Doc's Daily Commentary

Mind Of Mav

Investing In NFTs: Why Do NFTS Have Value?

Alright, let’s get into why NFTs have value and are the future. First, let’s talk about just exactly what NFTs are and a tad bit about the technology that underpins them.

NFT is an acronym for non-fungible token, which essentially means an asset that’s unique, rather than an asset that’s identical to many other assets.

An example of a fungible token, for instance, is like a US dollar or bitcoin — every US dollar is meant to be identical to every other US dollar, and can be used interchangeably and all of them represent the same amount of value. Same thing with bitcoin — there are 21 million bitcoin that will ever be created, and every single one of them is worth the exact same amount and is totally interchangeable with any other.

An example of something that’s non-fungible, on the other hand, is say, a piece of artwork, like the Mona Lisa, or your dog. There are many paintings in the world, but there is only one Mona Lisa, and you can’t just replace the Mona Lisa with some other random painting and call it the same thing. Same with your dog — plenty of dogs out there, but you’d probably be pretty upset if someone just decided to swap your dog with a random other dog one day.

In essence, an NFT is just a digital representation of this intrinsic concept of non-fungibility, or uniqueness, that we’re already intimately familiar with in the physical world. Houses are non-fungible, people are non-fungible, your mother’s cooking is non-fungible, for better or for worse, and so on.

The blockchain enables NFTs to exist

Digitally, to date, non-fungibility has been a bit difficult to come by, because any digital asset just consists of bits, strings of 0s and 1s all amalgamated together in a specific way, that are trivially easy to replicate perfectly a trillion times over by anyone in the world. How can you possibly create immutable uniqueness in a digital world?

Enter the blockchain. A blockchain, which is the technology that underpins cryptocurrencies such as Bitcoin and Ethereum, can be thought of as essentially a global public ledger that can permanently record any kind of data for anyone else to see and verify forever.

At first, the blockchain was envisioned for just recording financial transactions between two parties, e.g. me sending 10 bitcoin to my friend Alice. Fairly quickly along the way, however, people realized that you could essentially record any kind of arbitrary data in the blockchain as well, and this could serve as essentially irrevocable proof of anything — say, a binding contract between two parties.

If someone wanted to record, for all time immemorial, that they got married to some random person they met in Vegas a few hours ago, the best way for them to do that would be to both sign a transaction on the blockchain with their private keys attesting to that fact — that attestation would stay around for as long as any nodes (computers) in the world continued to maintain a copy of the blockchain, and would indisputably prove that they had, indeed, genuinely both certified this attestation.

This is a lot easier to both do in the first place and to verify later by literally anyone in the world than via a paper marriage certificate or going to the local county office or whatever. This is, incidentally, why public legal documents will almost certainly one day be filed away on blockchains and not on paper or in arbitrary siloed and fragmented government databases.

But back to NFTs. Okay, so we know now that we can store any sort of attestation on the blockchain as well as record simple financial transactions. What does that give us? In short, the ability to store, in a globally public, permanent, and trivially-verifiable-by-anyone manner, certifications that a given digital asset is the genuine article — the original true copy of something, and the only true copy of something, signed by the private key of the original creator of that asset.

Thus, no matter how many identical replicas of the genuine article are created, only the single asset, or NFT, certified by a digital signature from the original creator, can be appropriately designated as the true ‘original’ copy of the asset, so to speak.

Fully explaining and selling someone on the technological revolution that is the blockchain that underpins everything about NFTs and explains why NFTs weren’t possible until just right now is outside the scope of this newsletter — just take my word for it if you have better things to do with your time, unlike me.

The Value of the Original Versus the Replica

Alright — at this point you might be protesting that this is all bullshit, and just because an artist of some digital artwork might say that one specific NFT is the original artwork and nothing else is, that’s pointless, because all the copies are literally identical and thus can be equally enjoyed/utilized in whatever way the original can.

Okay, sure — that may all be true, but if we’re being honest with ourselves, that’s not really why any piece of artwork or anything else in the physical world truly has the value it does.

At the most analogous level, plenty of artists today — let’s take photography as the easiest medium of comparison — already often release arbitrarily limited edition prints of their work, so as to induce artificial scarcity and thereby drive up the value of their work even if there are no technical limitations that make this a necessity.

Clearly, this technique works, as plenty of photographs that could easily have been reproduced ad infinitum have instead sold as limited edition prints for millions of dollars.

Okay, some of you might not even consider photography real artwork and are purists for hand painted art. I’ve often heard the argument that a real physical painting takes real skill to create, and cannot ever be recreated quite precisely identically to the original, and thus the original always preserves its value in never being fully imitable.

The fact that famous auction houses often sell and museums often buy entirely fake works, and that possibly up to 20% of all paintings owned by museums may not be authentic, puts a little dent in this argument. These auction houses and museums go to extreme lengths to verify the authenticity of a work, and employ extremely specialized professionals utilizing extraordinarily fine equipment to attempt to distinguish between the genuine article and a replica — and they often fail at this task and replicas frequently go entirely unnoticed for decades or even lifetimes.

If a replica is so identical to the real thing that even experts can’t tell it apart after extremely close examination, why exactly is the replica worth less than the original, if the value of the art comes from its intrinsic physical properties and not something a little more abstract? Why, indeed, do museums even bother at all to spend hundreds of millions of dollars to acquire the original versions of priceless paintings instead of just simply commission indistinguishable replicas of all the pieces at a fraction of the price? Even the experts can’t tell them apart — definitely no chance a casual museum visitor would ever be able to.

Would you feel excited to go to a museum filled entirely with known replicas of famous artworks, which to you would seem entirely identical to the original genuine thing? My guess is that probably isn’t quite as appealing to you for some reason, and that’s probably why there are no famous museums filled entirely with publicly known replica art. Yet chances are in a ‘real’ museum filled with ‘real’ art, you’ve actually spent time staring at a replica that you thought was the real thing and that the museum and everyone else thought was the real thing, and up until the moment everyone realizes it is in fact fake, everyone appears to appreciate it just as much as they would the original.

