Premium Daily Crypto Newsletter

November 7, 2018Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

Mav's Daily Commentary

Market Slows As Bitcoin Catches Up

Despite Positive Price Movement, BTC Dominance Has Dropped 3% In Past Week As Alts Start To Rally

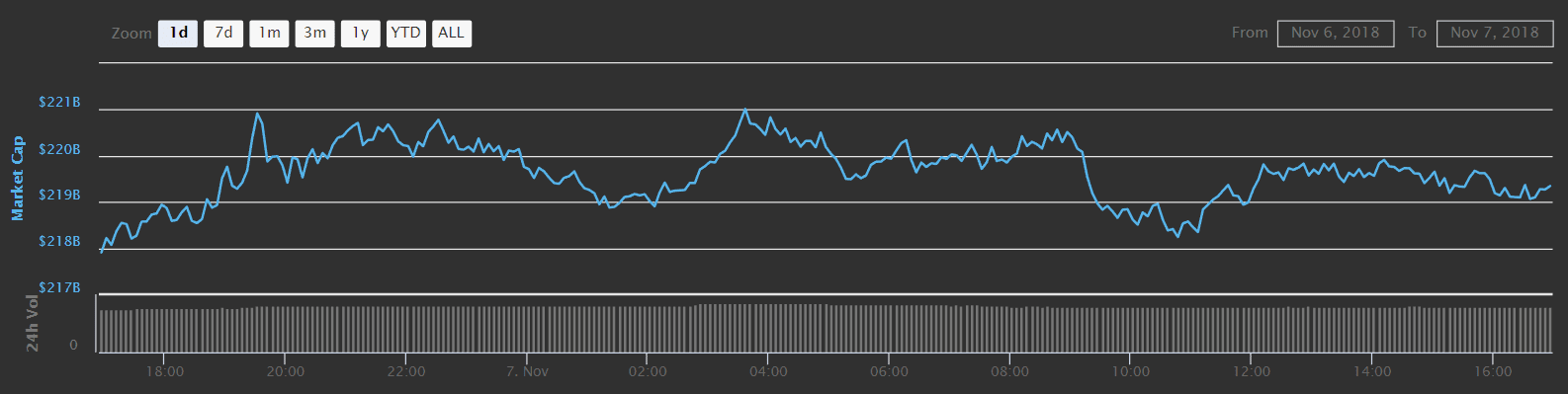

The market seemed to top off today as we hit 220 Billion overall and struggled to break through that mark.

Overall I’m liking where the volume is right now. What’s not evident from the macro view is how the market redistributed itself today. Sensing that alts have appreciated nicely, investors took their profits and redistributing gains to Bitcoin and other similar tokens that have remained stagnant.

