Doc's Daily Commentary and Watchlist

Mind Of Mav

What To Expect With Ethereum’s Merge

The most anticipated upgrade of the year is taking place soon as Ethereum transitions from proof of work to proof of stake. We have extensively covered the merge in this newsletter, but as market conditions have evolved many of the projected effects of the merge have changed.

That’s why this week we provide some projections of the impact the merge will have on key ETH supply and demand indicators. Moreover, we’ll cover second order effects that have begun to arise in anticipation to the merge and provide analysis on how these are likely to unfold.

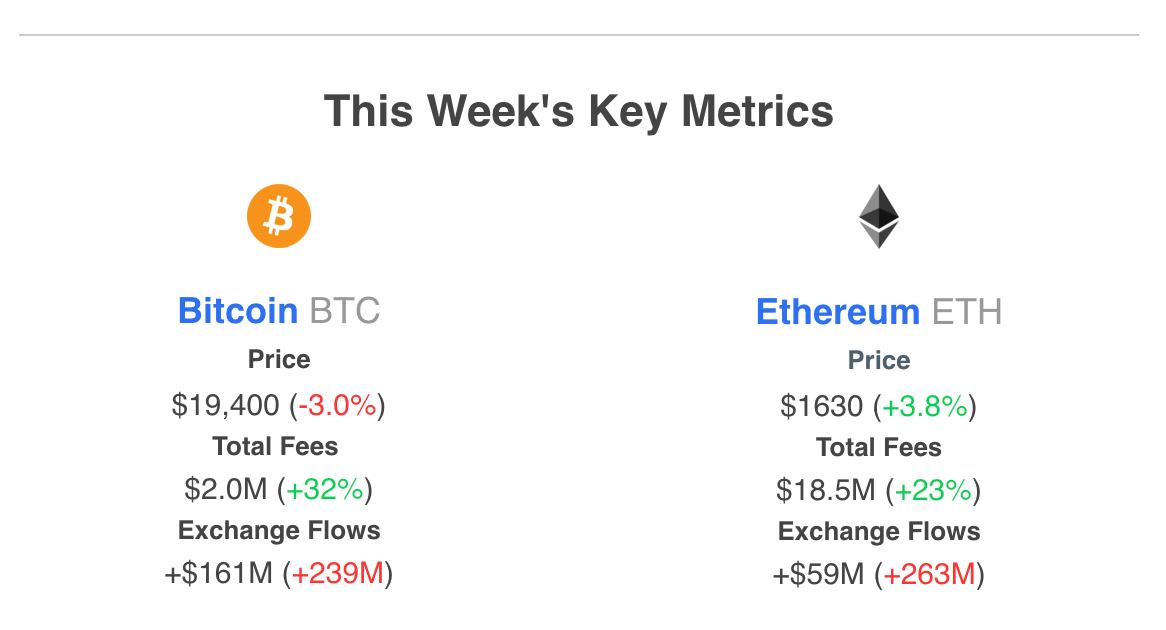

Fees — Sum of total fees spent to use a particular blockchain. This tracks the willingness to spend and demand to use Bitcoin or Ether.

Network fees for both Bitcoin and Ethereum rebounded from yearly lows seen last week

Exchanges Netflows — The net amount of inflows minus outflows of a specific crypto-asset going in/out of centralized exchanges. Crypto going into exchanges may signal selling pressure, while withdrawals potentially point to accumulation.

Both Bitcoin and Ether registered relatively small exchange inflows throughout the week

One likely reason for ETH inflows is from holders looking to claim the Ethereum proof of work hard fork token (ETHW), which will be accredited to users of multiple exchanges including Binance

What to Expect With the Ethereum Merge

Ethereum will be migrating to proof of stake (PoS) next week, an event that has been largely anticipated for many reasons. This upgrade has been under development for several years and is expected to bring forth several improvements for the Ethereum network and Ether (ETH) the asset.

