Doc's Daily Commentary

Mind Of Mav

IDOs: All Hype or All Substance?

I analyzed 39 IDO projects held on Polkastarter in the past 6 months and found that buying tokens at an IDO and selling them an hour later on Uniswap can yield over 2,000% in profits, while selling after a few weeks can increase the ROI to 2,700%.

However, the long-term survival of the IDO model is under question.

The crypto industry is incredibly inventive when it comes to fundraising. Almost every year, the community gets excited about a new investment model, builds a massive hype around it, ends up disillusioned, and moves on to the next idea. We’ve gone through ICO, STO, IEO – and now it’s the turn of IDO, or Initial DEX Offering.

Polkastarter DEX is built on Polkadot and has emerged as one of the largest IDO launchpads. It owes its popularity to its low swapping fees and cross-chain token pools, which allow users to trade tokens issued on different blockchains. Out of the 54 recent IDOs listed on CoinMarketCap (some of them in the ICO category, but on IDO launchpads), 14 (26%) were held on Polkastarter, as opposed to 6 each on Duckstarter and Balancer, 5 on Poolz, 3 on BSCpad, and 2 on Ignition.

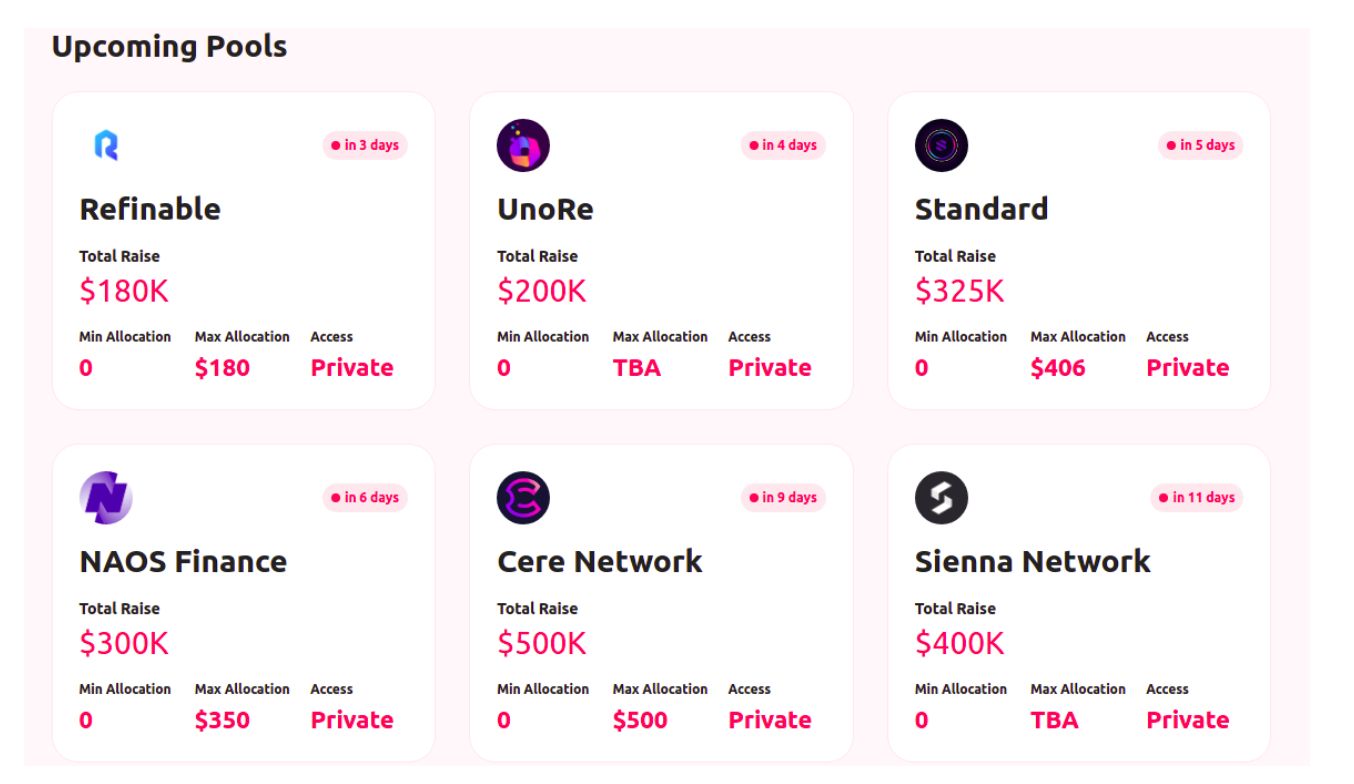

Image: Polkastarter

1) Every IDO pool has a maximum allocation, so the amount of funds that can be raised is capped – for example, $500k;

3) Users have to be whitelisted and pass a KYC by submitting a copy of their ID and a selfie;

5) The IDO is scheduled for a specific time, such as 4:00 PM UTC, and lasts one hour and a half, though the pool usually sells out faster. The IDO price is fixed.

7) Once the IDO ends, the buyers can claim their tokens and sell them on Uniswap if they wish.

Average listing returns for IDO investors: +2,347%. Across the 39 projects under study, buying tokens at the IDO price and selling them on Uniswap immediately after listing would have earned an investor over x23. However, this number is purely indicative, because in some cases there is a 20-30 minute gap between the listing and the moment when IDO investors can claim their tokens.

Average returns as of March 30: 2,761%. As it turned out, holding tokens for a few weeks can yield more than selling them immediately as they are listed on Uniswap. IDO investors with ‘strong hands’ made an average of x27 on their contribution.

Highest IDO ROI as of March 30: 11,060% (SuperFarm). Those who bought SuperFarm tokens at the IDO on Feb 23 and held on to them until March 30 earned a whooping 11,060% on their investment as the token appreciated from $0.025 to $2.79.

Joining after the listing yields 65 times less profits than participating in IDOs

In a stark contrast with IDO investors, those who bought tokens on Uniswap once they were listed earned an average of 36%, or 65 times less than those who joined the IDO.

Granted, 36% in a couple of months is still a great result, but this average value hides vast differences between the winners and the losers. The project that enjoyed the highest price increase between listing and March 30 was Ethernity (+704%), while the worst performer among the 39 projects in the study was DAOventures with -73%.

IDOs are not magic money machines – nothing in crypto is. For every investor who makes x23 on Polkastarter, there are many who end up in the red. It’s crucial to realize that the IDO model is fraught with problems, the three most serious ones being the following:

An even more cunning scheme is using bots to buy lots of tokens at the very start of an IDO, while they are cheap, then spam the blockchain to prevent other users from buying them until the price rises – at which point the bot offloads the tokens.

Studying the data, in early 2021, IDOs easily outperformed Bitcoin, Ethereum, and even BNB in terms of ROI. However, this fact points only to the level of hype surrounding IDOs rather than to any specific merits of IDO tokens.

Of course, this investment strategy can be damaging to the projects themselves, because it favors speculation, not long-term investment. Yield farming is one way to encourage IDO buyers to hold tokens in the long term, but it’s unsustainable, as Vitalik Buterin himself pointed out. As users sell their rewards, the market gets flooded with tokens, and the price eventually drops.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.