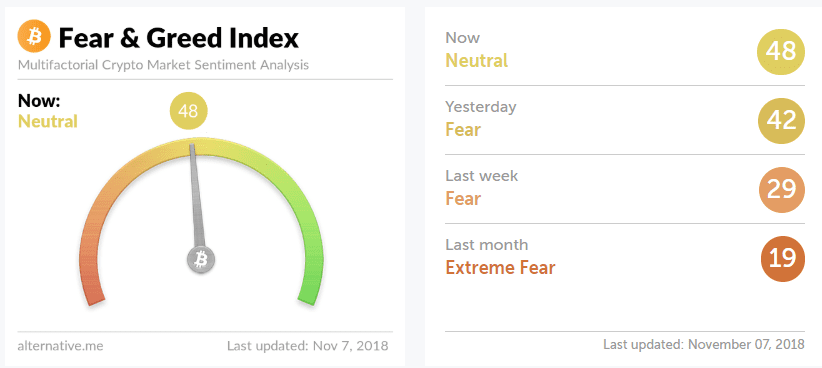

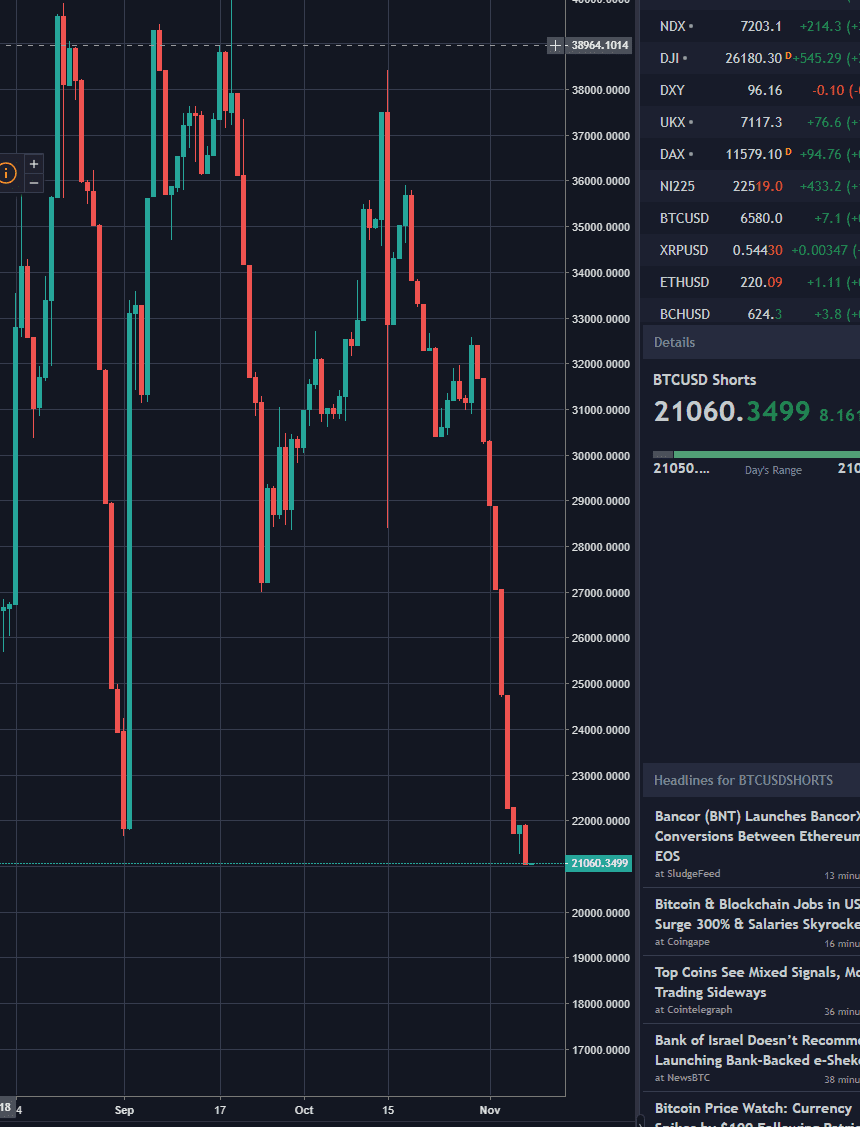

It wouldn’t be a bad move to open small longs on BTC here, and take profits sequentially as we’re seeing an overly greedy market right now. Consider laddering your longs around support levels of 6450 and 6400.

I’m watching BTC for a 6600 breakout. If we can get through that, we should see more aggressive volatility as shorts begin to cover. Understandably, they’re still very much down for the month.

While I think there could be a surprise bear move that could wash away all of this feel-good sentiment the market is on right now (as we’ve seen in just about every recent month), we do have the beginnings of a determined market.

Today we received more indications that banks are moving hard on cryptocurrency. Moreover, they don’t intend on being usurped by decentralized technology and innovation.

Instead of ignoring blockchain, financial organizations are scrambling to leverage it for their own benefit. I’ve talked about how it’s currently a horse race amongst some of the biggest banks on the planet, and today was no exception.

We learned of their latest attempt at breaking ground: a consortium of fifteen banks are working with The Depository Trust & Clearing Corporation (DTCC) to use a blockchain-based system for trading credit derivatives.

What we know is that DTCC is building a cloud-based distributed ledger, aimed specifically at its credit derivatives trade and information warehouse.

While 14 of the banks involved are unnamed, British multinational investment bank Barclays is known to be involved in the trial.

DTCC’s TIW distributed ledger will go live after Q1 2019

Lee Braine of Barclays was quoted saying, “We are pleased to be working with DTCC, our partners and colleagues on this exciting project to bring distributed ledger technology to life in a demonstrable way that will enhance efficiencies and lower costs and risks for the industry”

Here is what you need to know:

You probably haven’t heard of DTCC. It’s alright, neither have I. And yet, DTCC processed over $1.61 quadrillion in securities transactions in 2017.

Think about the potential of disrupting even 1% of that figure. It’s certainly possible given the archaic infrastructure DTCC is using.

Even still, they process over 95% of all credit derivatives globally. They serve a the transaction and settlement point connecting hundreds of banks and financial organizations across the world.