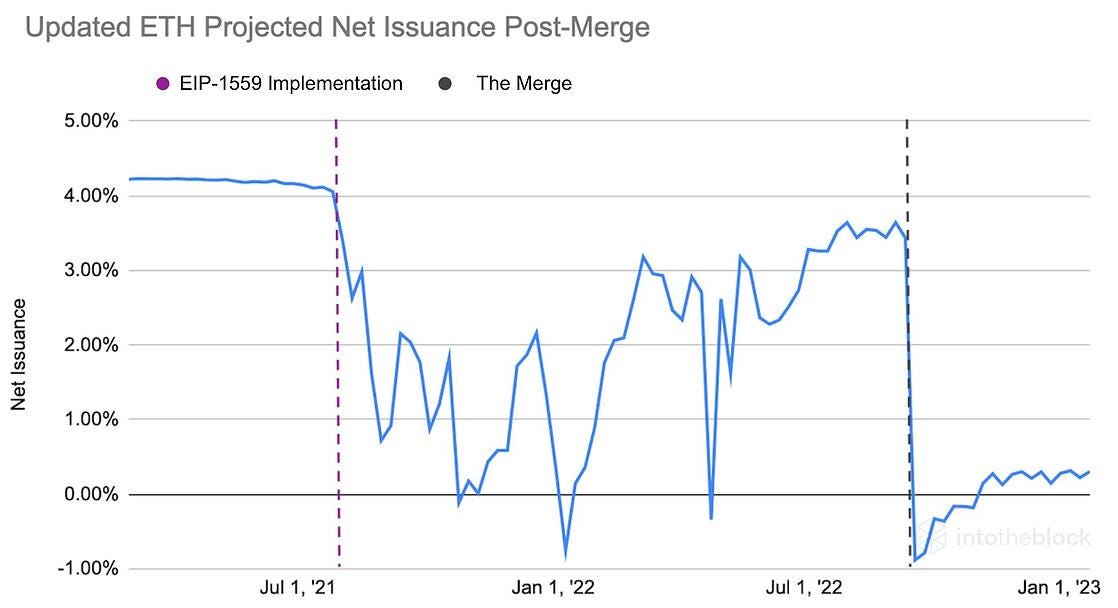

One of the most impactful effects coming from the merge is that the amount of ETH issued per block will decrease by 85%-90% following the merge.

“Triple Halving” — A 87.5% reduction in issuance is equivalent to the effect of three Bitcoin halvings all at once

ETH supply pressure entering the market will vastly decrease as miners will become a thing of the past

This will remove $20M to $25M worth of price pressure based on current miner rewards

ETH staked will not be able to be withdrawn yet (until the Shanghai upgrade), postponing this supply inflow to a future date still unknown

Following the issuance drop right after the merge, it should gradually increase as shown in the graph above as more ETH being staked leads to greater emissions even if these can’t be claimed yet

Slightly Deflationary — ETH supply is likely to decrease briefly after the merge

Transaction fees are expected to increase in the hours and days following the merge as the anticipated event is likely to drive volatility and speculation, thus burning more ETH in the process

However, if Ethereum fees return to their 30-day average, ETH will be modestly inflationary

For these reasons, the most up-to-date projections for ETH inflation following the merge are between -1% to +0.5%. These figures are lower than previous projections given that transaction fees have dropped 75% over the past three months.

