Doc's Daily Commentary

Mind Of Mav

What Is Yield Farming Really?

The terms decentralized finance and yield farming have been aggressively thrown around social media and the Cryptocurrency press as of late in an attempt to capitalize on the buzz and interest of the community. These terms encompass a range of protocols that have launched on the Ethereum mainnet, in the form of smart contracts, that allow token holders to take part in various activities in an attempt to generate more tokens and increase their holdings. One can think of these smart contracts as financial instruments that token holders can take part in, and generate rewards in return.

These financial instruments have become quite sophisticated — they provide a level of automation and ability to move assets around protocols based on which protocol can offer the best returns. The most popular suite of tools to do this currently is with Yearn Finance, a relatively new library of smart contracts that aim to maximize the profit of token holders by automatically moving their tokens around protocols to generate the most revenue possible.

One can think of Yearn Finance as a DeFi orchestrator. Its value proposition lies in its ability to leverage the growing DeFi ecosystem on Ethereum and automatically convert, split, distribute and deposit tokens in order to generate commissions and rewards in the form of liquidity commissions and governance token mining. These concepts and more will be covered throughout this piece to provide the reader a well-rounded overview of what yield farming is, and some of the popular protocols hosted by Ethereum to make it happen.

By the end of this series, you should understand how Yearn Finance leverages DeFi protocols to increase a token holder’s yield on their returns, as well as its relevance in the DeFi space.

The Underlying DeFi Value Propositions

Before jumping into specific protocols, it is important to understand how a token holder can increase the yield of their tokens. Here are the main methods of doing so today.

Providing liquidity to decentralised exchanges

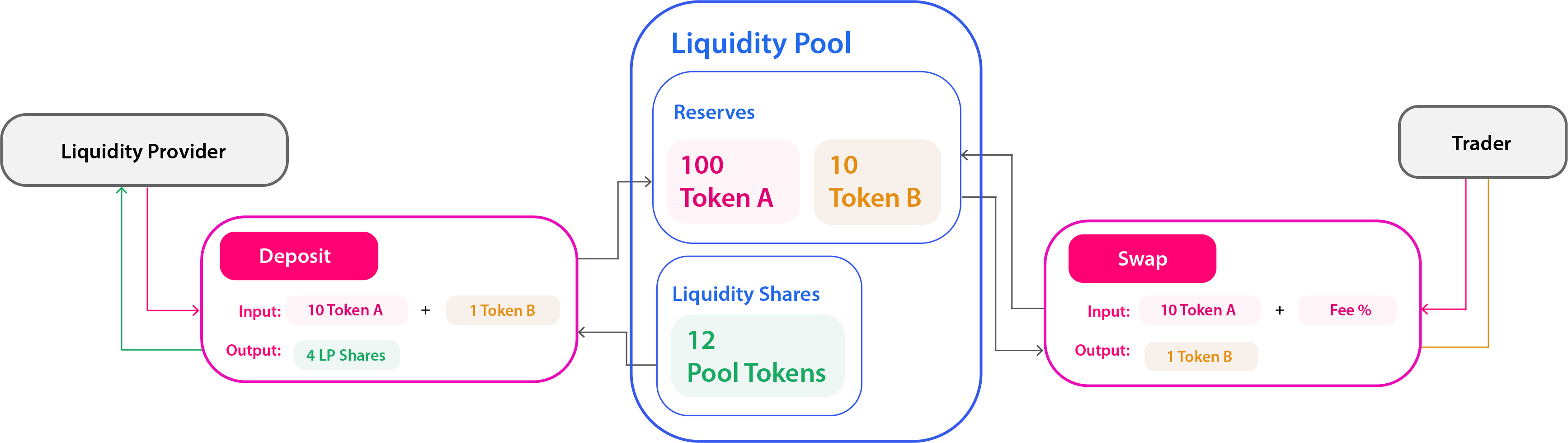

One way to generate a passive token income is by providing liquidity to decentralised exchanges for particular token pairs (such as WBTC — ETH), whereby the depositor provides the equivalent value of both tokens in that particular pool, and will receive a share of the pool’s exchange fee that is charged with each token swap.