So what is the reason we appreciate genuine originals over replicas? Ultimately, what we’ve grown up intrinsically knowing and understanding about physical objects is that the original of a rare, highly-prized-by-society object, has some inimitable value that transcends that of any replicas, by sheer dint of being the original genuine artifact.

Humans love the concept of genuine authenticity and scarcity, and knowing that the Mona Lisa that you own was truly personally created and signed by da Vinci (okay, da Vinci never actually signed the Mona Lisa because it was never actually completed because he was ADHD and barely ever completed anything in his entire life, but that’s beside the point) is the difference between it being worth $850 million and a replica being worth just tens of thousands, if that.

We inherently understand this at an emotional level because that’s the way the world has always worked as long as we’ve lived and we’ve grown up with this understanding of the world, but NFTs are an entirely different story. Not only is the idea of an NFT having value an idea so novel just a few years ago the term didn’t even exist, but the entire concept of the digital world is still a nascent notion.

Okay, that’s nice, but art is still worthless, right?

Okay — at this point in time, hopefully we’re somewhat on the same page in acknowledging that a technology that allows for trusted and permanent certification of the authenticity and originality and uniqueness of digital assets such as digital art allows for digital assets to at least retain value along the same premises as physical assets of a like kind.

That is to say, hopefully we both somewhat agree that the original Mona Lisa has more value than an almost indistinguishable replica simply by dint of the fact that the former is certified by some trusted certifying body, such as a professional art appraiser or auction house or museum, to be the original, and that fact alone is what gives the Mona Lisa the bulk of its value.

That doesn’t, however, answer the question of why precisely the original Mona Lisa is worth ~$850 million and a work by a contemporary artist of the same degree of technical skill or philosophical merit or whatnot is almost certainly worth infinitely less.

Perhaps some of you reading this already understand why the Mona Lisa is worth $850 million and agree that it should be worth something in that approximate ball park, but I certainly wasn’t in that camp up until just a few weeks ago, and so I’d like to take some time to speak to my former self here. Spoiler alert — this ends in me attempting to justify why several pixelated images of sickly-colored barely identifiable punks are worth multiple millions of dollars, at least.

Okay — so one reason people may give for why the Mona Lisa is so expensive is because it’s arguably the finest painting made by the finest painter ever to live. Seems not unreasonable that the literal greatest painting ever should be worth a lot of money. That’s something I could buy.

There’s just a slight catch here — what exactly makes the Mona Lisa the best painting ever made? There’s no question that Leonardo da Vinci was an incredible artist, and that the Mona Lisa was executed with masterful skill, but there are countless works of similar quality, including many by Leonardo himself, that don’t fetch nearly as high a premium.

Here’s another reason people may give, that at face value might seem like the same argument, but is in fact slightly different in its nuance — the Mona Lisa is the most expensive painting in the world because it is the most famous painting in the world.

Why exactly is it the most famous painting? One could argue that it’s the most famous painting because it’s the objectively best painting, which would be the same argument as prior posited, but there’s a slight catch here too — the painting was almost entirely unknown by anyone outside the art world for literally four hundred years, from the early 1500s to 1911. Weird for the objectively best painting in the world to only be recognized as such after 400 years.

What exactly happened in 1911 to begin a chain of events that today makes just about everyone in the world aware of the Mona Lisa? Well — the Mona Lisa was stolen from the Louvre, and overnight the scandal became a global sensation and thrust the Mona Lisa into the spotlight forevermore. From Wikipedia:

The Mona Lisa was regarded as “just another Leonardo until early last century, when the scandal of the painting’s theft from the Louvre and subsequent return kept a spotlight on it over several years.”

The 1911 theft of the Mona Lisa and its subsequent return was reported worldwide, leading to a massive increase in public recognition of the painting. During the 20th century it was an object for mass reproduction, merchandising, lampooning and speculation, and was claimed to have been reproduced in “300 paintings and 2,000 advertisements”.

Today, this is the kind of attention the Mona Lisa can pull:

In 2014, 9.3 million people visited the Louvre. Former director Henri Loyrette reckoned that “80 percent of the people only want to see the Mona Lisa.”

In New York, an estimated 1.7 million people queued “in order to cast a glance at the Mona Lisa for 20 seconds or so.”

It wasn’t the heist alone, however, that caused the Mona Lisa to be thrust into permanent prominence as the most famous painting of all time. The heist was just the catalyst — an event that initially cast the Mona Lisa into the global spotlight. From there, the Mona Lisa was able to essentially enter a self-perpetuating chain reaction of fame, where the initial fame lent to the piece by the heist inspired the Mona Lisa to essentially become a 20th century meme, with endless parodies and reproductions, each of which made it yet more famous, and yet more parodied, and so on, and so forth.

From Britannica, if Wikipedia isn’t your jam:

The Mona Lisa was certainly more famous after the heist, but World War I soon consumed much of the world’s attention. Some scholars argue that Marcel Duchamp’s playful defacement of a postcard reproduction in 1919 brought attention back to the Mona Lisa and started a trend that would make the painting one of the most-recognized in the world.

He played against the worship of art when he drew a beard and mustache on the lady’s face and added the acronym L.H.O.O.Q. (meant to evoke a vulgar phrase in French) at the bottom. That act of irreverence caused a small scandal, and other cunning artists recognized that such a gag would bring them attention. For decades after, other artists, notably Andy Warhol, followed suit.

As artists distorted, disfigured, and played with reproductions of the Mona Lisa, cartoonists and admen exaggerated her further still. Over the decades, as technology improved, the painting was endlessly reproduced, sometimes manipulated and sometimes not, so that the sitter’s face became one of the most well known in the world, even to those who had little interest in art.

The actual power of memes

At some point, people begin parodying the Mona Lisa simply because it’s famous, and every parody makes the Mona Lisa more famous, and this becomes a self-perpetuating cycle forever, until the Mona Lisa becomes firmly entrenched as the most famous painting of all time. Hell, we’re still memeing the Mona Lisa today.

So now that we know that the Mona Lisa isn’t the most famous painting in the world solely on the basis of its obvious artistic merit, but rather due to a lot of arbitrary happenstance and memeing, do we appreciate it a little bit less? I know I would have — this is precisely why all art is bullshit and it’s all predicated on hype and has little to do with objective tangible value.

