Premium Daily Crypto Newsletter

March 15, 2018Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

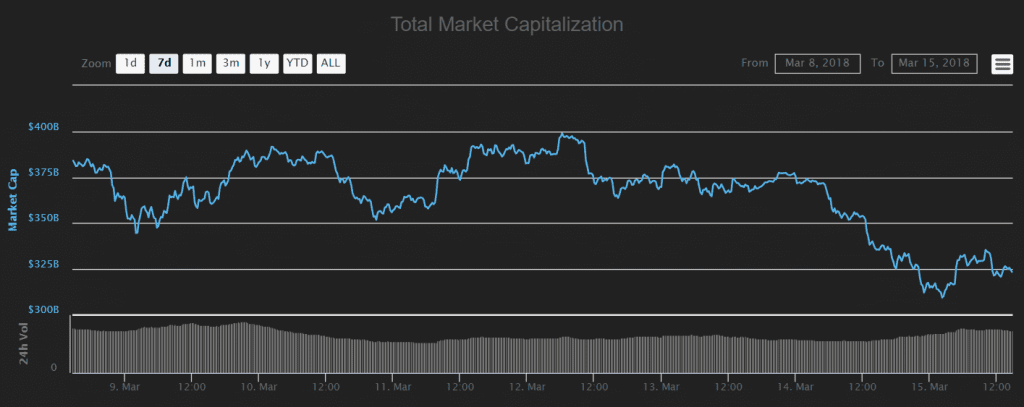

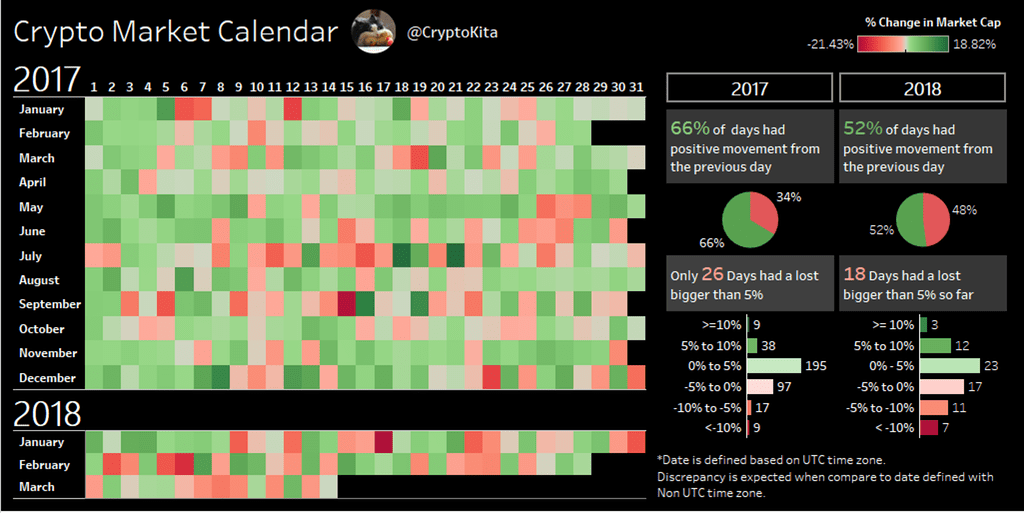

Market makes small recovery

Are we setting up a double bottom?

Today was a big day for Bitcoin, even if the market hasn’t reflected it.

The first official beta implementation of the Lightning Network (LN) went live March 15 as developer Lightning Labs announced it had won $2.5 million in funding, including backing from the Twitter CEO.

The Lightning Network Daemon (styled ‘lnd’), which enables easy access to LN for developers, represents the first mainnet beta release for the technology, which is tipped to revolutionize Bitcoin’s use as a currency.

“Note that this release is intended for developers of future Lightning applications (Lapps) along with technical users and prospective routing node operators. In this early phase of Lightning, we’re focused on providing the software infrastructure (such as lnd!) necessary to bootstrap the network and serve as a platform for future applications, services, and businesses. As this is the first mainnet release of lnd, we recommend that users experiment with only small amounts.”

So why is this important?

