Doc's Daily Commentary

Mind Of Mav

What Is Yield Farming Really? Part 2

Let’s pick up where we left off yesterday.

Curve Finance Pools

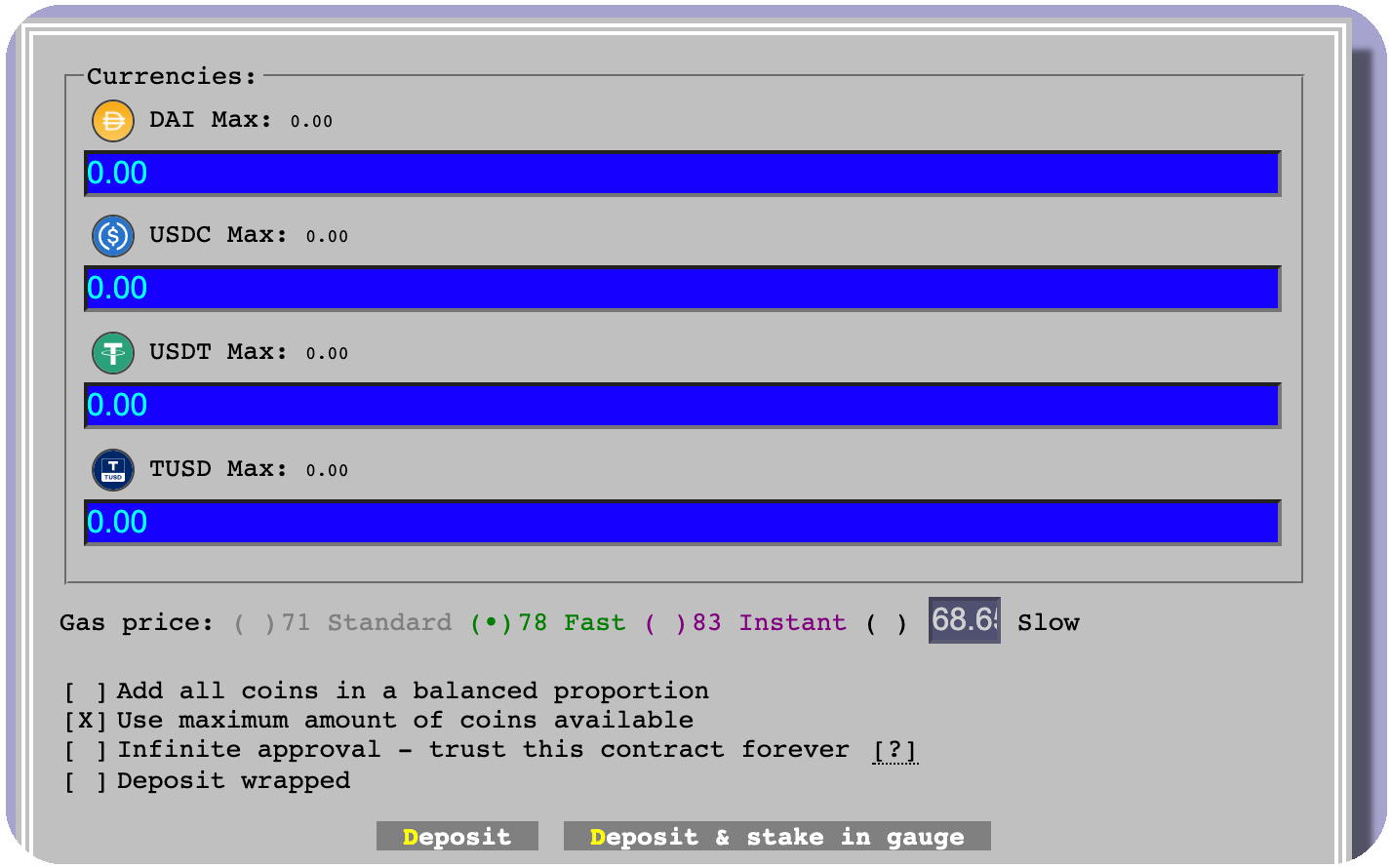

Curve hosts a number of pools that consist of multiple assets, either in the form of stablecoins or wrapped Bitcoin. The Y Pool for example contains DAI, USDC, USDT and TUSD stablecoins, and users can deposit any of those tokens into the pool, either in a balanced proportion or disproportionately. There are two stand-out properties that have made Curve pools popular in DeFi:

- Low fees for traders: Very low fees for exchanging one stablecoin into another, some of which rival centralized exchanges, and are much less than competitors such as Uniswap.