Now, I think quite differently. The fact that it is so famous, regardless of why it is so famous, has extraordinary actually justified value in of itself. You can even quantify some of this value in monetary terms — if a company were to produce an ad parodying the Mona Lisa to sell its products versus an ad parodying an equally well drawn yet wholly unknown to the public art piece, the former would obviously perform far better and earn the company far more in revenue.

Ultimately, the strength of the brand of the meme, or shared mythology, in a sense, behind the Mona Lisa is what lends it its value, and justifiably so. How powerful is it to have a singular art piece that occupies rarefied air in the mindspace of just about everyone in the world, for whatever reason that it does?

This brand value of the Mona Lisa, so to speak, imparts priceless value to the original Mona Lisa as the ultimate status symbol — if you were to say you were the owner of the Mona Lisa, everyone in the world would understand how monumental a statement that is, versus if you were to say you were the owner of the Lady with an Ermine (which also has value, but principally in the fact that it is also painted by Leonardo da Vinci, and the Leonardo da Vinci brand altogether has immense value now as everyone knows Leonardo da Vinci because of the Mona Lisa).

Heck, if you were to deign so low as to prostitute priceless fine art for money, you could honestly probably even turn the Mona Lisa into a direct cash flow asset — if we take the former director of the Louvre’s word at face value that “80 percent of the people [at the Louvre] only want to see the Mona Lisa” and combine that with the fact that ~10 million people visit the Louvre every year and admission to the Louvre costs ~$20, you could cash in on ~$160 million a year by owning the Mona Lisa.

As any real estate investor would tell you, a cap rate of ~15% (let’s say it generously costs ~$30 million in operating expenses to run your Mona Lisa prostitution enterprise, and thus $130 million revenue / $850 million asset purchase price == 15% cap rate) is pretty damn good, and you’d be crazy not to put your money in a dumb obvious can’t-lose investment like this.

Crazy at face value that someone would pay $850 million for essentially something that just got famous because of a meme that doesn’t even impart you with any rights like copyright or licensing or royalty fees or anything, but when we dig into it a little bit more, it seems to make a lot more sense, no?

Keep in mind the Mona Lisa is a brand that’s developed its value over literally more than a century of free perpetuation in the public mindspace as a news sensation and a parodied meme. It wasn’t always viewed as the foregone conclusion is it now as the “the best known, the most visited, the most written about, the most sung about, the most parodied work of art in the world”.

Back in the early days, perhaps four years after it first blew up, in 1915 or so, even professional accomplished art critics might have (read: definitely would have) scoffed at someone who boldly proclaimed that the Mona Lisa would one day be worth close to a billion dollars (inflation adjusted, of course, so actually more like $30 back then).

Maybe that’s how we feel about the nascent internet memes fetching five and six figures today. Just a few decades ago, people weren’t even sold on the internet — how could we possibly expect people to see the value in owning internet memes yet? The mere word meme itself is still viewed as a neologism not yet fully appropriate to use in polite company, despite actually having been coined in fairly academic settings in Richard Dawkins’ landmark 1976 book The Selfish Gene.

Ironically or perhaps extremely fittingly, Dawkins’ academic definition of a meme was literally memefied itself and ‘evolved’ into the commonly known internet meme phenomenon, where instead of concepts and content attempt to replicate themselves accurately and naturally evolve and alter in the course of doing so just like actual genes might, internet memes deliberately alter themselves in transmission. Funny aside.

Regardless, the core concept and power remains the same across all memes — memes are a self-replicating unit of cultural transmission, analogous to the self replicating unit of biological transmission, the gene. This is an incredibly powerful concept when fully grasped at its core — the power of a meme derives directly from its degree of transmission and saturation and permeation in the cultural mindspace of the world.

Memes are profound, and not a new concept at all. In The Selfish Gene, Dawkins argues that language itself is a meme (how are new words invented and transmitted? Someone comes up with a word, others catch on, and soon everyone uses it and it becomes canon, like…the word meme). Religion is a meme, fashion is a meme, customs, traditions, and rituals are memes, philosophies are memes, political affiliations are memes, diets and ethnic food preferences are memes, fine art is a meme, and so on, and so forth. Yeah —just about literally everything that collectively constructs the fabric of human society as we know it came about through transmission as a meme, for one arbitrary or not so arbitrary reason or another. Hell, your name was probably transmitted as a meme. Memes are, like it or not, accept it or not, just about the most powerful things in the world.

A meme, just like a gene, can perpetuate itself to the point of cultural mindspace saturation on the basis of multiple merits and on pure happenstance alone — a more clever or useful concept may find itself more easily transmitted, for instance, just as a more ‘fit’ gene might find itself more likely to survive through generations, but just as well a meme might just catch a lucky break and be at the right place at the right time, or have to wait 400 years for a catalyst like being stolen from the Louvre to awake from dormancy and start spreading — but whatever the reason it spreads, when it does, its value is justified in that spread alone.

A virus, frankly, might be a reasonable analogy fitting in its present day visceral significance. There’s almost certainly a parallel universe in which COVID-19 never made the leap to humans (or never made it out of a lab or what have you), and in that world, it would have literally had zero significance and meaning in the world, despite existing all the same in exactly the same form, lying dormant in a bat or in a lab or whatever the prevailing conspiracy theory is these days, having all the same merits as the COVID-19 that did become a worldwide phenomenon — kind of not unlike an incredibly talented starving artist who never has the opportunity to have their work see the light of day, though in different circumstances and in a different universe, they could have become just as famous as Leonardo da Vinci (please excuse the uncouth comparison between an undiscovered incredibly talented artist and a latently virulent virus).

And yet, for whatever reason and whatever unfortunate chain of arbitrary circumstances, COVID-19 did become a worldwide phenomenon, and the selfish genes of COVID-19 have self-replicated themselves to a profound extent with undeniable worldwide consequences, both economic and otherwise.

Memes are just about the same thing, and for whatever reason, some memes self-replicate themselves to become cultural cornerstones of the world that anyone of a specific demographic can understand and utilize to effectively communicate, identify, or signal status or value with one another, and when that happens, those memes have real value.

