Doc's Daily Commentary and Watchlist

Mind Of Mav

Bullish About The Bear; What This Decade Means For Crypto

A lot of the current criticism surrounding crypto which also emanates from crypto natives themselves is the lack of real applications and how everything is valueless after a decade of development. But you can’t build a multi-trillion industry with an anthropologic impact within a few months.

The crypto market is an evolving consciousness that understands its points of failure, and its own state. On the contrary to other industries, each participant communicates with each other through what are millions of daily interactions on Telegram/Twitter. Bitcoin was born in a forum, and to my knowledge, it’s the only industry that revolves that much around social networks.

It’s a co-op/competition mode, which creates a synergy that pushes the industry further and faster, as it leverages the power of decentralized knowledge.

That said, I believe 2020 & 2021 mark the beginning of the most significant decade for crypto. The industry spent its first decade getting out of its genitors’ belly and learning how to walk by falling and rising up again.

And last two years, crypto said its first words to the outside world.

The great cultural war

Now, we’re the cool kids.

Crypto started to infiltrate the top of the pyramid in many other ways than through government and central bank talks.

* Top brands tweeting esoteric keywords like “gm, wagmi,fren”. But also actors, singers, DJs, footballers… always more people from the art & showbiz world buying NFTs and displaying it like a status thing.

The very same people who usually create the trends are now trying to surf on crypto culture and appropriate it for themselves. It’s also a class phenomenon, they like to be differentiated from the mass, and what’s one of the most contrarian cultural bet for an elite right now? But ngl, seeing Zuck’s sister singing WAGMI and stuff was painful.

WAGMI is a cry from the heart of a low/mid-class disillusioned youth who never found its place in a system that only offers alienating ways of life. “Making it” is the ability to live outside of the matrix.

It belongs to our generations, it belongs to us. Not to boomers, not to tradfi nor trad tech guys.

Sadly, it seems like it’s the fate of every subculture to get absorbed and distorted from its origin once it reaches the mass adoption stage. Eventually, banks will start giving away teeshirt flagged “I’m a happy sovereign individual ;-)” each time you’ll open an account.

Few other points :

* Many more universities have hours dedicated to blockchain, but also through universities sponsorship & grant from major protocols aiming for cultural influences.

* The rise of mobile apps

* Domino effect on BTC & other cryptos as legal tender

* Crypto top companies sponsoring elections, political parties, investing and buying medias companies

* Marketing became aggressive: Superbowl, Stadium, Esport team, football team, shitcoins displayed in Time Square, on a city bus, even on the [redacted] tee-shirt of Mayweather or on the [redacted] instagram story of K Kardashian.

* The polarisation around crypto is getting intense and radical. We’ve seen brands (mostly gaming) getting canceled because of potential NFTs integration. Maybe an idea has to be rejected by at least half of people before slowly evolving to a consensus.

The meme era

Memes tokens are a category on their own and should be analyzed aside.

Most performative assets also regardless of macro, are worth hundreds of billions at peak bull in 2021, with no VCs/marketing agencies/launchpad/whatever involved and truly valueless. Memes tokens are community tokens and a gateway for normies.

The scene is dominated by anime characters’ and dogs’ names which is not surprising from an industry-led by 16–35 years old mainly men nerds. It’s fun, cute, there’s nothing technical about it, and that’s the reason why it spreads like wildfire. It’s the perfect cultural vehicle.

Some people get angry at memes tokens because it generates so much value with no utility. But isn’t the gap between value and utility already massive in our societies? Think about a footballer and a nurse wage. Art, luxury stuff. Or all the random useless sh1t that get sold for thousands of $, like bathwater.

People find this gap absurd, and that’s exactly what meme tokens are: an extension and reflection of our world’s absurdity.

It demonstrates one absolute point: value is a consensus. All money are: shells, spices, dollars, and cryptos.

As you know, central banks and gov are trying their best to -successfully- discredit crypto in the eyes of the mass since its inception, but in two years, something changed. Not only because crypto started to appear as a viable alternative, but also because the world economic system is a monster eating its own flesh and writing its own ending narrative. But why would anyone use crypto instead of CBDC?

Because of the cultural influence, and our industry has now the possibility to fight back.

Could work to earn -soon- to be an outdated model?

