Doc's Daily Commentary

Mind Of Mav

Thoughts On The State Of The Crypto Market

DISCLAIMER: I am not a financial advisor and none of this is financial advice.

If there were any doubt that crypto is in a bear market, those doubts have now been vanquished. The last couple of days have been very volatile and brutal, and pretty much confirmed the bear trend. Altcoins have been getting completely destroyed, while BTC and ETH have actually held pretty strong, given the market conditions.

I think it is safe to say that most participants in the market expected BTC and ETH (and major altcoins) to reach way higher valuations during this recently finished bull cycle. Personally, I always believed that BTC and ETH would have traded above $100,000 and $10,000, respectively. However, those expectations revealed to be far from the reality. The market can be brutal and unexpected. It’s up to us to adjust our views on the market and try to position ourselves in the best way possible.

I personally believe that the current scenario in the world played a crucial role in ending this bull market sooner than anticipated (price-wise). The macro environment shows a lot of fear and uncertainty: inflation in the U.S. is at a 40-year high, the Fed is raising interest rates, the stock market has been plunging, there is post-COVID anxiety and, to make the scenario even worse, there is a war between Russia and Ukraine.

But what does this mean for the short-term future?

One thing is certain: all altcoins (with very few exceptions) will drop 95–99% during the following weeks/months. 95% of all cryptocurrencies will not make a new all-time high (EVER!) and will die. The other 5% will go through a very hard time but will probably recover in the next bull market.

The only thing that I know for sure is that BTC and ETH will eventually see new all-time highs in the years to come.

My thoughts at this point is to try to preserve as much firepower as possible and to not compare your peak net worth with your current net worth. The following months/years will be rough and depressing, but that is where the opportunity lies. Saving money and dollar-cost averaging is the best strategy to play here. Conviction and patience will reward you in the future.

Bull case for Bitcoin (and for the rest of the market)

It is very soon to try to predict bottoms but I am going to share my thoughts on where a potential bottom could happen and what are the levels that I am looking at.

First of all, it is important to consider that it is very unlikely that we have a V-shape recovery from the bottom (similar to COVID crash, in March 2020). It is way more likely that we have a prolonged bottom scenario like the one in 2015 and the one between December 2018 and March 2019.

That being said, what prices can we expect BTC to reach during this bear market? The 200 week moving average has proven itself as a great indicator for bottoms. In the last two bear markets, BTC bounced perfectly from the 200 WMA, including the COVID crash. Therefore, one could speculate that BTC might bounce from the 200 WMA again. Currently, it sits at around $22,000 but it is moving up everyday.

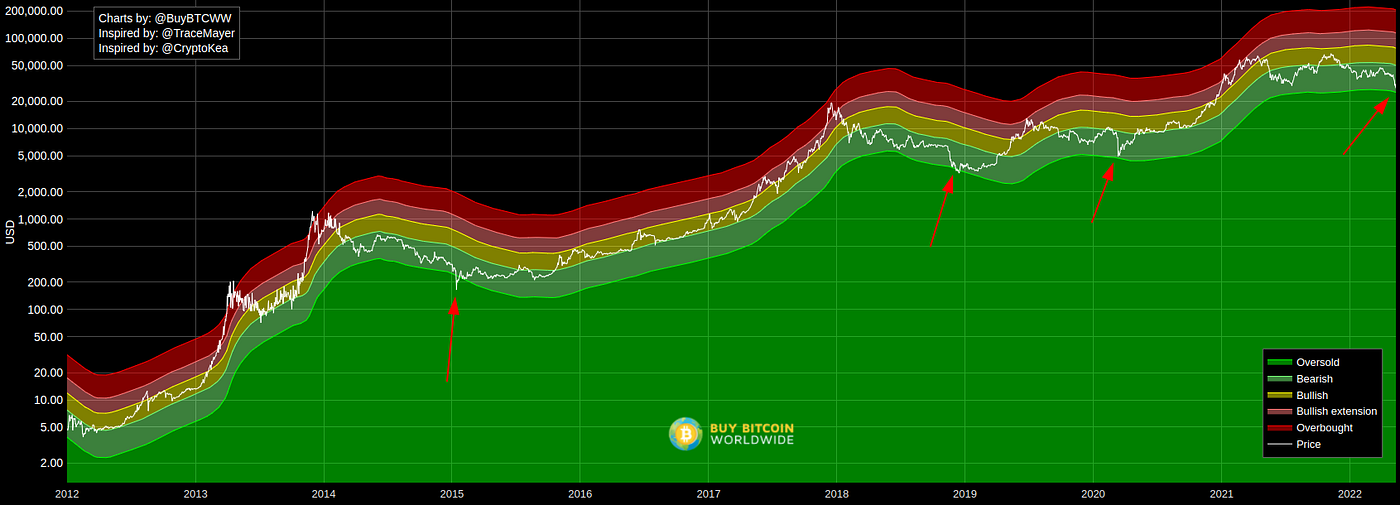

Another great indicator for both tops and bottoms is the Mayer multiple. These price bands, based on the 200 day moving average, show very clearly when BTC is overbought and oversold. Currently, the oversold price band sits at around $25,000. However, it is on a downtrend and may be a few thousand dollars lower in a couple of weeks/months.

Therefore, I expect BTC to bottom somewhere between $22,000 and $25,000. Nevertheless, this is a brutal market characterized by volatility. Thus, a wick bellow $20,000 would not surprise me at all.

The last two bear markets show that the bottom usually happens 50–60 weeks after the top. So, regarding the time frame, I believe there are two theories that we can use to speculate on when the bottom might happen.

1- The real market top happened in April 2021 and the November 2021 ATH was an “anomaly” that should have been a dead cat bounce: if we extrapolate the time frames from the last bear cycles, a realistic prediction for a bottom would be around the next 1–2 months.

2- The November 2021 top was the actual peak of the market: a realistic prediction for a bottom would be around the beginning of 2023.

(It is important to say that other events in the space also point towards a market bottom being near, such as Tether’s stablecoin (USDT) FUD, altcoin capitulation and extreme bearish sentiment.)

Final Considerations

I have no doubt in my mind that Bitcoin and Web3 are here to stay, and so is the cryptocurrency market. Bitcoin and Ethereum will obviously survive and thrive.

I expect BTC to be continuously adopted by nation states in the next two years, following the example of El Salvador and Central African Republic in declaring BTC as legal tender. Moreover, I expect that more and more companies will follow MicroStrategy and Tesla in holding BTC in their balance sheets.

Ethereum will soon move to Proof-of-Stake (The Merge) and will become a deflationary asset. For that reason, I also think that it is very likely that companies eventually start holding ETH in their balance sheets. Furthermore, adoption in Ethereum’s Layer 2s (in particular, Arbitrum, Optimism, Starknet and zkSync) will increase rapidly over the next 1–2 years (maybe even less than that) and gas fees will start going down. Speaking of Layer 2s, Arbitrum will soon follow Optimism and airdrop a token to early users. Later, StarkNet and zkSync will do the same. Be smart: try these rollups and experiment on them; they are way faster and cheaper than Ethereum’s mainnet, and the probability of you getting an airdrop worth 4 figures is insanely high.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.