Premium Daily Crypto Newsletter

September 2, 2018Watch this video to see how to use this newsletter. Click the square in the lower right to expand the view.

Check Out Doc's Trading Book

Have You Read Our Free Ebook?

Crypto Market Commentary

Mav's Daily Commentary

Week In Review

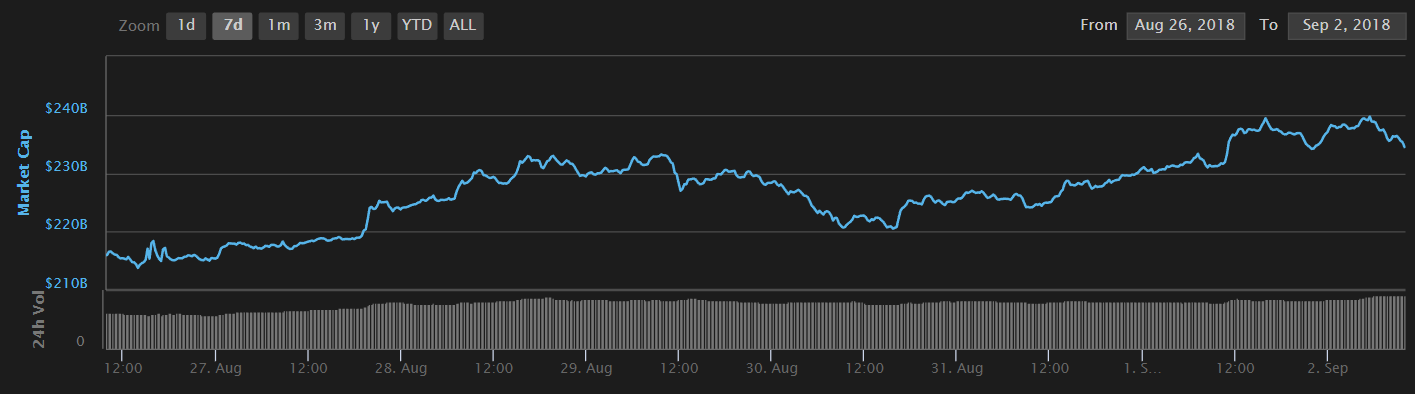

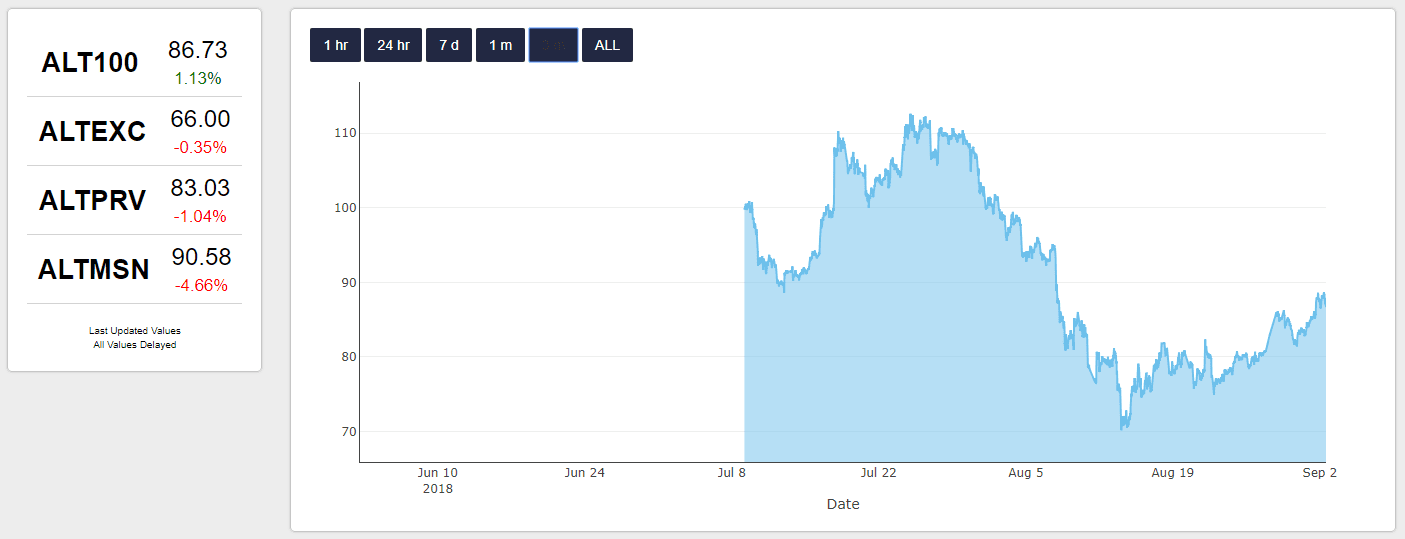

Market Has Best Week In Two Months

The market had an exceptional week, with the exclamation mark being the late week rally that added nearly 20 Billion to the overall market cap, ending this week with our first significant positive delta since early July.

