Doc's Daily Commentary

Mind Of Mav

Why Sound Money Is The Economic Future

By definition, money is a store of value and is designed to increase that value as the amount issued increases, or is kept scarce in its issuance.

Currency is a medium through which money becomes live, specifically as a unit of account that can be properly ledgered and its risks are amortized.

Most people don’t know this, as they toil in debates over digital currencies, cryptocurrencies, tradable commodities, the distinction between debt and credit, physical coins, paper money (cash), and the like.

Truth is, financial literacy is mostly driven by monetary and economic ideologies, rather than sound mechanics.

This is by design.

If people don’t understand the instruments of exchange (trading on accepted or agreed upon value) or barter (equal exchange of goods and services), they cannot control their own uses of money, let alone the assets they use money to purchase, and think they own.

This has contributed to massive market manipulations of what is commonly thought to be accretive value, and the commodification of assets that people work hard to acquire — not realizing that their time and labor have little effect on any of it, and in how inflation is unevenly distributed with both FIAT and cryptocurrencies.

Sound money literally refers to real wealth, with a natural, unmistakable signature of authenticity, as opposed to the paper, plastic, and electronic debt instruments used almost exclusively today.

Sound currency literally refers to the equal transfer of wealth that is earned naturally, and redistributed equitably.

As we’ll explore, sound mechanics for money really do matter.

THE HISTORY OF SOUND MONEY

The term “sound money” has its roots in Ancient Rome, where small silver coins were the standard in everyday commerce operations, whether used for paying Roman soldiers or buying exotic goods from all corners of the known world.

As Rome squandered its wealth, it found a shortcut to shore up the treasury. It gradually debased those silver coins with common metals, ultimately cutting the silver content to roughly 5 percent.

That move didn’t hold water for very long. Understandably, disciplined Roman soldiers did not appreciate being paid with worthless mystery metal in return for risking their lives on bloody battlefields. As a result, they “boycotted” the use of these worthless metals, and started pillaging what remaining resources were available as tradable goods, until Rome fell, and its rulers moved their seized assets elsewhere.

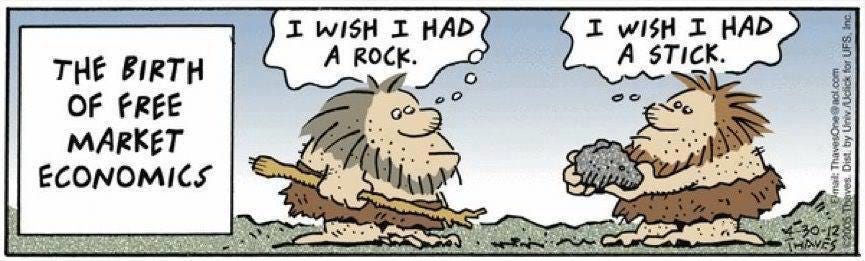

Austrian economist Carl Menger explains that the origins of money are spontaneous. The barter system’s shortcomings were quickly exposed by the problems of divisibility and “double-coincidence of wants.” This also had ramifications on what are considered to be free markets.

In a free market, a farmer can tender corn and wheat in exchange for medical services, but what if the town doctor already has all the corn and wheat he needs?

With scenarios like these, market actors realized that they could acquire more goods by tendering a more sought-after or “saleable” commodity as payment. And of course, free market activity makes it such that commodities are speculated upon, often pricing those same commodities out of the markets in which they are traded.

Meanwhile, the concept of sound money has persisted, as we are still trying to find that elusive middle ground that at once provides a sustained utility for the exchange of goods and services, and stabilizes the value of those utilities over time.

THE PROBLEM OF MONEY AS MONOCULTURE

In today’s hyperinflated landscape of goods and services and deflated currency, you will now find farmers without the ability to produce corn or wheat at competitive prices, and doctors without the ability to provide medical services at reasonable prices, therefore leaving the free market paradigm without much footing in economic reality.

This is a monocultural problem, whereby a single monetary system is used to govern polycultural environments — ones in which diverse social, ecological and outlying financial factors are never accounted for in assessments of economic health.

Still, the most marketable goods establish themselves as common media of exchange. The marketability differences between commodities serve to discern between them; it is precisely in this way that money undergoes free market competition. Historically through this process, gold and silver rose as the most marketable commodities due to their features: The metals are portable, homogenous, divisible, durable, and scarce.

Through market processes, the “most marketable commodity,” as economist Ludwig von Mises described money, makes itself known. Money is not created by government decree, but rather by surviving the test of time and the pressures of market forces while maintaining its value.

Problem is, the “free markets” themselves have not withstood the test of time or trade pressures, given that both are manipulated to serve special or private interests.

