Doc's Daily Commentary

Mind Of Mav

Which Polkadot Projects Are The Most Promising?

As the Ethereum 2.0 upgrade is again delayed until July, following a year-long series of delays, are other programmable blockchains using this opportunity to gain traction amid skyrocketing ETH Gas fees?

If you want to avoid exorbitant fees by using Ethereum’s many DeFi protocols, NFT marketplaces or stablecoin transfers to fiat money, there is not much an ordinary user can do. In February this year, the ETH Gas price was at an all-time-high of an incredible ~$40 per transaction, which would put even the most backward and greedy bank to shame.

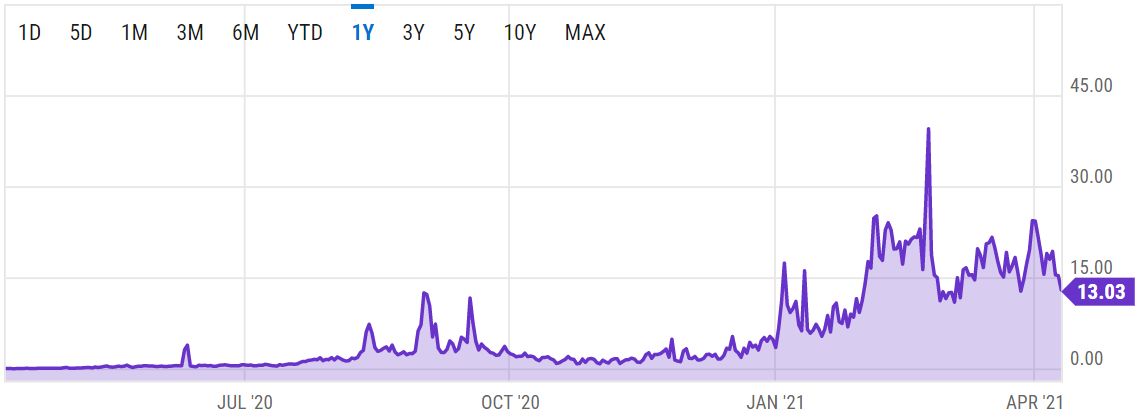

Source: ycharts.com

As of now, if you are a developer and want to avoid this debilitating pricing friction, you could make a workaround by deploying an Ethereum sidechain, either Matic or xDai:

Whether you choose xDai or Matic to deploy your dApp in order to avoid high Gas fees, you can then deploy it to Optimism Layer 2 once it unrolls. This is the recently delayed scaling solution that has been postponed until July 2021, which is supposed to launch on Ethereum’s Public Mainnet.

While it’s always good to know which workarounds are at your disposal, they do not make for mainstream smart contract adoption. More importantly, both xDai and Matic are dependent on Ethereum. Let’s say that the Ethereum Network is magically scrapped from existence tomorrow. Is there a similar blockchain that can host dApps — smart contracts — while also offering scalability and sustainability of the proof-of-stake (PoS) consensus algorithm?

Among dozens of Ethereum alternatives, not many have fully programmable smart contract features. For instance, the often-mentioned Cardano by Charles Hoskinson is still on the road to making this a reality. Other notable Ethereum alternatives that are generalist in their scope include the following:

Qtum – Alongside its vast, electricity-guzzling mining network, Bitcoin owes much of its security to UTXO (unspent transaction output) model. Qtum leverages UTXO and both EVM and x86 VM smart contracts into one hybrid, open-source Ethereum alternative. Recently, on April 7, Qtum announced a partnership with the Indacoin crypto exchange. Effectively, what Bitcoin blockchain seeks to do with the Lightning Network, Qtum does natively, while also being PoS instead of the energy-demanding PoW.

Solana – A Web 3.0 blockchain created by Anatoly Yakovenko in 2017, Solana offers a wide range of blockchain innovations. From Proof-of-History and Gulf Stream to Turbine and Pipelining, Solana offers transaction speeds comparable to Visa, which means they are instantaneous. Thus far, Solana has accounted for over 15 million transactions with an amazing $0.00005 average transaction fee. As a result, the Solana ecosystem holds a massive number of projects across all categories. Its own trustless bridge to interface with Ethereum is called Wormhole. Last week, Solana’s (SOL) price surged by at least 20%, thanks to its newly formed partnership with the FTX exchange.

Source: TradingView, boosted confidence in Solana as the ETH alternative’s native SOL token soars.

