Premium Daily Crypto Newsletter

March 24, 2018Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

Week In Review

Market Remains Even After Last Week’s Drop

It’s been another roller-coaster, milestone week in cryptocurrency.

This hasn’t been accurately reflected in the market, as the market capitalization has barely made any gains over the past 7 days. Like many people at this point, we’re eager for the market to go somewhere and for that to happen it has to get moving again. This low-volume sideways action frustrates the best of us, but the prize is worth the pain.

Let’s start with the big news from this week.

The G20 Summit was certainly on our minds heading into this week. The Group of Twenty meeting of finance ministers and central bank governors issued a statement that there would be continued international monitoring of cryptocurrencies, with a self-imposed deadline of July.

“We acknowledge that technological innovation, including that underlying crypto-assets, has the potential to improve the efficiency and inclusiveness of the financial system and the economy more broadly.”

However, the news came with a caveat implying regulation would still be relevant to protect consumers and investors with issues concerning “market integrity, tax evasion, money laundering and terrorist financing.”

One of the biggest reasons investors are starting to take a hard look at crypto is due to the governments of the worlds starting to take it seriously. That being said, cryptocurrencies are still a long ways off from being stable assets. Price volatility will likely remain as we are in this limbo state of waiting to hear more from regulators and governments over the next couple months.

Unfortunately, the reaction to the G20’s news was fairly muted as no real regulations or details were discussed, only a “wait and see” approach. Regardless, the sheer fact that cryptocurrencies are being discussed at this level is truly something noteworthy.

One government that is showing progress towards cryptocurrency regulations is the United States. This week, in the March 2018 United States Joint Economic Committee Report, they officially endorsed the future of blockchain technology and cryptocurrency in the U.S.

In the report’s general opening, Congress acknowledges, “it is important to proceed with prudence and provide proper guidance to the market… and not prejudge or hinder technological developments.” They continue, “The new technology also may be attractive for Government to use, improving efficiency in its own operations.”

One of the most telling statements:

“The report shows Bitcoin’s limitations as a medium of exchange, citing long transaction times and high fees, and further acknowledging that protocol improvements and off-chain solutions could speed up processing times and reduce transaction fees to help move cryptocurrency into the realm of actual currency.”

A cryptocurrency must do 3 things to compete as an actual currency vs existing methods:

1. It must be able to transact in seconds, the equivalent of grabbing a couple of bills out of your pocket or pulling out a card in order to make a transaction

2. It must be cheap – Preferably cheaper than your average credit card transaction (for both Merchant and the customer)

3. It must be secure and immutable

As far as we’re concerned, no cryptocurrency completely checks all three — yet. Once we have one that does, expect to see slow but widespread adoption. When the conversation about cryptocurrency changes from investment to adoption, that’s when we’ll truly see crypto thrive. We’ll get there.

Fast, cheap, and secure transactions may be a few years away, but that doesn’t mean crypto isn’t evolving every day.

Binance, in its quest to dominate the exchange space, announced its intention to have a decentralized exchange in tandem with its current centralized offering.

Decentralized exchanges promise a world in which cryptocurrency can be traded without a centralized middleman. Decentralized exchanges don’t use a third party to handle trades or store cryptocurrency. Instead, they use blockchain technology to enable peer-peer trading without a need for the services usually used in centralized exchanges. Because of this, decentralized exchanges don’t have to be for-profit entities, they can provide fee-less or close-to-free trading, but that unfortunately, that comes at the cost of usability.

Binance’s offering may be a ways off from being offered, but it’s an excellent direction for the exchange which is helping to push the space forward to legitimacy and mainstream adoption.

Furthermore, on Friday they announced their intention to offer fiat to crypto trading pairs. This is more good news as this is a space dominated by big entities such as Coinbase and shady operations such as Tether. Some new blood in the space will help to improve it and get existing players to clean up their act.

Speaking of big entities, last week Google announced that it was banning all cryptocurrency related advertisements on its platform. This comes after Facebook banned cryptocurrency ads in January, and just days later Twitter announced it would be taking similar actions. With Facebook and Google controlling about 65% of the ad market in the U.S. alone, these moves strictly limit the available channels for crypto advertising.

However, part of the reason these tech giants are going through with these actions is to clear the way for their own offerings, which was confirmed this week when Google announced two blockchain projects. J.P. Morgan Chase, which has been openly critical of Bitcoin, is also considering spinning off Quorum, its blockchain project, to improve the platform’s appeal as an independent entity.