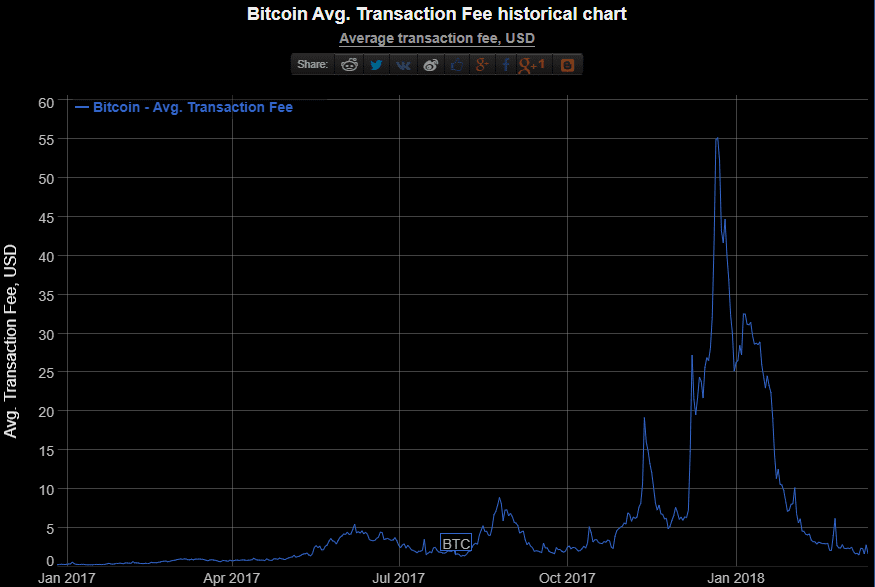

Well, remember this graph?

Even if you haven’t seen this before, you probably knew of the effects. Looking at the historical average transaction fee for Bitcoin, the average fee was $55 per transaction on December 22nd, 2017. Yes, you read that right.

Essentially, Bitcoin is old tech at this point and making changes to a decentralized platform, because you need to get the network to agree on them, is harder and harder as the network has grown and the miners have become more business oriented. If the proposed changes hurt the miner’s bottom line, then of course they won’t support it.

So enter the Lightning Network, the solution that is meant to solve Bitcoin’s scalability issues.

The importance of the Lightning Network should not be underestimated. This potential solution to Bitcoin’s currently slow and expensive nature will change how cryptocurrency is transacted. With the LN, payments are virtually instantaneous and cost less than a penny. Here is a simple video demonstration of the LN in action:

Of course, any proposed radical change is going to incite criticism and complaints that this abandons Satoshi’s original vision.

Many of these alternative currency loyalists will argue against LN, critiquing the costly need to open channels or the possible susceptibility to centralisation, for example. Andreas Antonopolous, an expert authority in the world of Bitcoin, dispels these and other fears in a recent Q&A on Youtube:

Ben Davenport, CTO at the blockchain security company BitGo, also weighed in:

“It’s something the entire community has been focused on and working towards for the better part of two years now. It’s really the culmination of a lot of work by many people, not just Lightning Labs. … We see it as a very important piece of the scaling solution for bitcoin, and perhaps other digital currencies as well.”

We’ll continue to watch what happens as this gets closer to a tipping point of adoption.

The other piece of news we want to discuss is the recent raid on three cryptocurrency exchanges in South Korea.

It’s certainly apparent that cryptocurrency news on the Korean peninsula is frequent and often dramatic, but every time we’ve discussed developments in the recent months it’s always come down to looking worse that it actually is.

Specifically, the “Korean FUD” that appeared right as the market turned in January was just re-reported news from December. It was media manipulation at its most flagrant. South Korea was simply looking to crack down on exchanges and ICOs that were violating standards and propping up the possibility of a black market. That’s completely sensible, but the market acted in a completely nonsensical fashion.

We see the news from today as more of the same. The three exchanges in question were not adhering to the guidelines that South Korean officials were now enforcing more stringently.

In particular, the exchanges’ executives and staff are suspected of using fiat deposits from customer accounts to buy cryptocurrencies at other exchanges.

“The firms turned up on our radar in January during our investigation of suspicious money transfers between Bitcoin exchanges that were detected during an audit by the Financial Services Commission and the Korea Financial Intelligence Unit,” said a prosecutor from Seoul.

Needless to say, we believe this is just the growing pains of an industry and a country looking to evolve a promising new market and asset class.

We look forward to the future of cryptocurrency in South Korea.

Have a great week everyone.

New to Cryptocurrencies? Check out our archived class “Intro to Cryptocurrency Trading” which is available for immediate purchase/viewing in the Premium Member’s Home. View more about it and watch the class today by visiting this link.

Sign up for our NEW Telegram channel by clicking here!

Watching on Mobile? Click this link to watch in HD

Click here for audio link of today’s video

Offense – Adding Trades

Offensive Actions for the next trading day:

- Expanded TRAC position.

Defense – Managing Risk

Defensive Actions for the next trading day:

- Exited EVE position.