Trading fees vary between exchanges; as examples, Uniswap’s free is currently 0.3%, whereas Aave charges 0.10–0.20% in trade value.

Providing liquidity can now be done with protools ranging from Aave, Compound, Curve Finance and Uniswap. Each come with their own token pools, strengths and drawbacks. Pool size and demand fluctuate over time, making it hard to project how much you will earn over the medium to long term.

This is a problem that Yearn Finance is attempting to solve, to an extent, by ensuring that a token holder’s funds are always distributed to pools that reward the highest value.

Staking liquidity tokens / UNI use case

Upon providing liquidity, decentralised exchanges in-turn provide you “LP Tokens”, or liquidity tokens, to prove that you own that stake within the pool. Protocols are now allowing these tokens to be staked (deposited into another smart contract) in exchange for more tokens, often in the form of the governance token of the protocol in question.

LP tokens are simply another ERC20 token received in exchange for depositing tokens into a liquidity pool. These tokens prove your share in the pool, and are needed to withdraw your tokens from the pool. But it has become common practice for LP tokens to also be deposited into other pools, mainly as a way to distribute governance tokens.

A good use case for staking LP tokens is that of distributing a particular protocol’s governance token.

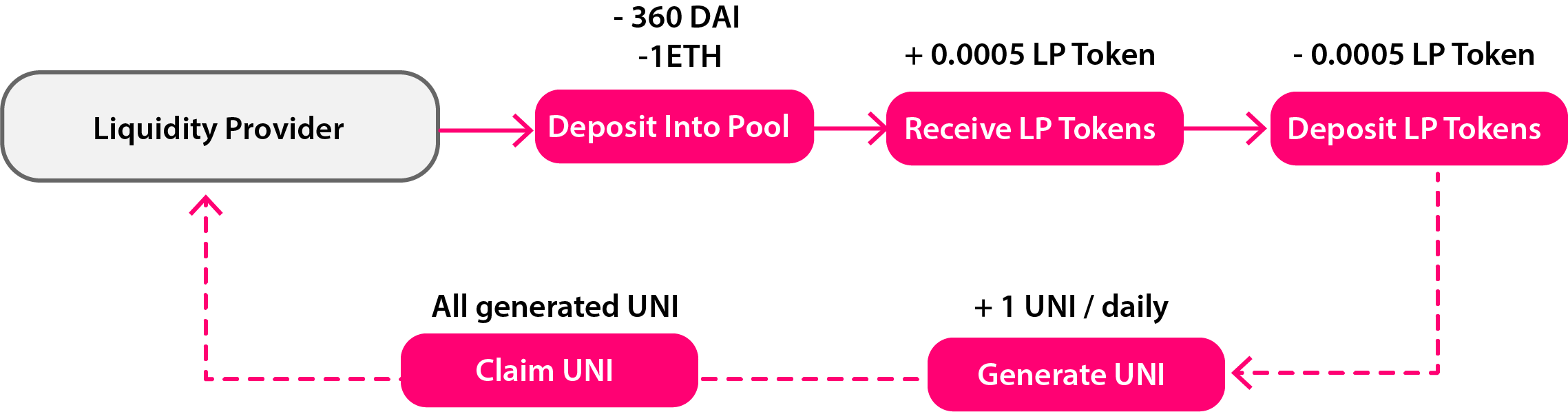

A great example of this is with Uniswap, where they launched a governance token in the form of the UNI token designed to be used for voting on potential governance proposals to improve the platform.

As a way to distribute the token, the Uniswap devs set aside 5,000,000 tokens for a select few liquidity pools (5 million tokens per pool), whereby users can stake their LP tokens (deposit those tokens into another pool for generating UNI) in order to generate UNI tokens over a period of time, adhering to the following model:

This in-turn incentivized users to deposit funds into those supported pools in order to receive UNI. This not only raised Uniswap to the top of DeFi in terms of value locked (and thus increased adoption), it has also solved the problem of how to fairly distribute minted UNI to parties that actually participate in the protocol.