The bank announced it still believes distributed ledger technology will perform a transformative business role and that it will continue to build multiple blockchain solutions. The statement also noted that Quorum has become an “extremely successful” enterprise platform even beyond financial services.

As Quorum is a minimalistic fork of the Go Ethereum client, it will be interesting to see what area they are considering.

Talk to you this week.

New to Cryptocurrencies? Check out our archived classes “Intro to Cryptocurrency Trading” and “How to Find Your Next Big Cryptocurrency: Intro to Fundamental Analysis” which are now both available for immediate purchase/viewing in the Premium Member’s Home. View more about them at our online store by CLICKING HERE.

Sign up for our NEW Telegram channel by clicking here!

Watching on Mobile? Click this link to watch in HD

Click here for audio link of today’s video

If you go to buy any of our courses at our online “store” you can receive $10 off the $59 street price with your member’s “coupon code” of member18crypto

Offense – Adding Trades

Offensive Actions for the next trading day:

- None.

Defense – Managing Risk

Defensive Actions for the next trading day:

- None.

Current Portfolio

Desired Holdings

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

None.

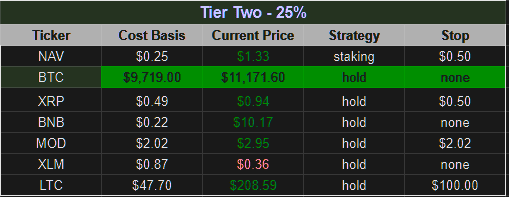

Tier 2

MOD

Tier 3

REQ

SUB

LINK

NANO

KNC

Tier 4

BNTY

TAU

WISH

PHR

LOCI

XBY

ELA

ECC

POE

HPB

BIX

EVE

ReadySetCrypto’s 7 Categories Of CryptoCurrency

Tier 1 coins are those coins which we have considerable assets invested, are firm believers in the project direction and execution, and have very little reason to sell within short to mid term. These are coins which we risk evaluated to be very solid, and have a high probability of existence duration.

NEO

NEO ($NEO) is classified as a Dividend and Platform coin. As our largest holding, we believe NEO has the potential to become a dominant smart contract and DApp platform in 2018. It’s four most compelling features are:

- An innovative consensus algorithm which will allow for greater TPS (transactions per second) over its competitors.

- A dividend structure for holders, incentivizing coin retention and network stability / diversity.

- SE Asia location, enabling NEO to break into markets more easily than competitors.

- Agnostic smart contract language, allowing for smart contract developers to use existing mainstream programming languages, which allows for cheaper smart contract implementation as compared to Ethereum who’s proprietary smart contract language, Solidity, can be a barrier to integration.

NEO is best acquired through Binance. Storing NEO on the Binance exchange will result in a GAS distribution once a month on the first. We recommend the NEON wallet for safe storage. GAS will be distributed on the NEON wallet daily.

WaltonChain

WaltonChain ($WTC) is classified as a Dividend and Utility coin. Waltonchain is on the cutting edge of using RFID hardware to enable supply chain management 2.0. We believe Walton has the potential to become a dominant IoT blockchain solution Waltonchain is the only truly decentralized platform combining blockchain with the Internet of Things (IoT) via patent pending RFID (Radio Frequency Identification) technology. The custom RFID chips are able to digitally sign and verify transactions at the integrated circuit level, automatically and instantly reading and writing data to the chain without human intervention. This unique implementation of blockchain + IoT facilitates the true interconnection of all things in the real world with the virtual world, creating a genuine, trustworthy and traceable business ecosystem with complete data sharing and absolute information transparency. Walton has two major competitive advantages:

- A recently confirmed (to be signed) partnership with China Mobile’s IoT Alliance. China Mobile is the largest mobile telecommunications service in the world as well as the world’s largest mobile phone operator by total number of subscribers. Walton’s Management system is set to be implemented through mobile communication networks, and China Mobile is the largest one. Waltonchain is positioning themselves to be the single connector of the entire Internet of Things initiative put forward by the China Mobile IoT Alliance.

- They implement the blockchain through the RFIDs at the foundational layer. Their technology is patent-pending and gives Waltonchain a solid claim as the only blockchain that connects the physical world with the virtual world with truly reliable data. This is because all other IoT solutions tag items through API, and this means all the data is first passed through a centralized intermediate, a potential point of vulnerability.