Michael Moro, CEO of Genesis Trading and Genesis Capital, believes the current market stability is due in part to the SEC’s ETF rejections last week

The important question now is how long the current price level holds.

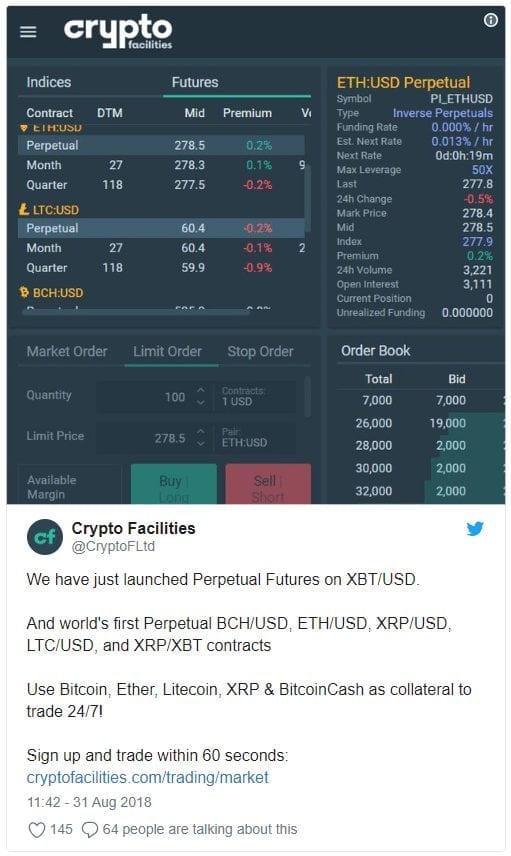

Meanwhile, it was revealed that the CBOE, the largest US-based options exchange, is getting closer to launching an Ethereum (ETH) futures contract.

Apparently, it is only months away from the public release of Ether futures. Some insiders speculate it will be as early as January 2019.

The catalyst, of course, is that the SEC clarified earlier this year that ETH is not a security. The CBOE Ethereum product will reportedly be based on the spot prices posted by Gemini, which recently announced a self-regulatory organization with 3 other exchanges.

Danny Kim, the head of growth at SFOX, believes ETH futures will help mature Ethereum’s development and the overall space:

“Cboe’s offering will enable crypto traders to take both long and short positions in ether, and it’s another step forward to a new accepted asset class. With this, I think the new investment opportunity will take crypto out of the bearish market and reverse to a new bull.”

Another point to consider is that ETH futures will provide new opportunities for bears, relieving the pressure on Bitcoin.

Since last December, if you’re bearish on any aspect of crypto but don’t want to own the underlying asset, you could short BTC. Now you’ll be able to short ETH, meaning the net shorts on BTC in futures will fall.

