Crypto Market Commentary

9 April 2020

Doc's Daily Commentary

The 1 April ReadySetLive session with Doc and Mav is listed below.

Mind Of Mav

What Caused The Crisis & How Do We Fix It? Part 4

So, this week, we’ve covered quite a bit.

We discussed how the Monetary Policy used by Central Banks works

We explored how Government use Fiscal Policy.

We shed some light on the underlying issue of Moral Hazard that compels Corporations to spread themselves thin by engaging in risky behavior.

Finally, let’s talk about the underlying forces of the economy itself.

You see, we’ve just lived through the most prosperous period in the 20,000 or so years of human society. Decry the avarice and prodigality all you want — we’ve never had a period in human history where bloodshed is seen by so few and long, happy life lived by so many.

We have embraced technologies like steam power, fossil fuels, automation, long-distance communication, bulk shipping, the internet, and everything else that we take for granted today. All of these advancements have meant that we are able to produce more things more efficiently and support a larger population of more people who are in turn able to produce more staff more efficiently.

This massive increase in global productive potential has made some people extremely wealthy. We are now in an age where individual men are wealthier than the entire planet was just a few centuries ago. Most importantly, sustained economic growth has meant that living standards have improved for regular people.

The economic development of China, just over the past 30 years has been responsible for pulling almost one billion people out of absolute poverty.

The global economy is a complicated network of money and rational actors, and one could argue that something as systemic as shutting down the main arteries of money flow should have an equally systemic solution.

Economic theory often addresses market shifts and actions that are on a much smaller scale than the massive shutdown of the economy. To help unpack what policy measures might make sense, let’s take a bottom up perspective.

