Doc's Daily Commentary

Mind Of Mav

A New Passive Income Opportunity: Running Web3 Nodes

It’s been said the future of the internet is Web 3.0 and some of the best passive income opportunities are helping to support the Web 3.0 infrastructure.

Even though Web 3.0 is still in its early stages, we are already seeing Web 3.0 nodes generate many thousands of dollars per month for their owners.

What is Web 3.0?

Web 3.0 is the decentralized version of the Web. While it is still early in its development, Web 3.0 has the potential to revolutionize the internet as we know it. It’s the “next big thing” in crypto as Metaverse is still finding its applications and NFTs are finding out how to evolve.

The basic principle underlying Web 3.0 is the decentralization of the internet and by running a node, you can help with this decentralization.

Web 3.0 Nodes

There are many ways to participate in helping the development of Web 3.0 and a Web 3.0 node provides this function through many mechanisms, such as providing data streaming, data computation, file storage, a decentralized framework and more.

To run a node typically requires the setup and configuration of a cloud computer as well as staking collateral (a certain amount of the project’s token).

3 Web 3.0 Nodes for Passive Income

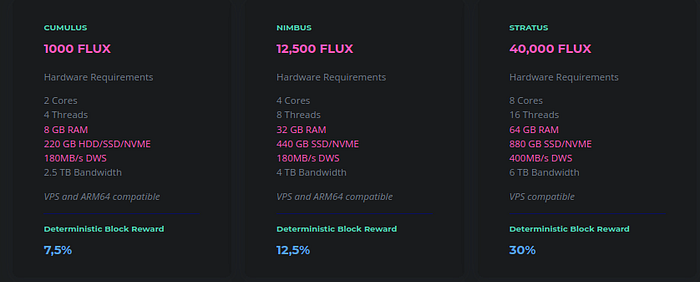

Flux (FLUX) #159

Website | Coinmarketcap On 86,088 watchlists

Flux is the new generation of scalable decentralized cloud infrastructure. The Flux ecosystem is a fully-operational suite of decentralized computing services and blockchain-as-a-service solutions which offer an interoperable, decentralized, AWS-like development environment with more than 2,200 online nodes.

Flux has been highly successful in the last few years and recently announced new node tiers, offering more affordable options.

A stratus node earns $2,400/mo, a Nimbus node earns $646/mo and a Cumulus node earns $274/mo. The up-to-date earnings can be found here.

The entry cost for a Cumulus node is around $1,500 and ROI is around 18% per annum. The ROI for Stratus is around 16% per annum, at the time of writing. Rewards are contingent on the number of nodes and the value of the rewards are determined by the market price of FLUX. Rewards also can be accumulated and used to purchase additional nodes which is a popular method to compound earnings.

Earnings per (Stratus) node:

$2,400 per month (30% block reward)

Price of (Stratus) Node:

$60,400 (40K FLUX x $1.51)

Two years ago, FLUX was trading at $0.02 and a Stratus node (which at that time required 100,000 FLUX) could have been purchased for $2,000.

Currently, the purchase price for a FLUX node is relatively expensive (when compared to a year ago). However, this is a good example of the long-term benefits available when getting in early with Nodes. That said, there is still a lot of room for growth in this project.

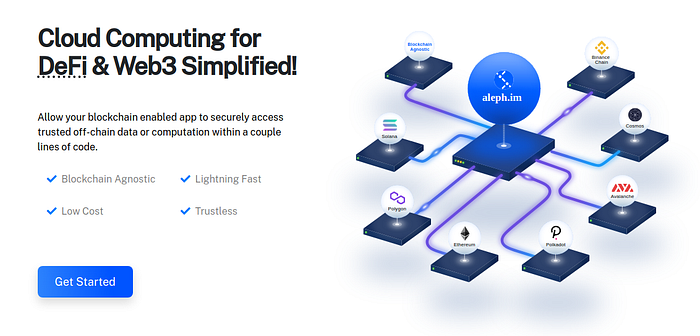

Alephi.Im Network (ALEPHI) #508

Website | Coinmarketcap On 27,679 watchlists

Aleph.Im is focused on decentralized apps and protocols. This project offers decentralized databases (including file storage), computation, and a decentralized identification (DID) framework. An easy way to think of Aleph.Im is a decentralized version of Amazon Web Services (AWS).

In addition to the hardware and configuration, a Alephi.Im node requires a minimum of 200K ALEPH and on average each node generates about 5,400 ALEPH. More information about the nodes, revenue share and dashboard can be found here.

Currently, Alephi.Im is trading at some of the lowest market prices this project has ever seen.

Earnings per node:

$1,591 per month (5487.80 ALEPH x $0.29)

Price of Node:

$58,000 (200K ALEPH x $0.29)

Pocket Network (POKT) #2997

Website | Coinmarketcap On 9,479 watchlists

Pocket Network is a web3 infrastructure middleware protocol that provides millions of daily RPC requests across a decentralized network, which includes Solana, Avalanche, Binance Smart chain, Polygon and more.

In addition to the hardware and configuration, a Pocket node requires a minimum of 15,000 POKT and on average each node generated between 1,950–3,000 POKT per month.

Currently, POKT is trading at some of the lowest market prices this project has ever seen.

Earnings per node:

$2,340 (up to) per month (1,950- 3,000 POKT x $0.78)

Price of Node:

$11,700 (15,000 POKT x $0.78)

Should you invest in a Web 3.0 Node?

While this is not intended to be financial advice, Web 3.0 is set to be the future of the internet and these projects are setting the foundation for Web 3.0 infrastructure. This could be compared to the early days of the internet.

As the Web 3.0 space grows and with it the need for infrastructure to support this growth, these projects will likely see much greater adoption in the upcoming years.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.