Doc's Daily Commentary

Mind Of Mav

How To Discover The Next Big Disruptor

Making money is quite a proposition today.

There are so many micro variables & macro trends to consider: economics, politics, societal shifts, pandemics (thank you, 2020), conflict, climate, consumer behaviors, company financials, market emotions, and so much more.

Honestly, it’s a dart toss on the best of days (or years).

But, there’s one trend that you can always bet on: human innovation & tenacity.

Confronted with the worst the world has thrown at them, humans as a species have always out-thought and out-maneuvered their problems.

As humans, we shape our worldview through our technology.

We were hunter-gatherers until we developed agriculture, which let us become more sedentary. Every major innovation changed human society and humans with it.

So, as an addendum to the earlier adage of always being able to bet on human innovation, we as investors can always confidently bet on technology.

In a sense, technology is always the next big thing.

Makes sense, right?

After all, how are we going to overcome a global pandemic? Where everything else has failed, technology will solve this crisis and prevent future ones. Moreover, it will help us build a better and more robust society as a result.

So, always bet on promising new technology.

Technology ETFs

Now, if you want to take the easy shortcut to invest in promising new technology trends years before they are mainstream or are going to market, I’d suggest you start by researching ETFs.

For those unaware, ETFs are essentially a basket of assets (like stocks) that you can easily invest in with one ticker. The ETF manager takes a small cut to run the ETF and rebalance the fund to the target allocation and performance targets.

Put simply, ETF managers who run future-focused funds are experts in finding the next big disruptors.

If you’d like a perfect example of this, simply follow ARK Investing to see what they’re eyeing (see https://ark-funds.com/).

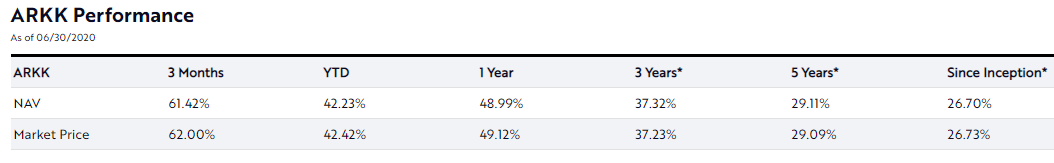

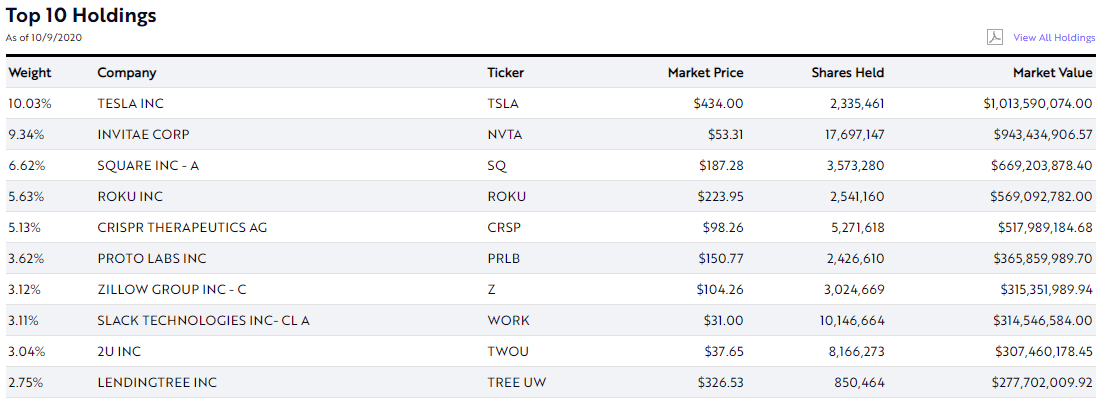

You could take a step even further and just buy a bunch of ARKK and let them do the work for you:

You should also research their other ETFs, such as ARKQ, which is focused on autonomous vehicles, energy storage, robotics and automation, 3D printing, and space exploration, or ARKW, which has exposure to the “Next Generation Internet” including artificial intelligence, big data, cloud computing, cybersecurity, and blockchain technology.