When you walk2earn, browse2earn, play2earn, whatever2earn, what you do has no social utility but does create value. Depending on the yield and current stage of those systems, even brainless people can generate a doctor’s range wage. Why would anyone destroy their health in low tiers jobs if they can make their salary by using basic daily services? As people are already looking for the best job to apply to regarding the salary, it’s not inconceivable to imagine them being yield chasers, going from one Axie to another Stepn in order to maximize — or sustain- their ROI, as those games inevitably lead to an inflationist death spiral.

At some point, governments and companies will have to sit around the table and reconsider labor’s conditions. “The greatest wealth distribution of all time” doesn’t only mean buying early and dumping on institutions. It also means finding new ways to generate and distribute value, fairly, to anyone who can freely play the game.

Where are we?

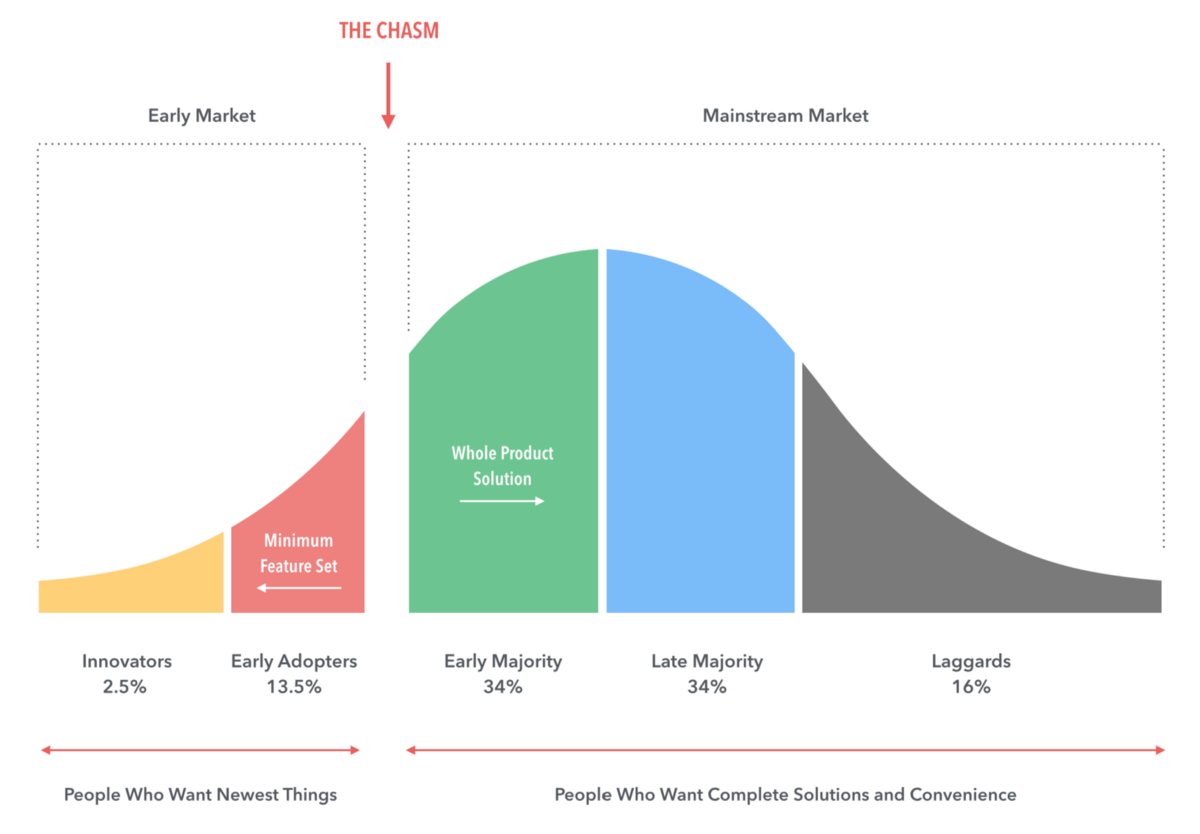

We’re heading for the chasm, and for that, we need a fully functional product, which means fixing two major problems before entering in a new phase: Scalability & UX/UI.

Fixing is probably not the right term to use, but rather “push further”, as both will constantly need improvements as more waves of millions of users influx.

Network congestions, gamification level still very basic, too complicated/not sophisticated UI, knowledge & $ entry barriers too high (remember, half of the world still exist), downtime, lagging app, exploits… The market is not ready to enter the exponential adoption phase, yet.

It needs more time. It probably needs another full cycle.

A civilization’s growth is deeply correlated to its capacity to transfer information and wealth. From oral tradition to birds to telegraph, each milestone leads to a new era.