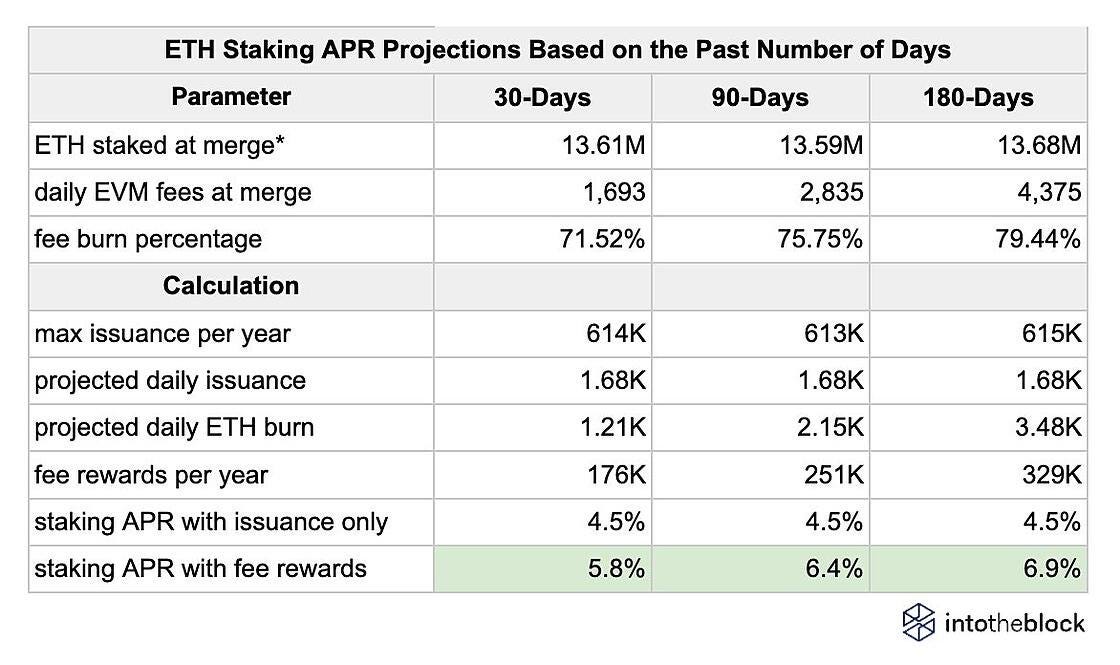

This also leads to lower projected staking rewards than those calculated in 2021.

5% — 7% Staking Returns — Based on data between the last 30 to 180 days, ETH staking rewards should be within this range

As fees have dropped in the last month, the yield these represent for stakers has decreased

To partially make up for this decline and incentivize network security, the Ethereum network automatically adjusts the percentage of ETH being burnt, giving a higher share of transaction fees to stakers in periods of low demand

As more ETH gets staked the returns pro-rata decline, suggesting that staking yields will decline over time unless fees spike back to the levels seen at the beginning of the year

These figures lie below the “conservative” projections first brought forth by the Ethereum Foundation’s Justin Drake. As market conditions have evolved and demand has eased, staking yields have become lower. Regardless, these yields will be 20–40% higher than the current 3.9% provided by staking ETH.

