Doc's Daily Commentary

Mind Of Mav

The World Is Running Out Of Bitcoin

Bitcoin supply is drying up across crypto. Here’s where it went and what it means.

You’ve probably seen a chart or analyst mention the fact there is a liquidity crisis happening in bitcoin.

Meaning Bitcoin were, and still are, leaving exchanges by the bucket load. In effect, this means the amount of bitcoin available for willing buyers is drying up. Which in turn creates scarcity, demand pressure… And the reason many of us are here: higher prices.

Today, I’d like to drop some charts in front of you that show what this ‘liquidity crisis’ is all about and what it means for the upcoming boom and bust cycle.

Where’d it go?

Here’s the chart that highlights the liquidity crisis phenomenon. Focus on the blue line, it’s taking a nosedive, showing us the total balance of BTC on exchanges has dropped from about 3 million to just a hair over 2.3 million from March 2020 to now.

That’s about 23% less BTC floating around on the supply side of the market than there were about a year ago.

For any investor sitting on the sidelines, a glance at this stat screams scarcity.

But is this really a clear picture of what’s going on?

Didn’t this thing called DeFi pop up and create wrapped BTC on the Ethereum network? Is that where all the BTC went?

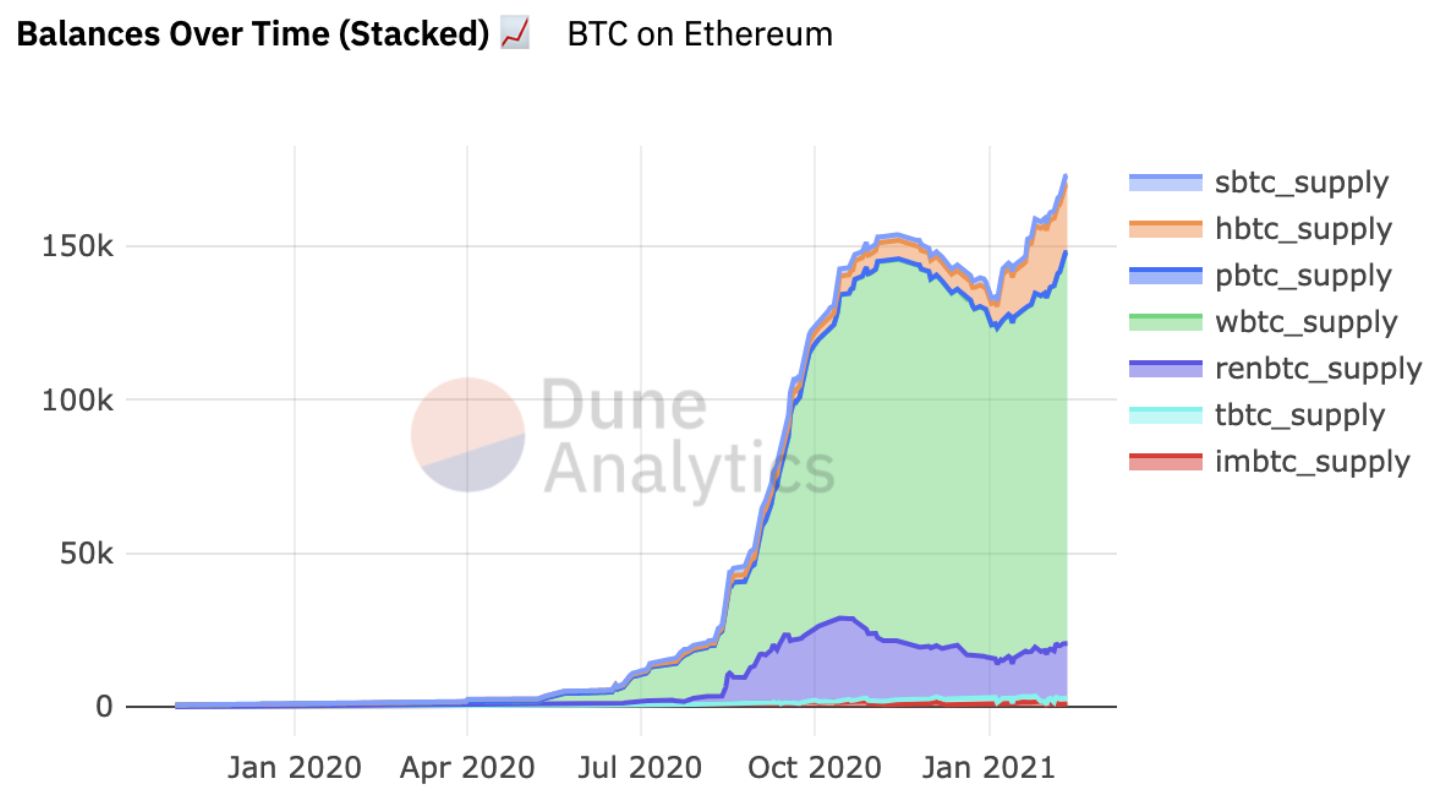

To take a look, here’s a chart from Dune Analytics showing the supply of BTC on Ethereum.

