Crypto Market Commentary

20 March 2019

Doc's Daily Commentary

Doc’s Most Recent Trade School

Next Trade School on 3/22 will be on BitMEX, please watch Discord for announcements

Mav's Analysis

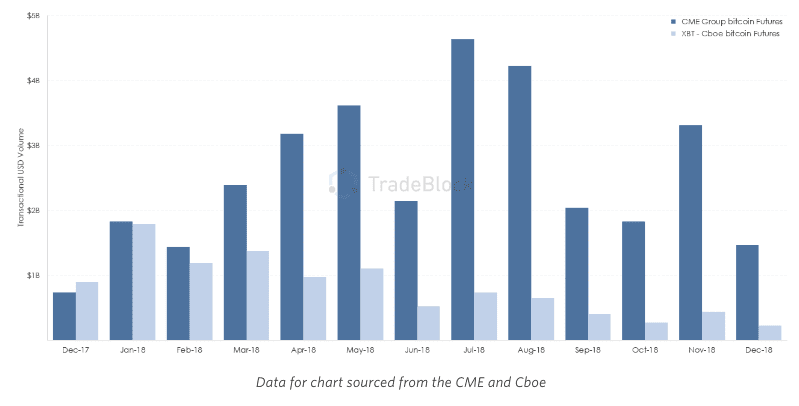

Today’s question: “I heard that the CBOE are removing their Bitcoin Futures. Does that mean institutional interest in Bitcoin is waning?”

Great question with heavy implications.

It’s true that the first-ever issuer of Bitcoin Futures contracts, the Chicago Board Options Exchange (CBOE), the largest U.S. options exchange offering options trading of over 2,200 companies, will shutter their Bitcoin operations. Here’s why that’s not as bad as it sounds.

For one, this chart of Bitcoin Futures interest tells us everything we need to know:

Digging deeper than just a chart, it should be stressed that Bitcoin Futures aren’t going away anytime soon.

In fact the CBOE had pretty terrible contracts, likely to capitalize on the Bitcoin fever of a year ago.

In Doc’s words, they were “crap”.

Despite what major news outlets like CNBC would tell you, the waning interest has a lot to do with the inability of the CBOE to offer anything noteworthy, different, or interesting. CNBC’s Fast Money panel speculate that the end of the CBOE cash backed futures coincides with retail investors and shorts becoming exhausted and losing momentum, whilst institutional investors gear up to enter the market later this year.

Frankly, I think it shows the need for derivatives that are not cash backed. Bitcoin futures could have a material negative impact on the price of Bitcoin as investors will have an easier time betting against Bitcoin.

We saw this to be (loosely) true. When the CBOE and CME futures contracts came online in December of 2017, the price of Bitcoin soon plummeted.

Yes, correlation and causation aren’t the same things, but it was no secret that cash based Bitcoin futures essentially allowed speculative investors to bet against the price of Bitcoin, and settle in cash.

There’s speculation that cash backed futures led to particularly wealthy participants intentionally causing market volatility within the BTC markets, aiming to profit via positions in cash backed futures contracts, i.e., cash backed futures enabled “whales” to do whale things.

In contrast we can see that Bakkt’s upcoming Bitcoin futures are settled in Bitcoin, providing a derivative much more closely correlated with the actual Bitcoin market itself.

That being said, when an institutional player toes the water, it does not mean that they will succeed, nor does that mean it’s necessarily good for the crypto space.

As of right now, the biggest exchange for Bitcoin derivatives is BitMEX — a crypto native exchange, showing that incumbents do have the potential to be displaced. There are many more futures exchanges coming online soon, and it is an easy conclusion to make that there will be brighter, more profitable days ahead for the traders of Bitcoin futures.