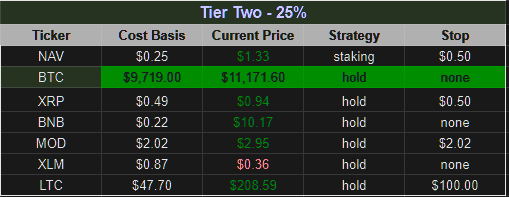

Current Portfolio

Desired Holdings

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

Tier 3

TRAC

Tier 3

REQ

SUB

LINK

NANO

KNC

Tier 4

BNTY

TAU

WISH

PHR

LOCI

XBY

ELA

ECC

POE

HPB

BIX

EVE

ReadySetCrypto’s 7 Categories Of CryptoCurrency

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Fundamental Currency Research

“Physically delivered” Bitcoin futures contracts contrast from those currently on offer from US platforms CBOE and CME Group in that they will physically deliver the underlying asset, BTC, upon the futures’ specified delivery date. Under the current model used by the CBOE and CME, investor receive dividends in fiat.

“When you talk to the liquidity providers, they all say the same thing, which is they want a physically delivered futures contract so they can hedge their exposure across exchanges,” said Coinfloor’s co-founder Mark Lamb.

This, combined with the upcoming NASDAQ futures, CBOE expansion into Litecoin and Bitcoin Cash futures, and the invitable Bitcoin ETF all point to 2018 being the year that cryptocurrency really made strides in becoming a mainstream investment vehicle.

It’s certainly exciting to be in early and watch it unfold, wouldn’t you agree?

Today we’ve exited our position in Devery ($EVE).

At this time, we’re not considering re-entering the position as we believe we will be able to make many more returns in the similar, yet different, project OriginTrail ($TRAC).

TRAC is attempting to create an interoperable supply chain traceability platform that handles multiple forms of supply chain in order to trace products back to source. They are not looking at how the data that is entered into the systems is accurate and correct.

EVE are looking to provide a mechanism for producers of products to be able to have end customers confirm authenticity of the product. This is currently done over the ETH network, but may in future integrate with the tracking platform in addition.

Unfortunately, we haven’t seen enough progress from the EVE team to warrant the interest we want to see in a space that is quickly becoming saturated and popular.

We’ve taken our position in EVE and used it to expand our position in TRAC, which is near its all-time-low, and with Masternodes on the horizon and many exciting announcements coming out for this crypto, we’re excited at the possibilities this presents in our portfolio.

If you missed my webinar on Fundamental Analysis, give it a watch here!:

In this section we’ll feature a daily ICO or new coin we think you should check out. Based on your country, you may not be able to participate in the ICO, but you will be able to trade the coin once it is listed on an exchange following its ICO (usually only a couple of weeks). ICOs are where a lot of money in crypto is made. Here’s proof. That said, we should warn you: ICOs are highly risky endeavours and you need to mitigate any potential losses. Treat it as money you’ve lost the moment you contribute to the ICO. We are not responsible for the ICO’s performance. Today’s featured ICO / New Coin is:

Open Platform

For flipping Neutral.

For long-term holding Good.

What is it?

Problem

No Practical Cryptocurrency Uses

No easy way for developers to accept and integrate them in a meaningful way

For example wallets do not communicate out to applications the way application developers need them to

Wallets live and communicate on-chain whereas applications need multiple information i.e when cryptocurrency was

paid into an application, how much, by who, what account number, what user, and to update specific data tables etc.

So there needs to be two way communication between an application’s backend and whatever they are interacting with

on the blockchain whether that be a wallet or smart contract or in our case a payment Scaffold

Needs to be super easy

As a developer I don’t want to have to learn each blockchain’s language (solidity or rholang) I should be able to code in

the languages I’m comfortable

Solution

An End-to-End Decentralized Applications

Payment Platform

Simple analogy = ‘The first cryptocurrency wallet for applications’

In addition, the components that enable backend centralized code to

talk to components on blockchain.

Enabling any application to integrate blockchain

technology, deploy any payment scheme, accept any

cryptocurrency and track payment states on the blockchain

Easier for mainstream developers to adopt cryptocurrency

technology into their applications

What is our verdict?

What we like: Could move crypto as a whole forward. Easy for developers to integrate.

What we don’t like: An increasingly competitive space and not much to stand out.

TBA (ICO)

Website: https://www.openfuture.io

Whitepaper: https://s3.amazonaws.com/openmoney/OPEN+Platform+White+Paper+2018-03-08.pdf

Technical Analysis Research

BTC has broken down below the Bear Flag that I discussed over the weekend, so we’ll see if we see the price ends up first breaking below the 61.8% fib retracement, and if so, then next step is BTC 6k. An undercut would be exactly what we need in order to generate the necessary capitulation.

More bad news across the board for crypto today. This is another key element necessary for the eventual rally.

Mav will be announcing his next class this week, “How to Find Your Next Big Cryptocurrency.” and if you missed it during Wednesday night’s webinar , then it’s available in the Premium Member’s Area under the “Classes Archive.”

If you go to buy any of our courses at our online “store” you can receive $10 off the $59 street price with your member’s “coupon code” of member18crypto..

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

I will also be experimenting with the Profit Trailer app which might be useful in this choppy market. I hope to share results and tips/tricks with you in here once I get this bot up and running.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.