Doc's Daily Commentary

Mind Of Mav

How Do We Address Millions Of Unemployed?

As economic activity plummets and joblessness surges, governments around the world have pulled out their proverbial checkbooks and begun spending at a level that would normally be considered to reflect the reckless abandon of drunken sailors on the last night of shore leave, but is increasingly viewed as necessary and prudent. Generally, this is framed as an emergency measure, with the expectation, spoken or unspoken, that when the crisis passes, some combination of tax increases, austerity, and the sale of public assets will be undertaken to right the ship and get the government on track to pay down the debt it is currently incurring.

But which crisis do they mean? Is it the narrowly defined pandemic crisis, which we are mostly assuming (perhaps optimistically, perhaps pessimistically) will end in a year or so, when a vaccine is expected to arrive like the cavalry. Or is it the economic crisis the pandemic has triggered, which might reasonably be expected to last years, as the bang created by millions of jobs disappearing all at once reverberates through the economy. Unless, of course, the government steps in with unprecedented stimulus that makes up for the pandemic shaped hole in our collective spending power. But when to step away?

The loss of jobs and income has been more rapid and dramatic than anything in history, including the Great Depression. And already, before the downturn, there had begun to be murmurs that, perhaps, the importance of this whole “balanced budgets” thing might be a little overstated.

Reality might be finally, violently, forcing its way into policy and public discourse, which has long been dominated by the (superficially convincing) idea that governments, like households, must “live within their means” by matching spending to tax incomes, or run out of money and “go broke” — an idea so widely accepted that the IMF has since the 80s made it a pillar of the structural adjustment programs enforced on borrower countries in the third world, and many countries and states, have tried to make it a constitutional requirement. The EU even had a similar rule, enforcing budgetary discipline on member states, but has been forced to trigger the “general escape clause”.

Let us hope that the escape is indeed general and lasting, and that governments don’t rush to lock themselves back in the prison of austerity at the soonest opportunity. These have always been terrible ideas, as the historical record shows. Even at the most superficial level, these ideas don’t hold up: It is possible for governments to run year after year of deficits, and still see debt shrink as a percentage of GDP. But whether this relative measure of debt even matters is also questionable, since governments can actually, contrary to the current taboo, simply spend new money into existence.

Hence, we covered Modern Monetary Theory (MMT) last week to try and understand this irrational circumstance we are falling head-first towards. MMT is a variety of post-Keynesian, soft currency economics, and importantly it accepts the current state of affairs as palatable.