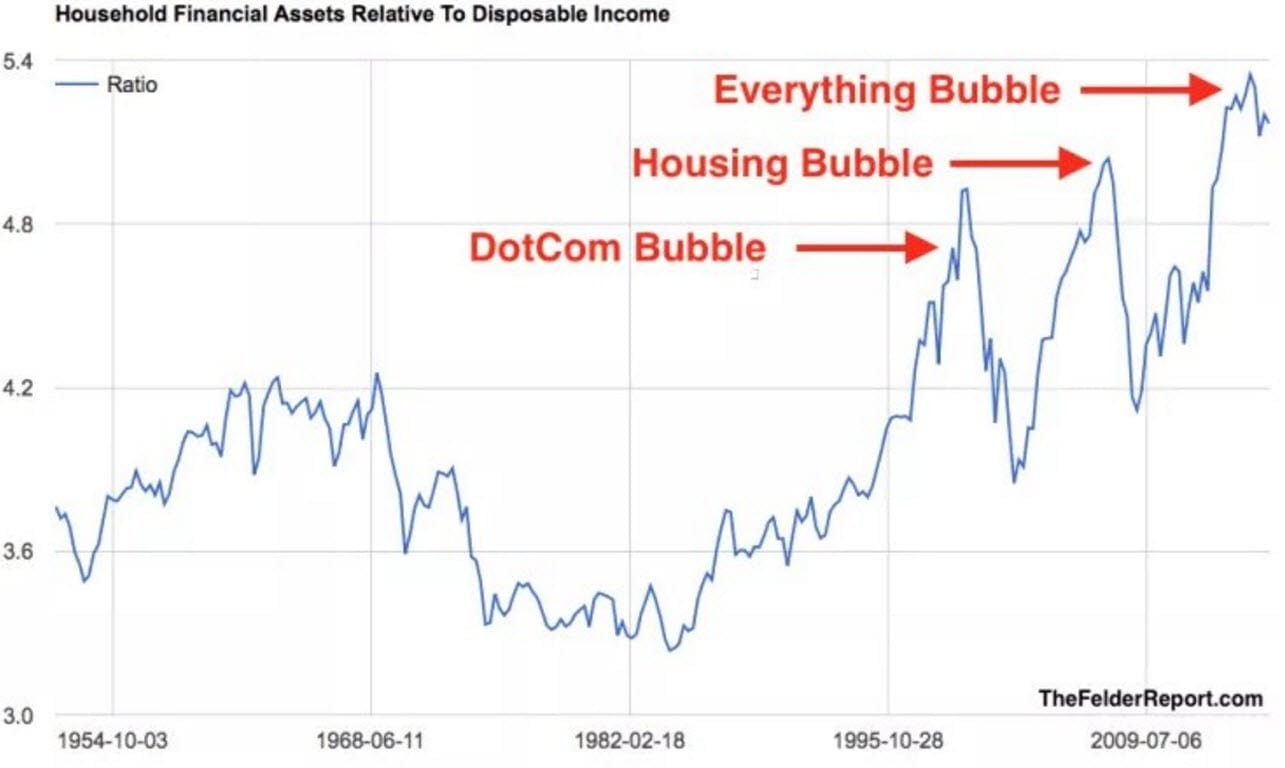

Combined with the possible exchange traded products, new exchanges, and a continued interest in blockchain by large corporations, it seems like the trend is positive heading into 2019.

As Bitcoin continues a third week of positive gains, it’s also important to see positive developments happening with second layer transactions.

Bitcoin’s second layer solution for instant and cheap transactions, the Lightning Network, had an important rollout this week.

Normally, Lightning users can pay other lightning users, and on-chain users can pay other on-chain users, but they aren’t able to pay each other directly.

The solution, known as “submarine swaps”, allows users to make trustless transactions between lightning and on-chain addresses in either direction, and is extremely important as it eliminates a large barrier to usability.

So if none of that made sense, or the gravity of it didn’t impress you, let me draw a parallel to something you might be more familiar with: the internet.

The underlying technology behind the internet, TCP/IP, hasn’t changed because to do so would essentially be a completely new network (i.e., a true hard fork). So, instead of changing the underlying protocol over the years, we instead built on top of it. All the great improvements in speed, usability, coding, etc., we’ve made with the internet has been on top of layers and layers of abstraction away from the core technology.

We find the same situation today with Bitcoin. The lightning network is second layer, or “off chain”, because the transactions processed, the speed at which they’re processed, and the fees for which they’re processed are all meant to be much smaller and faster than the current “on chain” transactions.

There’s still loads to figure out and improve, and in no way is the Lightning Network a perfect solution, but it’s an important step in the direction of off-chain scaling solutions.

Time will tell if off chain solutions prove more compelling from a usability perspective than on chain ones, but ultimately the end user will likely neither care nor notice.

So, while submarine swaps and ETH futures may be about as exciting as drying paint, it is important to note that these are milestones in maturity for both the market itself and the technology it concerns itself with.

We as traders and investors need to be able to see value in these less-than-exciting developments because they predicate the exciting ones.

While finishing the race may be the most exciting part, it was every step you took along the way that ensured you got there. In such an immaturing and developing space, we need to make every step count and recognize them as important.

Subscriber Notice: Monday is a Holiday in the United States and as such we’re going to take one of our eight days off a year. There will be no Premium Newsletter produced on Monday. The next Premium Newsletter will be produced on Tuesday.

