Let’s talk about fractions for a moment, and how it affects your crypto trades in today’s market.

You see, every cryptocurrency trade that you execute is a fraction. You have the numerator on top, which is the asset that you’re trading….but you are also trading that asset against something else, which is the base currency identified in the denominator. BTCUSD, for example, is trading Bitcoin vs. the US Dollar.

Confused? This is really not a new concept. Every time you go to the grocery store and buy something like Oreo Cookies, you’re making a trade. You’re trading Oreos for dollars or Euros or Yen or whatever your base currency is. OREO/USD would be the currency pair in this case if I were 18 years old again and could eat anything.

Buying Bitcoin is a simple exchange, typically at a fiat broker where the fraction is the number of Bitcoin that you’re going to purchase vs. the denominator or base currency, which is Dollars, Euros, Yen, Won, whatever you use. And for the most part, these sovereign currencies don’t move around all that much due to their size and liquidity.

Here’s the Euro vs. the USD on the weekly chart, which is known as a currency pair. Yes, this pair moves, but the actual realized volatility day to day is relatively small vs. crypto assets.

To prove that there is a “stable” relationship between the USD and the EURO, here’s Bitcoin vs. the USD:

And now Bitcoin vs. the Euro:

Hardly any difference in these two charts, they are nearly identical…and that’s because the EUR/USD pair does not vary all that much. Both the Euro and the Dollar are considered to be “stable.”

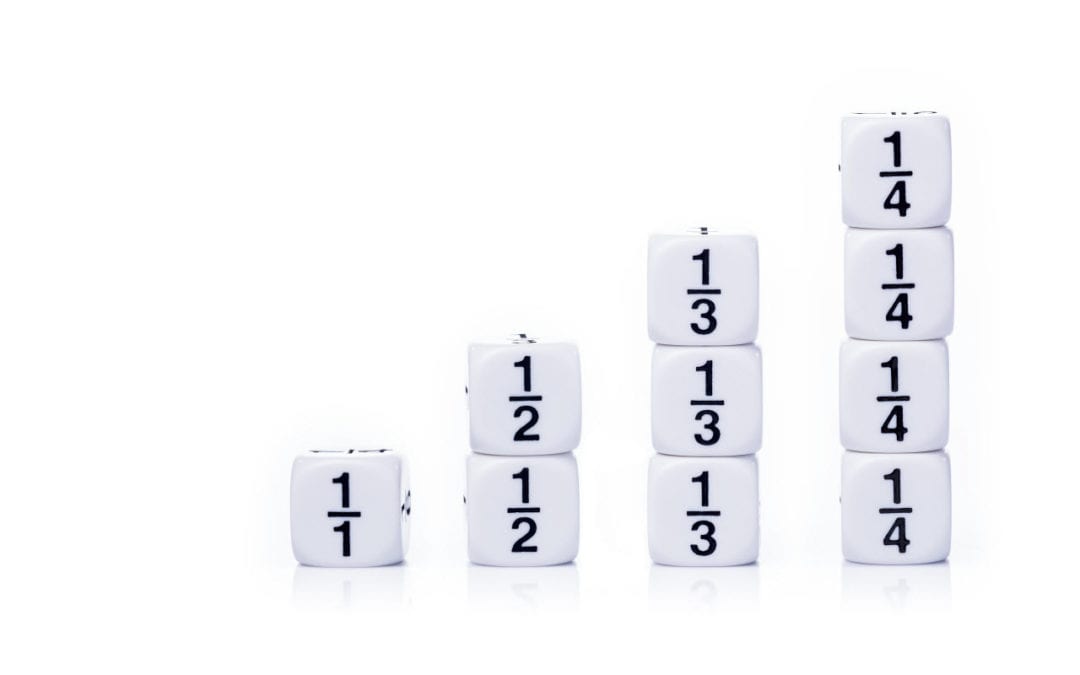

The point that I want to make here is that when you are trading crypto assets, every trade is a fractional relationship. The numerator being the asset traded, and the denominator is the base currency. And you want to do everything in your power to reduce the number of variables when you trade.

The point of this article is because of the mistakes that I’m seeing traders make today is just that, trading altcoins against Bitcoin and increasing the friction in your trade….when there are increasing numbers of smarter alternatives.

Think about how a fraction operates; if we want the value of the fraction to go up, then we need EITHER the numerator to rise, or the denominator to fall. Either of these will accomplish the same thing.

The problem these days is when we are trading altcoins vs. BTC. We all learned to do this in 2017 for a couple of reasons. First, acquiring altcoins vs. BTC was your only option period. And secondly, many altcoins were rising FASTER than BTC overall, so it was a big party until the end.

But it’s not 2017 any more, so unless your altcoin is rising faster than the base currency that you’re using, you’re like sisyphus rolling the stone up the hill. You’ve got a huge headwind that you have to overcome.

To prove this, let’s look at Cardano, which was considered an altcoin two years ago. If you use BTC to acquire this, this is what the chart looks like for ADA/BTC. With BTC in the denominator and rising fast, it doesn’t have a chance unless Cardano rallies faster than BTC, which few assets are doing these days.

Now, Cardano vs. USD:

See the difference? It’s like the two charts have no relation to each other. ADA/USD is in a strong uptrend and ADA/BTC is a poster child for an asset in a strong Bear market.

The primary reason why ADA/BTC is in a Bear market is because BTC itself has been rallying like crazy for the past two months. Using that asset as your base currency for the trade puts you at a huge disadvantage, unless your asset is rallying stronger than BTC. Now, with that said, if BTC does fall into a counter-trend corrective pattern, then there will be a short-term edge to trading some altcoins against BTC, since the denominator or base currency is losing value. But trading counter-trend is never an easy task.

So before you make your next trade, do everything you can to reduce the number of variables in your currency pair. See if it’s possible to trade an asset vs. a fiat currency, or yes, even against a stablecoin that’s not rising every day. More and more exchanges are featuring the ability to trade against a stable asset, so you should only have to trade against BTC as a last resort if you are cleaning house and taking out the bags, and have no other option on your exchange but to trade against BTC.

Doc Severson

Westerville, OH