That’s a bit over 160k BTC sitting on the Ethereum network… we’re about 475k BTC short of where it all went. Plus, that really only accounts for the drop in exchange supply from August to November.

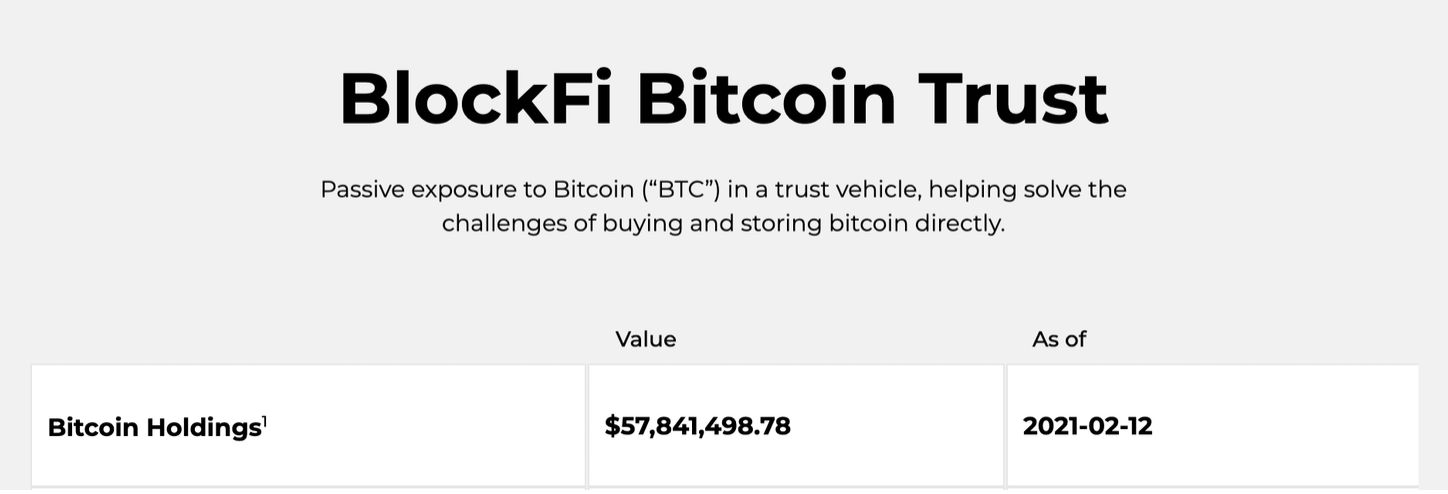

Another thought is BlockFi and Celsius. However, deciding which wallet is held by these entities is a bit of an educated guess, so rather than making an assumption let’s just assume “some” bitcoin is held in these vehicles.

Honestly, I don’t believe this amount is as big as many believe. Here is BlockFi’s recent Bitcoin Trust product and its current AUM of $57 million or nearly 1,200 BTC. Let’s keep these entities out of our back-of-the-envelope math for the time being.

