Crypto Market Commentary

28 October 2019

Doc's Daily Commentary

The 10/25 Trade School with Doc is listed below.

Mind Of Mav

Catalysts Behind The Upcoming Monetary Failure & Rebirth

Today, the public is blissfully unaware of the inexorable trend of monetary debasement while enjoying the continuing benefits of government welfare. Government economists tell them that moderately rising prices, the consequence and justification for expanding the quantity of money and credit, are good for them. And who are they to question the experts?

Fortunately, people pursuing their daily lives usually adapt to the circumstances forced upon them by governments. A targeted two per cent inflation rate of prices is not overtly disruptive, and government statisticians have become skilled at goal-seeking price inflation figures. Everyone’s experience of price inflation is different, so government figures become believable by default. But for some considerable time, increases in peoples’ wages have badly lagged the price rises of their normal purchases, which bear little relation to the composition of governments’ consumer price statistics. Coupled with the financial freedom afforded to them to borrow, they have made up the difference between income and expenditure just like any modern government: by borrowing with little or no intention of repaying.

The cause of the problem people face is the continual destruction of their personal wealth by monetary inflation. It has led to a fundamental difference between the credit cycle today and those earlier described in the textbooks of the Austrian School of economists. Before Keynesianism took hold, investment in production was funded by savings. Those savings have been substantially destroyed. Instead of savings being a cushion against uncertainty, for practical purposes they no longer exist.

There are two consequences that concern us here. The first is that the burden of investment and its continuity now falls entirely on the state and its licenced banks, whose only recourse is yet more monetary expansion. The second is the almost total reliance today’s wage earners place on receiving their monthly salary to survive, with a reported 78% of US workers living pay-check to pay-check. British workers are similarly strapped. They have no means of surviving a credit crisis and the economic consequences that follow. That will be another cost that falls to the government and its central bank to add to already escalating welfare commitments.

Currently, there are a few countries experiencing hyperinflation. To name a few, Zimbabwe, Venezuela, and South Sudan are all seeing record inflation rates with Argentina posting in 2018, the highest rate in 27 years. With bitcoin gaining global traction, along with how easy it is to purchase, people that reside in countries facing currency devaluation, may start to hedge their savings against their government’s actions via Bitcoin.

Not only do governments devalue the currency, Central banks do too but through interest rates and other manipulative monetary policy. Two of the largest central banks are currently manipulating the market as we speak. The Federal Reserve (Fed) and the European Central Bank (ECB) are and have been using a set of controversial methods to “loosen” and “tighten” the economy. They accomplish this by what’s known as Quantitative Easing (QE) and Quantitative Tightening (QT.) Simply put, QE increases supply and demand, by lowering interest rates and making large scale asset purchases and QT does the opposite. Theoretically, this gives commercial banks capital to lend, and with the reduction of interest rates, encourages consumer and commercial credit.

