Doc's Daily Commentary

Mind Of Mav

The Smart Money Bitcoin Bull Run

This Bitcoin rally that we have just experienced is even more promising than what some may think.

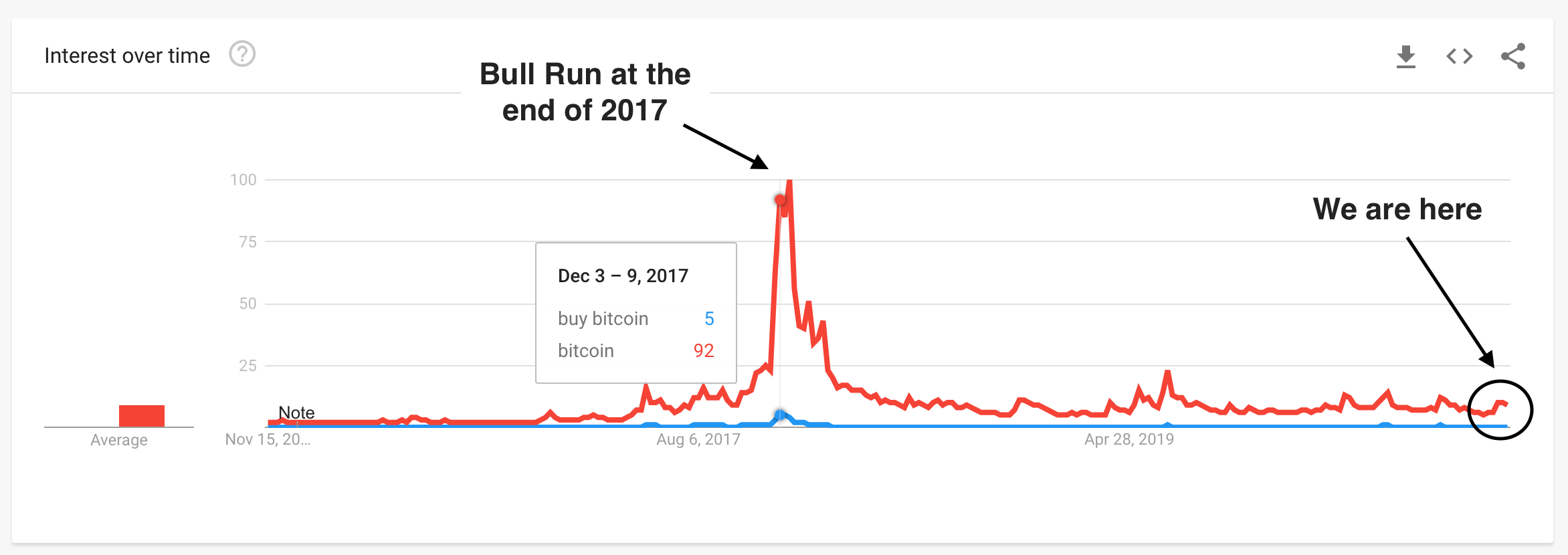

To understand this, I suggest you look at the Google search volumes for the terms “Bitcoin” and “Buy Bitcoin”:

As you can see, at the peak of the Bull Run at the end of 2017, madness had seized the Web regarding Bitcoin. Interest in Bitcoin had then overtaken the Bitcoin world, but also that of the financial markets.

The general public wanted to discover what Bitcoin was. The number of people wanting to buy Bitcoin was literally exploding day by day. At the peak of the Bull Run in 2017, Coinbase was receiving up to 100,000 applications per day.

So, how does that compare to the small bull rally we just experience, and who was driving it?

Well, the number of addresses with at least 100 BTC reached a 7-month high after the latest Bitcoin rally. This is a sign that does not deceive. The investors with the most means were in the maneuver.

The Whales are more and more numerous. This indicates that confidence in Bitcoin for the coming months continues to grow.

More favorable regulation for Bitcoin could speed things up

Institutional investors will continue to flock to Bitcoin, while large companies will follow the lead of MicroStrategy and Square. While the arrival of PayPal will not bring 346 million new Bitcoin users overnight, it will bring undeniable credibility around Bitcoin to the general public.

The election of Joe Biden as the new President of the United States opens up prospects on several levels, but the most important in the long term is the establishment of a favorable regulatory environment for Bitcoin. This is probably the last thing that is really missing right now for Bitcoin and crypto as a whole to gain more widespread adoption as fiat currencies start to go digital.

The Biden Bitcoin Boost To Come?

We are not there yet, but things continue to move in the right direction for Bitcoin.

As Bitcoin’s price rises in the coming months, interest from the general public will also rise. As the positive feedback loop churns, this will lead to even more players in the Bitcoin world.

Don’t be surprised if $15k is considered “cheap” in the months and years to come.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.