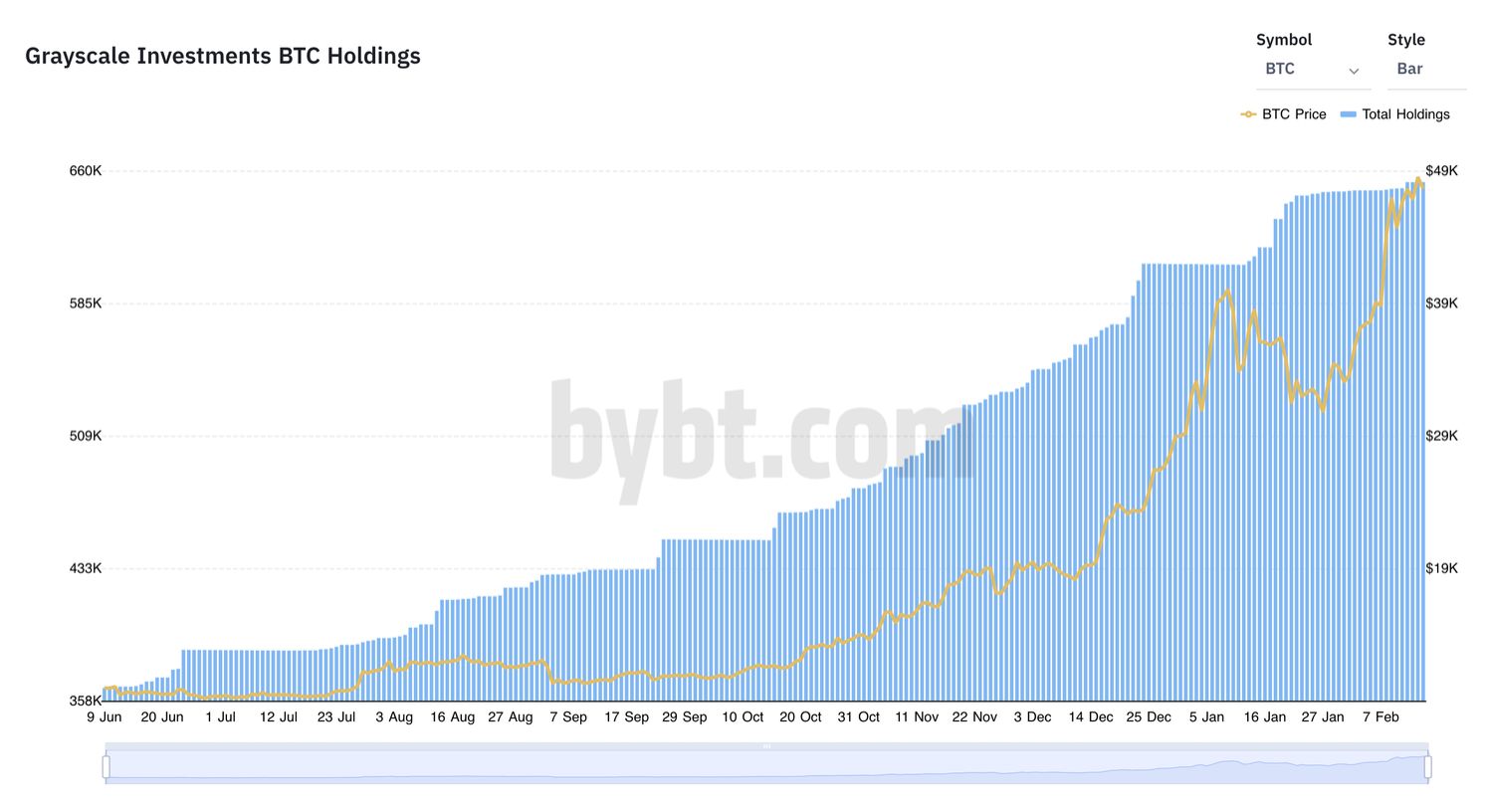

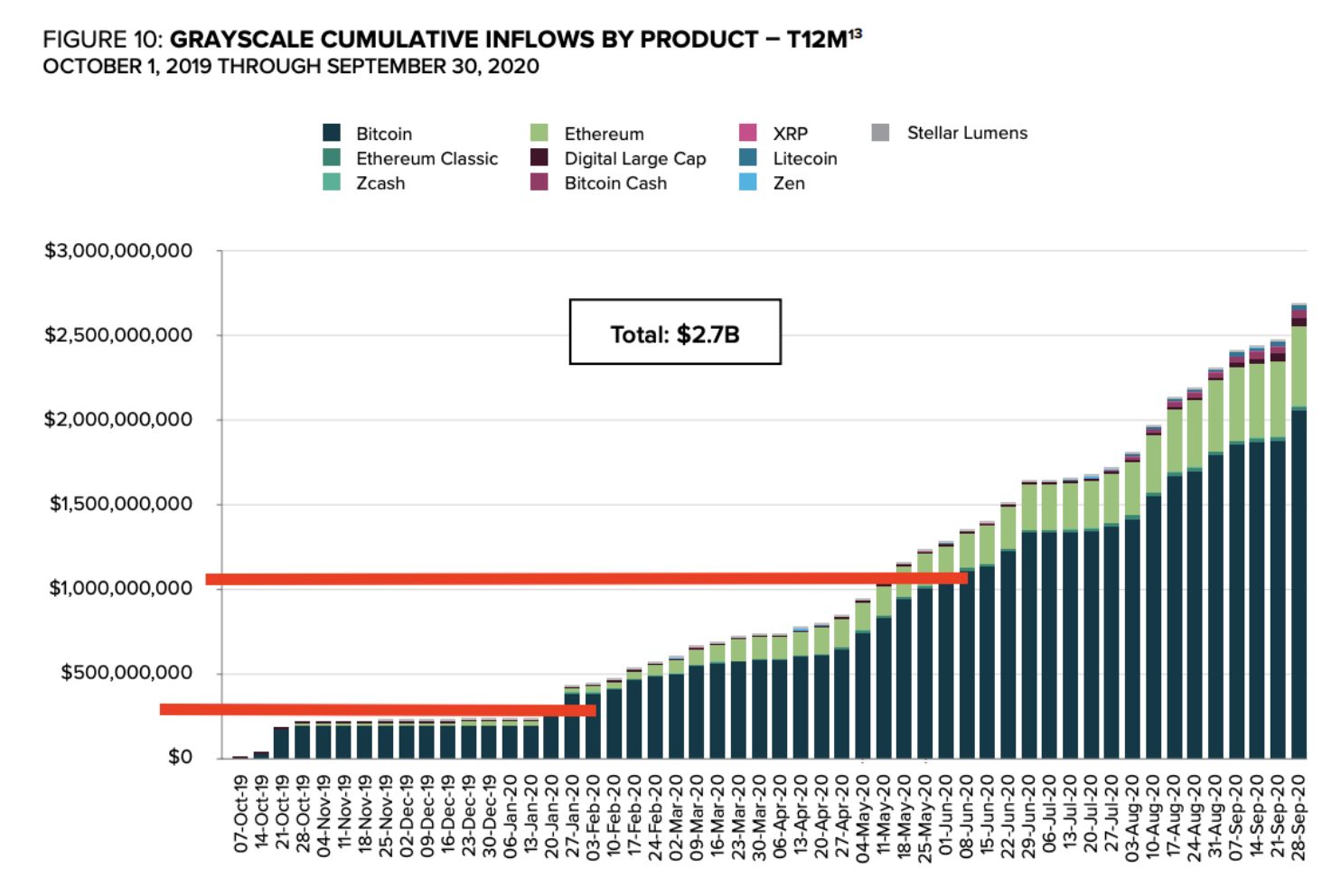

The other place we can look is the ‘Prince of Pump’, Grayscale.

Here’s a quick look at their holdings from early June 2020 to now. That’s about 300k bitcoin. Wow.

Still, that leaves us about 175k BTC short.

Let’s call it $750 million of inflow into Grayscale Bitcoin Trust from Feb 2020 to June 2020 – where the bybt.com chart left us hanging. Using monthly closing prices the average price of BTC was $8,250. Meaning approximately 90k BTC flowed into the fund during this time span.

Tesla purchased $1.5 billion of bitcoin in January. Assuming the purchase averaged out around $35k, that’s over 42k BTC off the table.

What does this mean?

It means bitcoin is in fact becoming scarce.

If this continues, a liquidity crisis will transpire pushing prices considerably higher.

Then there’s DeFi. Which to me is the most interesting of the three because BTC is predominately used in DeFi to earn yield. Not to trade. Meaning similar to Grayscale, this is a sinkhole. Looking at the chart above that shows the amount of bitcoin transacting on Ethereum, you can see the growth is predominately one way, up.

Why?

The ReadySetCrypto "Three Token Pillars" Community Portfolio (V3)

Add your vote to the V3 Portfolio (Phase 3) by clicking here.

View V3 Portfolio (Phase 2) by clicking here.

View V3 Portfolio (Phase 1) by clicking here.

Read the V3 Portfolio guide by clicking here.