Humanity is inevitably moving forward on the path of reduction of time and space since its inception, and crypto pushes this contraction further, for anyone, in an unseizable and unstoppable way.

We’re assisting in the wakening of a poly /multi-layered world with thousands more innovative and life-changing applications to come.

L1s/L2s — The Pre-Cambrian explosion

I started my DEX trading voyage in august 2020, when using a charting tool was still an alpha and news tokens tracking was literally the same 200 people alone.

It was wild, and information was extremely scarce. Slowly, the market understood its points of failure, and it started creating solutions: first to protect the investor, second to give him tools.

Liquidity and team tokens locking services, presales platform -which eventually evolved as launchpads-, dashboards, audits, solutions like unicrypt, pinksale, dextools, which are now very basic took months to develop.

1.5 years later, there are hundreds of tools on dozens of different chains.

Each new layer took less time than the precedent to set up its “basic services”, and what took months to develop on Ethereum only took a few days on those new chains. The preset is evolving but approximatively :

* DEXs

* NFTs marketplace + nft collections

* Memes tokens

* DAOs

* Yield farming/aggregator

* P2E projects

* Decentralized derivatives market

* Stablecoins

* Naming services

* Lending/borrowing platform

* Trendy and changing protocols like $OHM was, preferably one that can attract liquidity on the chain

In other terms, the market is getting ready to absorb millions of users in the upcoming years. I believe the next 2 years will also bring dozens of new different applications and services that will get reproduced and tweaked onto different chains. The Cambrian explosion is coming.

But, the main question is…

Is it all a scam?

In the end, a Ponzi is just a monetary experience, like the dollar is. And the most underrated killer app of crypto: anyone can become a Madoff or a FED. In other words, it’s the decentralization of the power of creating a monetary system.

That’s exactly what is happening, and that’s beautiful.

Crypto is a laboratory that can iterate monetary policies thousands of times faster than any other administration gov, FED, or ECB can do. And without the consequences on millions of lives.

Last 1.5 years, several concepts were implemented and tested in tokenomics. From those tokens, hundreds of tweaked forks appeared.

It’s hard to tell which protocol created which trends, as the first is not especially the biggest or the most impactful. Among the ones that helped popularised some concepts :

$RFI: introduction to tax & redistribution model, which led a few months later to different applications, such as:

* “Defi 3.0” (failed attempt from marketer) like $MCC, taxed money used to generate profit redistributed to holders

* DAOs funding projects: like $PEOPLE, taxed money used to acquire control over a something

* Charity & community token: like $MRI, taxed money used for charity

$CORE: popularisation of LGE, price floor & buyback concept

$ESD: popularisation of seignorage concept

$OHM: popularisation of bonds concept

$Ampleforth : popularisation of rebase concept

$BEANS: Tentative of a stable coin based on debt

Also, $LUNA, $ERSDL, $TOMB, $FRAX, $SHARE, $ZAI… Too many for one to remember and list. Someone should create a kind of wikipedia of every tentative we had over the last two years. It could help tokenomics builders to adjust parameters.

All those experiences come from a thought, rise and shine on a network carried by loud hopes, until it dies in the very same place, carrying away broken dreams of some bag holders.

Every token created, even the fork with the slightest tweak is a new iteration that adds a brick to the collective understanding of how to make a good tokenomics. But what’s good tokenomics?

Guess we can agree it’s something you will benefit from, and you will be happy with other people profiting from it too. Maybe an optimal system is an only-up system.

One that serves everyone. One where everyone wins.

Price floor mechanism, buybacks, burning, farming profit redistribution to holders, airdrop, unit bias, max tokens per wallet, per tx, sniping bot blacklisting… All those things are either made as tentative of monetary parameters optimization to generate a value accrual, and/or to (try) to make healthier and more sustainable tokenomics. It’s like an abstract obsession of the industry, like a Schelling point. And you know, maybe one day someone will succeed in this quest and come up with the tokenomics.

In the end…

Criticism about crypto not achieving anything yet are short-sighted and are missing the higher context. If you see it that way, every failure is necessary and is contributing to a bigger scheme. Innovation never stops but it does also come through waves, as more attention and capital are deployed during bull cycles. Anyway, crypto is the closest chance we have to induce a more human-centric world by re-establishing the equilibrium between people and companies/gov/banks.

But we must do better than the old world.

From the hardcore devs, to the exploiter, the scammer, the influencer to the retail losing money, everyone is playing their role in this theater.

Chose yours.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.