Thanks to the internet, memes can now spread at speeds never before fathomable — just like thanks to air travel, COVID-19 can now spread at speeds never before fathomable for a virus. The world is more interconnected than ever before, both physically and digitally, and thus, internet memes can rise to global worldwide prominence and saturation in what feels like (or literally is) a matter of days, and not months, years, and decades, like it once used to take. This makes it feel almost unfathomable to us that an internet meme just a mere few years old could possibly become worth six or even seven figures — and yet no one questions that the damage wrought by COVID-19, despite its equally wildfire never-before-seen spread in just a few months, is very real indeed (unless you don’t believe in COVID-19, in which case I’d say you already viscerally understand the true power of internet memes in the cultural transmission of any form of information and the real power that has, for better or for worse).

Let’s just call it brands if you want

Okay — I recognize that for some, memes as a term is just definitionally too much of an intrinsic turn off for any amount of nagging coaxing to overcome. In that case, let’s just consider these things a brand — the Mona Lisa is a brand, and Leonardo da Vinci is a brand, and the Louvre is a brand, and all these brands play into and support each other, and they all have real value from doing so.

Louis Vuitton is a brand, and Nike is a brand, and Air Jordans are a brand. I never understood this until getting into NFTs either, frankly, and always thought it was a hilarious rip off (and still do, because these brands don’t cater to the Silicon Valley culture I’m a part of — our brands are Teslas and MIT diplomas and tickets to space — and, more so with every passing day, CryptoPunks) that anyone would buy a Coach or Louis Vuitton bag that could be made for like 1% of the selling price and be indistinguishable in quality and merit from an identical generic bag without the brand tag.

Now I get it — the brand has real value in that it occupies real mindspace in billions of people around the world and owning a Louis Vuitton item, in the right circles, instantly communicates in a provable way that cannot be faked (spoiler alert: this is actually an advertisement for NFTs, because Louis Vuitton bags can and are in fact trivially faked, but NFTs are much less easily faked as sources of incontrovertible truth can be trivially verified by anyone in the world instantly on demand, unlike with physical goods) status that can in very tangibly manifest ways open doors for you and create connections and generally beneficially modify the way you are able to move through life in a way that can more than justify the price of membership in that brand.

All subcultures have brands, and these brands open doors of membership when you possess them. These brands have incredible value and often have near unassailable moats protecting that value in that they are incredibly difficult to replicate, and often impossible to do so intentionally. Most of the most famous memes on the internet were all entirely accidental, like side-eyeing unimpressed Chloe being actually just a sidekick in a video that was supposed to showcase her sister’s excitement on being gifted a surprise trip to Disneyland. Many subcultures value authenticity above all, and are like sharks drawn to blood when they sense any whiff of a scent of intentional brand formation.

Fair or not, these brands are often also winner-take-most markets, such as in the art world, where only 0.2% of artists ever sell work for more than $10 million, and yet 32% of the entire $63 billion in annual art market sales a year derive from those $10 million+ works by those 0.2% of artists.

As status symbols, the best brands in a subculture become Veblen goods and positional goods (if, at least, money isn’t firmly antithetical to the values of that subculture — and it most certainly is not for the subculture of crypto, incidentally, hint hint), where the price of the good becomes an inherent motivation in of itself to acquire the good as a mark of status in being able to afford that good, and this becomes a self-perpetuating up-cycle in propelling the price of the good ever yet further up, until it reaches an equilibrium only dictated by the scarcity of the good and the amount of buyers willing and able to afford the given price.

That, in of itself, is one reason why the price of the highest priced works of art every year continue to grow and break records — because the wealthiest people in the world continue to grow wealthier as both the overall economy of the world continues to expand as a non-zero pie and also as inequality rises due to a myriad of factors, and thus, the price of admission to the most elite circles of status in the art world continues to rise to keep pace and retain an equilibrium in its quota of members, so as to not dilute that status.

Jesus, will you talk about CryptoPunks and NFTs already?

And finally, we arrive at our justification for why CryptoPunk NFTs can be worth millions of dollars, and some day, may be worth yet still many multiples more.

Just to remind you what these things look like:

For a little history, there are precisely 10,000 CryptoPunks in existence, and their total combined market cap value exceeds $4 billion at present day.

So, in short — 10,000 of these little questionably cute most certainly pixelated punks are worth about five Mona Lisas — the most valuable and famous and memed painting ever to exist in the world. How is that possibly justifiable?

Well, for a little history — CryptoPunks are broadly known as the first NFTs to ever be created on the Ethereum blockchain (disclaimer — this is not technically true, and several projects arguably predate CryptoPunks on Ethereum, such as Etheria, PixelMaps, and Curio Cards), all the way back in June 2017, which may as well be prehistoric in Ethereum time (I’m not even really kidding — the ‘second’ NFT project on Ethereum, MoonCats, was literally rediscovered recently in the digital analog of an ‘archeological’ dig).

They’re also the first ever PFP (profile picture) NFT art project, which refers to an NFT collection that can be used as profile pictures on social media. These two facts (among many other factors, of course) created the perfect storm for CryptoPunks to take off in classic meme replication, Veblen and positional good fashion. But let’s rewind a bit and start at the beginning, and maybe we’ll see the CryptoPunk story isn’t so unlike the story of the Mona Lisa, though as with all things internet and crypto, the timescale has been compressed from ~400 years to approximately 4. No big deal.

When CryptoPunks were first launched to the public on June 23rd, 2017, just about no one paid it any attention whatsoever, despite the fact that punks were literally offered for free (plus shipping and handling, er, Ethereum gas transaction fees). Only 20–30 punks were claimed in the first week post launch. It was only when Mashable covered the project with an incredibly prescient and open minded article titled, no longer at all hyperbolically, “This ethereum-based project could change how we think about digital art”, that things started to take off, and within hours, every single past punk out of the 10,000 offered had been claimed.

Sales then stagnated, to put it mildly (though there remained a resilient, active though small community of enthusiasts all the while very passionate about CryptoPunks — perhaps consider these rare folks akin to the art intelligentsia who were the only ones to see value in the Mona Lisa before it blew up for arbitrary reasons, 400 years after inception, though I’m sure you still find that a bit of a stretch right now — more on this later), for about the next four years, before things started taking off in real force in early 2021.

