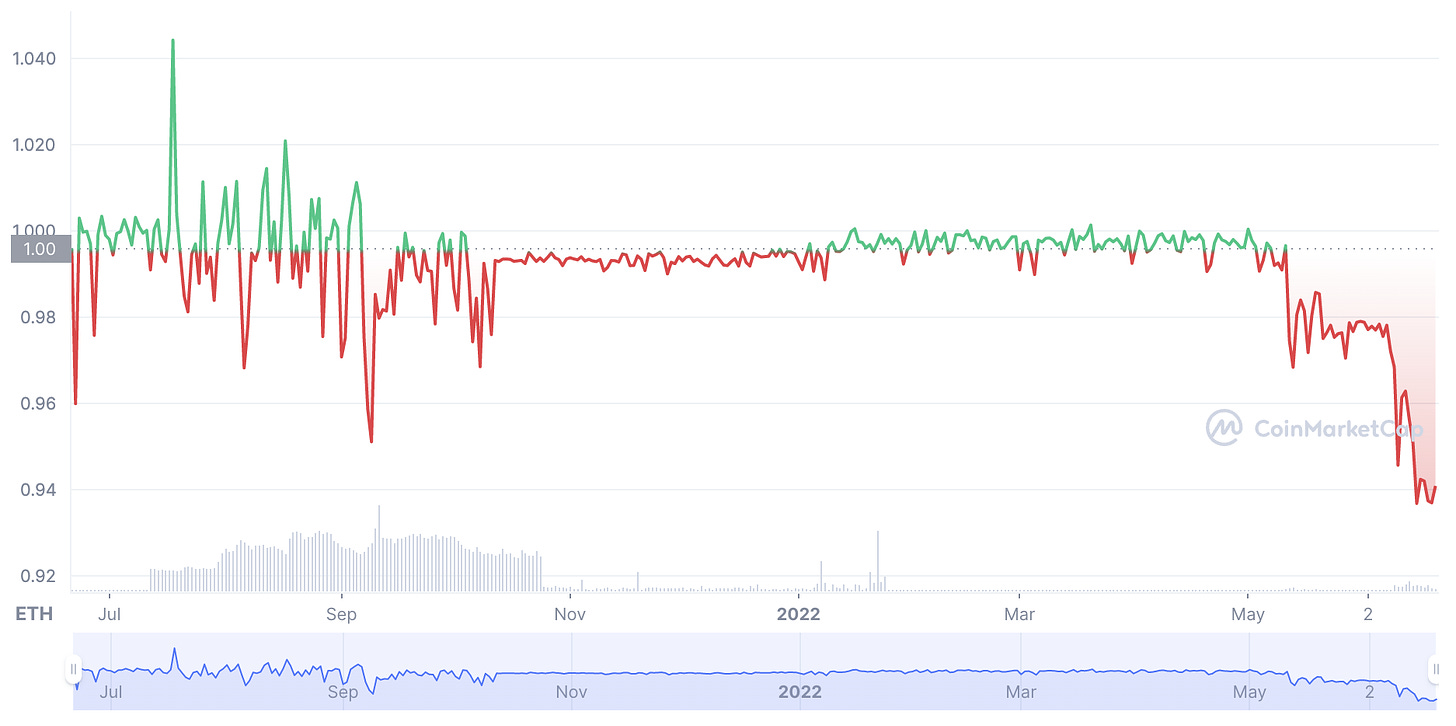

Users deposit their ETH and receive stETH (staked Ethereum) tokens in return. The stETH tokens can be used in other parts of the crypto ecosystem. Users can redeem 1 stETH for 1 ETH after Ethereum moves to PoS and completes phase 2. There is no date confirmed for this.

The stETH / ETH pair has diverged from its 1:1 ratio over the last few weeks.

Let’s look at how the two factors above nearly brought down two behemoths in crypto.

Celsius

Celsius is a centralised finance platform for crypto. They’re like a bank; they take crypto from people, lend it to someone else and make a profit.

Users can deposit crypto and earn as much as 18.63%.