Something to keep in mind is that they are not secret about their portfolio holdings or allocations for each ETF. Looking into each ARK ETF gives you ~50 stellar companies to consider for research and investing directly into.

ARK is not alone, however, as there are other companies building future-focused ETFs you can consider.

In particular, I’d recommend Invesco’s QQQ:

As well as BOTZ / SNSR / LIT / FINX / CLOU from GlobalX ETFs:

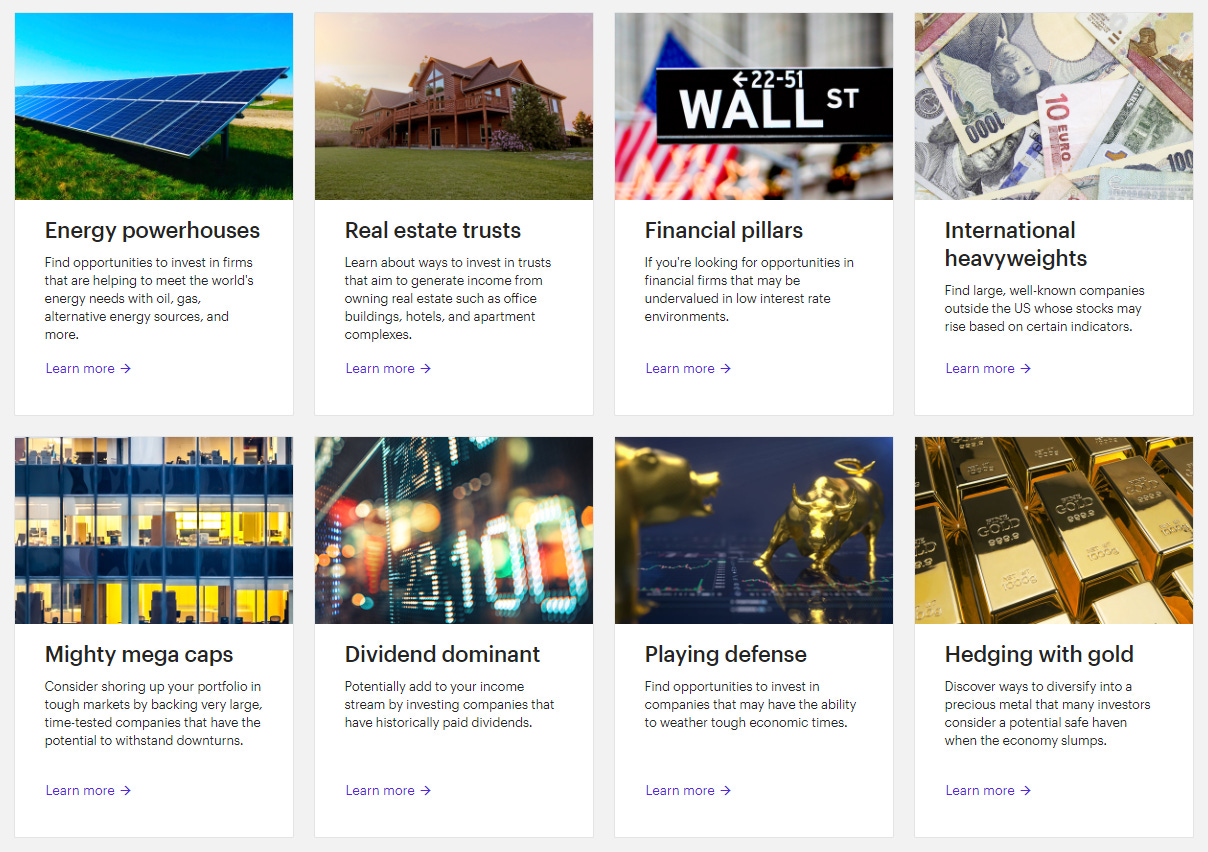

Lastly, I’d suggest searching for “Thematic Investing” or “Thematic Insights” offered by major brokers and other intelligence platforms. These will give you pre-built portfolios and funds geared towards a certain trend or niche.