If you missed Mav’s webinar “Top Ten Ways to Create Passive Income With Crypto” then you can watch the webinar at this link.

We’ve started to produce episodes for The ReadySetCrypto Podcast; all of our episodes are posted on our blog (and on iTunes) and Episode Eleven is now available. Episode Eleven is an interview with Adam Todd of Digitex Futures which we’ll be looking to employ as soon as it’s live. Look for more episodes shortly as we comb the crypto space for valuable interviews, and create valuable content to keep you in the loop!

See you over the weekend!

Doc's Daily Commentary

Our Weekly Premium-Only Livestream

Our next Premium-Only Livestream is scheduled for 5 September 2018 at 8 PM EDT (UTC/GMT -4 hours). Watch below for new link.

Our Public Livestream

New to Cryptocurrencies? Check out our archived classes “Intro to Cryptocurrency Trading”, “How to Find Your Next Big Cryptocurrency: Intro to Fundamental Analysis,” Mav’s class on “Security and Wallets” and Doc’s classes, “Introduction to Technical Analysis” and “Short Term Trading Strategies” which are now all available for immediate purchase in our Store, and seconds away from viewing in the Premium Member’s Home. View more about them at our online store by CLICKING HERE.

Last Thursday we held a “Passive Income” webinar. Click here for the replay!

Sign up for our NEW Telegram channel by clicking here!

Watching on Mobile? Click this link to watch in HD

Check out our BLOG for the latest videos, posts, and Podcasts! Click this link and bookmark the page!

If you go to buy any of our courses at our online “store” you can receive $10 off the street price with your member’s “coupon code” of member18crypto

Check out our new merch store! Simply go into the regular store and select “Merchandise” to pick up some RSC merch!

Offense – Adding Trades

Offensive Actions for the next trading day:

- None today.

Defense – Managing Risk

Defensive Actions for the next trading day:

- None.

RSC Managed Crypto Fund

- ETH/USD 2% added 8/10/2018 @ $363.14. (12% more to add)

- LTC/USD 2% added 8/10/2018 @ $62.56. (6% more to add)

RSC Altcoin-Exclusive Crypto Fund

What is this? The RSC Altcoin Fund is meant to replace our V1 portfolio. This portfolio, referred to as Portfolio V3, will represent a portfolio that is built upon more risky assets (assets outside the top 20), and is inherently more risky than Portfolio V2, the RSC Managed Crypto Fund (above). We will NOT be actively entering positions for this fund, but we will be updating the portfolio percentages and contents periodically.

Technical Analysis Research

In today’s video I went over three main items:

- Analysis on the Managed Fund entries; XMR is about the closest right now.

- How to input a watchlist on the new AltCoin fund

- New players on the Crypto Futures front.

In August we introduced a new “fund” project that we’ll be creating over the next few months, in piecemeal form. I will be slowly and methodically creating a “fund” with (currently) 23 assets that we will do “live” or at least very plainly indicate where we intend to enter portions of assets. As long as the market continues grinding down in a bear, we will use sentiment-based entries to hopefully secure a better entry. All that I saw were bear flags tonight; we are close to some good entries on coins showing positive divergence on the RSI.  Going forward into the end of this year my plan is to do a LOT more swing trading; what would really help is a decent derivatives exchange. I am looking for big things from Digitex in this regard, which will be a commission-free futures platform however all trades must be made in DGTX as the base currency. Put yourself on the waitlist for this platform by clicking here. I have started to acquire DGTX tokens at Mercatox in anticipation of them turning up their platform, and this looks to be a good candidate for a pump prior to the production event. Here are the recent swings that we’re tracking in the portfolio below; :

Going forward into the end of this year my plan is to do a LOT more swing trading; what would really help is a decent derivatives exchange. I am looking for big things from Digitex in this regard, which will be a commission-free futures platform however all trades must be made in DGTX as the base currency. Put yourself on the waitlist for this platform by clicking here. I have started to acquire DGTX tokens at Mercatox in anticipation of them turning up their platform, and this looks to be a good candidate for a pump prior to the production event. Here are the recent swings that we’re tracking in the portfolio below; :

- DGB/BTC – long @ .00000608 (7/23). My target exit is .000008BTC.

- WTC/BTC – Long @ .00155980BTC (4/23). My target exit is at .002BTC.