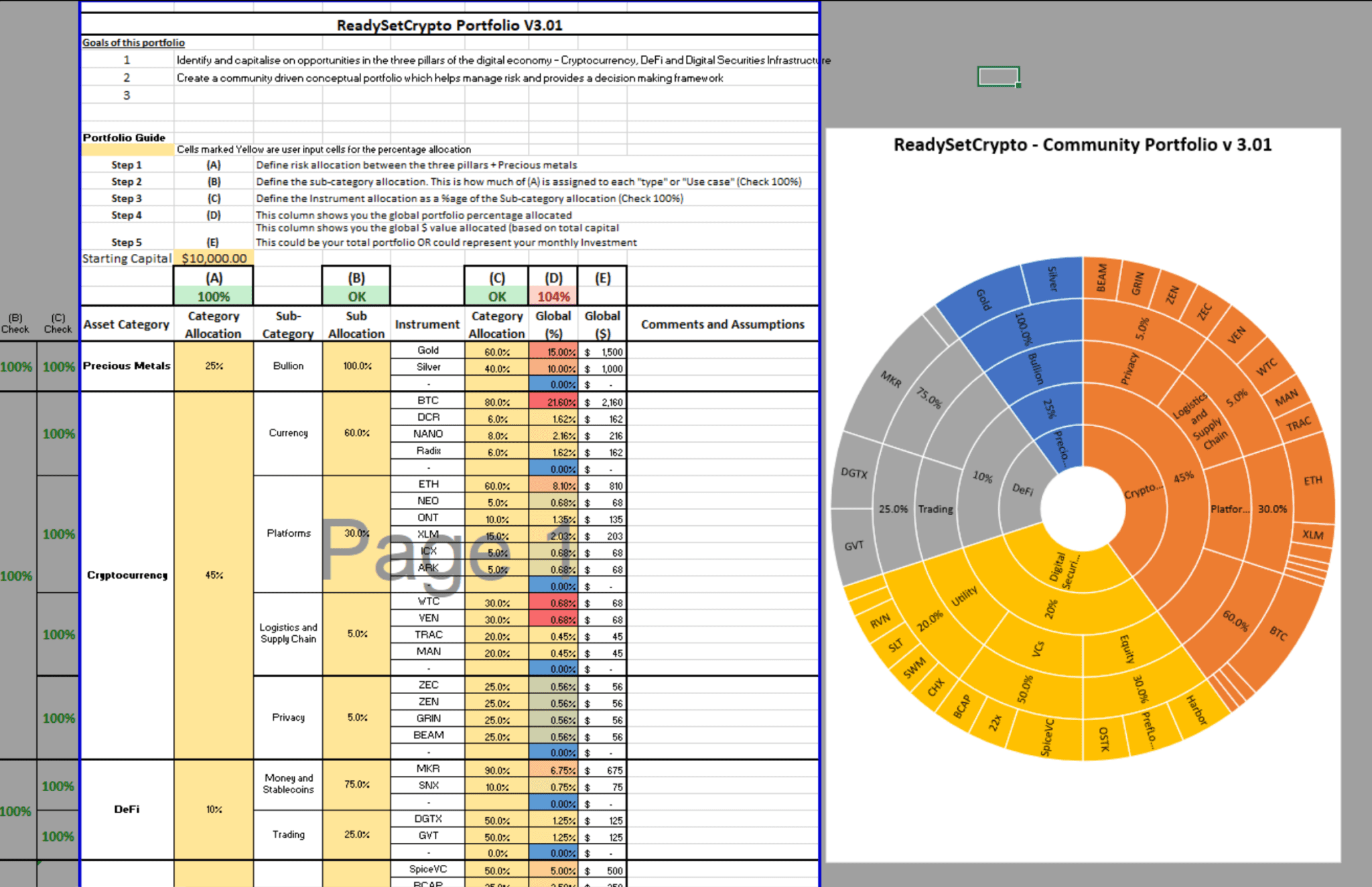

An Update Regarding Our Portfolio

RSC Subscribers,

We are diligently working on providing you with our new RSC Managed Portfolio (V3.01) in the coming weeks. We will be posting iterative updates in the discord.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects.

We will also make a concerted effort to draw from community involvement and make this portfolio community driven, like our Portfolio call on yesterday’s Discord chat.

Thank you for your patience.