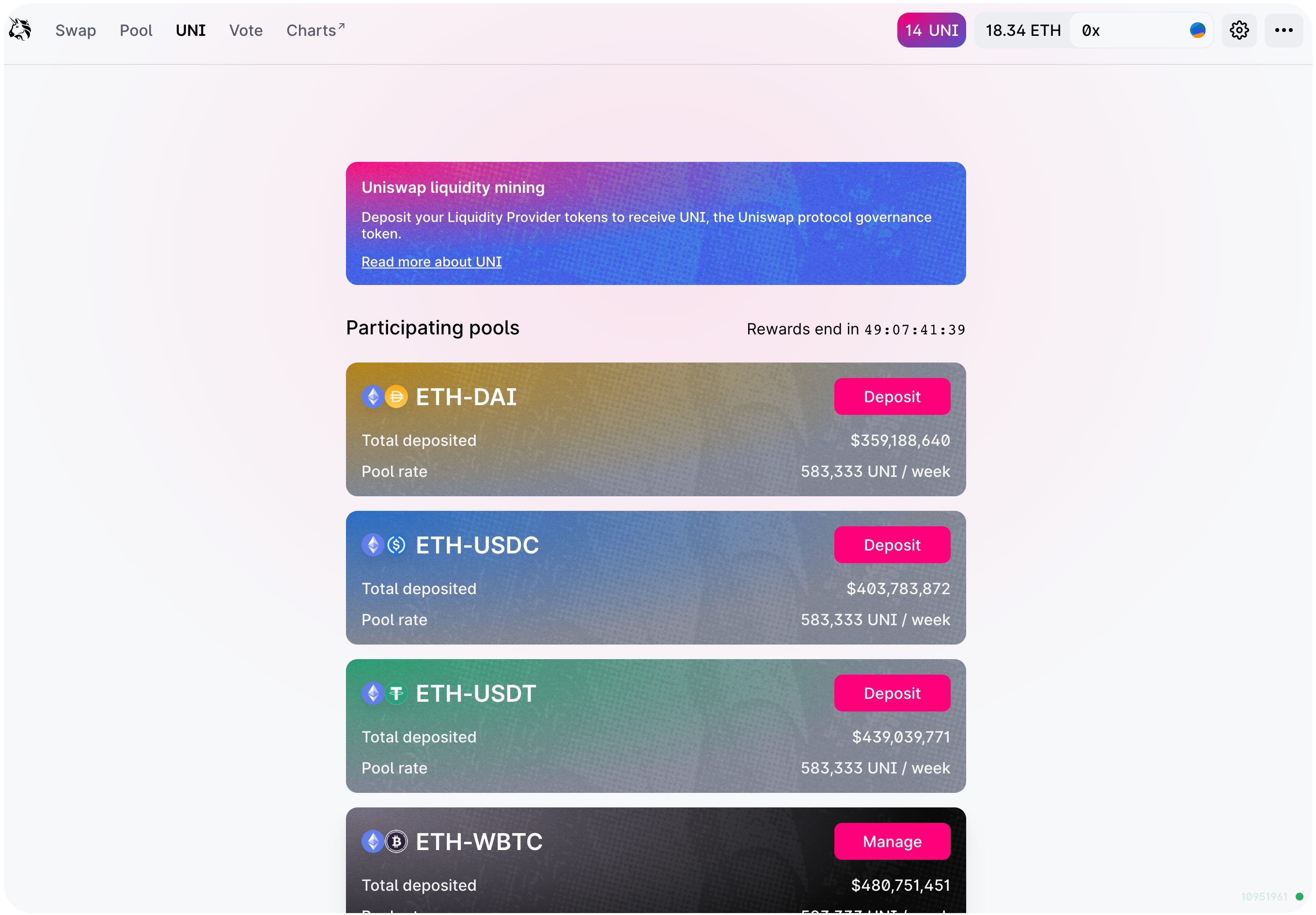

The mechanism of generating governance or utility tokens by staking LP tokens is termed liquidity mining. The UNI page of Uniswap currently lists the available pools taking part in the UNI liquidity mining distribution:

Such opportunities allow token holders to boost their holdings with little risk, but as in the case with the UNI token, it is only available to be mined for 2 months — with the process starting on September 17th 2020. Not only this, but the share of tokens distributed to each participant is based on the value of your share relative to the whole pool. In other words, as more people take part in the mining process, your share of funds will go down.