For example, the thematic investing portals from Fidelity and ETrade in particular are fantastic examples of curated themes that let you cater an approach based on your values or economic, technological, and social trends.

Elsewhere, you can find similar collections from more “open-source” and “investor-focused” applications like Robinhood and M1Finance especially.

For example, here is a curated list of Blank Check companies, otherwise known as SPAC IPOs, offered and tracked by Robinhood.

Elsewhere, you can get really professional or really comical “pies” offered by M1, such as the “White Girl Index” which tracks stocks of brands that appeal to middle-class women browsing Instagram selfies while sipping pumpkin spice Starbucks on their $1200 iPhone. You know the type.

Emerging Tech Trends

So, let’s talk about a few emerging tech trends, and dig into them.

In particular, just to name a few, here are some really interesting fields that will be surefire players in the years to come:

- Biotech/Life Extension/Gene Therapy

- Fintech

- Semiconductor

- Space Tourism/Commercial Space (way too early to invest)

- Augmented Reality/Virtual Reality

- Artificial Intelligence

- Robotics

- Human Augmentations (2030’s for sure)

- Clean Energy

- Electric/Autonomous Vehicles

- 3D Printing

Let’s go into a couple now.

Genomics

It’s already happening. As an example, before 2000, they rarely did genetic testing on tumors. Now, it’s so common to send a biopsy for a gene panel to see if there are targeted therapies available.

One of the first and oldest is Gleevec which is specific to the BCR-ABL gene fusion caused by a common chromosomal rearrangement that you could see with a microscope.

Fast forward to 2020 and we are using sequencing technologies (read largely on the Illumina platform) to find base-pair resolution mutations in tumors for treatment.

Note that genomics isn’t just about addressing cancer. It’s currently being applied to family planning and general health, as well. The technology is a little stagnant at the moment (cost of sequencing hasn’t declined), but people are finding new applications every day.

Not to mention the promise CRISPR editing has, now that it has been approved for research and is being developed around the world. Expect small specific treatments in the coming decade. A CRISPR (or some other more precise genome editor) revolution is still many years in the future, but that makes it great for investors which such a vision.

Automation

Another trend to focus on is Autonomous IoT (i.e., AIoT) powered by advances in wireless communication (e.g., 5G) capabilities.

Autonomous rideshare fleets get one step closer to becoming a reality. Given the size and reach of new communication towers, it is easy to see future cars being made with flexible solar paneling with their own miniature comm tower onboard.

This transforms vehicles from more than a means to transport something or someone from Point A to Point B; they become a node for the network powered by their own source of energy.

Sure, it’s hard to imagine a solar-powered car of the future becoming your new daily driver, but you’re not likely going to be the target demographic initially.

Instead, industrial/factory automation, with the help of these advances, will become drastically more streamlined and efficient.

It is also a tailwind for enhanced cybersecurity.

Cybersecurity

Terrorists crashing a fleet of autonomous vehicles on the L.A. freeway would be quite the scene.

Drone “servants” will boost commercial agriculture as well as household gardening. Imagine a drone that can survey your garden area, till the area, then direct another drone into shaping the soil into mounds and aisles while another drone deposits seeds and packs the dirt around them. This hive network of farming robots can be easily reconfigured and suddenly they’re a team sorting packages in Amazon’s warehouse.

Looking for advances in technologies that enable advances in other technologies is the central thesis by which we look to the future . . . and how to invest in it.

Then, you start getting into the stuff that we don’t even know yet. We’re dealing with many new technologies, and it is conceivable that someone will discover new ways of using them that were either impossible before or simply never considered.

New problems, new solutions, new thinking.

Let those guide your vision, and you’ll be well on your way.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.