- ADA/BTC – Long @ .00003931BTC (5/1) My target exit is at .00005BTC.

- ONT/BTC – long @ .0008905 (5/20) My target is .0013BTC.

Please keep in mind that if you want to follow these trades, I am using FIXED RISK POSITION SIZING. This means that I am using a fixed amount of risk capital that is based on my account size, like 2%. I am assuming that the trade will burn to the ground and that I will lose that entire capital position! Only in this manner can one effectively manage a position the way that you have to. If you’ve every checked your blockfolio nervously every 5 minutes when you’re underwater, this will prevent that. I will track these positions in this area and not in the main portfolio section. I will use a public portfolio tool to do so, which you can access by clicking below:

Public Swing Portfolio Link

I hope you all got a chance to catch my webinar class from earlier this year; if not, the replay is available here. If you missed my earlier webinar, “More Profits in 2018; Ten Ways to Chart Like a Pro.” then you can catch the replay here. My new class “Introduction to Technical Analysis” is now available via our online store.

If you go to buy any of our courses at our online “store” you can receive $10 off the street price with your member’s “coupon code” of member18crypto..

Coinigy is a great tool for determining prices on each exchange, however I may not have access to the full suite of tools on TradingView charts. I am currently not using it as a front-end GUI for my exchanges, which it supports.I also use Blockfolio and/or Delta to give me a quick snapshot of my holdings, and find that it does an excellent job to aggregate all of my holdings into one easy-to-read snapshot of my cryptocurrencies, which are typically located in many different places.

I am also trialing the Profit Trailer and CryptoHopper trading apps which are working well in this choppy market.

Fundamental Currency Research

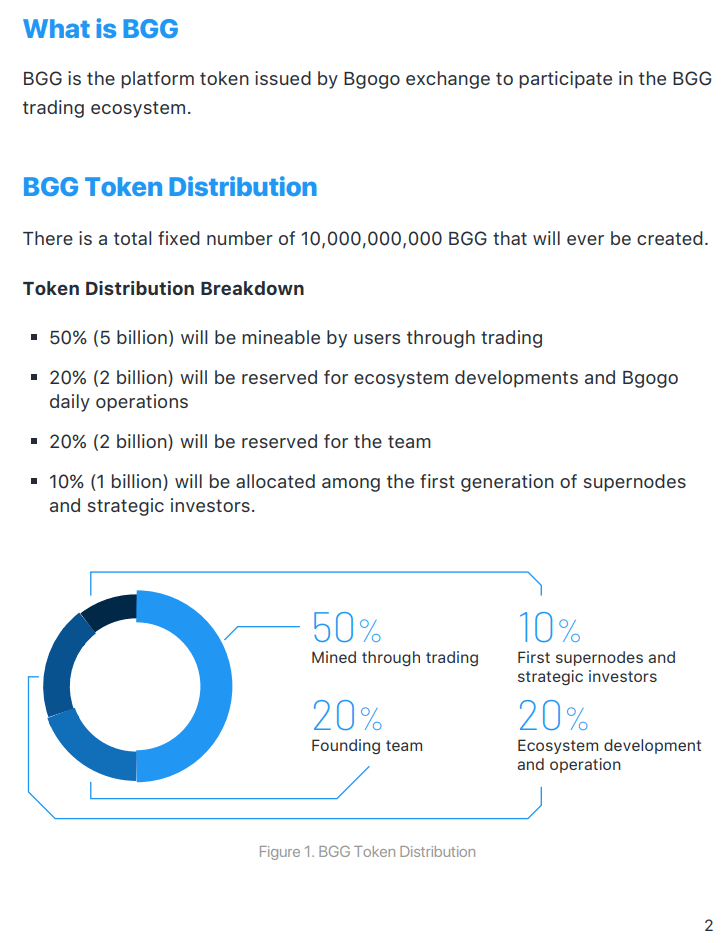

Bgogo Exchange

For flipping Good.

For long-term holding Neutral.

What is it?

What is our verdict?

What we like: Supernodes are very interesting. No trading commissions for users.

What we don’t like: There are many exchanges already on the market. Transaction mining isn’t currently solvent.

- Project name: Bgogo Exchange

- Token symbol: BGG

- Website: https://bgogo.com

- White paper: https://bgogo.com/assets/white-paper/BGG-Token-Whitepaper-v1.8EN.pdf

- Hard cap: 17,000 ETH (15,000 ETH during private sale and to supernodes, 2,000 ETH during public sale) for 10% of total tokens

- Conversion rate: Private sale: 1 ETH = 66,666 BGG; public sale: 1 ETH = 69,999.3 BGG.