- High APYs for liquidity providers: Not only do liquidity providers receive commissions via the small fees the protocol charge for exchanging tokens, liquidity is also supplied to lending protocols (such as Compound in Curve’s C Pool) so providers gain even more rewards.

In the case of the C Pool, the amount of liquidity sent to Compound is automatically managed by Curve’s smart contracts. The thinking behind this is to maximize your yield when the Curve pool is experiencing low volumes — it makes sense to delegate some liquidity to more active protocols to maximize your returns.

The Y Pool takes this concept one step further

Now consider the scenario where Compound is also experiencing low borrowing activity and APYs are low — sending liquidity to inactive protocols will not yield much of a return.

This is the problem the Y Pool attempts to solve, by automatically sending liquidity to the lending protocol that offers the biggest returns. The Y Pool relies on Yearn Finance’s “yTokens”: wrapped tokens that Yearn’s smart contracts can then move and exchange to other assets, depending on the targeted lending protocol. The Y Pool in fact considers Compound, Dydx, and Aave as the lending protocols to provide liquidity to.

Curve’s C Pool (or Compound pool) mentioned earlier also relies on wrapped tokens, denoted by cTokens. DAI wrapped as a Compound cToken will be cDAI.

This is where the UX of Curve can make things more confusing — visiting their Y Pool page represents each currency as a native token:

But once deposited, these tokens will be converted into yTokens, before being further exchanged and distributed to the targeted lending protocol.

Notice the “Deposit wrapped” option in the above screenshot — this allows the token holder to deposit ready-wrapped yTokens, thus skipping the conversion process from native tokens and saving gas fees.

How wrapped tokens are exchanged

At this stage, one may wonder how wrapped tokens maintain their value to the native token, and how they are exchanged. For example, how would a yUSDC token be converted into DAI and then supplied on a lending protocol such as Aave? The answer lies once again in decentralised exchanges and liquidity pools. Concretely, a pool can be set up for any ERC20 token, including wrapped tokens. It is these pools that allow wrapped tokens to be exchanged and their value to be maintained by arbitrage trading.

Decentralized exchanges rely on arbitrage trading to keep token prices balanced relative to market demand. This is a fundamental concept in keeping a DEX token price inline with the overall market price of a token.

Furthermore, smart contracts communicate with DEX protocols on the user’s behalf, removing the need for humans to interact with front-end portals. Understanding this is key in understanding how platforms like Yearn Finance automatically move and exchange assets on your behalf.