So in order to be successful in liquidity mining, understand that:

*There will always be a first-mover advantage. The fewer participants in a pool, the larger your share.

*Opportunities will come and go. The distribution purpose of liquidity mining happens when a new governance token launches, and the process of which could only last days or weeks. Keep up to date with the field and prospective governance token launches so you’re prepared to leverage such opportunities as they arise. (and no, Yearn Finance will not monitor these opportunities for you — its strategies are limited to known smart contracts and their corresponding addresses hard coded into a particular strategy).

*There will undoubtedly be many tokens adopting such a distribution method, some of which will have flawed business models and valueless tokens. Understand that depositing your tokens in such a pool will render them useless to others — consider the opportunity costs of participating in liquidity pools.

Generating governance tokens / Curve Finance use case

The third underlying DeFi value proposition we’ll cover here is generating governance tokens over time, which is often done by participating in a particular protocol.

Unlike an initial token distribution, governance token generation is a stable and long-term mechanism to reward users for using the protocol over the long term. An increased holding of governance tokens will then give the holder more voting power when improvement proposals arise.

The ability to change a protocol should be the main value proposition of governance tokens, giving the user-base the power to shape or evolve the protocol in question. Governance tokens, like any other CryptoCurrency, are subject to pump-and-dump schemes and radical market movements in extreme bullish or bearish sentiments.