Starting with the early mercantile exchanges such as Monti di Pieta, or the first gold custody outfits which spawned modern institutional and retail banking, it has become clear that money and credit have been used as a front for control over trade activity by those who can mine precious metals or manage inventory, be it through the custody of hard assets or ledgering the oversight of units of account.

Even worse, commodities of real fungible value — meaning things we can eat or drink or use for energy — are hedged against their own uses across society. This creates an issue of resources being used as assets that no longer hold utility value, at least not in financial terms, and not in the best interests of those who really need money to eat, to drink and to use energy.

Whether assets are extracted as resources and financialized for profit, or middlemen are used to arbitrage those financial instruments, the “little guy” always gets left in the dust.

This ties directly into the need to manage resources as stable assets.

Modern applied economists such as Bernard Lietaer — who was once a central banker and later a co-architect of the Euro — were among the first to recognize that the only way forward would be to create ecosystems in which currencies complement the real resources people use to trade and barter, without unnecessary middlemen, and without inflation rate adjustments not commensurate with real market activities.

Lietaer called this complementary currency, or more pedantically, the use of sound money.

His main point was that there is no need to store value with currency, because conditions per every geography are variant, or polycultural.

What you want is an open system that adheres to the law of entropy — the measurement of a physical property that is most commonly associated with a state of disorder, randomness, or uncertainty — whereby all externalities (side effects) are accounted for. This is what this author specifically refers to as amortizing risk.

CENTRAL PLANNING & PRICE-FIXING

History is wrought with all sorts of economic distortions resulting from currency debasement by central planners, specifically central banks (or what the Bible described as money changing temples for usury).

Central banks have not only printed notes separate from Treasury without any intrinsic value, but have done so using citizens as collateral to back those notes.

In other words, in a central planning system, you don’t actually own the notes you use to make purchases or borrow on credit — you borrow against your own time, labor and right to life (your birth certificate). This construct exists whether you live in a capitalist system, where corporations own the commerce systems, or in a communist system, where governments own the corporations.

To add insult to injury, personal income taxation is a debit on your time and labor under the promise of subsidizing public utilities, such as social security, pensions and the construction of roads or schools. Problem here is, the vast majority of these taxes are used as funds which aren’t properly ledgered, and/or are squandered for nefarious if not downright criminal activity. Hence the shortfall in off-balance sheet activities in the many trillions of dollars, as central banking debt accumulates to irrecoverable heights.

To make matters worse, central bankers think that they can now reauthorize minted notes by digitizing them as automatic debits on your time, your labor and your health assessments. They call these digital currencies, or CBDCs (central bank digital currencies), but what they really represent are just a way to rehypothecate interbank debt, at the cost of unsuspecting taxpayers.

As ridiculous as this sounds, it is not surprising given that they are governed by their own laws that bypass constitutional mandates, and essentially have been using their reserves to buy up what should be public and private assets, at will. What was formerly known as “quantitative easing” to print money endlessly to somehow redistribute inflation, is now known as cloning, in which reserve notes are used to purchase and hold assets such as stocks, bonds and real estate holdings, unbeknownst to the public.

Meanwhile, appreciation for gold and silver has been driven out of the public consciousness. Gold’s price is fixed in back rooms by a handful of people, while central bank notes are interest rate adjusted with no real handle on asset valuations. In either case, there is no real means to distribute their inflation evenly, or redistribute their value to “common people”.

The recent silver squeeze is a classic example of how market forces turn on each other in order to make up for the delta in price reflections, or more accurately, price refractions, as in the case of the devalued USD. With bullion supplies bought up and hoarded, silver notes (IOUs, futures, etc.) go to the highest bidder, regardless of who is trying to “even out” the market. Otherwise known as backwardation, conditions whereby traders outcompete each other create higher prices in shorter timeframes.

With little understanding of what money or currency actually is, or its origins, the folly of politicians, bankers and so-called financial “experts” carries forward with patchwork monetary policies and outright financial fraud supported by the institutions we are supposed to trust.

There’s a reason why the rich are getting richer, the middle class is a fiction of the past, and the poor are more or less considered obsolete in economic reform efforts.

There’s also a reason why cryptocurrencies are not a solution in the ways they are thought to be.

THE CRYPTOGRAPHIC GAP

Most cryptocurrencies are thought of as instruments which can solve for things like stores of value and double-spends.

This is a half-truth.

As Lietaer pointed out, any currency that has physical use and physical weight as a utility does not need a store of value to determine its worth, whether it is tethered to a network or not.

This is because any real currency at once has physical uses to demarcate its value and transferable uses to manage its ongoing value. That is determined by its real uses in the real world, primarily free of speculation.