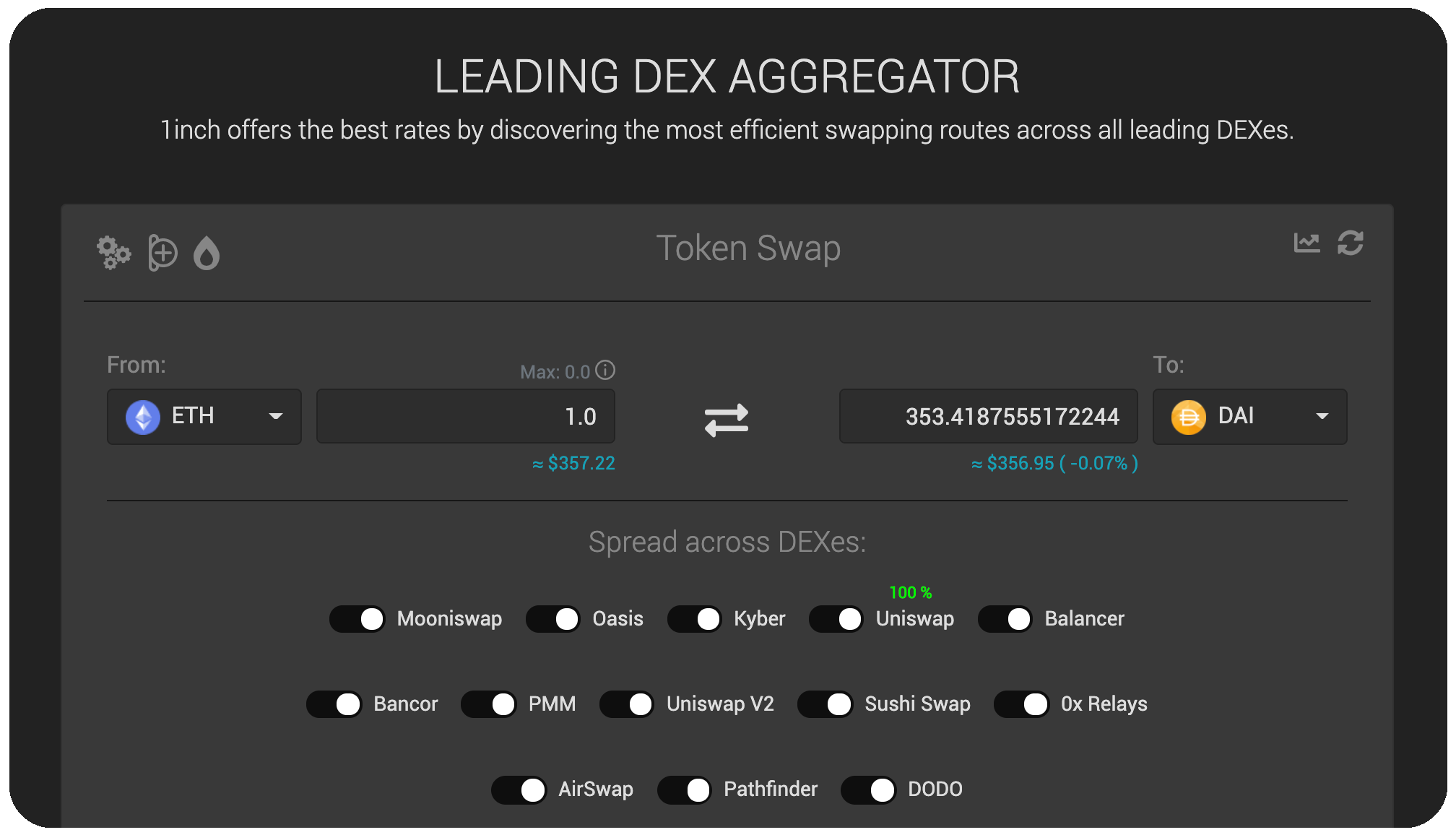

A particularly useful exchange for making token swaps we’ll mention here is 1inch Exchange. 1inch Exchange aggregates the popular DEX protocols and discovers which offers the cheapest fees for a particular token swap. Here is their home page at the time of writing and the supported exchanges to spread your trade over:

1inch Exchange is a good reference to discover other DEX protocols. Mooniswap and Sushi Swap for example are forks of Uniswap, but have their own liquidity pools and rates within their independent smart contracts. Therefore, there is a possibility that one of these forked exchanges have better rates than the original.

To summarise this section:

- Wrapped tokens are heavily used in DeFi to manage assets.

- Wrapped tokens rely on liquidity pools to their native counterparts to maintain their value.

- Curve Finance leverages liquidity pools, but also delegates liquidity to other lending protocols to maximize a lender’s yield.

- To expand on the above point further, Curve’s Y Pool further optimizes this process by automatically choosing the most profitable lending protocol.

A note on Token Lists

To accommodate the vast amount of tokens being added to the Ethereum ecosystem, Token Lists have been created to curate lists of Tokens for particular needs, such as the mostly traded tokens, or Lists tied to a particular protocol or yield strategy. Check out Token Sets here.

The last section of this piece will explore a few more tools in relation to Yearn Finance and its products.