- Maximum market cap at ICO on a fully diluted basis: $51 million based on current ETH price of $300

- Bonus structure: Whitelisted public sale participants have a 5% bonus over the private sale price, with no lockup period.

- Private sale: The private sale has already been completed with 10,500 ETH raised from 21 supernodes and 4,500 ETH from strategic investors.

- White list: Bgogo’s public sale will be a Genesis Mining event (exact date to be confirmed) that will start 24 hours before mining is officially opened to the public. Only whitelisted users can participate. Details on the Genesis Mining event can be found here: https://bgogo.com/announcement?link=mining.

- ERC20 token: Yes (will be switched to native tokens when the mainnet is launched)

- Countries excluded: TBA

- Timeline: TBA

- Token distribution date: TBA

Website: https://bgogo.com

Whitepaper: https://bgogo.com/assets/white-paper/BGG-Token-Whitepaper-v1.8EN.pdf

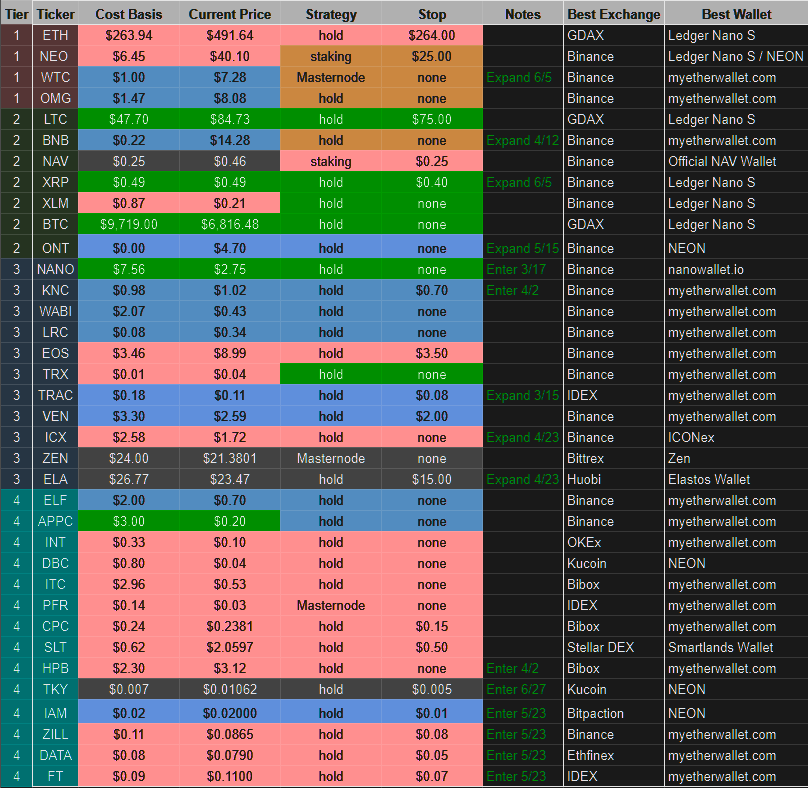

2017- 2018Q2 Portfolio (Discontinued)

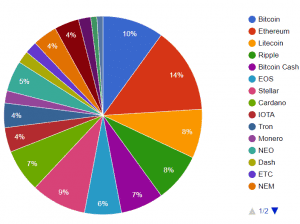

Desired Holdings

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

How to read this portfolio: Please click on the Chart Key tab above for definitions and color codes. The colors correspond to our 7 categories in the graphic below.

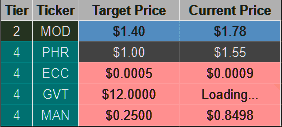

Tier 4

ZIL

IAM

FT

DATA

ELEC

None.

Tier 2

MOD

Tier 3

REQ

SUB

LINK

NANO

KNC

Tier 4

BNTY

TAU

WISH

PHR

LOCI

XBY

ELA

ECC

POE

HPB

BIX

EVE

XVG

NULS

DNA

READYSETCRYPTO

We’re ReadySetCrypto, and it’s our mission to uncomplicate cryptocurrency.

Let’s get started.

© 2018 Ready Set Crypto, LLC.