But, as we know, any centralized conduit is ripe for disruption by a distributed ledger, especially one that is faster and more secure.

To their credit, DTCC have chosen to embrace blockchain as a nascent technology instead of ignoring it.

However, they are simply trying to replicate their existing warehouse model on a blockchain. It’s the same uphill battle we’ve seen play out over and over this decade: newer technology moves faster than old methods trying to adapt. Why was Amazon able to completely demolish the brick and mortar retail industry? Because they didn’t have to try and retrofit an existing solution or method. They simply needed to improve upon it.

So, when it comes to what DTCC is doing, they are ripe for disruption because they simply are approaching this from a corporate perspective: lower costs by retrofitting the current system instead of building from the ground up.

This represents a huge opportunity for the entrepreneur able to challenge the DTCC’s monopoly. We’re still years away from any serious contender, but nonetheless the fight is very real.

What excites me the most is that this is just one industry of many that blockchain is suitable for and disruptive of.

I hope your seatbelts are fastened. We’re in for a big decade ahead.

Watch Doc’s recent online classes here and here on “Four Rules to Chart Like a Pro.”

We’ve started to produce episodes for The ReadySetCrypto Podcast; all of our episodes are posted on our blog (and on iTunes) and Episode Fourteen is now available. Episode Fourteen is entitled “Atomic Habits and the Four Maxims of Trading.” Look for more episodes shortly as we comb the crypto space for valuable interviews, and create valuable content to keep you in the loop! See you tomorrow!

Doc's Daily Commentary

Our Weekly Premium-Only Livestream

Our next ReadySetLive session will be this Wednesday evening at 2000ET/0000UTC. Watch for the link below and set a reminder for yourself! Doc’s latest “Trade School” video is also listed below; we announce those with links in the Premium Chat room of the Discord page.

Our Public Livestream

New to Cryptocurrencies? Check out our archived classes “Intro to Cryptocurrency Trading”, “How to Find Your Next Big Cryptocurrency: Intro to Fundamental Analysis,” Mav’s class on “Security and Wallets” and Doc’s classes, “Introduction to Technical Analysis” and “Short Term Trading Strategies” which are now all available for immediate purchase in our Store, and seconds away from viewing in the Premium Member’s Home. View more about them at our online store by CLICKING HERE.

Listen to Doc’s presentation “Four Powerful Rules for Crypto Trading” here!

Sign up for our NEW Telegram channel by clicking here!

Watching on Mobile? Click this link to watch in HD

Check out our BLOG for the latest videos, posts, and Podcasts! Click this link and bookmark the page!

If you go to buy any of our courses at our online “store” you can receive $10 off the street price with your member’s “coupon code” of member18crypto

Check out our new merch store! Simply go into the regular store and select “Merchandise” to pick up some RSC merch!

Offense – Adding Trades

Offensive Actions for the next trading day:

- If breakouts support going long, keep position size small.

Defense – Managing Risk

Defensive Actions for the next trading day:

- None.

RSC Managed Crypto Fund

How to read this portfolio: Please read through the FAQ tab

- ETH/USD 2% added 8/10/2018 @ $363.14

- ETH/USD 2% added 9/9/2018 @ $200.50 (10% more to add)

- LTC/USD 2% added 8/10/2018 @ $62.56. (5% more to add)

- XMR/BTC 2% added 9/21/2018 @ .018BTC

- BTC/USD 2% added 11/7/2018 @ $6501

RSC Altcoin-Exclusive Crypto Fund

Technical Analysis Research

Take initial positions on the first breakouts, but expect volatility. Make sure that you’re using small positions that you aren’t going to panic and sell if they go underwater, as most of them will before long. It’s a rare first breakout from a consolidation like this that actually gets traction.

In August we introduced a new “fund” project that we’ll be creating over the next few months, in piecemeal form. I will be slowly and methodically creating a “fund” with (currently) 23 assets that we will do “live” or at least very plainly indicate where we intend to enter portions of assets. As long as the market continues grinding down in a bear, we will use sentiment-based entries to hopefully secure a better entry. All that I saw were bear flags tonight; we are close to some good entries on coins showing positive divergence on the RSI.  Going forward into the end of this year my plan is to do a LOT more swing trading; what would really help is a decent derivatives exchange. I am looking for big things from Digitex in this regard, which will be a commission-free futures platform however all trades must be made in DGTX as the base currency. Put yourself on the waitlist for this platform by clicking here. I have started to acquire DGTX tokens at Mercatox in anticipation of them turning up their platform, and this looks to be a good candidate for a pump prior to the production event. Here are the recent swings that we’re tracking in the portfolio below; :