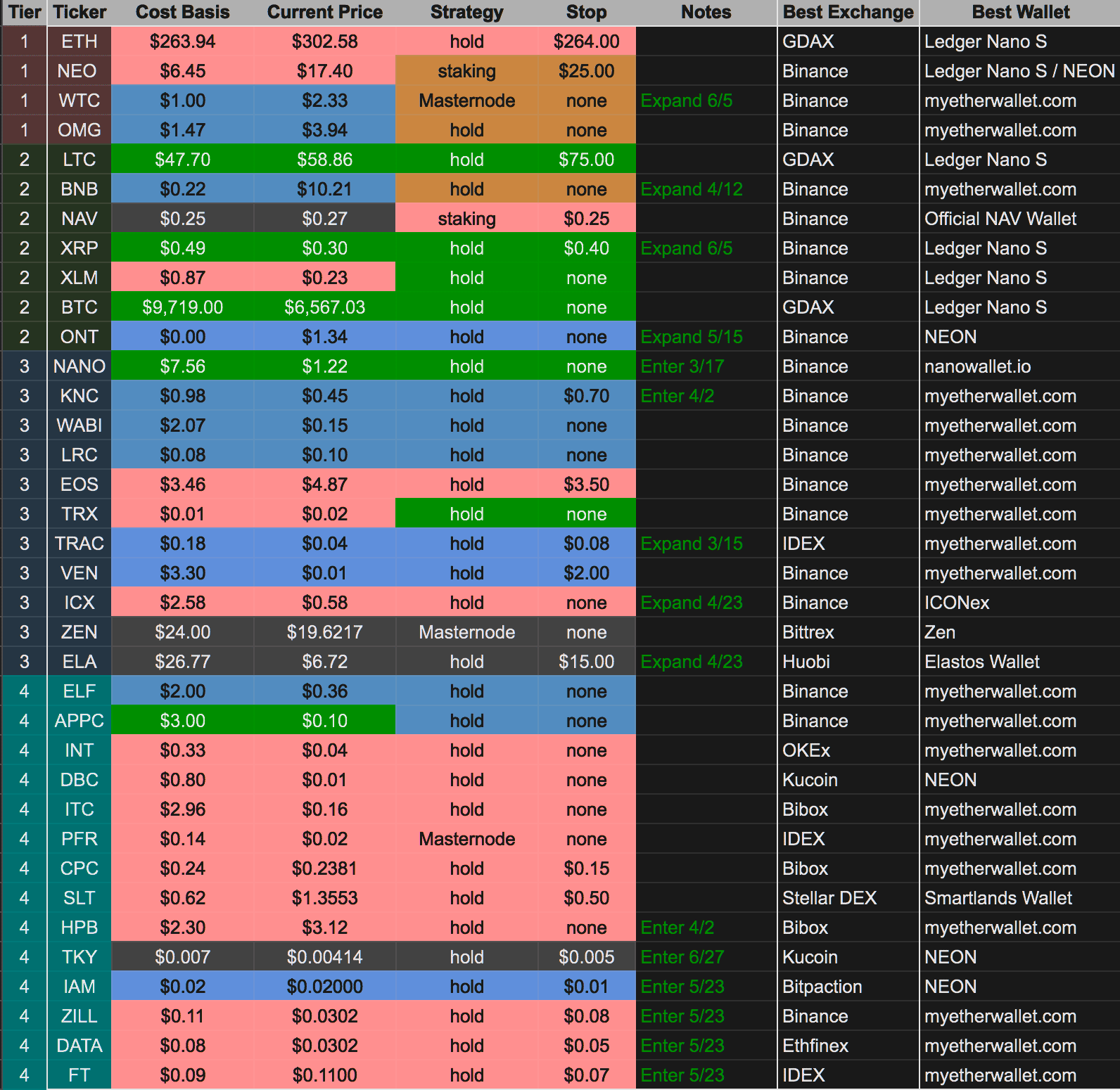

Let’s take a look at how money flows through the system in the narrow example of an individual’s weekly spending.

This map shows how the dollars they spend flow through various corporations and financial institutions to ultimately pay employees. We can imagine that an employee of a corporation similarly stem from a chart like this and that each blue boxed employee here looks out onto a graph like this of their own.

