Premium Daily Crypto Newsletter

March 20, 2018

Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

Cryptos Continue Rise As US Stocks Flatline

Bitcoin Once Again Testing $9,000

A draft of a G20 document — acquired by Bloomberg — reads that cryptocurrencies “lack the traits of sovereign currencies,” implying that the G20 considers crypto to be an asset rather than a currency, Bloomberg writes today.

“Whether you call it crypto assets, crypto tokens, but definitely not cryptocurrencies, let that be clear a message as far as I’m concerned. I don’t think any of these cryptos satisfy the three roles money plays in an economy,” said Klaas Knot, the chair of the Financial Stability Board (FSB).

The idea is similar to Governor of the Bank of England (BoE) Mark Carney’s recent outlook on crypto, arguing that Bitcoin has “failed” as a currency, and should be regarded as an asset.

What we need to stress is that in our view crypto is not just an asset, it’s not just property, it’s not just a currency, and it’s not just a commodity. It’s all of them at once, which is made even more compelling when smart contracts are added in. It is an entirely new entity that can’t be confined into pre-existing categories. Everyone is still trying to figure out “what it is” and the depths of what it can offer society.

The issue is that those in power are still trying to understand this space according to what has come before. It’s a precarious position to be in to be sure. Coming up with new laws and regulations to better fit and adapt to Distributed Ledger Technology is more time-consuming than trying to correspond it predetermined classifications. It’s an accuracy vs. efficiency issue, and it seems with this news they’re trying to prioritize the latter.

As we move forward, the regulations will shift by necessity, but unfortunately this is how we perceive them moving forward. While we would prefer they get regulations right the first time, we concede that faster regulations are in some ways desirable.

In particular, member nations of the G20 have a firm deadline of July for recommendations.

This corresponds with a public document released preceding the meeting noted that “the technology behind crypto assets has the potential to promote financial inclusion,” but noted that the impact on financial stability and potential uses in tax evasion and illegal activities needed to be understood first.

While the future is uncertain for crypto at this moment, we cannot lose sight of how important it is that crypto is being discussed at the G20 as a major area of focus.

One other notable event from today is that for the first time since January, Tether has printed new coins. A massive 300M Tether has been issued.

As a reminder, Tether is the stablecoin which is majority owned by Bitfinex. 1 Tether is always meant to equal 1 US Dollar. While there’s some bias and the creator is trying to push you to his service, I do think this video is a great summary of the current state of Tether and how it’s a ticking timebomb in many respects.

Essentially, just about every time we’ve seen Tether flood the markets, Bitcoin’s price has gone up. That being said, we have little confidence that Tether’s account has the Billions needed to print money so carelessly. In this way, Bitfinex is acting as the central bank of crypto, printing money that is dangerously proliferated throughout the markets.

One of the biggest reasons I highly recommend getting your crypto investments off exchanges is that should Tether go bust many major exchanges use Tether and would be adversely affected, possibly even losing solvency and shutting down. If an exchange shuts down with your crypto on it, you will not get it back. Mt.Gox is a great example of this.

Now, I have to admit that Tether isn’t likely to “blow up” anytime soon, and if a legal investigation is underway Tether would not be printing money like this. That said, I am staying far away from Tether and Bitfinex because their practices are very morally inept and do not have the long-term interests of crypto at heart.

Talk to you this week.

New to Cryptocurrencies? Check out our archived class “Intro to Cryptocurrency Trading” which is available for immediate purchase/viewing in the Premium Member’s Home. View more about it and watch the class today by visiting this link.

Sign up for our NEW Telegram channel by clicking here!

Watching on Mobile? Click this link to watch in HD

Click here for audio link of today’s video

If you go to buy any of our courses at our online “store” you can receive $10 off the $59 street price with your member’s “coupon code” of member18crypto

Offense – Adding Trades

Offensive Actions for the next trading day:

- None.

Defense – Managing Risk

Defensive Actions for the next trading day:

- None.

Current Portfolio

Desired Holdings

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

None.