In other words, its entropy is not confined to the conditions of a market that cannot account for any and all factors driving its supposed intrinsic value.

You and I can agree that food is necessary to eat, water is necessary to drink, and energy is necessary to stay warm, and we can discern their intrinsic value, whether we use cash, credit or tokens.

With units of account (such as Bitcoin), each block is container of transactional data that connects to other blocks of transactional data.

With stores of value, trust is not thought to be necessary, or is treated as a given, because of the network itself. Yet, over 60% of online identities are synthetics or fakes. Which means you take on inherent counterparty risk by simply transacting within or across a network. Which also means that instability occurs no matter how immutable smart contracts may be.

Oddly enough, data structuring — that is, providing a wider range of data to include social, ecological and econometric information — is woefully absent from the design of most blockchains, distributed ledgers and DAGs (direct acyclic graphs). This is especially important in protecting public and private personally identifiable information.

And while identity protection is thought to be a given with cryptographic ledgers of all types, this article explains the work being done to authenticate and verify a real human being’s identity through SSI (self-sovereign identity).

With double spends, identities can be duplicated with wallets, and custody can be held by various parties, and so verification and provenance can be questionable, depending on the architecture of the blockchain or distributed ledgering system you are using.

Reality is, you can also route a theft of wallets, or canvass a network to fake transactions, which renders a double spend obsolete in its entirety.

Stablecoins are also the stuff of monetary lore, if you consider that very few if any have stable pegs to other currencies that aren’t volatile, or speculated upon. The more classic examples involve coins that are tethered to FIAT, or tethered to other non-fungible assets that have indiscernible value in the real world.

So, there are still not the proper protections in place that are required to actually avoid what is thought to be stores of value or avoiding double spends.

Neither FIAT, nor precious metals, nor cryptocurrencies, nor stablecoins represent these protections at scale, not yet at least. This is mostly because of market competition that emphasizes the arbitrage of trading on yield (volatility), rather than placing the focus on stabilizing the value of the units of account over time, and across networks.

If you still don’t accept these truths, then consider this: The FBI is among the largest holders of Bitcoin in the world.

SOUND INSTRUMENTATION

Alas, there are many silver linings (pun intended) readily available to us.

As mentioned earlier, the most important element in managing economic health is amortizing risk in real-time.

In doing so, it is also the case that the greatest hedge against flationary risk (inflationary, deflationary, reflationary and disinflationary), and specifically hedging on inflation, is in the responsible management of physical or fungible assets.

Why is this the case?

Because we all need to eat food, drink water and use energy without unnecessary interest rate adjustments that commodify the time and labor we put into their production, and ultimately, the consumption of goods, or the use of services.

To summarize what this looks like in terms of sound money, we should consider:

the issuance of money should be stable from the onset

the trading of currency should not require a store of value

the exchange of goods and services for barter should not be held back by speculative measurements of value

This is a stretch in logic given our dependencies on monocultural systems of finance and economics for all these years, but the time has come to get back to real fundamentals.

It is also the case that blockchains, ledgers and quantum technologies do in fact provide some of the fundamental programmatic logic for all of this, but they are not yet designed for non-flationary value.

This is an enormous opportunity space for those who are looking at the design of cryptographic systems that take social, ecological and financial parameters into full account. This is also where the evolution of smart contracts will reveal their value in spades.

NON-FUNGIBILITY AS AN ASSET HEDGE ON INFLATION

With all the buzz surrounding NFTs (non-fungible tokens), the hedge on inflation is mostly overlooked. A lot of this has to do with the inflexibility of smart contracts, such as ERC-1155, which is offered on the Ethereum blockchain.

NFTs are basically serial numbers that establish provenance (ownership).

Anyone can mint an NFT, but not anyone can secure a scarce asset using an NFT.

This is a critically important distinction.

Case in point: Most NFTs are used to trade or exchange an asset that actually belongs to a holding entity, with a central database, not a blockchain, as most people think they do.

Here are screenshots of how many NFT serial numbers redirect to centralized servers with a simple right click.

SOUND CURRENCY STACKS

Irrespective of what digital currencies enter the mix, or how they are speculated upon through market competition, we see a scenario unfolding whereby currency will take on more and more real world utility value.

If you consider that the Internet is being rewritten, web3 applications are becoming more progressive, truly decentralized carrier systems are being developed, and security is of the highest importance, currencies really have nowhere else to go but towards enabling more autonomy for people.

Natural programmatic logic will have to accelerate with a far better comprehension of how resources are managed within and across ecosystems to do this.

It’s an exciting evolution for those who are dedicated to fundamentals.

And yes, sound mechanics for developing currencies really do matter.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.