They do this by looking for the best yield in the market. The playbook is as follows (numbers are hypothetical):

1. Collect deposits by offering a rate of 5%

2. Find protocols that offer 9% yield

3. Stake the crypto

4. Pocket the difference 4%

This works really well in a bull market, but collapses in a bear market.

They invested in Terra / Luna, which offered a 18% return. Terra and Luna collapsed. This made a huge dent in their portfolio. On Ethereum, they offer 6 – 7% while Lido offers 4%. This is because they deposit Ethereum on Lido, receive stETH and then use this to earn more yield elsewhere.

In the last 30 days, the price of Ethereum has fallen by >40%. With prices falling, people wanted to exit their positions and cut their loses. Unfortunately, Celsius did not have the funds to return to users. These funds were stashed away in other protocols and were illiquid.

They halted withdrawals.

This is a ticking time bomb. Celsius is still working to recover its financial position. Even if it manages to do so, customers will withdraw their funds as soon as they can, given the lack of trust in the protocol.

Three Arrows Capital (3AC)

3AC is a proprietary trading firm. Unlike VCs and hedge funds, it does not take in outside capital. They invest their own capital, which is borrowed from other parties.

They’ve invested in several crypto protocols.

3AC was also a big investor in Terra. They invested $560 million in Luna (which collapsed last month) and is now worth $670. This made a big dent in their balance sheet.

When crypto prices fell, 3AC faced multiple margin calls. 3AC was unable to put up further collateral and lenders (e.g. BlockFi, Genesis) started liquidating its positions.

Takeaways

The fine print for Celsius and 3AC might differ, but the principle is the same. They took on large amounts of debt. Prices fell and lots of people wanted their money back. The money is locked away somewhere, and is inaccessible.

There are only a few ways out:

* They borrow more → no immediate impact on crypto, but the bubble gets bigger.

* Liquidate positions to pay back their lenders → crypto prices fall further, and may lead to further margin calls.

* Sell equity → selling a portion of their company may help them raise funds. But they’ll need to do this at a much lower valuation, and need to find an investor who’s willing to take the risk.

There are valuable lessons to learn from the above whether you are a DeFi builder, investor or observer:

Invest what you can afford to lose.

Whatever your view is on crypto, it’s a risky asset. In the UK, the government guarantees up to 85K of bank deposits. There is no recourse in crypto. I’m not commenting on whether the guarantee is required, I’m just calling out that this is a nascent market with no guarantees — treat it appropriately.

Leverage can kill.

It’s the best thing in the world in a bull market, but can kill you in a bear market. If you are thinking of leveraging, please be very wary of margin calls.

There’s no free lunch.

Celsius and 3AC chased unrealistic returns in protocols like Luna. Luna’s collapse crippled the balance sheet of both these protocols. If you decide to invest in a protocol that claims to offer a high return, ask yourself whether it’s sustainable.

Seek contrary opinions.

Crypto is largely un-regulated. It’s important to actively seek contrary opinions and form your thesis. It’s easy to get carried away with what you want to hear, and what everyone else thinks.

Decentralised Finance is an interconnected web.

Like traditional finance, everyone is a borrower and a lender to someone else. Remember this when you invest. Only the best in the business will manage risk appropriately.

Decentralised Finance is superior to centralised finance.

A truly decentralised protocol is superior to a centralised protocol because of transparency and custody.

First, in writing this deep-dive, I realised that assets and liabilities for both Celsius and 3AC remain opaque. This is dangerous. If the protocol was truly decentralised, assets and liabilities can be clearly tracked. This helps investors make decisions with more information. A centralised product may choose to be open, and that’s great. But a decentralised product offers transparency as the default.

Second, a decentralised protocol offers the ability for you to stay in complete control of your funds. It won’t prevent a token going to zero, but at least you’ll be in control to cut your losses whenever you want to. Celsius customers wanted to cut their losses but couldn’t.

To close

It’s been a tough few weeks for crypto. The decline in prices has been brutal. In many ways, it feels similar to 2008 — excess leverage, complexity and risk. Let’s use this experience to be more critical of where we invest our money, ask the right questions and remain in control of our funds.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.