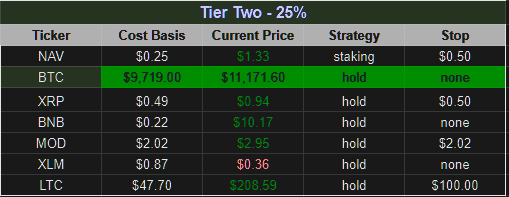

Tier 2

MOD

Tier 3

REQ

SUB

LINK

NANO

KNC

Tier 4

BNTY

TAU

WISH

PHR

LOCI

XBY

ELA

ECC

POE

HPB

BIX

EVE

ReadySetCrypto’s 7 Categories Of CryptoCurrency

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Fundamental Currency Research

One interesting strategy we’ve been thinking about is the use of Github activity as a metric for entering positions. For those who don’t know, Github is a public website that lets open-source code be viewable by anyone. When someone edits or adds code to the repository, that is known as a commit. More commits mean more activity, and more activity is usually a good sign for very tech-heavy projects.

So, the idea is that you make investments only in projects that have the highest amount of activity. This site lets you easily track these rankings. Now, most of the top ones by activity are not our favorites as they are clearly missing from our portfolio, but there’s something to be said about investing for the long term with projects that are the “most active”. It should be noted that quantity is not indicative of quality, but it certainly is a weathervane for progress.

As we mentioned in the top story, the Tether issuance could bring about renewed volume to the market as the injection has usually brought about upward surges, but remember that it is likely fabricated and continued Tether issuances could actually cause mistrust in the system and lead to further negative implications. It’s definitely been an interesting week so far.

Today Nano released their Roadmap which is probably one of the best examples of how to do one I’ve ever seen.

Give it a look here and see if you don’t agree.

One of the best excerpts is, “A vendor need only run software to implement Nano payments with their current terminals, making it simple for any brick & mortar location to securely accept Nano as a form of payment.”

Ladies and gentlemen, this is what real adoption will look like. No silly cards like Litepay or Monaco, just integration with an existing PoS (Point Of Sale) system giving consumers straight feeless instant Nano transactions without using a service provider. Brilliant.

For more great (and not so great) roadmaps, I recommend checking out crypto roadmaps.

In this section we’ll feature a daily ICO or new coin we think you should check out. Based on your country, you may not be able to participate in the ICO, but you will be able to trade the coin once it is listed on an exchange following its ICO (usually only a couple of weeks). ICOs are where a lot of money in crypto is made. Here’s proof. That said, we should warn you: ICOs are highly risky endeavours and you need to mitigate any potential losses. Treat it as money you’ve lost the moment you contribute to the ICO. We are not responsible for the ICO’s performance. Today’s featured ICO / New Coin is:

Enkidu

For flipping Neutral.

For long-term holding Neutral.

What is it?

ENKIDU is a global collaboration platform where individuals can find like-minded collaborators and team up to build and launch a monetizable product or service. This happens via a trustless payment gateway. Each payment gateway has a payment splitting function that replicates a cap table.A payment gateway that obeys the rules of it’s associated cap table, thereby allowing users to collaborate with each other trustlessly. All incoming payments on this gateway are split amongst team members, treasury, investors and bots (if any). There is no dividend system. A proprietary resolution voting system that has a private record of resolutions (action items) passed by the collaborative entity – allowing people to vote on decisions like dilution, treasury threshold, etc. A time-locked smart contract based vesting system to prevent premature rewards for collaborators.

What is our verdict?

What we like: Alpha is live. Could be a new and exciting venture for bootstrapping other crypto projects.

What we don’t like: Large hard cap for a simple solution, the team seems inexperienced.

4 days (PREICO)

Website: https://enkidu.io/

Whitepaper: https://enkidu.io/enkidu_whitepaper.pdf

Technical Analysis Research

And another article says that the “bear is largely over” in crypto, however we have yet to go through the “purgatory” phase that precedes the true bull again. My theory is that this is due to the lack of strong short interest in crypto due to the difficulty of being short delta in this market. Strong short interest is always an accelerating factor if you can get them to cover as the “smart money” bulls step in. The green candles over the past three days is a welcome change, but three days does not a reversal make.

And another article says that the “bear is largely over” in crypto, however we have yet to go through the “purgatory” phase that precedes the true bull again. My theory is that this is due to the lack of strong short interest in crypto due to the difficulty of being short delta in this market. Strong short interest is always an accelerating factor if you can get them to cover as the “smart money” bulls step in. The green candles over the past three days is a welcome change, but three days does not a reversal make.

If you go to buy any of our courses at our online “store” you can receive $10 off the $59 street price with your member’s “coupon code” of member18crypto..

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

I will also be experimenting with the Profit Trailer app which might be useful in this choppy market. I hope to share results and tips/tricks with you in here once I get this bot up and running.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.