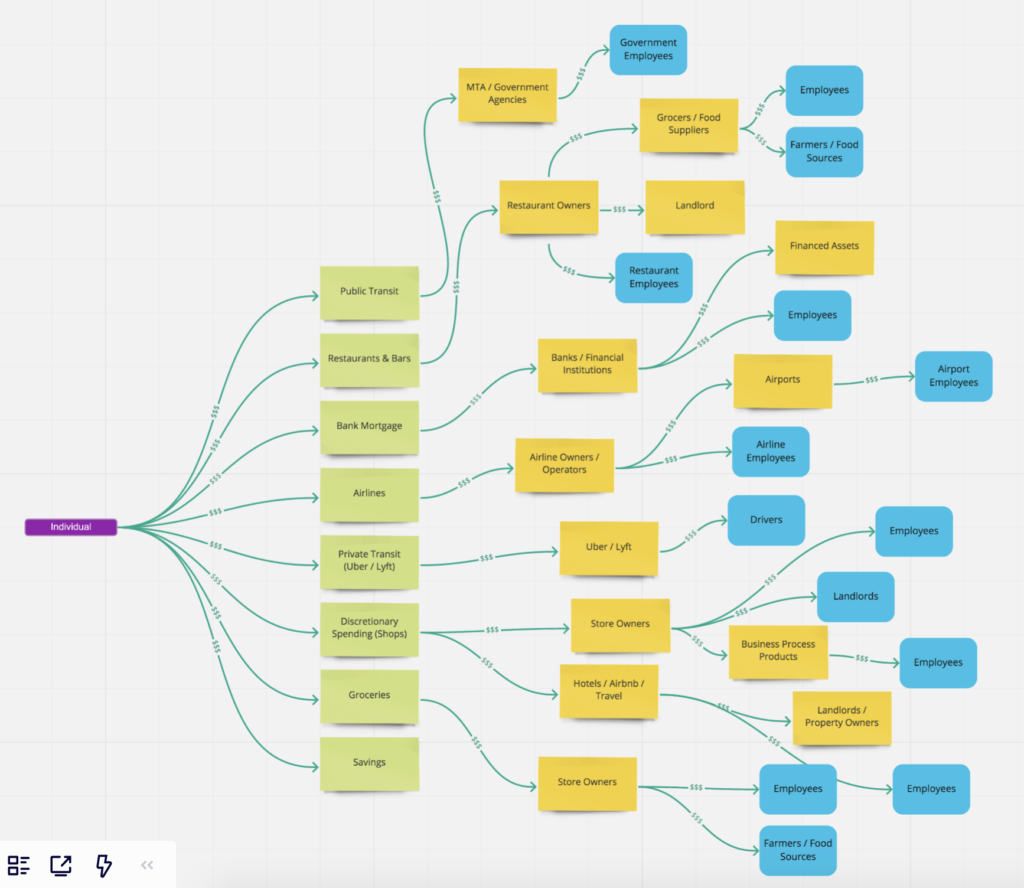

Now, let’s take a look at what happens when you cut off that individual’s spending.

What should the government do to mitigate these red lines? First and foremost, our goal needs to be getting the country back up and running at full capacity. Removing restrictions to enable test kit manufacturers, healthcare professionals, and technologists to nimbly serve the growing number of patients in the system is paramount. In the meantime, mitigation strategies to alleviate household level struggles are critical because not everyone is impacted in the same way.

The best way to keep our economy afloat in “maintenance mode” where spending across the board has been dampened is to ensure that those households impacted by these shutdowns get their normal stream of cash flow as opposed to corporations. The type of shock we’re experiencing is first a supply shock — certain types of businesses like hotels, airlines and restaurants have been forced to close or scale down temporarily due to force majeure. On the demand side, dynamics haven’t changed for those who haven’t been laid off, it’s just that there’s no outlet for their spending power due to the supply shock, so demand is significantly lower. For out of work employees of businesses that have shut down, their spending power is greatly reduced just by virtue of not getting their regular paycheck — a demand shock.

Another unique characteristic of this type of economic event is that it’s happening in a universal, systemic way rather than based on bad company or sector level business fundamentals. When the Treasury and Federal Reserve bailed out failing banks back in 2008, it was because the banking sector had on their own, taken on risky underwriting activities and dug themselves into a hole. Our current situation is completely different — it’s because of a global pandemic that certain types of businesses have no revenue and can’t pay their expenses not any fundamental issue with business as usual.

So how should the government fund this gap? By paying the operating expenses of those businesses that have been forced to close due to the coronavirus directly — from employee salaries to rents. The simplest place to infuse capital is where it is no longer flowing due to the coronavirus. Other attempts to mitigate like halting some evictions and mortgage payments will either solve for too broad or too narrow a cohort of individuals. A second-order impact of tying federal funds to direct expenses is that it will incentivize the government to try to “solve” this pandemic as fast as possible and reduce the number of weeks we suffer under shutdown.

One could argue that paying employees who aren’t actually producing goods or services is a disincentive for them to find work, but when the number of active jobs has been reduced as significantly as it has, it is the government’s duty to step in and be the backstop. There are a number of companies rumored to be hiring workers to fulfill excess demand like Amazon and grocery stores, but that is nowhere near equal to the 3 million people who filed for unemployment, so we can’t even argue that free labor markets will allow for a redistribution of talent. This also isn’t a permanent and sustainable reality — our hope is that eventually, life will return to normal at which time a reshuffling in the labor market would create even more marginal costs.

In the past month, we have seen absolute sell-off across all asset classes. Even safe haven assets like U.S. treasuries and gold suffered because the lack of market liquidity (ability to buy & sell), the extreme volatility and the complexity of investment positions of hedge funds and other professional investors led to indiscriminate selling in a sell whatever you can moment.

They did, of course, hurried most out of the corporate debt. Funds that invest in corporate bonds have recorded colossal outflows of over $108 billion in the past week.

The insatiable hunger for cash reverberated through the entire market, crushing liquidity, and even stopping market functioning in some areas. ICE stopped posting prices of large hedging instruments like swaptions — all large transactions are voice-brokered.