What is the goal of this portfolio?

The “Three Token Pillars” portfolio is democratically proportioned between the Three Pillars of the Token Economy & Interchain:

CryptoCurreny – Security Tokens (STO) – Decentralized Finance (DeFi)

With this portfolio, we will identify and take advantage of the opportunities within the Three

Pillars of ReadySetCrypto. We aim to Capitalise on the collective knowledge and experience of the RSC

community & build model portfolios containing the premier companies and projects

in the industry and manage risk allocation suitable for as many people as

possible.

The Second Phase of the RSC Community Portfolio V3 was to give us a general idea of the weightings people desire in each of the three pillars and also member’s risk tolerance. The Third Phase of the RSC Community Portfolio V3 has us closing in on a finalized portfolio allocation before we consolidated onto the highest quality projects.

Our Current Allocation As Of Phase Three:

Move Your Mouse Over Charts Below For More Information

The ReadySetCrypto "Top Ten Crypto" Community Portfolio (V4)

Add your vote to the V4 Portfolio by clicking here.

Read about building Crypto Portfolio Diversity by clicking here.

What is the goal of this portfolio?

Current Top 10 Rankings:

Move Your Mouse Over Charts Below For More Information

Our Discord

Join Our Crypto Trader & Investor Chatrooms by clicking here!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.