Going forward into the end of this year my plan is to do a LOT more swing trading; what would really help is a decent derivatives exchange. I am looking for big things from Digitex in this regard, which will be a commission-free futures platform however all trades must be made in DGTX as the base currency. Put yourself on the waitlist for this platform by clicking here. I have started to acquire DGTX tokens at Mercatox in anticipation of them turning up their platform, and this looks to be a good candidate for a pump prior to the production event. Here are the recent swings that we’re tracking in the portfolio below; :

- DGB/BTC – long @ .00000608 (7/23). My target exit is .000008BTC.

- WTC/BTC – Long @ .00155980BTC (4/23). My target exit is at .002BTC.

- ADA/BTC – Long @ .00003931BTC (5/1) My target exit is at .00005BTC.

- ONT/BTC – long @ .0008905 (5/20) My target is .0013BTC.

- ETP/BTC – long @ .000522BTC (9/21) My target is .00072BTC

Please keep in mind that if you want to follow these trades, I am using FIXED RISK POSITION SIZING. This means that I am using a fixed amount of risk capital that is based on my account size, like 2%. I am assuming that the trade will burn to the ground and that I will lose that entire capital position! Only in this manner can one effectively manage a position the way that you have to. If you’ve every checked your blockfolio nervously every 5 minutes when you’re underwater, this will prevent that. I will track these positions in this area and not in the main portfolio section. I will use a public portfolio tool to do so, which you can access by clicking below:

Public Swing Portfolio Link

I hope you all got a chance to catch my webinar class from earlier this year; if not, the replay is available here. If you missed my earlier webinar, “More Profits in 2018; Ten Ways to Chart Like a Pro.” then you can catch the replay here. My new class “Introduction to Technical Analysis” is now available via our online store.

If you go to buy any of our courses at our online “store” you can receive $10 off the street price with your member’s “coupon code” of member18crypto..

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio and/or Delta to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

I am also trialing the Profit Trailer and CryptoHopper trading apps which are working well in this choppy market.

Fundamental Currency Research

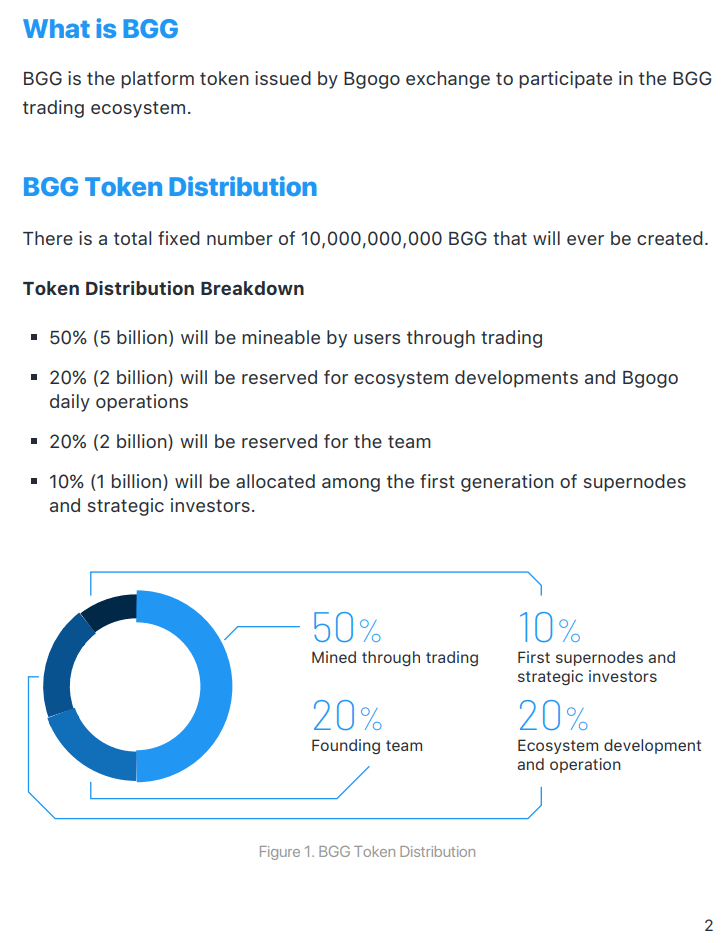

Bgogo Exchange

For flipping Good.

For long-term holding Neutral.

What is it?

What is our verdict?