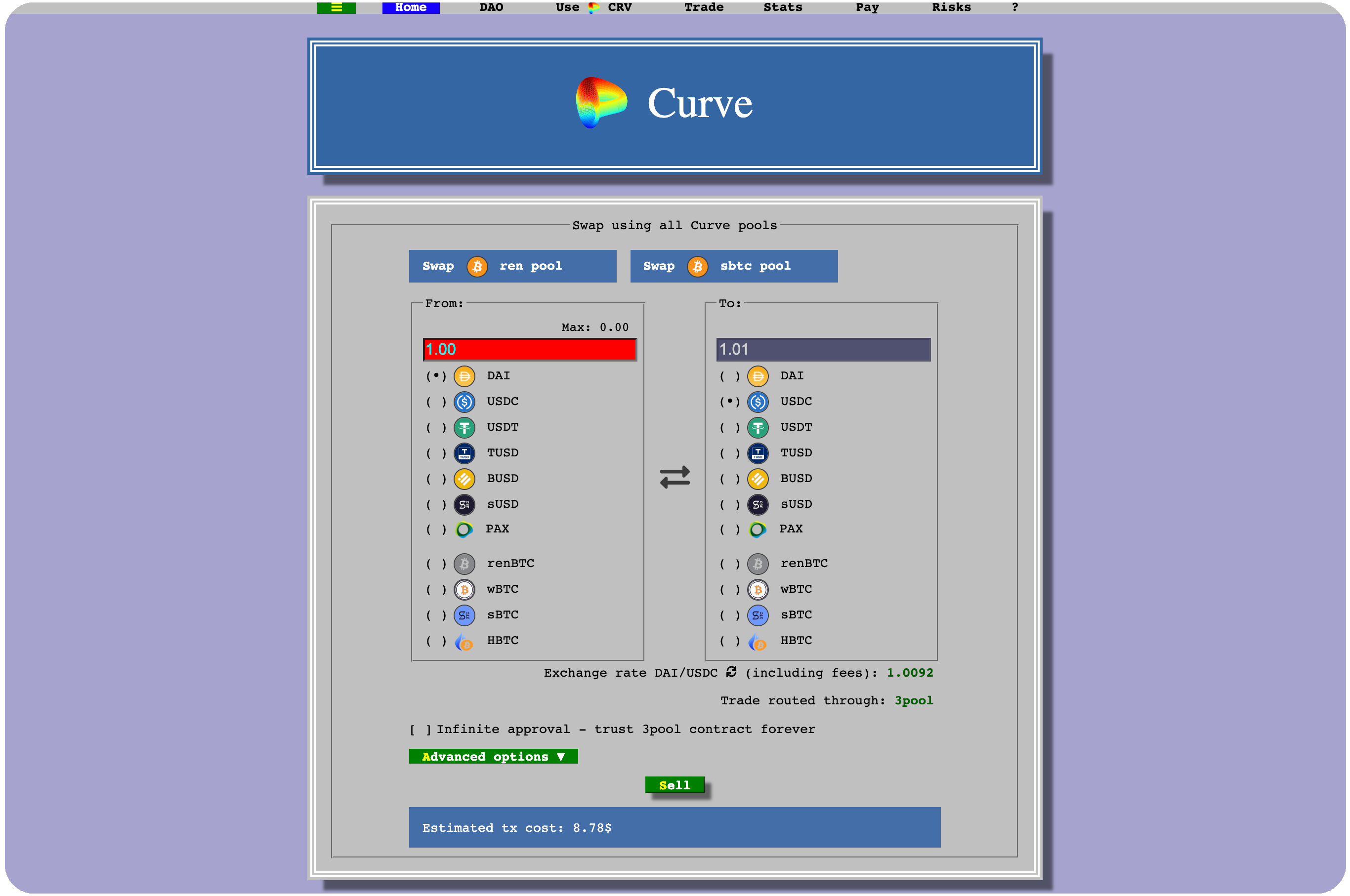

A good example of generating governance tokens is that of Curve Finance, a decentralized exchange that focuses on trading stablecoins and wrapped Bitcoin. Here is the Curve home page, where users can exchange a range of stablecoins from the get-go:

The UI of Curve is rather bizarre and not too user friendly, mimicking a dated operating system GUI. As we’ll cover further down, there are alternative front-end apps available to interact with the protocol.

The governance token of Curve Finance is CRV, and is rewarded to users that take part in Curve’s liquidity pools. This is done similarly to how the UNI distribution was done, but with no time limit this time.

The next section will dive more into Curve liquidity pools and how they operate.

The story does not stop here by generating CRV — there is another mechanism in place to generate more CRV with your current holdings — a mechanism called vote locking. Vote locking, as the name suggests, involves sending your CRV to a smart contract for a certain amount of time (this could be a period of months or years), where it will be locked up until the time period is over.

Curve’s DAO page is where vote locking and other governance mechanisms can be interacted with. Tokens can be locked for up to 4 years using the provided GUI. Curve have stated that vote locking can multiply your CRV rewards by ~2.5x, making it a tempting proposition to give your LP tokens a yield boost.

CRV vote locking risks

Before you lock up CRV, assess the following considerations to ensure you commit to a strong position:

*Do you have enough LP tokens in your wallet to make the commitment worth your while? The more LP tokens you have staked, the more CRV you will be rewarded.

*Weigh up the opportunity cost of locking the CRV. In that time period there could be major price movements, with selling opportunities in-particularly being missed.

*Do you believe in the long-term prospects of the protocol? You’re ultimate goal is to increase your CRV governance token holdings, with the derived value pertaining to the ability to shape the protocol in future improvement proposals. Don’t lock value into protocols that you do not understand or those that do not have a clear roadmap or market need.

Beyond the CRV token, Curve Finance is a great protocol to study to understand other concepts and mechanisms used in DeFi. The next section will visit how Curve pools work, how one can back a range of tokens in a particular pool, and how we can leverage “wrapped tokens” to increase yields.

Tomorrow we’ll continue this topic. See you then!

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.