Yearn Finance and Yield Strategies

The level of sophistication and inventiveness that the Yearn Finance creator, Andre Cronje, has demonstrated is mostly unmatched within the space. Community adoption of the protocol is high (as is reflected in the YFI token price, that has been capped at 30,000 unless a Yearn improvement proposal, also known as a YIP, is approved by token holders).

Yearn Finance aggregates quite a few protocols in Ethereum’s DeFi space to form the “strategies” of their vault products. A “Vault” is a program in the form of smart contracts, designed to leverage particular DeFi protocols and automatically move assets between them to maximize returns, much like we have discussed throughout this piece. Each of Yearn’s Vaults have a different strategy.

As an example, the yETH vault, designed to yield ETH over time, has the following strategy:

- You deposit

ETHorWETH(wrapped Ethereum) which is then exchanged intoyETHoryWETHand added to a vault (aka, pool). - The vault then takes your

ETHand puts it in a Maker DAO vault — a vault that combines every deposit from theyETHcontract.DAIis then borrowed from this vault with the depositedETHas collateral. - This

DAIis then deposited into the Curve Y Pool in order to generateCRV(Curve’s governance token we covered earlier) plus exchange fees. - The generated

CRVand exchange fees are then exchanged back intoETH, which is the final form of your reward.

It is important to note that the yETH vault contract maintains a 200% collateralization ratio on Maker. By knowing what the ratio will be in the next hour, the smart contract can rebalance the vault to ensure there will not be a liquidation. If the ETH price falls, DAI will be paid back in the vault. If ETH increases in value, more DAI will be drawn from the vault.

This may sound complex on the first read — and it is. This is just one strategy Yearn Finance offer. It is encouraged to read the Yearn Docs to find out more about the inner workings of their products.

As you can probably sense by now, yield farming is simply stacking DeFi products together to yield as much of their reward mechanisms as possible.

Yearn’s offering is constantly evolving, so it is likely that the reader will discover new products on their website that are not mentioned in this piece. What this piece aims to do however is to introduce the concepts and mechanics of how yield is generated, shedding some light on the heavily used Yield Farming terminology.

Yearn’s YFI token — that has dramatically increased in value since its inception — also acts as both a governance and utility token for Yearn’s products. YFI can only be generated by using Yearn products.