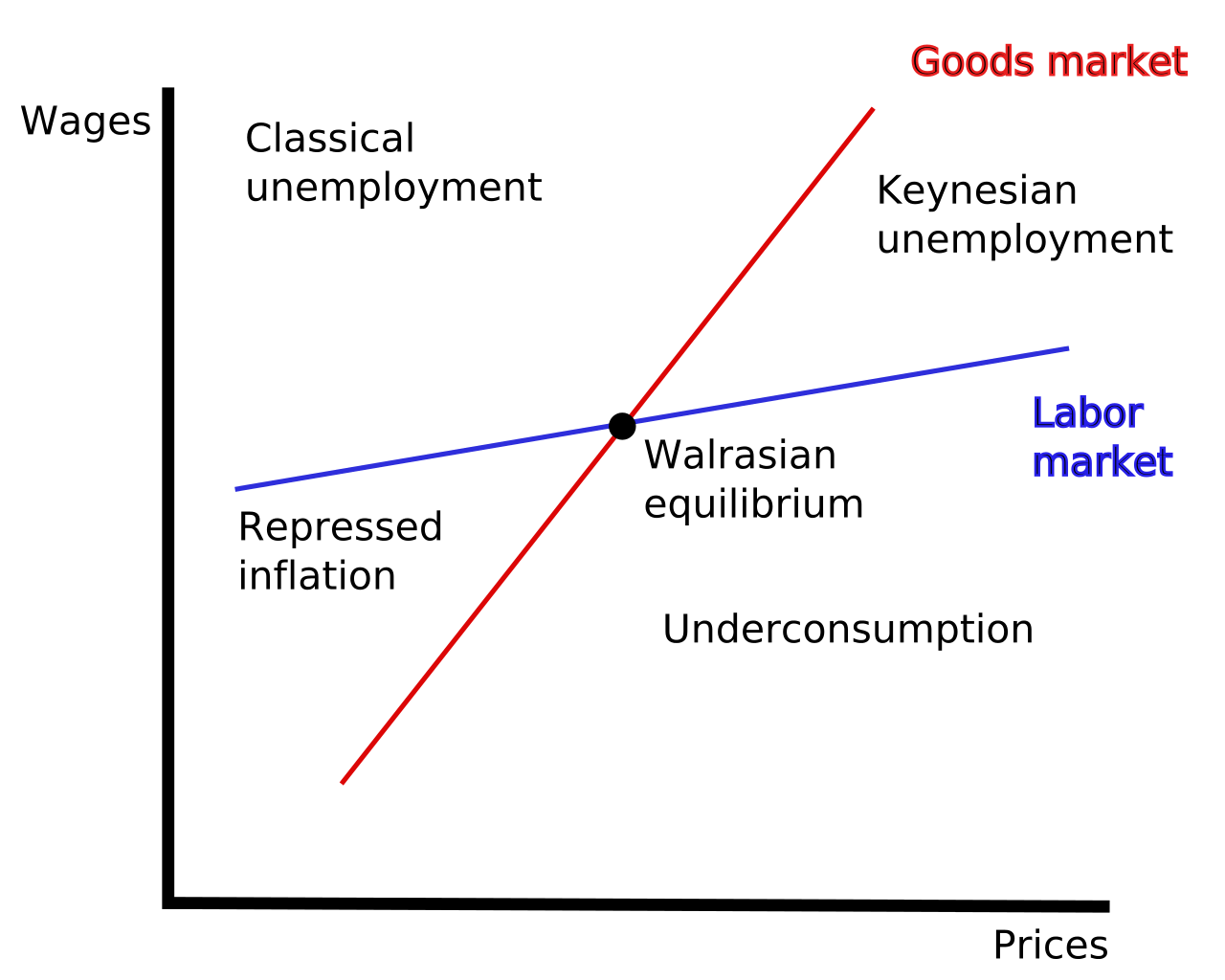

Typically, QE and QT is supported by most keynesian economists because many believe consumer demand is what powers the economy. The support for consumer demand is what drives the use of such monetary policies, but unfortunately for us, trouble is unfolding behind the scenes; the global economy is on the track to a liquidity crisis.

Recently, the UN stated that they are in the midst of their very own cash crisis, with many member states unable to pay dues, which on its own is alarming. With the liquidity of global markets in danger, and interest rates sitting at record lows, performing QE in this market is simply a band-aid on a gun-shot wound, but luckily for us, Bitcoin will benefit when this pig bleeds out.

So, what comes next?

I’m honestly surprised few people have been focusing on the 4th industrial revolution (IR) in its entirety. For those who are unaware, we are in the early stages of the 4th IR, which consists of cyber-physical systems, internet of things, (IoT) artificial intelligence, and networking as a whole. Technology is evolving at an unthinkable pace that was once unheard of, and in the world of finance, traditional ledgers and other forms of monetary communication are slow, impractical, and inefficient.

The Society for Worldwide Interbank Financial Telecommunication (SWIFT) system, is the world’s largest monetary network, which is used by well over 200 countries, and on average, provides transportation for 31 million financial transactions daily.

The SWIFT system is simply a secure means of communication, which utilizes either an 8 or 11 digit bank identifier code. Although powerful, the SWIFT system does not hold any assets, it does not manage funds, it can be expensive, and is relatively slow, but blockchain technology provides the means to fix these flaws and many more.

When transferring digital assets via blockchain, one can usually expect to pay a small fee, and depending on which used, rarely exceed a few dollars. When transferring funds the traditional way, institutions usually charge a small percentage as a fee. Now, hypothetically speaking, say you are wealthy and need to transfer, say 1 million dollars for whatever reason; a traditional transfer at 1% will cost $10,000, but using a blockchain, this same transfer could cost less than 50 cents and cut transaction time down to a mere fraction.

Technology is evolving at a record pace, and I am willing to bet the SWIFT system cannot keep up, or will end up lacking efficiency in comparison to a blockchain. The 4th IR will require an entirely new monetary system, one which can consolidate its features, automate transactions in a reliable, yet secure fashion, and one which can be integrated into almost anything you can think of.

Within the last decade, financial technology (FinTech) has exploded. Financial services that were previously reserved for wealthy clients of large investment banks or hedge funds, are now available to everyone. Within the bullish FinTech expansion, blockchain technology resides as the heart.

Global tensions between nations are rising, both private, and government debt is at record highs, goods and services are too expensive for most, and wealth inequality is getting much worse. Everything and everyone are bearing the burden of failing financial infrastructure and once-dominant currencies are rapidly losing their purchasing power.

Earlier this year, Rep. Brad Sherman of California, (D) said Facebook’s Libra project “may do more to endanger America’ than 9/11,” but many view these comments as an expression of fear. Although, not every member of Congress sees this as a threat, many encourage free market innovation, for example Rep. Warren Davidson, (R) actually proposed Facebook to ditch Libra and adopt bitcoin instead.

The rapid expansion of technology, along with governments and central banks slowly losing the monetary grip they have on society, will ignite to fuse to a much-anticipated blockchain rocket. The almost forced institutionalization of crypto, on governments and banks alike, will benefit the people and hopefully pave the way for generations to come.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)