Here’s a sneak peek at the new portfolio:

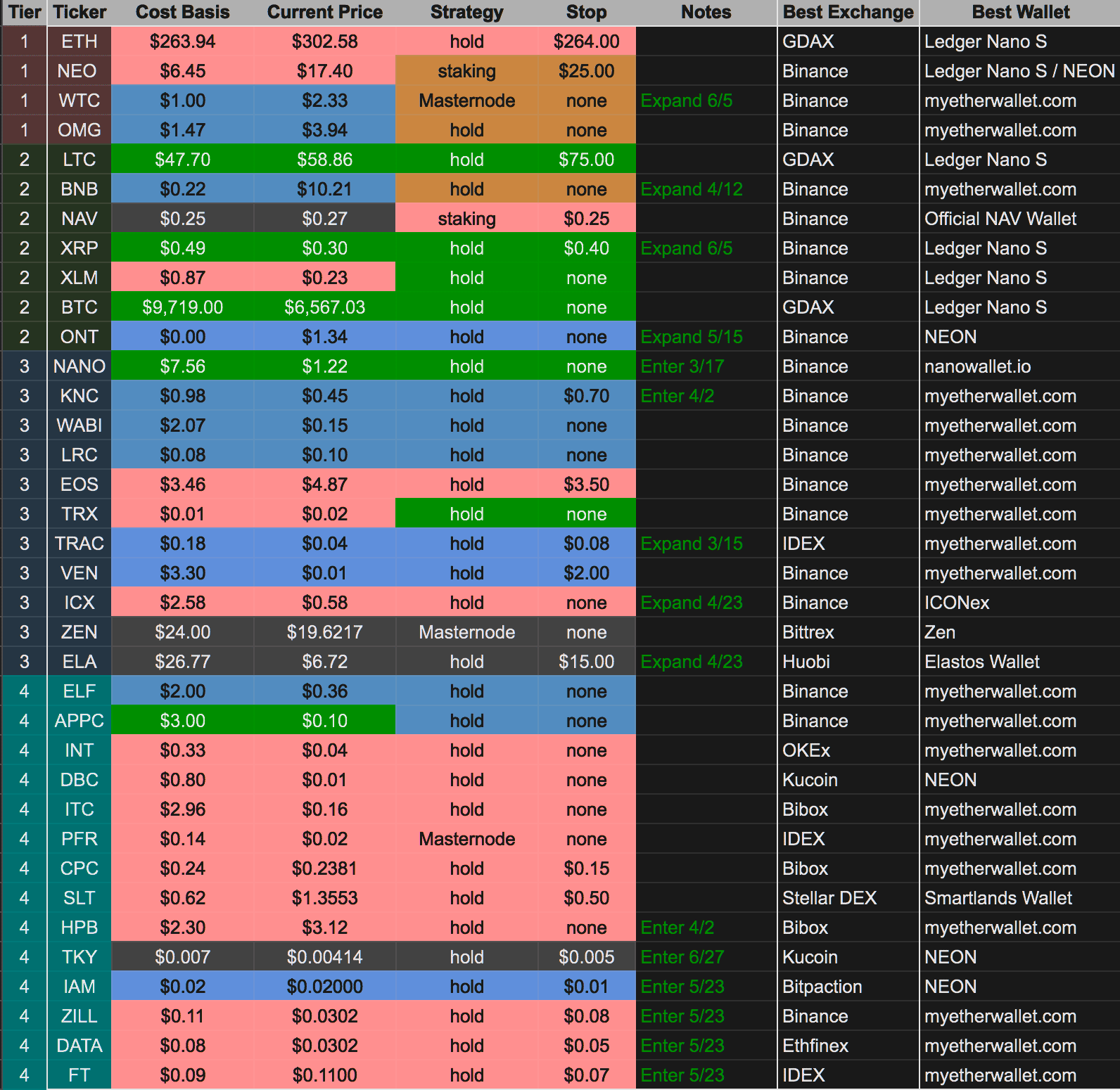

Here’s our past portfolios for reference:

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)