What we like: Supernodes are very interesting. No trading commissions for users.

What we don’t like: There are many exchanges already on the market. Transaction mining isn’t currently solvent.

- Project name: Bgogo Exchange

- Token symbol: BGG

- Website: https://bgogo.com

- White paper: https://bgogo.com/assets/white-paper/BGG-Token-Whitepaper-v1.8EN.pdf

- Hard cap: 17,000 ETH (15,000 ETH during private sale and to supernodes, 2,000 ETH during public sale) for 10% of total tokens

- Conversion rate: Private sale: 1 ETH = 66,666 BGG; public sale: 1 ETH = 69,999.3 BGG.

- Maximum market cap at ICO on a fully diluted basis: $51 million based on current ETH price of $300

- Bonus structure: Whitelisted public sale participants have a 5% bonus over the private sale price, with no lockup period.

- Private sale: The private sale has already been completed with 10,500 ETH raised from 21 supernodes and 4,500 ETH from strategic investors.

- White list: Bgogo’s public sale will be a Genesis Mining event (exact date to be confirmed) that will start 24 hours before mining is officially opened to the public. Only whitelisted users can participate. Details on the Genesis Mining event can be found here: https://bgogo.com/announcement?link=mining.

- ERC20 token: Yes (will be switched to native tokens when the mainnet is launched)

- Countries excluded: TBA

- Timeline: TBA

- Token distribution date: TBA

Website: https://bgogo.com

Whitepaper: https://bgogo.com/assets/white-paper/BGG-Token-Whitepaper-v1.8EN.pdf

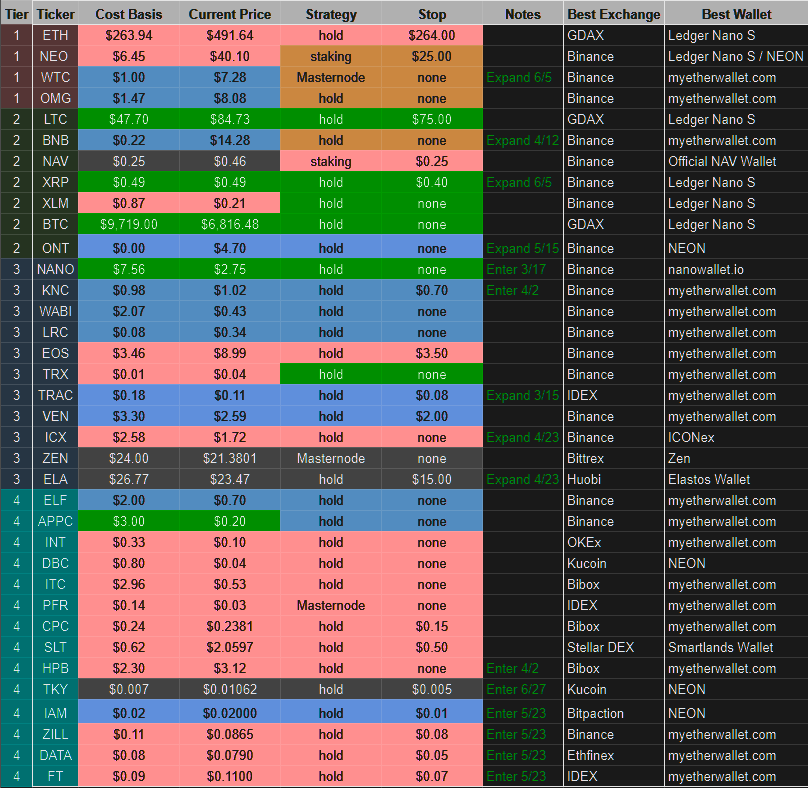

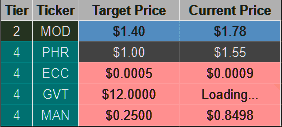

2017- 2018Q2 Portfolio (Discontinued)

Desired Holdings

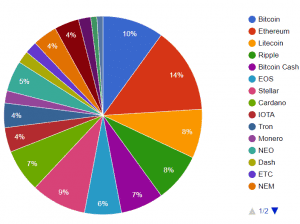

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

Tier 4

ZIL

IAM

FT

DATA

ELEC

None.

Tier 2

MOD

Tier 3

REQ

SUB

LINK

NANO

KNC

Tier 4

BNTY

TAU

WISH

PHR

LOCI

XBY

ELA

ECC

POE

HPB

BIX

EVE

XVG

NULS

DNA

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.