Polkadot Hype Explored

Polkadot stands out in terms of its credibility and the ambitious scope of blockchain problems it aims to resolve. Its credibility is owed to the impressive career of Dr. Gavin Wood, the creator of Polkadot. Not only was he one of Ethereum’s co-founders but he is also the creator of Solidity, the foremost programming blockchain language present in Ethereum and other alternatives. But wait, he is also the founder of Web3 Foundation, giving grants to projects that make the internet more open and amenable for AI systems to exploit.

Source: Electric Capital

Here are the Polkadot projects that are live, close to live and most importantly, are the most promising.

ChainLink (LINK)

Because of its obvious utility of linking real-world assets to the blockchain ecosystem, this week, ChainLink has been adopted by Grayscale Investments into its Digital Large Cap Fund. This follows Synthetix integrating ChainLink into its delivery of synthetic stocks, such as Tesla, on the Ethereum blockchain.

Given the current environment of aggressive mass censorship, which is at different times under the guise of different censorship frameworks — hate or misinformation — it is more important than ever to develop a censorship-resistant social networking platform. Polkadot’s SubSocial is one such Web 3.0 solution.

Polkaswap (PSWAP)

More notably, Polkaswap’s contribution to blockchain development is its liquidity aggregation algorithm (LAA). This means that your exchanges will be conducted from a selection of the best offers existing across all liquidity pools that are present on the network. Lastly, Polkaswap will work in conjunction with another Polkadot project — Sora and its XOR token. If you don’t like the concept of central banks, Sora has you covered.

Kickstarter and GoFundMe are great services, except for losing a big chunk of the funds raised to pay for their mediation. Moreover, they are not available in most parts of the world. Likewise, if someone has an issue with your worldview, you could be de-platformed at a moment’s notice. Polkastarter aims to solve these issues as a decentralized crowd-sourcing platform.

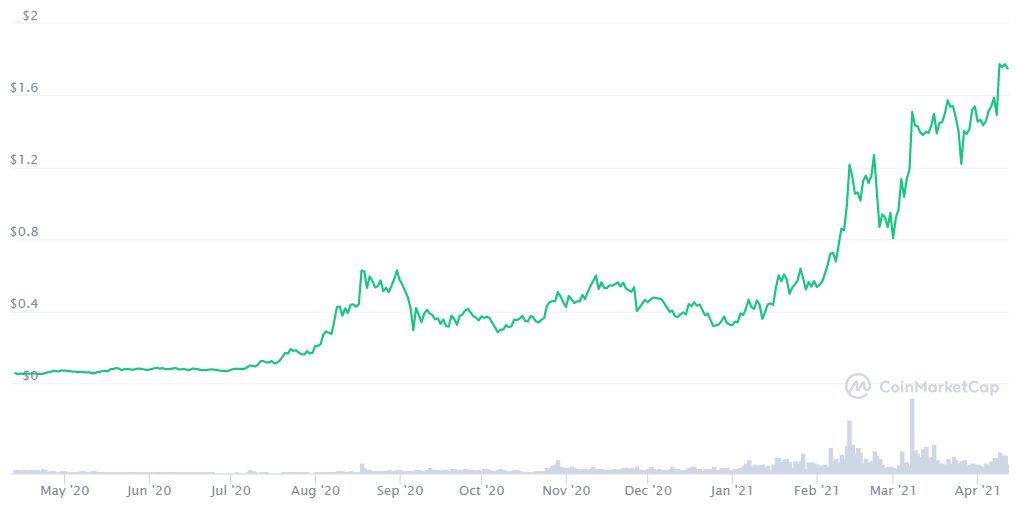

After the KuCoin heist last year, the cyber-criminal pilfered 21 million OCEAN tokens. As a result, the Singapore-based Ocean Protocol Foundation initiated a hard fork. which was finalized on 27th September. As you can see from its token’s price movements above, this didn’t have much of an impact. The reason for this is Ocean’s unique value proposition. We are now in the full swing of the information age, which translates into “data = money”.

Source: Statista, immense data volume growth of 2850% in just 10 years.

People often use the analogy of comparing Facebook to Myspace, with the latter, previously the more dominant one, becoming superfluous. Yet, Myspace still exists. Given its decentralized and compacted nature, this applies even more to the blockchain space. While some blockchain ecosystems will be larger than others, they will be interoperable and all based on some variation of the Proof-of-Stake consensus algorithm — bonded, pure or nominated.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.