Why did things take off? In part because the entire market for NFTs began taking off this year and last (as collectibles all around the world surged in price, quite possibly thanks to the pandemic forcing people into more eclectic homebound hobbies), with projects such as NBA Top Shots (created by Dapper Labs, which was also behind CryptoKitties, the most successful and widely known NFT project of 2017) which launched October 2020 doing over $700 million in revenue by the end of May and digital artists such as Beeple selling NFTs of his artwork for millions, culminating in a gargantuan $69 million sale at Christie’s in March.

As interest in the NFT space at large grew, the projects and artists with the most compelling narratives (along with a healthy dose of randomness and luck, as is true with all things that succeed, even the Mona Lisa) quickly found their way to the top, such as NBA Top Shots building off the colossal brand and fan base of the NBA, or Beeple building off his reputation as a pioneering digital artist for decades, or CryptoPunks building off its reputation as the OG NFT project on Ethereum.

As each of these projects began to take off, most certainly a bubble did form, as news of every record breaking sale fueled the rise of the next record breaking sale, and the promise of overnight untold riches lured ever more speculators to the front lines. NFT projects proliferated, and just about every single one seemed like it was guaranteed success, with or without any fundamentals whatsoever. Things, not unexpectedly, faded as quickly as they came. The NFT market peaked at $102 million in sales volume on May 3rd, but dropped to just a few million in sales volume just a few weeks later.

Notably, however, CryptoPunks was not remotely as affected by this drop in volume as other projects in the space, and while average sale prices did fall from their spring highs for a brief blip in the summer, prices have charted a remarkably steady and remarkably strong rise up and to the right ever since. The average sale price of a punk in early July was ~$40,000, and today, just three months later at the start of October, the average sale price is more than 10 times greater, at ~$450,000.

Why have CryptoPunks remained so resilient even in the so called popping of the first NFT bubble in spring 2021, and why are they steadily gaining value so quickly as time continues? To answer that, we might want to turn to some insight from some of the earliest true believers in CryptoPunks.

CryptoPunks True Believer Case Study

Dylan Field, the co-founder and CEO of the multi-billion dollar collaborative design tool Figma, made headlines for selling a very rare CryptoPunk (all CryptoPunks are unique, and some have traits that are much rarer than others, and thus command higher prices) for $7.5 million on March 11th, 2021.

This guy, to put it mildly as the understatement of the century, is not what you might conceive of as your average uninformed retail YOLO investor in NFTs, as most publicly evidenced by the fact that he’s been on a one-way ticket to stratospheric success for just about the entirety of his life. I’ve had the tremendous privilege of actually knowing him personally for just about a decade now as a fellow Thiel Fellow, and as such I vividly remember just how much potential everyone saw in Dylan from the very beginning. Some quick excerpts, from when he was literally a 19 year old intern at Flipboard:

Flipboard CEO Mike McCue still can’t believe how excited people got when he hired a Brown University student for an internship.

At a barbecue celebrating the second anniversary of the mobile news-reading app, McCue told a story about how John Doerr, the lead partner at legendary venture-capital firm Kleiner Perkins Caufield & Byers, called him about Dylan Field, an intern McCue was recruiting.

“Do you need any help with Dylan?” Doerr asked him, as McCue recalled.

“I think I’ve got this,” McCue replied.

At the time, Field was 19. He just turned 20 in March.

But it’s not like Doerr was alone in his interest in Field. After Flipboard hired him, Oren Jacob, the former CTO of Pixar who now runs a startup called ToyTalk, spotted McCue across a parking lot and shouted, “I heard you got Dylan!”

Here’s one big reason why Field is such a big name. A math whiz from an early age, in high school he interned at O’Reilly Media, a publisher of technical books which also produces geeky events like Foo Camp and Strata. So he got to know the Valley’s technical elite by helping out with those events. He went on to become an expert on data analytics and now speaks himself at O’Reilly events.

So yeah — this was a guy who at age 19 had the billionaire lead investor of one of the biggest VC firms in Silicon Valley and the former CTO of Pixar interested in and personally helping him, and who at age 29 now helms a startup worth literally $10 billion. He’s also possibly the world’s best Werewolf/Mafia/Settlers of Catan player, to the point that all the Thiel Fellows eventually just decided the correct strategy was to always kill Dylan first no matter what in every game as the objectively game theoretically optimal move in categorically all situations. In short, this guy is prescient genius incarnate (he’s also just about the most down to earth, humble, kind, thoughtful and giving person ever, which is another reason why everyone loves/admires/respects him so much).

And what’s this guy doing in his spare time, when he’s not busy becoming the most successful person on planet earth in record time? Buying CryptoPunks before literally everyone else. Here’s his story about how he got into CryptoPunks and why he’s still unbelievably excited about CryptoPunks, and — get this — why he thinks some CryptoPunks are literally the closest thing to a digital Mona Lisa (emphasis mine):

Go back to, like, 2017 Dylan. How did you get into CryptoPunks in the first place?

Well, I was really into Ethereum. And the reason I was into Ethereum was because I had lived in a house with Juan Benet, who was the creator of IPFS and Filecoin. And I was a Thiel Fellow. And in that community, with Juan, with the Thiel Fellowship, everyone was into crypto. I was actually the person that wasn’t into crypto. I was like, “Y’all are absurd, it’s crazy!”

In 2017, that was when the ICO craze was starting to happen. And I was looking at, you know, ERC20 tokens, which are fungible. I was looking at centralized organizations, DAOs like Aragon Project, for example, which I remain fascinated by. And I started just to pay attention to CryptoPunks, which I thought was just genius. I didn’t do anything when it launched. And then I kind of watched the community form from afar, and started getting really excited about it as I saw more and more people resonate with it just the same way I was. And so, as an observer, I didn’t do much with it until the holidays, because I was just busy running Figma. And then right before the holidays, I bought my first CryptoPunk, which is now my avatar. The one with the messy hair, which I think kind of looks like me.

But wait, you skipped a step I think is really interesting, which is to go from this moment of vague awareness that “this is a space that is interesting” to putting down real money and buying into it. Is that the flip you’re talking about?