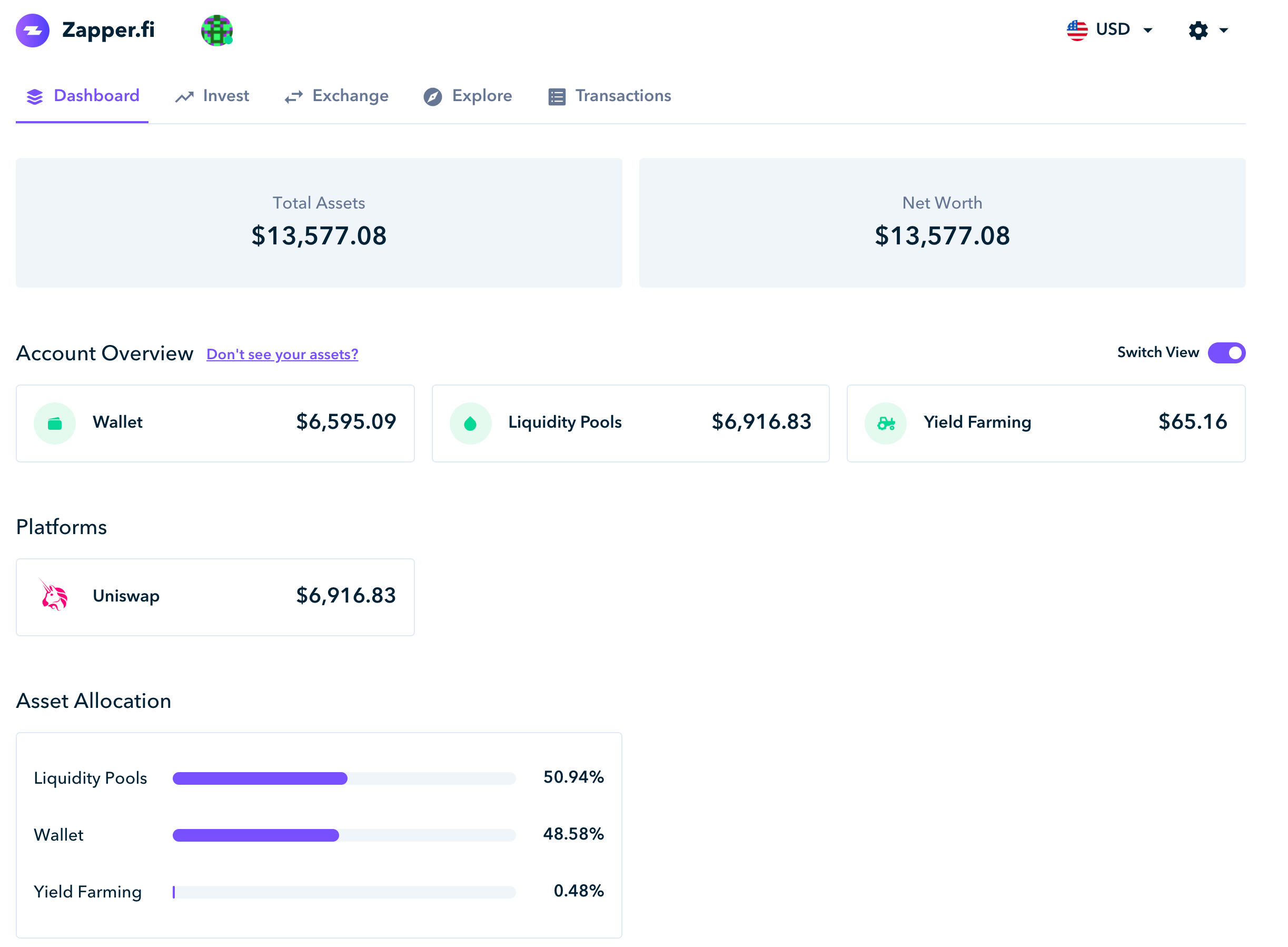

Interact with Yearn Finance from Zapper.fi

One of the easiest ways to get started with Yearn Finance is via Zapper, at Zapper.fi. Zapper creates easy-to-use front-end portals to interact with smart contracts — even Curve Finance’s pools we discussed earlier.

Zapper aggregates exchanges, lending protocols, and investment vehicles like Yearn Finance’s Vault products and integrates them all in one portal. The dashboard page displays every protocol you have invested in, your total assets, and net worth, as the following screenshot illustrates:

In order to make a deposit into a liquidity pool, such as Curve’s Y Pool, simply click the Invest tab and find the pool listed. It is worth familiarizing yourself with all the investment opportunities listed on the platform, some of which we have discussed here.

Main bottleneck of DeFi adoption: gas fees

DeFi is evolving quickly, and there will most certainly be many more products added to the space in the months ahead. At the time of writing Ethereum gas fees have seen the highest prices in its history, making a lot of the tools discussed here unprofitable for trading small amounts of tokens.

Although network congestion is likely to continue to be an issue in the short term, they are a primary focus for the core developers of Ethereum clients right now. Until Ethereum 2.0 launches with sharding capabilities, it is likely that gas fees will continue to be high.

Keep an eye on the Ethereum Gas Tracker if you aim to set up a position, such as depositing funds into a liquidity pool. If you would like to leverage Yearn’s Vault products, keep in mind that every asset exchange, movement, and withdrawal will require gas fees, that will eat away at any rewards you aggregate — this is the main bottleneck of DeFi.

In Summary

This piece by no means covers the entire DeFi space (and more articles pertaining to DeFi will surely be plugged here as the space evolves), but we have covered the major concepts and some of the components behind the inner workings of yield farming.

We’ve covered how tokens can be generated and the reward mechanisms behind providing liquidity to pools. We’ve also covered how Curve Finance and Yearn Finance work together, and some useful tools such as 1Inch Exchange and Zapper to facilitate this activity.

Be sure to check out DeFi Pulse to view the most popular DeFi protocols based on total value locked. The website offers good metrics and overviews for a range of protocols, a lot of which have not been discussed in this piece.

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.