Doc's Daily Commentary and Watchlist

Mind Of Mav

The Fed’s Endgame

Today, the Fed announced a third 75 basis point interest rate hike. Going beyond what that means, let’s focus on what the Fed actually wants: world domination.

Ok, maybe nothing as overtly dramatic as that, but certainly they want to increase their control of domestic and international monetary systems.

After a pandemic and multiple financial crises, we’ve finally entered a lengthy period of rising interest rates. But while most are aware of the ominous outcomes this could create, those who understand how the Fed actually controls interest rates will gain an edge in predicting the future.

Because of recent events ushering in exceptional circumstances, current textbooks describing how the Fed influences interest rates have become obsolete. Until recently, Federal Reserve officials could simply raise and lower interest rates by decreasing and increasing the level of bank reserves in the financial system. Bank reserves are “interbank” money, which can only be used by entities with reserve accounts inside the Federal Reserve System. JPMorgan, for instance, can pay Goldman Sachs for prime New York real estate using its reserves, while the average citizen must use bank deposits or “Federal Reserve Notes,” a fancy term for physical cash.

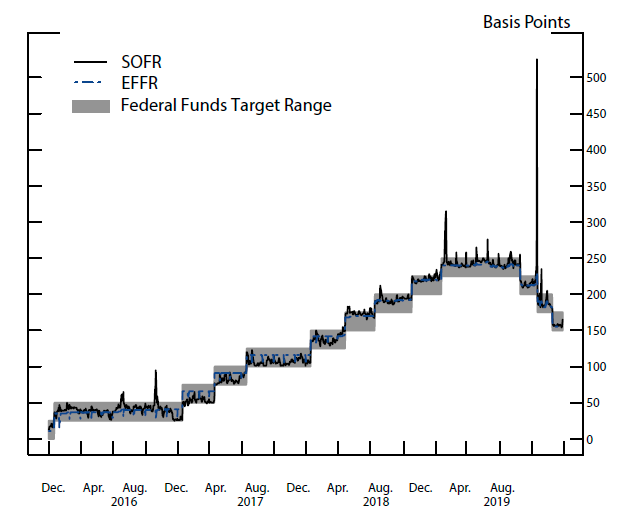

Before the Great Financial Crisis (GFC), the Federal Reserve had enough power to push interest rates toward its target, commonly known as the Federal Funds rate or EFFR — the price at which banks lend reserves to one another. The U.S central bank did so by adding and removing a specific amount of reserves to and from its interbank system. By lowering the supply of bank reserves, the Fed forced financial institutions to bid up the price of Federal Funds, resulting in higher interest rates throughout money markets. Conversely, by increasing the supply of bank reserves, the Fed influenced interest rates lower. The following graphic from the St. Louis Fed website illustrates these forces at work.

Everything ran smoothly. The Fed set a target range in which interest rates could fluctuate and made the necessary adjustments to keep rates within set boundaries. Conveying and implementing its latest monetary policy stance was a cakewalk.

Then, in 2008, the Great Financial Crisis (GFC) hit, changing the central banking paradigm and the Federal Reserve System forever. The primary catalyst that fueled a radical transformation was the Fed officials’ decision to flood the system with bucketloads of reserves. The amount was staggering. In 2007, the system held a total of $15 billion in reserves. Today, that total has skyrocketed to roughly $3.2 trillion. The Fed’s latest quantitative tightening agenda has been aggressively eliminating bank reserves from the system. Still, it’s long before we return to “normal” levels.

With a system full to the brim with reserves, the Fed could no longer control interest rates through its previous policy of increasing and decreasing levels of interbank money. As shown in the graphic below, the Fed flooding the system with reserves meant that even sizeable supply adjustments no longer influenced the demand curve. The U.S central bank needed a new mechanism to take back control of Federal Funds and fast.

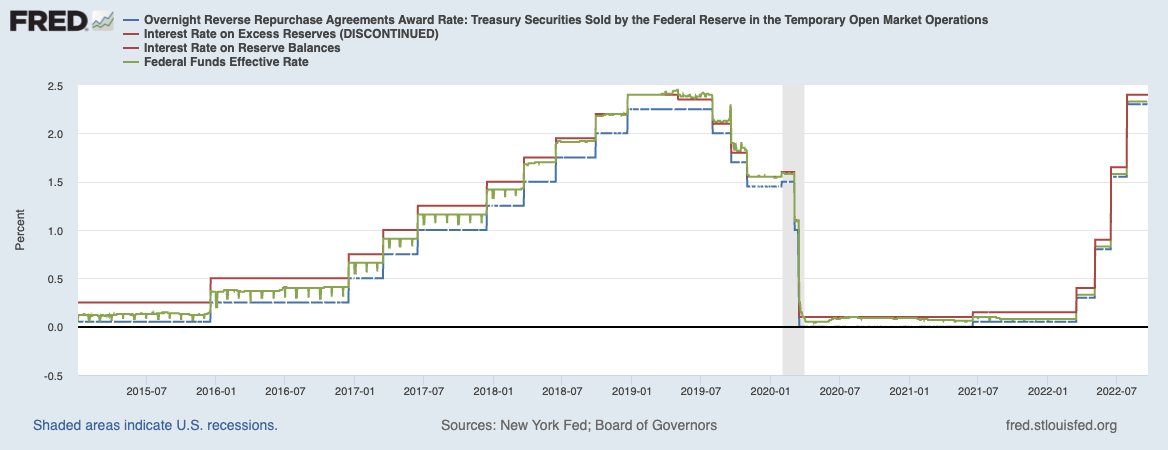

Enter the Fed’s “Ample Reserves” regime, where Fed officials stopped using open market operations (OMOs) — buying and selling government securities to alter reserve levels — as its primary tool to adjust the price of money. On October 6th, 2008, the Fed began paying reserve account holders, mostly large commercial banks and government-sponsored enterprises (GSEs), interest on their balances. IOER (Interest On Excess Reserves), as it was called back then, had been chosen as the Fed’s chief tool to control interest rates.