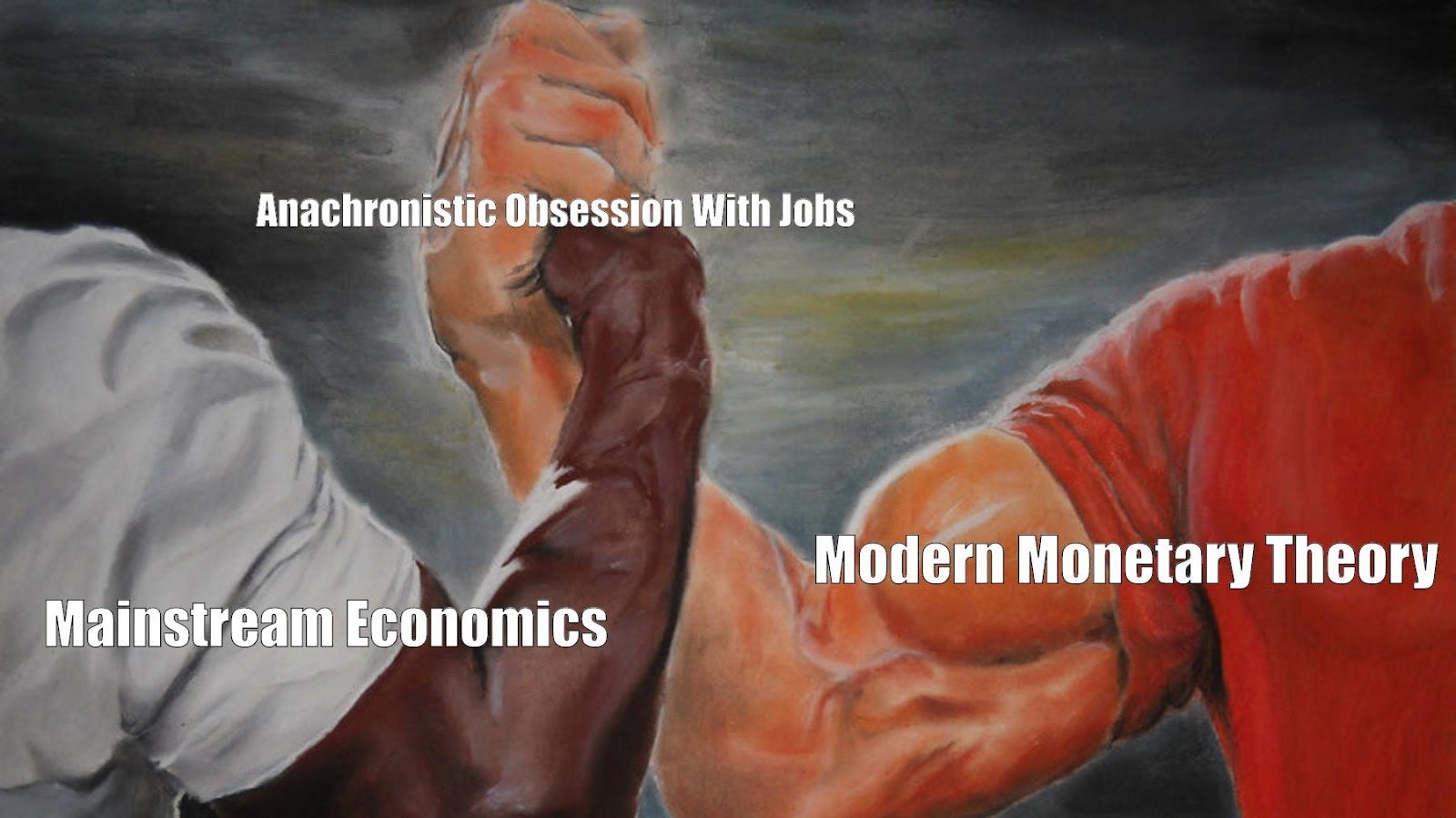

The MMT crowd is right that the government has far more headroom to spend, and better macro-economic (as opposed to nice-but-silly humanitarian) reasons to do so than their mainstream opponents think. They correctly understand that government spending is constrained by the economy’s available resources rather than by tax revenue.

But are they wrong about what to do with that spending power? About the role of government and deficits?

Let’s more specifically address this by asking this question: what do we do about the millions of unemployed people right now?

At the heart of most MMT economic thinking and thesis is the concept of a Job Guarantee. Think Universal Basic Income meets New Deal — a job for anyone who wants it.

Let’s view this from the MMT side:

From a purely economic standpoint, the major advantage of the job guarantee is its ability to stabilize employment over the business cycle. This doesn’t just benefit those who are able to quickly find new jobs. It benefits all of us. If we had a job guarantee in place today, it could employ many of the people who are currently without the work they need. It would weave stronger fibers into the existing social safety net, catching people with new employment opportunities the moment they’re laid off. Whether you own your own business or work for someone else, your own economic security is probably closely tied to the income security of others.

Why take the drastic step of a job guarantee? It’s because simply relying on unemployment insurance isn’t good enough. Not everyone is eligible, and most states only pay benefits for thirteen to twenty-six weeks. When the Great Recession began (December 2007), there were already 1.3 million people experiencing long-term unemployment (more than twenty-seven weeks). In August 2009, after the recession had officially ended, 5 million Americans had been without work for twenty-seven weeks or longer. A year later, that number had climbed to 6.8 million. Even though Congress voted to extend the benefit period, those extensions eventually ended, leaving millions without jobs or income. Businesses and communities across America felt the blow. As the unemployed struggled to pay their mortgages, homes were foreclosed on, property values plummeted, revenue from property taxes shriveled up, state and local governments slashed spending on everything from education to transportation, classroom sizes swelled, infrastructure deteriorated, and on and on. The deep and protracted recession hurt us all.

In short, the job guarantee is the MMT solution to our chronic jobs deficit. Instead of trapping millions in unemployment as a sacrificial tribute to the “natural rate” of unemployment, the job guarantee ensures that everyone who wants to work can have a job. It’s also a better price stabilizer. It spends only enough to hire everyone who is prepared to work, and it maintains a pool of employable people from which the private sector can readily hire at a modest premium over the program wage. Further, by establishing the right to a living-wage job, the job guarantee strengthens the bargaining power of labor, reduces racial inequities, decreases poverty, and raises the floor on low-wage work while building stronger, more vibrant, more connected communities.

So, what’s the issue? Is this a rational response?

Well, let’s address the merits first. Let’s assume for a moment, though, that through some alchemy, the FJG and its administrative organs are able to eliminate all administrative glitches and errors, and scale perfectly to match the fluctuating numbers of the newly jobless, as well as preventing corruption, wage theft and worker abuse throughout their various employment programs. There is still a deeper problem with the very concept of a “guaranteed” job.

For the “job” to be meaningfully deserving of that name, you have to be minimally good at it. You may have to pass a drug test or a “working with children” background check. You have to have a positive attitude, avoid foul language, and not make your co-workers uncomfortable. You have to show up on time, or your boss has to trust you, and believe your car really did break down. Any job is, and by its nature must be, conditional. If it’s a job, it’s not guaranteed. If it’s guaranteed, it’s not a job — it’s adult daycare.

There’s also an opportunity cost, which MMT ignores, implicit in having people be found jobs to do (rather than finding people for the jobs that need doing). It’s extremely unlikely that the jobs such a program provides will fully utilize the capacities of the people it provides them to. Worse, it will preclude them from developing those skills, by retraining, or starting a new business, or any other undertaking outside the immediate pursuit of waged labor.

Thus, we have to consider the most insidious reason guaranteed jobs are unrealistic in today’s climate: a government’s power isn’t based on the levels of production, but the levels of control. As we’ve seen time and time again throughout history, a working populace is one spark away from revolt. Furthermore, we are increasingly close to automation replacing most of the traditional “unskilled” jobs.

Why force your populace to work when you can better control them with a check that covers just enough for them to get by?

Indeed, the guaranteed job is a leftover fantasy of how economics and the forces that drive an economy worked 50 years ago — but the game has changed.

It’s not the worker who holds the power. It’s the one printing the dollar bills who has power.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.