Yeah. Before I put down real money and whatnot, I went and I read the contract code. And that, to me, was a really interesting moment. Because if you look at the CryptoPunks smart contract, first of all, the code is very elegant. It’s very simple and beautifully written.

Essentially with CryptoPunks, what you get is an entry in an array. There’s an array from zero to 9,999 for the 10,000 punks, and that array indexes to a two-dimensional image. Basically 01 is in the top left, 9,999 is in the bottom right. The image is not stored on Ethereum. It’s just an image that exists in the world somewhere. And then you are bidding real money on an array index.

At first I was like, is that art? Is that actually owning anything? I don’t know! But then I started to see that other people were believing it was. So I was kind of really fascinated by this question of, what is digital ownership? Do you get IP rights? No. Yet, I really wanted this thing. And I really resonated with the project. And I cared about the project immensely.

And so I bought my first one. I was like, OK, 100 bucks. I can’t stop thinking about this thing. I’m just gonna do it.

And worst case, it’s a neat thing you’ve tried and it only cost $100.

Exactly. And, what I found was that the more that I thought about it, the more that I cared about it, the more I actually was interested in engaging with this project more. I started looking at the Discord, at the community that was forming. And I was not the only one. There are a lot of other people who are just amazing — they’re still around today. The people that were around then like these people have not gone anywhere. And they were also obsessed with it. And everybody was cataloging them, they were figuring out which ones are the most rare, which ones are the ones that have the most aesthetic value. Different people had different proclivities towards different attributes. And so I started kind of figuring out which ones I liked the most, and then I bought a few over the course of sort of the winter of 2017 to 2018.

I think that the way that digital communities grow that are important, are that they grow gradually over time. They don’t grow all at once. And I’ve seen that characteristic in CryptoPunks, too, which made me even more interested.

So there was one that I got obsessed with the most, that I really coveted, I was really attracted to, I felt like it had just total gravitas. Among the 10,000 CryptoPunks, there were only nine aliens, and of the nine aliens, the one that I really resonated with was 7804, which was a picture of an alien smoking a pipe.

It was totally magnetic to me. I couldn’t stop thinking about it. And so I saw that the person who had it had sold a few others. And I was like, I think that if I make a big enough bid, they’ll sell. And so I bid 12 ETH, which at the time was $15,000. And it did sell, after three days or so of waiting around and trying to see if I’d go a little bit higher.

I really thought, “this is the digital Mona Lisa.” CryptoPunk is the first project. And of all the CryptoPunks, this is clearly, to me, the best CryptoPunk. And everyone will want it when people want CryptoPunks.

There are some symbols, I think, that really imprint in your mind. I think that’s an example of one: I can see it as clear as day right now. And I think most other people can do that. This image just is very sticky. And I think there’s some other Punks that do the same. But it’s one of the ones that does. For that reason, and also its rarity, and also how magnetic it is, I thought this has potential to be the digital Mona Lisa.

I believe even more than before that CryptoPunks is art after selling 7804, which is super fascinating. And I think the reason why is after parting with it, I did feel emotional. I felt sad. It wasn’t just sad like, “Oh man, this is the digital Mona Lisa and I can make way more money at some point.”

It was sort of a part of my identity. It was a mask. What are masks? They’re objects that you can project identity onto. And for 7804, the wise alien, I felt a bit different wearing it. And as soon as I sold it, it didn’t feel right to wear it anymore. And so I had to take it off. And now the person that’s wearing it, I’m like, “Wow, you are totally the wise alien, this is perfect.” But I definitely did feel very emotional about it. I felt extremely attached to it. It felt like a breakup to have sold it. I literally had dreams about it.

It’s more than just like a collectible. I never dreamed about a Pokemon card when I was a kid, you know? It’s just different.

Is that unique to 7804? How much is that about this specific one? It goes back to the question of like, what is art?

I think the “What is art?” question for CryptoPunks is super fascinating, because there’s all these different ways to break it down.

There’s the algorithm of how punks were generated in the first place: They had this algorithm that would remix all these different characteristics infinitely, and they took a random sampling of 10,000 of the different images that came up. They could have had millions. This is a random collection of the universe of punks. So maybe that’s the art.

Then there’s individual punks as well, like 7804. And that seems to be art, too, in terms of the individual piece of art. But what I’ve come around to is the belief that the community itself is the art piece. The market, the discussions that are being had, the community that’s forming. It really does care so much about the project and is loving it into existence. That is the art piece itself, these interactions were all happening around the punks ecosystem.

And on the side of, what does it mean to own art? If you look at Geneva Freeport, it’s basically a warehouse that houses almost $100 billion worth of art. If you have something in the Freeport, which is art, and you own the right to own the art, and you own a smart contract in an array, maybe they’re kind of the same thing. I think there are parallels in the existing art world, to this sort of structure.

Okay, yeah, I basically copied that entire interview, because just about all of it is a gold mine of insights. You probably notice the theme of community and some sort of mythology (meme?) forming around these CryptoPunks now — there were people who were incredibly invested in CryptoPunks and believed in them even when there was no sales action, and when no one outside their tiny CryptoPunk subculture ever cared about these pixelated art pieces.

There’s also the profound emotional attachment, which is fundamentally what I think distinguishes art from non-art assets — if you’re emotionally attached to an art piece, which typically people aren’t with non-art assets like fungible money, it becomes more sticky than just the strict asset value the art piece can command, and that’s an incredibly powerful thing for value retention and growth — more on that later.

It might seem insane that people are becoming this emotionally attached to a pixelated JPEG, but 1. that’s why I wanted to take the time to really impress on you all that Dylan is not some crazy half-addled crackpot, but really someone you never, ever want to bet against, and 2. that’s why it’s so hard to really understand, on an emotional level, why any art piece, or really any asset you can personally own, including an NFT, can be so compelling or profound to its owner until you yourself have a similar experience — and why I personally have also fallen so deep down the NFT rabbit hole precisely after becoming a collector myself.

It’s hard to truly understand the appeal until you walk the journey yourself — but once you walk that journey and you do understand, you’ll never go back. It’s a one-way street, and the entire point of this article, really, is just to try to convince you to dip your toe into getting into your first NFT. Once you do that, you really don’t need all of this logic left brain hour and a half long convincing bullshit — you’ll understand the value proposition of NFTs on a visceral, emotional level, and that’s more powerful than anything an article could ever impress on you.