Ethereum

Ethereum ($ETH) is an open blockchain Platform that lets anyone build and use decentralized applications that run on blockchain technology. Like Bitcoin, no one controls or owns Ethereum – it is an open-source project built by many people around the world. But unlike the Bitcoin protocol, Ethereum was designed to be adaptable and flexible. It is easy to create new applications on the Ethereum platform, and with the Homestead release, it is now safe for anyone to use those applications.

OmiseGO

OmiseGO ($OMG) is classified as a Dividend and Utility coin. OmiseGO is a Southeast Asia-based company creating an e-wallet that will make transfer of assets and currencies possible. Merchants and users of the wallet can transfer whatever asset or currency they desire. For example, you could use your ethereum, bitcoin, international fiat, or even your airline points to buy groceries using the e-wallet app on your mobile phone. Transfers can happen across borders, or even while traveling abroad. Unlike Western Union or PayPal for example, the fees are almost negligible, and the transfer is instant. Because it’s based on a blockchain, there are no intermediary banks necessary and users don’t need bank accounts to access those funds. This is especially good for migrant workers who send money home and often don’t have bank accounts and are forced to use expensive wire services instead.

NAVCoin

NAVcoin ($NAV) is a Privacy coin with upcoming Platform features. NAVcoin has been around for 3 years. It is not minable, instead being based on a Proof of Stake system in which stakers earn 5% annual returns. Theoretically this means there could be 5% inflation on the supply, however, that would require every coin holder to stake, so likely there will be very marginal inflation between 1 and 3% year over year. It is a currency originally based off of Bitcoin version 0.13, which should tell you it’s got a good foundation from which to build its feature set. Being based off Bitcoin, it currently is a method of transaction, with notable upgrades in the form of Segwit (with possible lightning network integration in the future) and 30 transaction times with extremely marginal fees. That’s great but a lot of coins have that going for them, so thankfully we’re just getting started with the real interesting pieces of NAV. The first and currently only implemented feature, NavTech is a unique dual blockchain technology. Essentially, NAV runs on these two blockchains in order to completely disconnect the sending wallet (your wallet), to the receiving wallet (where the money is getting sent). Think of it like a VPN, NavTech completely strips the sender’s details so the transaction is completely anonymous. The anonymous transaction space has really gotten big lately, with Monero’s recent price action and Ethereum’s implementation of ZKSnarks being two big examples that come to mind.Moving on to the roadmap, there are two big upcoming features for NAV:

- The first is Polymorph, which is a really cool blend of Nav’s anonymous transactions and Changeally’s instant exchange. What this means is that, for example, I wanted to pay someone in Bitcoin but I wanted to do it anonymously. Polymorph would take my bitcoin, turn it into navcoin in order to be processed and sent anonymously using the Navtech dual blockchain, then turned back into bitcoin at the to be sent to the receiving wallet. This will certainly set NAV apart, as it guarantees anonymous transaction for all of the coins on changeally. This is huge for exposure, and a great opportunity for NAVcoin to gain trust, which is absolutely critical anonymous transaction coins.

- The second big upcoming feature is ADApps, or Anonymized Decentralized Apps. This is also a huge potential win for Nav as there is already a huge amount of interest in the crypto space surrounding Dapps, such as Ethereum and Omni. Adding in the anonymous layer would attract projects that would value the anonymity. Nav is still in the planning stages for this project so it could still be awhile before it comes to fruition, but we should see the whitepaper for it soon, and if they could be first to market with ADapps that could prove to be a killer feature for them as it would give them first access to the interested demographics.

Ripple

Ripple ($XRP) is a real-time Payment protocol for anything of value. It’s a shared public database, with a built-in distributed currency exchange, that operates as the worlds first universal translator for money. Ripple is currency agnostic and has a foreign exchange component built right into the protocol. Ripple acts as a pathfinding algorithm to find the best route for a dollar to become a euro or airline miles to become Bitcoin. It will look at all the orders in the global order book. The case for XRP comes down to the following: 1) Payment systems work best with bridge assets to focus liquidity. 2) There are good reasons to expect a cryptocurrency to be the most popular bridge asset. 3) There are good reasons to expect that cryptocurrency to be XRP.

- Open, decentralized payments will have lots and lots of assets, including national currencies of all kinds and cryptos. A significant fraction of payments will be among assets that aren’t the most popular. Using intermediary assets to settle those payments concentrates liquidity and reduces spreads.

- National currencies are always tied to jurisdictions and can’t be universal. Systems built around them will never be as open and inclusive as systems that aren’t.