Now, let’s go back to what this could mean for corporate debt. Should the grim virus predictions prove true, and the economy remains at a standstill for longer, weaker companies won’t survive. Many of them would struggle to pay interest, and they would certainly not be able to prolong their debt or issue new, since the rates are rising (i.e. credit spreads are widening) as a result of the market functioning.

More importantly, many companies will have their credit rating downgraded by agencies like Fitch, which means that their bonds could fall to junk rating, and become essentially un-investable for the largest investors of this world — pension funds, insurance companies and mutual funds — who currently own them in colossal proportions. This would cause a sell-off which could indeed prove systemic.

That is, companies will default on their debt, rates will go higher, asset prices will fall lower still since they will be discounted by a higher rate, and debt markets will shut down, companies will go bust. And just like that, the recession would turn to a depression with structural implications.

This has prompted FED and other central banks to act, and act fast. FED has committed to buy trillions of assets, from corporate bonds to student and auto loans and even credit card loans.

This is completely unprecedented. FED would not normally be allowed to take credit risk of this extent. This time, however, FED is using the U.S. Treasury as a special purpose vehicle levered up and buying anything in its way. It isn’t just FED. The ECB has unveiled similar measures, announcing $750 billion in government and corporate bond purchases.

So, we may be saved after all. Right? If central banks keep buying corporate debt in these colossal amounts, spreads will narrow and rates will fall. Companies (even weaker ones, again) will be able to service their debt and stay alive. The price of bonds will stabilize, credit ratings stay protected, and the large institutional investors won’t have to sell.

Of course, all of this debt buying has to be funded by .. debt. Governments also have to sell their debt to someone. The unavoidable consequence of the mechanism described above is that now even government bond yields are rising as investors brace for a level of borrowing not seen outside of wartime period.

Since U.S. Dollar is the reserve currency of the world, majority of international trade and cross-border transactions are done in greenback, and the profits from international trade are also, therefore, made in the $ (for example Chinese exporters incomes are in U.S. Dollars).

As a result, it is estimated that 60% of foreign bank reserves are in U.S. Dollar or U.S. treasuries or other $-denominated assets since these banks have to fund and service this international trade. This means that there is a seemingly insatiable demand for the U.S. treasuries and that the U.S. can keep printing its debt forever.

Think of it this way: companies, banks, traders, investors, banks and central banks have to park their assets somewhere and it has to be in a currency they can use to operate, i.e. the $. Therefore, U.S. debt is the best option.

Western economies lean on this hegemony of U.S. Dollar — that balance could prove to be more delicate than we like to think.

It feels awful now — the crisis — as it should. But it is, after all, just another crisis. China hasn’t gotten through the virus unscathed; its economy suffered just as much, but its media were, of course, not allowed to go on a doomsday parade, which made the whole crisis look a little bit calmer. See How China Is Reshaping the Coronavirus Narrative.

Though the central banks are using more of the same medicine (liquidity pump), it is an effective medicine. The credit markets will calm down. The virus spread will slow down, too, and more importantly, the peak panic will turn for better as more data is collected and more people are tested, showing that the fatality rate is, in fact, not worth the hysteria. See World with permanent circulating coronavirus?

It is also unlikely that the Global Coronavirus Crash will be structural. Fear will switch to greed soon again.

What does it mean for you? Every crisis is an opportunity. There are short-term and long-term opportunities. In the short-term gaming, video streaming and grocery, e-commerce and healthcare (especially digital) stocks will rebound because they are clear beneficiaries of the domestic lockdown.

Some of that rebound will be misguided — it isn’t clear that Netflix, for example, will gain new subscribers or make more revenue just because people are stuck home watching it.

In the long-term, everything will rebound. It is difficult to see how the virus could undermine the superiority of companies like Apple, Facebook or Google, yet their stock prices went down sharply with the broader market.

Rough and general, the advice above holds for both equities and bonds. With corporate bonds at their lows, this might be a good opportunity to pick up debt of a strong and stable companies — or move into alternative assets like gold and Bitcoin.

To predict the future, we often only have to look into the present and extend trends outwards.

Press the "Connect" Button Below to Join Our Discord Community!

Please DM us with your email address if you are a full OMNIA member and want to be given full Discord privileges.