By offering banks IOER, a “risk-free” investment option, the Fed gained the power to control money markets through two mechanisms. First, through the “reservation rate,” the lowest rate that banks were willing to loan out funds to the market. Because the Fed started handing out a risk-free investment that paid superior interest (IOER), no entity would want to lend to others at rates lower than the Fed. This set a ceiling on how high rates could go, alongside the Fed’s second mechanism: arbitrage. Fed Funds rarely dropped beneath IOER because entities could create a risk-free arbitrage, borrowing Fed Funds at say 1% and depositing it at the Fed, which paid out 1.5%. The 50 basis points gap would eventually narrow to near zero, as Fed Funds participants competed to arbitrage the spread away.

With these two new levers, the Fed believed it had successfully regained control of money markets. If it wanted to alter rates, the Fed simply adjusted the discount rate and IOER at the same time and by the same level. If the FOMC (Federal Open Market Committee) was indicating that rates should rise, money markets could adjust, preemptively pricing in a tightening cycle.

From there, the Fed established a ceiling on interest rates, but a slight problem remained. They also needed to establish a floor on rates. Influential participants in the Fed Funds market, such as Federal Home Loan Banks (FHLBs), were ineligible to earn interest on their reserve balances. This meant they sometimes pushed money market rates below the Fed’s targets. To counteract this, the Fed created the overnight reverse repo facility, ON RRP. This offered a risk-free investment at a set rate to parties ineligible for IOER, thereby correcting the bug and setting a lower bound on interest rates. Money markets obeyed with minimal fuss.

For now, that was that. After implementing a trio of policy rates (IORB, ON RRP, and the discount rate), the Fed once again felt it had total control of money markets. Yet, it still held one weakness: repo, the shadow banking market that allowed parties to temporarily transform their Treasuries into quasi-bank deposits. By 2019, barely any entities other than a few government-sponsored enterprises (GSEs) still participated in the Federal Funds market, as most institutions now had all the reserves they needed. Instead, animal spirits and regulation pushed market participants into repo.

On September 17th, 2019, rates in the repo market exploded higher. Everyone wanted cash, but there was a shortage. Corporate tax payments and increases in Treasury issuance prompted a large decline in reserves. As a result, banks had to cut back on repo lending. Nobody could provide.

Responding to this demand-supply mismatch, the Fed created what it eventually called the “Standing Repo Facility”. This allowed specific entities to obtain cash from the Fed at a set rate using U.S. Treasuries, agency debt, or agency mortgage-backed securities as collateral. The Fed’s gambit worked. Since everyone started borrowing from the central bank, the Secured Overnight Financing Rate (SOFR), which tracks the cost of transactions in the repo market, fell from over 5% to within the Fed’s target range.

Fast forward to July 2021, after COVID and the ensuing QE Infinity, IOER along with IORR (interest on required reserves) had grown redundant. The Fed retired these measures in favor of a single benchmark: IORB (Interest on Reserve Balances). QE Infinity had made the term “excess reserves” meaningless.

Since then, it’s been plain sailing for the Fed. It has, at least for now, eliminated potential crises in money markets. If rates soar above its target range, the Fed adjusts IORB or fires up the Standing Repo Facility, bringing rates back into its desired range. At the lower bound, entities barely want to borrow under the Fed’s ON RRP rate, as they’re missing out on a risk-free investment from an entity that can issue debt with no credit or default risk. The Fed’s rate floor has been “leaky” a few times, but everytime it’s been fixed.

So by implementing a trio of policy rates (IORB, ON RRP, and the discount rate), and utilizing its Standing Repo Facility, the Fed has gained a solid grip on money markets. Ever since the repo market blowup, minus a few “hurdles”, the status quo has evolved into stability.

Now, claiming the system is “stable” is what many will deem contrarian. But contrary to popular belief, the Fed has created a more durable system and increased resilience. Most Fed analysis is ideologically driven, not based on validities, so it’s hard to acknowledge.

This, however, does not mean financial markets have been stripped of hazards. With the Fed being able to prevent domestic money market crises, the danger now lies offshore in exotic areas of the financial system.

But once again, the U.S is gradually gaining authority and power over these markets. By providing central bank swap lines and foreign exchange swaps to its closest allies, opening a FIMA facility to seemingly supply emergency dollars to China, and issuing $1 trillion in Treasuries every year till at least 2055, America will increase its grip on global finance, with the U.S. Dollar front and center.

It’s for these and many other reasons that Concoda sees the endgame as not a collapse but the Fed gobbling up every shadow banking paradigm to maintain financial stability. The REM Industrial Complex (Repo, Eurodollar, and Money Market Fund) will continue to fall under the Fed’s umbrella. The U.S dollar hegemony requires a complex, ever-changing financial system, and as it becomes increasingly elaborate and intricate, the Federal Reserve must expand its powers to preserve authority. The so-called world’s central bank possesses almost total control over most of the global monetary system, but if another threat emerges, it can — and will — adapt to the situation, changing the rules of the game once again to keep the monetary system functional and stable.

Despite a brief backlash, everyone — central bank critics, average citizens, and even crypto advocates — will go along with the Fed’s contemporary policies because the alternative is a financial catastrophe so ominous that even collapsitarians will choose to avoid it. When everyone is faced with the real consequences of the so-called Great Financial Reset™, it will be exposed as a mere daydream.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.