The forming of an emotional attachment to anything doesn’t have to be predicated on visual fidelity or anything else tangible — I know I’ve become incredibly emotionally attached to purely non-existent imagined characters in a book, for example, that theoretically exist only as abstract concepts. A child can form a profound emotional attachment with a simple stuffed animal that would be incomprehensible to an external observer, but would be as real and as valuable as anything else to the child at hand — formed through inimitable and non-fungible unique experiences and moments of attachment with the stuffed animal.

A CryptoPunk, and many other NFTs, become so much more than they might seem at face value to someone not steeped in the community who doesn’t have a personal connection to the art piece at hand. But this isn’t the only argument that provides CryptoPunks with value, and isn’t even the biggest reason — after all, stuffed animals don’t sell for millions of dollars, because as much as you love something dearly and will only sell it for a dear price, there needs to be a buyer on the other side willing to pay that price —and so for more insight, let’s hear from the other side of the story: the person who bought the CryptoPunk for $7.5 million from Dylan.

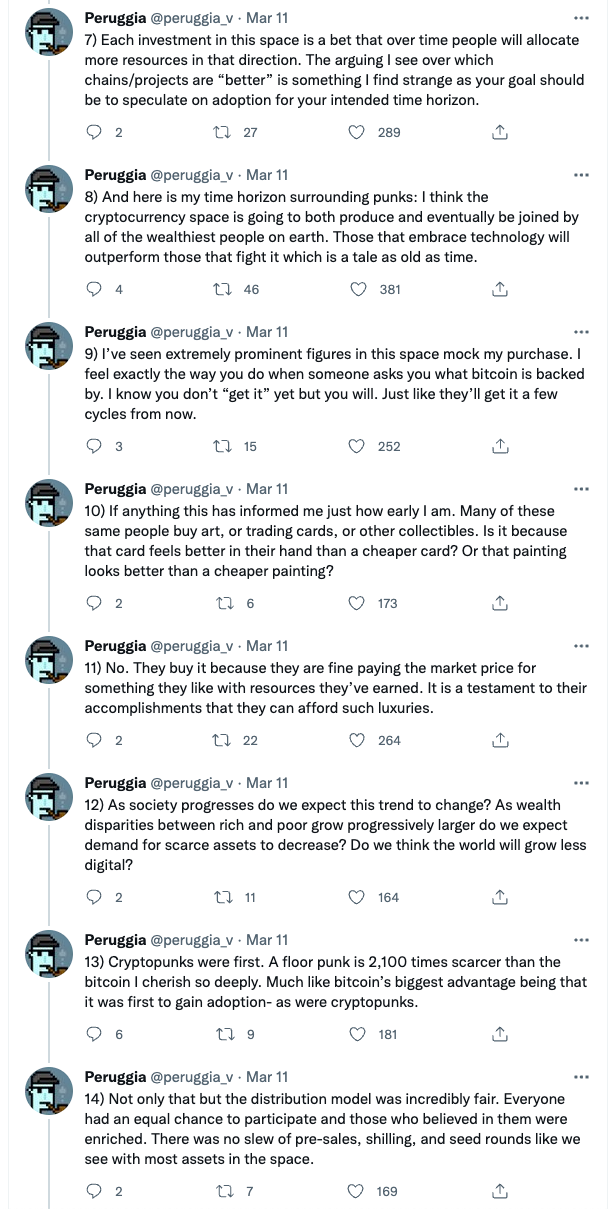

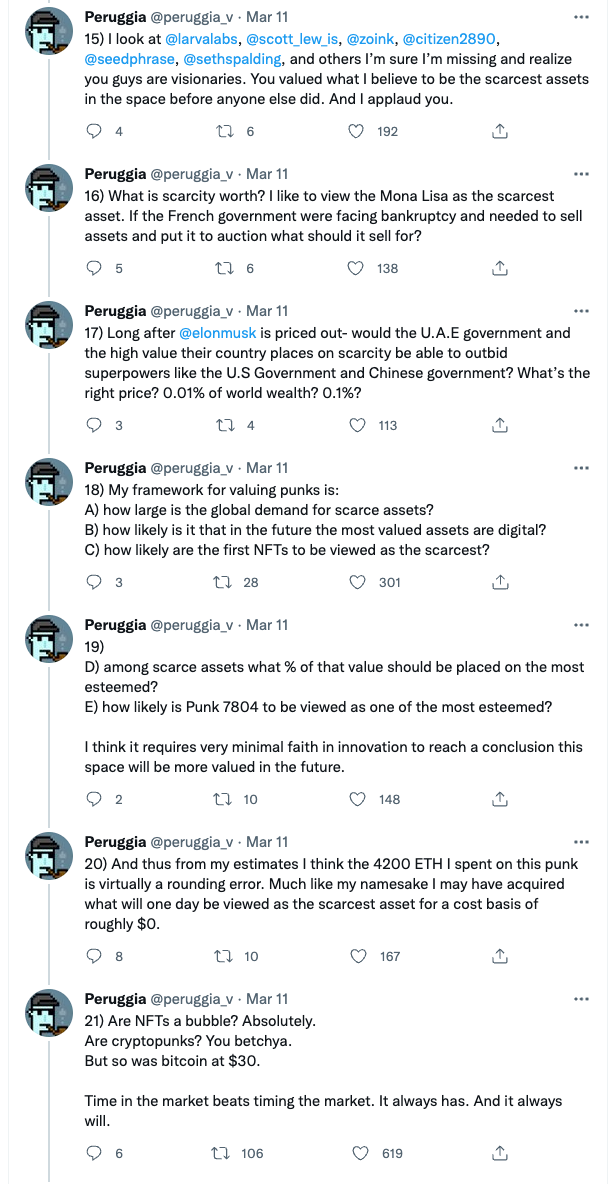

The buyer is pseudonymous, and goes by Peruggia (named after the thief who stole the Mona Lisa and made it famous, incredibly fittingly — this event the pseudonymous Peruggia precipitated of buying this CryptoPunk for such a stupendous sum of money is what made CryptoPunks really hit the radar, in a way). After he bought CryptoPunk 7804, he wrote this on Twitter, the great transmitter of memes:

And so this is the other piece of the puzzle, to complete our tale of why CryptoPunks, regardless of whatever local timescale bubble we may or may not be in now, will likely continue to retain value surprisingly well and quite possibly skyrocket ever further up over a sufficiently long enough time horizon as a paradigmatic example of an ideal Veblen good — something perfectly limited and scarce in supply that will only continue to rise in value as more people join the subculture as it becomes mainstream culture, and the number of ultra rich people who decide they would like membership to this most original and elite of NFT and cryptocurrency clubs grows, and as the mythology and memes surrounding CryptoPunks continue to grow in tandem with every new notable member who joins its ranks at an ever new scandalously high record breaking price point, and CryptoPunks become ubiquitously memed and parodied around the world, as the Mona Lisa has been.