An Update Regarding Our Portfolio

RSC Subscribers,

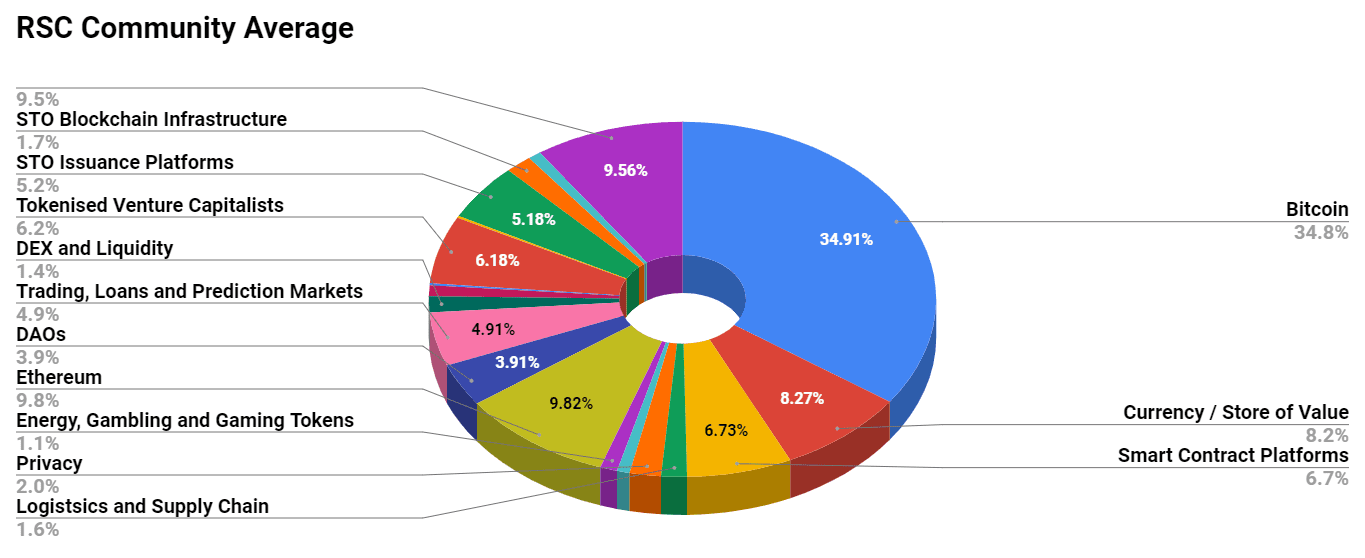

We are pleased to share with you our Community Portfolio V3!

Add your own voice to our portfolio by clicking here.

We intend on this portfolio being balanced between the Three Pillars of the Token Economy & Interchain:

Crypto, STOs, and DeFi projects

We will also make a concerted effort to draw from community involvement and make this portfolio community driven.

Here’s our past portfolios for reference:

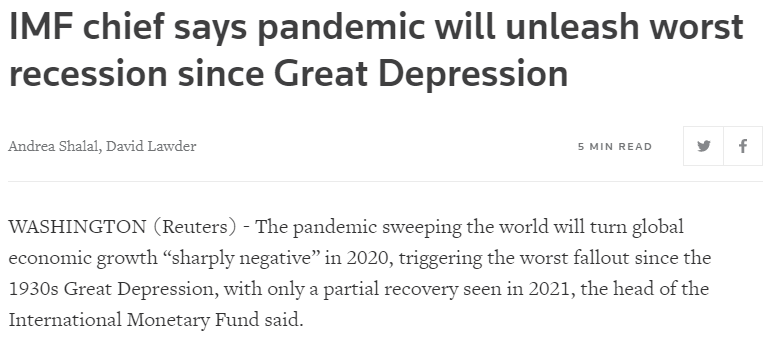

RSC Managed Portfolio (V2)

[visualizer id=”84848″]

RSC Unmanaged Altcoin Portfolio (V2)

[visualizer id=”78512″]

RSC Managed Portfolio (V1)