- XRP settles faster than any other major crypto. It higher transaction rates than other major cryptos. It is beat by others only by the amount of liquidity available today. And, most importantly, XRP has a company that is devoted to making sure XRP succeeds for this specific use case.

ICON

Simply put, ICON ($ICX) is a massive scale blockchain Platform that allows

- Decentralized Application (DAPPS) – Build DAPPS on ICON Platform like on Ethereum and NEO. Yes, soon, you will see ICOs happening on ICON platform for different DAPPS

- Interchain (Interoperability with Blockchains) – Allows different blockchains connecting to one another through their protocol. ICON is fully compatible with traditional blockchains like Bitcoin and Ethereum and in future can bridge other public blockchains such as Qtum, NEO and many others to achieve their mission statement – “Hyperconnect the world”

- Artificial Intelligence (AI) – Use of AI to ensure all nodes contributing to ICON Republic/platform are rewarded fairly and not to have certain powers over distribution policies. AI will continue to learn a variety of variables to determine optimal distribution policies and achieve complete decentralization.

- Decentralized Exchange (DEX) – ICON will integrate different DEX protocols on their platform to facilitate exchange of ICX and other future ICON platform currencies. Bancor protocol will be their first DEX protocol when mainent launches this month end and Kyber and others will follow. Not just throwing Kyber’s name out there, it was confirmed they are working with each other, official partnership yet to be announced.

Fundamental Currency Research

Origin Protocol

For flipping Neutral.

For long-term holding Good.

What is it?

Origin is a sharing economy marketplace and set of protocols that enables buyers and sellers of fractional use goods and services (car-sharing, service-based tasks, home-sharing, etc.) to transact on the distributed, open web. Using the Ethereum blockchain and Interplanetary File System (IPFS), the platform and community are decentralized, allowing for the creation and booking of services and goods without traditional intermediaries. We are specifically building a large-scale commerce network that:

- Transfers direct financial value (listing, transaction, and service fees) from large corporations like Airbnb, Craigslist, Postmates, etc. to individual buyers and sellers.

- Transfers indirect financial and strategic value (privately aggregated silos of customer and transaction data) from those same corporations to the entire ecosystem.

- Creates new financial value for marketplace participants that contribute to the growth of the network (e.g. building new technology for the 0rigin network, bootstrapping new product verticals, and referring new users and businesses).

- Is built on an open, distributed, and shared data layer to promote transparency and collaboration.

- Immediately allows buyers and sellers across the world to do business with each other without difficult currency conversions or tariffs.

- Promotes personal liberty by not allowing a central corporation or government to impose arbitrary and oftentimes onerous rules on how to do business.

To accomplish these ambitious goals, the 0rigin platform is being launched with incentives from the outset to encourage other technologists, businesses, and consumers to build, contribute, and extend the ecosystem with us. We imagine a broad collection of vertical use cases (e.g short-term vacation rentals, freelance software engineering, tutoring for hire) that are built on top of 0rigin standards and shared data. Together, we will create the Internet economy of tomorrow.

What is our verdict?

What we like: Over 30 blockchain projects are already using Origin. Lots of potential around this use of blockchain.

What we don’t like: Very vague roadmap.

TBA (ICO)

Website: https://www.originprotocol.com/en

Whitepaper: https://s3.us-east-2.amazonaws.com/originprotocol-assets/docs/whitepaper_v4.pdf

Technical Analysis Research

Over the next few days I’ll be featuring different popular studies to use on your charts, and some possible different ways to “read between the lines” on them. I prefer to use studies to show the “grey space,” or signals that you can’t necessarily see through your eye alone. Tonight’s featured studies are “volatility indicators” like the Bollinger Bands as well as the Keltner Channels. Each of these will show relative extremes in price against the current levels of volatility, and volatility tends to be mean-reverting. In other words, if the price goes outside of one of these envelopes, it tends to revert back inside of the envelope quickly as vol reverts to the mean.

We can even combine them together to form a hybrid indicator called the “squeeze” which tends to spot very quiet periods in markets, which normally shows a higher probability of forward volatility. Mark your calendar for this Wednesday evening as I’ll be conducting a live webinar about Technical Analysis; we’ll share the signup link shortly.

If you go to buy any of our courses at our online “store” you can receive $10 off the $59 street price with your member’s “coupon code” of member18crypto..

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

I will also be experimenting with the Profit Trailer app which might be useful in this choppy market. I hope to share results and tips/tricks with you in here once I get this bot up and running.

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.