Crypto Market Commentary

29 October 2019

Doc's Daily Commentary

The 10/25 Trade School with Doc is listed below.

Mind Of Mav

What Is Open Banking; Does It Compete With Crypto?

Every aspect of our lives is transforming into a digital experience in this era. Everything is becoming easier, faster and better.

And yet.

99% of people using the Internet have no clue what TCP/IP is. In the same way there is no need for the masses to understand Blockchain to achieve adoption. We need to make it simple to use and accessible while limiting the possibility of human error.

More competition & more innovation is always better for customers. This is about delivering more variety and more creative products to help you manage your money better.

Emerging of credit and debit cards like VISA, Mastercard, American Express and the banks building up their own online transaction systems bridged this gap up to a certain extent, but still, there is a lot that can be done to ease the process of financial transactions that we do. That is where Open Banking comes into play.

So, what is Open Banking, and does it pose a threat to cryptocurrency?

First, the definition.

Open Banking means banks must allow you to share your financial info with authorised third parties & new services.

Like you, I see “third party” and “data” and immediately groan with disapproval.

But, this is somewhat different than Facebook telling you to buy something.

For quite some time we have been able to let budgeting apps use some of our account data to provide a more unique service. Now, thanks to open banking, you will have your back covered by regulators.

To emphasize that point, your data is not to be shared without your consent — contrary to what “open” in “open banking” might imply.

You can close all your accounts and stick to cash if you want. The awareness of choice is crucial to open banking being a success. The rules are there to ensure banks share your data only when you explicitly provide permission to a new provider. They can’t go nosing around when they fancy it.

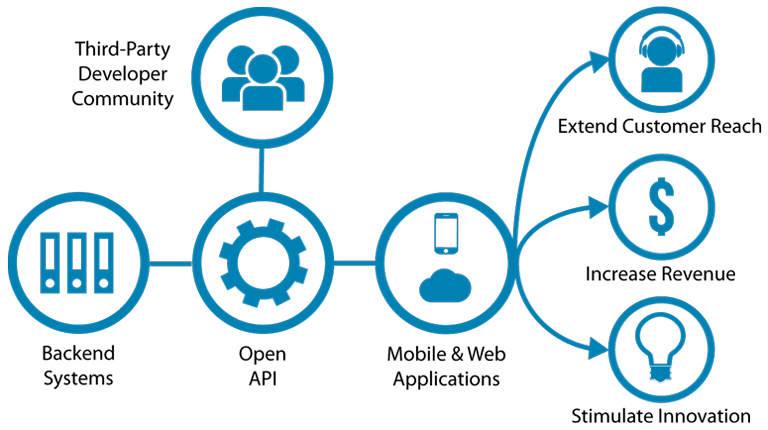

New providers authorised under Open Banking will offer two types of services:

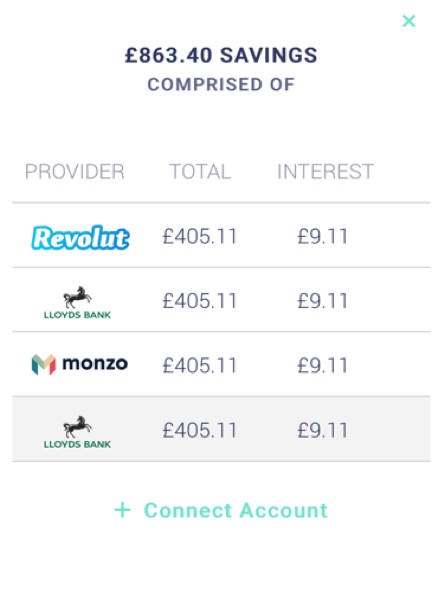

- Account information services. All your account information from different banks in one place. Providing overviews, budgeting guidance and product recommendations.

- Payment initiation services.Allowing you pay companies directly from your bank account without the help of Visa or Mastercard .

If they’re authorised, providers will only be able to access data needed for the service you have signed up to. If you want them to check out your credit card info, they cannot take a peek at your current account. It is account-by-account permission provided by you.

One of the fundamental goals of technology, from the invention of general ledgers to the conception of the blockchain, has long been to provide a single version of the truth: a record of evidence that serves as a trusted intermediary to facilitate the exchange of products and services. Yet this trust can be quite fickle, just 36% of British consumers trust banks to work in their customers’ best interests, while in Germany (35%), Italy (30%), France (29%, and Japan (27%) the skepticism is higher still.

It’s no surprise, as the social mechanics of digital marketing distort the relationship between truth and trust even further, promoting psychological profiling as a house of mirrors reflecting contradictory versions of reality.

The zero-sum experiences in which the corporation’s perceived need for data outweighs any concern for individual privacy have drawn widespread public condemnation. So, the pertinence of Open Banking depends less on the sophistication of its tools and techniques than on the extent to which consumers leverage financial applications to improve individual and collective well-being. Trust isn’t an attribute of the quantity of how much data you hold as much as a result of consumer perceptions of how that data is being used.

Open Banking will create multiple avenues to enhance customer perceptions of the value of financial services. People will be able to interact directly with their financial products rather than going through each individual bank. FinTech can leverage transactional and behavioral data to suggest and personalize products — without a lose of trust due to breach of privacy and data.

But, this is only as good as the people they are built by.

Even though Open Banking looks awesome, it comes with its own drawbacks. Open Banking centralizes all the user data into one place. On the one hand this is more secure as you have to protect only one place, but on the other hand, if this is compromised all of your data gets exposed.

Open Banking standards minimize this by enforcing strict rules on who access your data, what parts of your data is visible to third parties, how to verify a third party etc. But similarly, for any other system, when you go centralized nothing is 100% secure and you have to make a decision based on the tradeoff between the pros and cons of Open Banking about whether you want to use third-party applications or not.

Hence, it should be clear that blockchain and open banking are distant cousins attempting to solve a central issue around trust: blockchain is trustless, open banking is more efficient trust.

Ultimately, consumers benefit from competition and options, and I look forward to the day when more options are widespread.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)