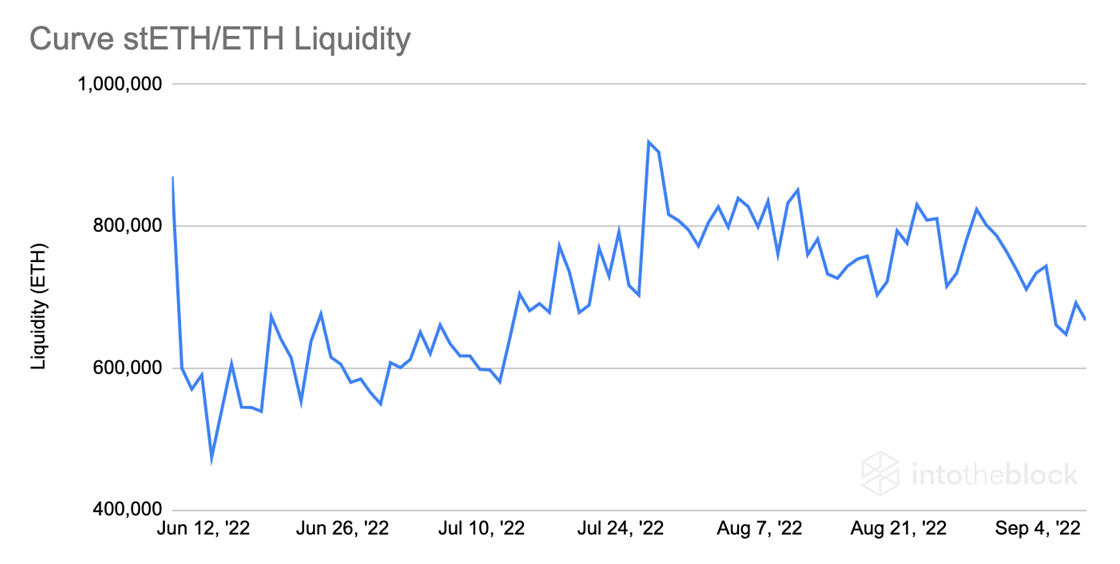

Second order effects of the merge have began to show up in on-chain data. The Ethereum proof of work (ETHW) fork expected to take place during the merge has led to ripple effects on DeFi. Since liquidity pools nor staking tokens will receive the ETHW airdrop, liquidity has been exiting DeFi over the past few weeks.

Instant vs Periodic Returns— The ETHW airdrop poses an instant return opportunity for addresses holding Ether

ETHW is currently being priced just above $30 based on IOU markets trading the asset in advance

This represents ~1.8% of ETH’s current value, which would be able to be claimed right after the merge

This has led to the withdrawal of liquidity from ETH pools across DeFi, as investors seek this instant yield and forego much smaller daily yield

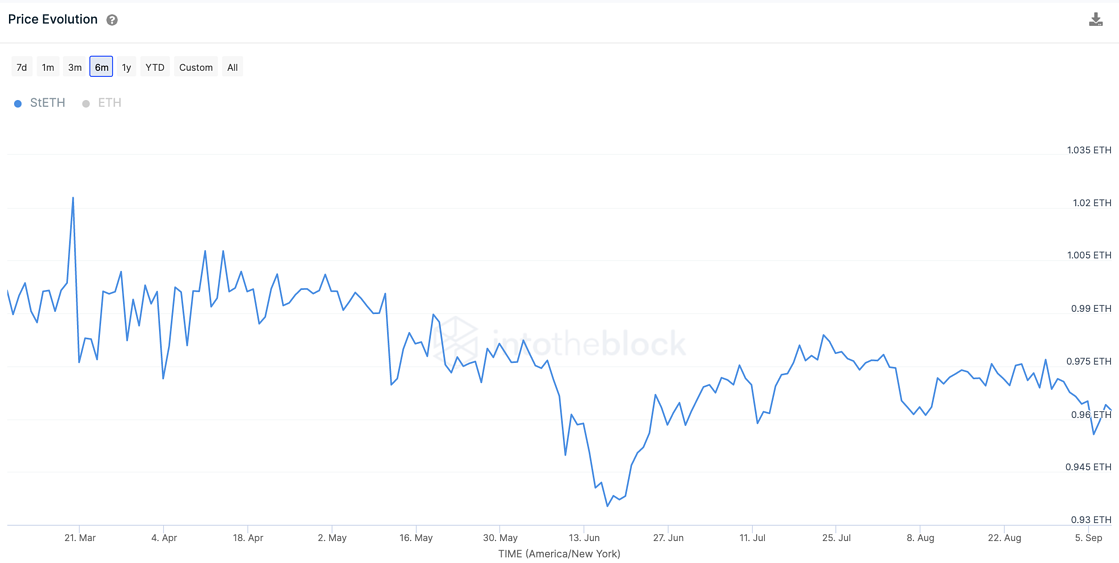

stETH discount — The price of Lido’s stETH token has been decreasing as it will not receive the ETHW airdrop

With liquidity exiting the stETH pools, volatility is likely to spike shortly before and after the merge

Thus far liquidity is exiting mostly with ETH, leading the Curve pool to be the most imbalanced (77% stETH / 23% ETH) since June

While this puts short-term price pressure on stETH, if the merge is successfully implemented it would be de-risked and yield higher returns for holders, potentially attracting buyers afterwards

Despite being years in the making, there is still risk behind the upcoming Ethereum merge.

Volatility is likely to spike given the large anticipation and drive higher fees short-term.

Overall, we are likely to see ETH be briefly deflationary due to this and observe several ripple effects across the market as multiple forces are at play.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.