Already, we see this happening, and another huge uptick in the value of CryptoPunks occurred as Visa — yes, the literal staid multinational credit card processing company — purchased CryptoPunk 7610 for $150,000 on August 18th, 2021, sparking another wave of renewed interest in CryptoPunks. Christie’s even conducted a sale of 9 CryptoPunks on May 11th, 2017, bringing in $17 million. A veritable slew of celebrities and other brand name individuals are also already members of the CryptoPunk elite, from Jay-Z to Snoop Dogg to Serena Williams to Jason Derulo to Steve Aoki to Gary Vaynerchuk to Logan Paul to Dylan Field (who still owns many cryptopunks even after selling 7804) to so many more — each and every record sale of a CryptoPunk to another brand name celebrity further increases the clout of the CryptoPunk meme and brand, and further cements its status as a positional good that can demand Veblen pricing.

Every collector who buys a CryptoPunk also becomes heavily invested in perpetuating its continued success, and what happens when thousands of the richest and most influential people on the face of the planet are all collectively working together to signal value and status in their shared investment and community? I don’t know, but I know I wouldn’t want to bet against it. Hell, Jay-Z’s profile picture on Twitter is literally his CryptoPunk, and so is Serena Williams’ (slightly modified), and so is Snoop Dogg’s (fun fact — I just learned Snoop Dogg has more Twitter followers than Serena Williams and Jay-Z combined. Who knew?).

What brand can you think of has so many of the most famous and influential people in the world all working behind it to promote it so outrageously front and center publicly as to literally replace their profile pictures with it? What brand can you think of didn’t have to pay these outrageously successful and famous influencers untold sums of money to do this, but instead was paid by the influencers for the privilege and honor of advertising it? Do you really want to bet against that brand, or would you like to join it before you get priced out of membership?

In short, buying a CryptoPunk certainly is a speculative bet right now, but it’s far from being a totally baseless, foundationally empty speculative bet.

Far from it, it’s a bet on quite a few things that have extremely strong signals going in their favor —

It’s a bet that Ethereum and other cryptocurrencies will continue to grow and capture market and mindshare and someday possibly dominate and permeate the world just as the internet and computers have today, and —

It’s a bet that when that happens, the first cultural artifacts on Ethereum (i.e., the first NFTs) will have untold demand as both incredibly scarce collectible values of historical interest as well as commensurately powerful status symbols, and —

It’s a bet that the community behind CryptoPunks, which began with a stalwart subculture of true, steadfast believers willing to stay invested and build out their art piece (the community itself and the history behind it, which is always inextricably part of the value of any art piece, is arguably the art piece, as Dylan suggested), and has now expanded to include already some of the most influential individuals and even corporations in the world even at this most nascent of stages in the ongoing NFT revolution, will continue to grow and blossom and agitate for CryptoPunks to penetrate the global mindspace ever further, and —

It’s a bet that the meme power of CryptoPunks will continue to self-perpetuate and also help this saturation of mindshare and consequent influence, and —

It’s a bet that NFTs and digital assets at large will come to one day eclipse physical assets as we come to the realization that the metaverse is far less bounded and offers far more opportunities for exploration, communication, discovery, and so much more than the physical universe, and —

It’s a bet that similarly when that happens, the original NFTs will have the most profound value associated with them, and —

It’s a bet that when all the rich people in the world are into crypto and CryptoPunks are firmly established as contemporary fine art and displayed in museums, the fact that there are already almost 3000 billionaires in the world and over 50,000 centimillionaires and over 200,000 ultra high net worth individuals with over $30 million in assets already in the world (and that these numbers will only continue to grow as the overall wealth of the world at large continues to grow each year as science and technology continue to expand the productivity and resource and value production of the human race) will probably mean that there will be quite a few people with quite a bit of money quite willing to pay quite a fair price for quite a few of the very, very limited 10,000 original CryptoPunk NFTs.

What the rich seem to want to acquire is what economists call positional goods; things that prove to the rest of the world that they really are rich.

Even if you are only moderately rich, there is almost nothing you can buy for £1 million that will generate as much status and recognition as a branded work of contemporary art — at that price maybe a medium-sized Hirst work. Flaunting a Lamborghini might be viewed as vulgar. A country house in the south of France is better, but it had better have a small vineyard and a sea view. A great many people can afford a small yacht. But art distinguishes you. A large and recognizable Damien Hirst dot painting on the living room wall produces: “Wow, isn’t that a Hirst?” — The $12 Million Stuffed Shark: The Curious Economics of Contemporary Art

Yeah, it’s a bet. But it’s a pretty damn f—–g good bet, as far as I can tell.

As Dylan mentioned, he was able to find his way to CryptoPunks because he was surrounded by Ethereum true believers long before others were ever remotely convinced on Ethereum — and I believe the CryptoPunks true believers are in the same way the right people you’d want to surround yourself with if you want to find your way to the next big thing in the world before everyone else. That, in my estimation, is priceless, which is why Mastercard missed a true golden meme opportunity in allowing Visa to snap up the first credit card processing CryptoPunk. Brand or meme? Meme that adds value to the brand? Either way, priceless.

Are you convinced on CryptoPunks yet? If not, I’m afraid I must now move on to actually expounding on the myriad technically revolutionary benefits NFTs introduce into the world of assets at large, for the sake of both my sanity and yours.

More on that tomorrow.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.